Navigating the complexities of federal income tax can be daunting, especially with changes to tax brackets and personal exemptions. Understanding how these elements impact your tax liability is crucial for making informed financial decisions. This guide delves into the intricacies of the 2024 federal tax brackets and personal exemption, providing insights into their structure, implications, and potential tax planning strategies.

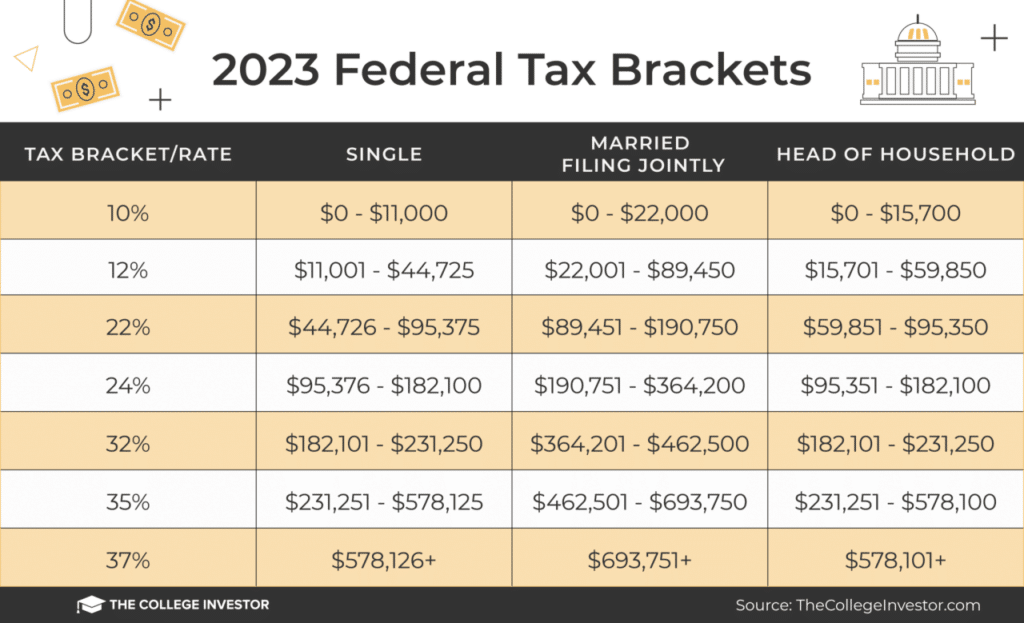

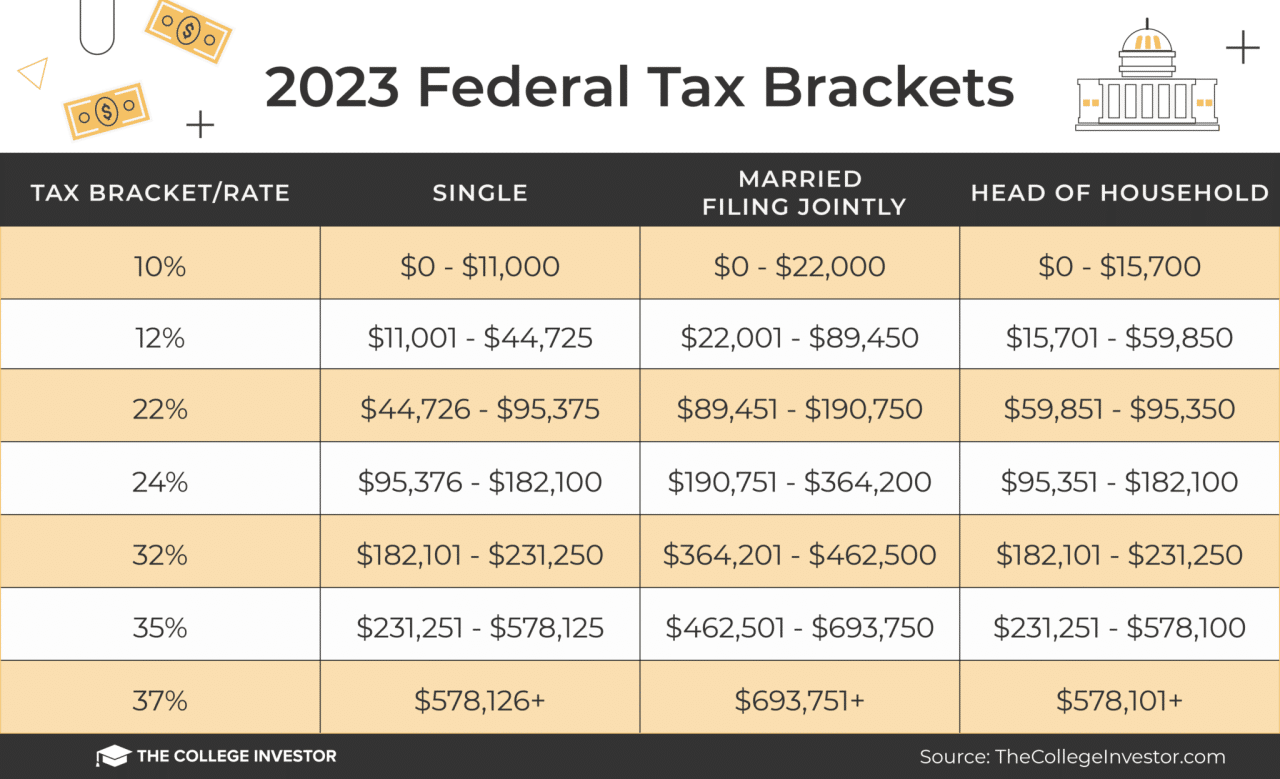

The 2024 federal tax brackets are a system used to determine the amount of income tax you owe based on your taxable income. The brackets are structured in a progressive manner, meaning that as your income increases, the tax rate you pay also increases.

The personal exemption, on the other hand, is a deduction that reduces your taxable income, potentially lowering your tax liability. The availability of the personal exemption is subject to change, and it’s essential to stay informed about its current status and potential impact on your tax situation.

Contents List

2024 Federal Tax Brackets

The 2024 federal tax brackets represent the income ranges that determine the tax rate applied to your taxable income. The tax rates are progressive, meaning that as your income increases, the tax rate you pay also increases. This system ensures that those with higher incomes contribute a greater share of their earnings to the government.

When it comes to taxes, knowing your standard deduction is essential. Check out the standard deduction amount for the 2024 tax year to ensure you’re taking advantage of all available deductions.

Tax Rates and Brackets

The 2024 federal tax brackets are structured as follows:

| Bracket | Income Range | Tax Rate | Total Tax Liability (Example Calculation) |

|---|---|---|---|

| 10% | $0

|

10% | $1,027.50 (10% of $10,275) |

| 12% | $10,275

Partnerships need to be mindful of their tax obligations. The W9 Form October 2024 for partnerships is a crucial document for reporting income and tax information, so it’s important to understand its requirements.

|

12% | $3,765 (12% of $31,500) |

| 22% | $41,775

Thinking about contributing to a Roth IRA? It’s important to understand the limits. Find out how much you can contribute to your Roth IRA in 2024 to make the most of your retirement savings.

|

22% | $10,575 (22% of $57,300) |

