20 Year Mortgage Rates offer a compelling alternative to the traditional 30-year mortgage, providing a shorter repayment term with the potential for significant savings on interest. This guide delves into the intricacies of 20-year mortgages, exploring their advantages, disadvantages, and current market conditions.

We’ll examine factors that influence rates, provide practical guidance on calculating monthly payments, and discuss key considerations for choosing a 20-year mortgage.

Whether you’re a first-time homebuyer or a seasoned homeowner looking to refinance, understanding the nuances of 20-year mortgages is essential. This comprehensive guide provides the information you need to make informed decisions about your home financing options.

Contents List

Understanding 20-Year Mortgage Rates

A 20-year mortgage is a type of home loan where you agree to repay the principal and interest over a 20-year period. This differs from a traditional 30-year mortgage, which stretches the repayment term over a longer duration. Choosing between a 20-year and 30-year mortgage involves weighing the pros and cons of each option, considering your financial situation and long-term goals.

Credit unions often offer competitive loan options. Consider exploring credit union loans as a potential financing source for your needs.

Advantages and Disadvantages of a 20-Year Mortgage

- Lower Interest Payments:A 20-year mortgage generally comes with a lower interest rate compared to a 30-year mortgage. This is because lenders perceive a shorter loan term as less risky, leading to a more favorable interest rate for borrowers.

- Faster Debt Repayment:With a 20-year mortgage, you’ll pay off your home loan faster than with a 30-year mortgage. This means you’ll accrue less interest over the life of the loan, saving you a significant amount of money in the long run.

- Increased Equity Buildup:As you pay down your mortgage faster, you’ll build equity in your home at a quicker pace. Equity represents the portion of your home’s value that you own outright, providing you with financial security and potential investment opportunities.

- Higher Monthly Payments:While the total interest paid over the life of the loan is lower with a 20-year mortgage, the monthly payments are typically higher than those for a 30-year mortgage. This can put a strain on your budget, especially if you have other financial obligations.

- Less Flexibility:A 20-year mortgage offers less flexibility than a 30-year mortgage. If your financial situation changes, you might have fewer options for refinancing or adjusting your payments.

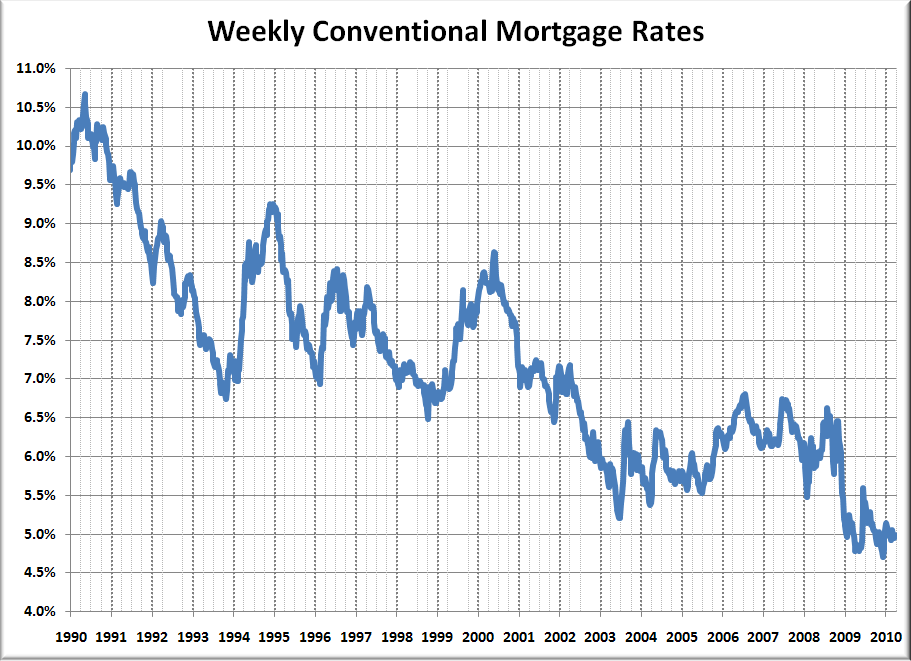

Historical Overview of 20-Year Mortgage Rates

Historical data on 20-year mortgage rates reveals a fluctuating pattern, influenced by economic factors like inflation, interest rate policies, and market conditions. For instance, during periods of low inflation and stable economic growth, 20-year mortgage rates have generally trended downward.

Conversely, during periods of economic uncertainty or rising inflation, rates have tended to increase.

Looking for fast access to funds? Explore no credit check loans same day options, but remember to carefully consider the terms and potential risks involved.