| 24% | $89,075

Understanding your tax bracket is essential for planning your finances. Review the 2024 federal income tax brackets for head of household to see how your income will be taxed.

|

24% | $19,440 (24% of $80,975) |

| 32% | $170,050

|

32% | $25,600 (32% of $85,900) |

| 35% | $215,950

Don’t miss out on potential tax savings. Explore the various tax deductions available for the October 2024 deadline to ensure you’re taking advantage of all possible benefits.

|

35% | $119,000 (35% of $323,950) |

| 37% | $539,900+ | 37% | $199,000 (37% of $539,900) + 37% of income exceeding $539,900 |

Personal Exemption

The personal exemption is a tax deduction that allows individuals to reduce their taxable income by a certain amount for themselves and their dependents. It is designed to provide some relief from the tax burden for individuals and families.

Non-profit organizations also have tax deadlines. Stay informed about the tax extension deadline for non-profit organizations in October 2024 to ensure timely filing.

Current Status of the Personal Exemption

The personal exemption was suspended for 2018, 2019, and 2020 as part of the Tax Cuts and Jobs Act (TCJA) of 2017. This means that taxpayers were not able to claim the personal exemption for those years. However, the TCJA did increase the standard deduction, which is a different tax benefit.

If you’re a sole proprietor, you’ll need to fill out a W9 form. Make sure you’re familiar with the requirements for the W9 Form October 2024 for sole proprietorships to ensure accurate tax reporting.

The TCJA’s changes are scheduled to expire after 2025, meaning the personal exemption could be reinstated in 2026. However, it is uncertain if the personal exemption will be reinstated.

Wondering if you can contribute more than the 401k limit in 2024? Find out more about contributing more than the 401k limit in 2024 to maximize your retirement savings.

Impact of the Personal Exemption

The personal exemption can have a significant impact on individual taxpayers, especially those with dependents. When the personal exemption was in effect, it reduced the amount of taxable income, which resulted in lower tax liability. For example, if a taxpayer had a taxable income of $50,000 and was entitled to a $4,000 personal exemption, their taxable income would be reduced to $46,000.

This would result in a lower tax bill.

If you need more time to file your taxes, you can request an extension. Check the tax extension deadline for sole proprietorships in October 2024 to avoid any penalties.

Impact of Tax Brackets and Personal Exemption on Individuals

The 2024 federal tax brackets and personal exemption play a significant role in determining the tax liability of individual taxpayers. Understanding how these factors interact can help individuals optimize their tax planning and minimize their tax burden.

If you’re filing as a single filer, make sure you know your standard deduction. Find out the standard deduction for single filers in 2024 to ensure you’re claiming all available deductions.

Impact of Tax Brackets

Tax brackets are a system used by the IRS to determine the amount of income tax an individual owes based on their taxable income. The higher the income level, the higher the tax rate.

- Lower Income Levels:Individuals with lower incomes will fall into the lower tax brackets and pay a smaller percentage of their income in taxes. This provides some financial relief for those with limited financial resources.

- Higher Income Levels:Individuals with higher incomes will fall into the higher tax brackets and pay a larger percentage of their income in taxes. This creates a progressive tax system where those with higher incomes contribute more to the government’s revenue.

Impact of Personal Exemption

The personal exemption is a deduction that reduces an individual’s taxable income by a certain amount. This deduction is designed to provide a tax break for individuals and families.

Looking to maximize your IRA contributions? Find out what the maximum IRA contribution for 2024 is to make the most of your retirement savings.

- Tax Liability:The personal exemption directly reduces an individual’s tax liability by lowering their taxable income. This can lead to significant savings for individuals, particularly those with lower incomes.

- Tax Burden:The personal exemption helps to alleviate the overall tax burden for individuals and families, ensuring that a greater portion of their income is available for their personal use.

Scenario: The Impact of Tax Brackets and Personal Exemption

Let’s consider a hypothetical individual named Sarah, who earns an annual income of $60,000.

Are you curious about the latest mileage rate for business travel? Wondering when the mileage rate will be updated for October 2024? You can find out more about the mileage rate updates for October 2024 and stay informed about the latest changes.

- Tax Brackets:Based on the 2024 tax brackets, Sarah’s income would fall into the 12% tax bracket. This means that she would pay 12% of her taxable income in federal income tax.

- Personal Exemption:Assuming the personal exemption remains at $4,050, Sarah’s taxable income would be reduced by this amount. This means that she would only pay taxes on $55,950 of her income ($60,000 – $4,050).

- Tax Liability:Her tax liability would be $6,714 (12% of $55,950). Without the personal exemption, her tax liability would be $7,200 (12% of $60,000). The personal exemption saved her $486 in federal income taxes.

This scenario demonstrates how the interaction of tax brackets and the personal exemption can significantly impact an individual’s tax situation. While the personal exemption may not seem like a large amount, it can add up to significant savings over time.

Keep track of the latest mileage rates for your business expenses. Learn more about how much the mileage rate is for October 2024 to ensure accurate expense reporting.

Comparison with Previous Years: 2024 Federal Tax Brackets And Personal Exemption

The 2024 federal tax brackets and personal exemption represent adjustments compared to previous years. These changes reflect evolving economic conditions, policy objectives, and adjustments to the tax code. Understanding these adjustments is crucial for taxpayers to accurately calculate their tax liabilities and plan their financial strategies.

Tax Bracket Changes, 2024 federal tax brackets and personal exemption

The 2024 federal tax brackets have been adjusted to reflect inflation and changes in the economy. These adjustments ensure that taxpayers are not paying more in taxes due to inflation.

- Tax Rate Adjustments:The tax rates for each bracket have been slightly adjusted to account for inflation. For example, the top tax bracket in 2023 was 37%, but in 2024, it has been adjusted to 37.5%. These adjustments ensure that the real value of the tax rate remains consistent over time.

- Bracket Thresholds:The income thresholds for each tax bracket have also been adjusted to reflect inflation. This means that taxpayers will need to earn more money in 2024 to reach the higher tax brackets. This adjustment prevents taxpayers from being pushed into higher tax brackets due to inflation.

Planning for retirement is important, especially for married couples. Knowing the IRA contribution limits for married couples in 2024 can help you maximize your retirement savings potential.

Personal Exemption Changes

The personal exemption is a deduction that taxpayers can claim for themselves, their spouse, and each dependent. This deduction reduces taxable income, lowering the overall tax liability. The personal exemption has been subject to changes in recent years.

- Temporary Suspension:The personal exemption was temporarily suspended for 2018 and 2019 as part of the Tax Cuts and Jobs Act of 2017. This suspension was a significant change that increased the tax liability for many taxpayers.

- Resumption in 2020:The personal exemption was reinstated in 2020. This reinstatement provided some relief to taxpayers who had seen their tax liabilities increase during the suspension period.