Current 20-Year Mortgage Rates

Current average 20-year mortgage rates fluctuate daily, reflecting market conditions and lender pricing. It’s crucial to check with multiple lenders to get the most competitive rates.

Factors Influencing Current 20-Year Mortgage Rates

- Federal Reserve Interest Rate Policy:The Federal Reserve plays a significant role in influencing interest rates across the economy, including mortgage rates. When the Federal Reserve raises interest rates, it generally leads to higher mortgage rates, and vice versa.

- Inflation:Inflation, a general increase in prices for goods and services, can also affect mortgage rates. When inflation rises, lenders may demand higher interest rates to compensate for the declining value of their money.

- Economic Indicators:Various economic indicators, such as unemployment rates, GDP growth, and consumer confidence, can influence mortgage rates. A strong economy typically leads to lower mortgage rates, while a weakening economy may result in higher rates.

Comparing Current 20-Year Mortgage Rates to Historical Rates

Comparing current 20-year mortgage rates to historical rates provides valuable context. If current rates are significantly higher than historical averages, it might be prudent to consider delaying a major purchase or exploring alternative financing options. Conversely, if rates are lower than historical averages, it might be an opportune time to secure a mortgage.

A finance loan can be a valuable tool for achieving your financial goals. Explore different lenders and loan options to find the best fit for your specific needs.

Factors Affecting 20-Year Mortgage Rates

Understanding the factors that influence 20-year mortgage rates is crucial for making informed decisions about your home financing.

Role of the Federal Reserve in Setting Interest Rates

The Federal Reserve, the central bank of the United States, plays a pivotal role in setting interest rates. Through its monetary policy tools, the Federal Reserve aims to control inflation and promote economic growth. When the Federal Reserve raises interest rates, it becomes more expensive for lenders to borrow money, which can lead to higher mortgage rates.

Need a loan for a specific purpose? Whether it’s for a car, home improvement, or personal needs, exploring need a loan options can help you find the right financing solution.

Conversely, when the Federal Reserve lowers interest rates, it becomes less expensive for lenders to borrow, potentially resulting in lower mortgage rates.

For quick and convenient access to funds, explore fast payday loans online. Be aware of the potential high interest rates and repayment terms before making a decision.

Impact of Inflation on Mortgage Rates

Inflation, a sustained increase in the general price level of goods and services, can significantly impact mortgage rates. When inflation is high, lenders may demand higher interest rates to compensate for the declining value of their money over time. This is because lenders need to ensure they receive a sufficient return on their investments to offset the erosion of their purchasing power due to inflation.

Influence of Economic Indicators on Mortgage Rates

Various economic indicators can influence mortgage rates, reflecting the overall health and stability of the economy. Key indicators include unemployment rates, GDP growth, and consumer confidence. A strong economy with low unemployment, robust GDP growth, and high consumer confidence generally leads to lower mortgage rates, as lenders are more willing to lend money at lower rates in a stable and prosperous environment.

A credit loan can provide a flexible financing option for various needs. Compare different lenders and interest rates to find the best fit for your financial goals.

Conversely, a weakening economy with high unemployment, sluggish GDP growth, and low consumer confidence can lead to higher mortgage rates, as lenders may perceive a greater risk of borrowers defaulting on their loans.

Even if you’re currently unemployed, there might be loans for unemployed individuals. Research lenders who offer programs specifically designed for this situation.

Calculating 20-Year Mortgage Payments: 20 Year Mortgage Rates

Calculating your monthly mortgage payments for a 20-year term is essential for understanding your financial obligations and budgeting accordingly.

Monthly Mortgage Payment Calculation, 20 Year Mortgage Rates

The monthly mortgage payment is calculated using a formula that considers the loan amount, interest rate, and loan term. The formula is as follows:

M = P [ i(1 + i)^n ] / [ (1 + i)^n

1 ]

Staying informed about current mortgage rates is essential for homebuyers. Monitor these rates to determine the best time to lock in a loan.

Where:

- M = Monthly payment

- P = Loan amount

- i = Interest rate (expressed as a monthly decimal)

- n = Number of payments (loan term in months)

Monthly Payments for Various Loan Amounts and Interest Rates

| Loan Amount | Interest Rate | Monthly Payment |

|---|---|---|

| $200,000 | 4.00% | $1,206.91 |

| $250,000 | 4.50% | $1,634.73 |

| $300,000 | 5.00% | $2,076.79 |

Impact of a Higher Down Payment on Monthly Payments

A higher down payment can significantly reduce your monthly mortgage payments. When you make a larger down payment, you borrow less money, which reduces the principal amount and, consequently, your monthly payments.