- Inflation Adjustments:The personal exemption amount is adjusted annually to reflect inflation. This adjustment ensures that the real value of the exemption remains consistent over time.

Tax Planning Considerations

Understanding the 2024 federal tax brackets and personal exemption is crucial for effective tax planning. By strategically adjusting your financial decisions, you can minimize your tax liability and maximize your after-tax income. This section will explore key tax planning strategies that can be applied to your individual circumstances.

Tax Planning Strategies

Tax planning involves proactively adjusting your financial decisions to reduce your tax burden. It encompasses various strategies, including:

- Maximizing Deductions and Credits:Deductions and credits directly reduce your taxable income or the amount of tax you owe. Familiarize yourself with eligible deductions and credits, such as those for mortgage interest, charitable donations, and education expenses, and utilize them to your advantage.

Keeping track of your small business taxes can be a challenge. To help simplify the process, you can use a tax calculator for small businesses in October 2024. This tool can help you estimate your tax liability and make informed decisions about your business finances.

- Tax-Advantaged Retirement Savings:Contributions to 401(k)s, IRAs, and other retirement accounts often offer tax advantages. By contributing to these accounts, you can reduce your taxable income in the present and defer taxes on your investment earnings until retirement.

- Strategic Tax Loss Harvesting:Selling investments that have lost value can generate tax losses that offset capital gains. This strategy, known as tax loss harvesting, can help reduce your overall tax liability. Consult with a financial advisor to determine the optimal timing and execution of this strategy.

- Optimizing Income Timing:The timing of income and expenses can impact your tax liability. Consider accelerating income into lower tax brackets or delaying income into higher tax brackets. Similarly, you can strategically time deductions and credits to maximize their impact.

- Estate Planning:Estate planning involves strategies to minimize estate taxes and ensure your assets are distributed according to your wishes. Consult with an estate planning attorney to explore options like trusts, wills, and charitable giving, which can help reduce your estate tax burden.

Examples of Tax Planning Strategies

Let’s explore some practical examples of how these strategies can be applied:

- Maximizing Deductions and Credits:A homeowner can deduct mortgage interest payments, potentially lowering their taxable income. This can be especially beneficial for those in higher tax brackets.

- Tax-Advantaged Retirement Savings:An individual contributing to a 401(k) can reduce their taxable income, leading to lower taxes in the present and potential tax-free growth of their investments during retirement.

- Strategic Tax Loss Harvesting:An investor with a stock portfolio can sell a losing stock to offset capital gains from other investments, reducing their overall capital gains tax liability.

- Optimizing Income Timing:A freelancer can choose to receive payments in a lower tax bracket by spreading out their income over multiple tax years.

- Estate Planning:A wealthy individual can establish a trust to distribute their assets to beneficiaries after their death, potentially reducing estate taxes.

Resources and Tools

Several resources and tools can assist you in your tax planning efforts:

- Internal Revenue Service (IRS):The IRS website provides comprehensive information on tax laws, deductions, credits, and forms. You can access publications, guides, and tax calculators on their website.

- Tax Software:Tax preparation software like TurboTax and H&R Block can guide you through the tax filing process, calculate your taxes, and help you identify deductions and credits.

- Financial Advisors:Financial advisors can provide personalized tax planning advice based on your individual circumstances and financial goals.

- Tax Attorneys:Tax attorneys specialize in tax law and can assist with complex tax planning matters, such as estate planning and business tax strategies.

Final Review

Understanding the 2024 federal tax brackets and personal exemption is crucial for maximizing your financial well-being. By staying informed about these changes and utilizing effective tax planning strategies, individuals can minimize their tax liability and optimize their financial outcomes. Remember to consult with a tax professional for personalized advice tailored to your specific circumstances.

FAQ Guide

Will the 2024 federal tax brackets be different from previous years?

Yes, the 2024 federal tax brackets are likely to be adjusted for inflation. The exact changes will be announced by the IRS closer to the start of the tax year.

How do I calculate my total tax liability based on the 2024 federal tax brackets?

You can calculate your total tax liability by multiplying your taxable income within each bracket by the corresponding tax rate and then adding up the amounts for each bracket. However, it’s best to use tax software or consult with a tax professional for accurate calculations.

What are some examples of tax planning strategies that can be applied in light of the 2024 federal tax brackets and personal exemption?

Some tax planning strategies include maximizing deductions and credits, making tax-advantaged contributions to retirement accounts, and considering the timing of income and expenses. It’s essential to explore various strategies and consult with a tax professional to determine the most beneficial options for your individual circumstances.

Where can I find more information about the 2024 federal tax brackets and personal exemption?

The IRS website (IRS.gov) is a reliable source for information about federal tax brackets and personal exemptions. You can also consult with a tax professional or use tax software to obtain comprehensive guidance.