Choosing a 20-Year Mortgage

Deciding whether a 20-year mortgage is right for you depends on your individual financial circumstances and goals.

Pros and Cons for Different Financial Situations

- For Individuals with a Strong Financial Foundation:If you have a stable income and minimal debt, a 20-year mortgage can be an excellent way to build equity quickly and save on interest payments. You can also benefit from the psychological satisfaction of paying off your mortgage sooner.

If you’re a veteran, you may be eligible for a VA loan. Check today’s VA interest rates to see if this financing option is a good fit for your home purchase.

- For Individuals with a Limited Budget:If your budget is tight, a 20-year mortgage may not be the best option, as the higher monthly payments could strain your finances. Consider a 30-year mortgage to spread out your payments and create more financial flexibility.

Scenarios Where a 20-Year Mortgage Might Be Beneficial

- Early Retirement:If you plan to retire early, a 20-year mortgage can help you reduce your housing costs and free up more income for other expenses during your retirement years.

- Investment Goals:If you have ambitious investment goals, a 20-year mortgage can help you accelerate your savings by freeing up cash flow that would otherwise be going towards mortgage payments.

Potential Drawbacks of a 20-Year Mortgage

- Higher Monthly Payments:The higher monthly payments associated with a 20-year mortgage can make it challenging to manage other financial obligations or achieve other financial goals.

- Less Flexibility:A 20-year mortgage offers less flexibility than a 30-year mortgage, as you have fewer options for refinancing or adjusting your payments if your financial situation changes.

Additional Considerations for 20-Year Mortgages

When considering a 20-year mortgage, there are several additional factors to keep in mind.

Mortgage Points and Their Impact on Interest Rates

Mortgage points, also known as discount points, are prepaid interest that can lower your interest rate. Each point typically costs 1% of your loan amount. For example, if you purchase two points on a $200,000 loan, you would pay $4,000 upfront.

In exchange, you may receive a lower interest rate, which can save you money over the life of the loan. However, it’s important to weigh the potential savings against the upfront cost to determine if purchasing points is financially advantageous for you.

Thinking about a home improvement project or additional investment? Understanding 2nd mortgage rates is crucial. Compare different lenders and rates to find the best fit for your financial situation.

Private Mortgage Insurance (PMI) for 20-Year Mortgages

Private mortgage insurance (PMI) is typically required for borrowers who make a down payment of less than 20% on their home purchase. PMI protects lenders against losses if a borrower defaults on their loan. While PMI is typically required for both 20-year and 30-year mortgages, it can be a factor to consider when comparing the overall costs of each loan term.

Potential Tax Benefits Associated with Mortgage Interest

In some countries, including the United States, mortgage interest payments may be deductible for tax purposes. This can help reduce your tax liability and save you money. However, tax laws can be complex and vary depending on your individual circumstances.

For those seeking a loan to purchase a boat, exploring boat loans is essential. Compare lenders and rates to find the best financing solution for your dream vessel.

It’s essential to consult with a tax professional to determine if you qualify for mortgage interest deductions and to understand the specific rules and regulations that apply to you.

Bridge lending can be a helpful tool for transitioning between properties. Explore bridge lending options if you need short-term financing during a real estate transaction.

End of Discussion

In conclusion, 20-year mortgages present a unique path to homeownership, offering the potential for substantial long-term savings and a faster path to equity. By carefully weighing the pros and cons, understanding current market conditions, and considering your individual financial situation, you can determine if a 20-year mortgage is the right choice for you.

With careful planning and informed decision-making, you can unlock the benefits of a shorter mortgage term and achieve your homeownership goals.

FAQ Guide

How do 20-year mortgage rates compare to 30-year rates?

If you’re struggling with overwhelming debt, seeking debt relief options might be the right step. There are various programs and strategies available to help you manage and potentially reduce your debt burden.

Generally, 20-year mortgage rates are slightly lower than 30-year rates. This is because lenders perceive a shorter loan term as less risky.

Paying for your child’s education can be a significant financial commitment. Consider the Parent Plus Loan as a potential funding source, but remember to carefully evaluate its terms and interest rates.

What are the tax benefits of a 20-year mortgage?

Buying a home is a major financial decision. Researching current house loan interest rates is a smart first step. This will help you determine affordability and explore different loan options.

You can deduct mortgage interest payments on your federal income taxes, regardless of the loan term. However, with a 20-year mortgage, you’ll pay off the principal faster, potentially reducing your overall interest payments and increasing your tax deductions.

Is a 20-year mortgage right for everyone?

A 20-year mortgage might not be suitable for everyone. It requires a higher monthly payment, which could strain your budget. It’s crucial to assess your financial situation and determine if you can comfortably afford the increased payments.