Navigating the 2024 tax bracket calculator for different income levels can feel like deciphering a complex code. This guide will unravel the mysteries of tax brackets, illuminating how income affects your tax liability. We’ll delve into the intricacies of the 2024 tax code, explore the impact of various income levels on your tax burden, and provide insights into strategies for minimizing your tax bill.

Understanding tax brackets is crucial for making informed financial decisions. By grasping the relationship between your income and tax rate, you can better plan for the future and make choices that optimize your financial well-being. Whether you’re a seasoned investor or just starting out, this guide will equip you with the knowledge to navigate the complexities of the tax system and make informed decisions about your finances.

Contents List

Introduction to Tax Brackets

Tax brackets are a fundamental part of the United States tax system, defining the different rates at which taxpayers are taxed based on their income levels. Understanding tax brackets is crucial for individuals and businesses to accurately calculate their tax liability and make informed financial decisions.Tax brackets work by dividing taxable income into ranges, each associated with a specific tax rate.

The more income you earn, the higher the tax rate you pay on a portion of your income. This progressive tax system ensures that those with higher incomes contribute a larger share of taxes to support government programs and services.

The 2024 Tax Code and Potential Changes

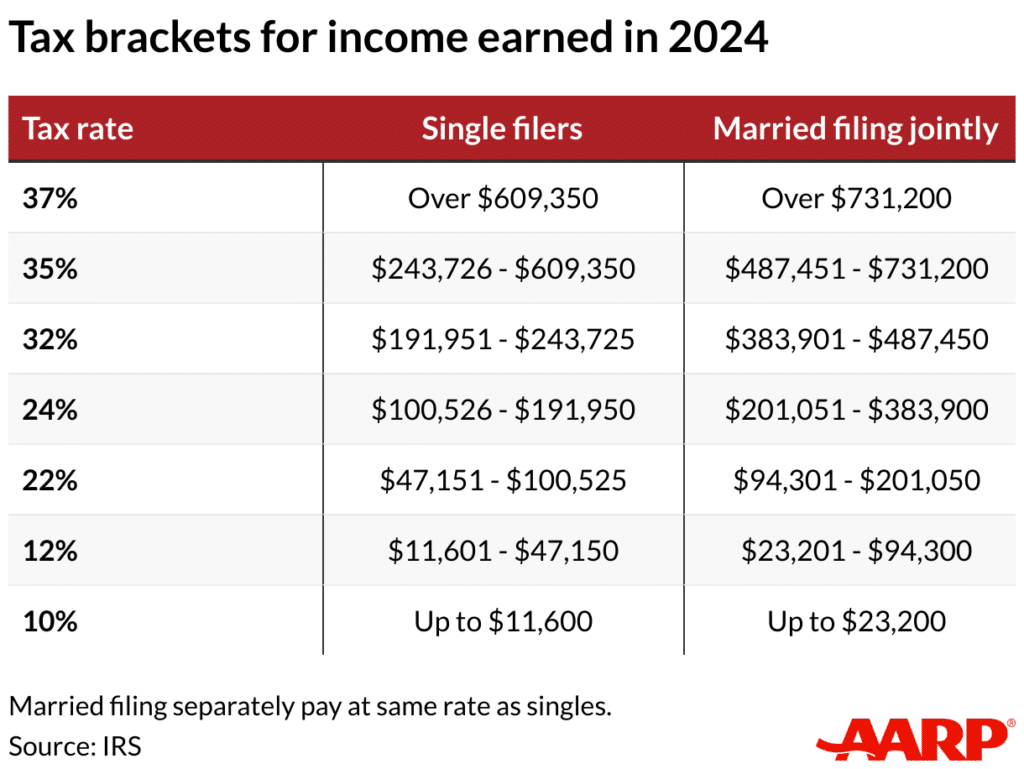

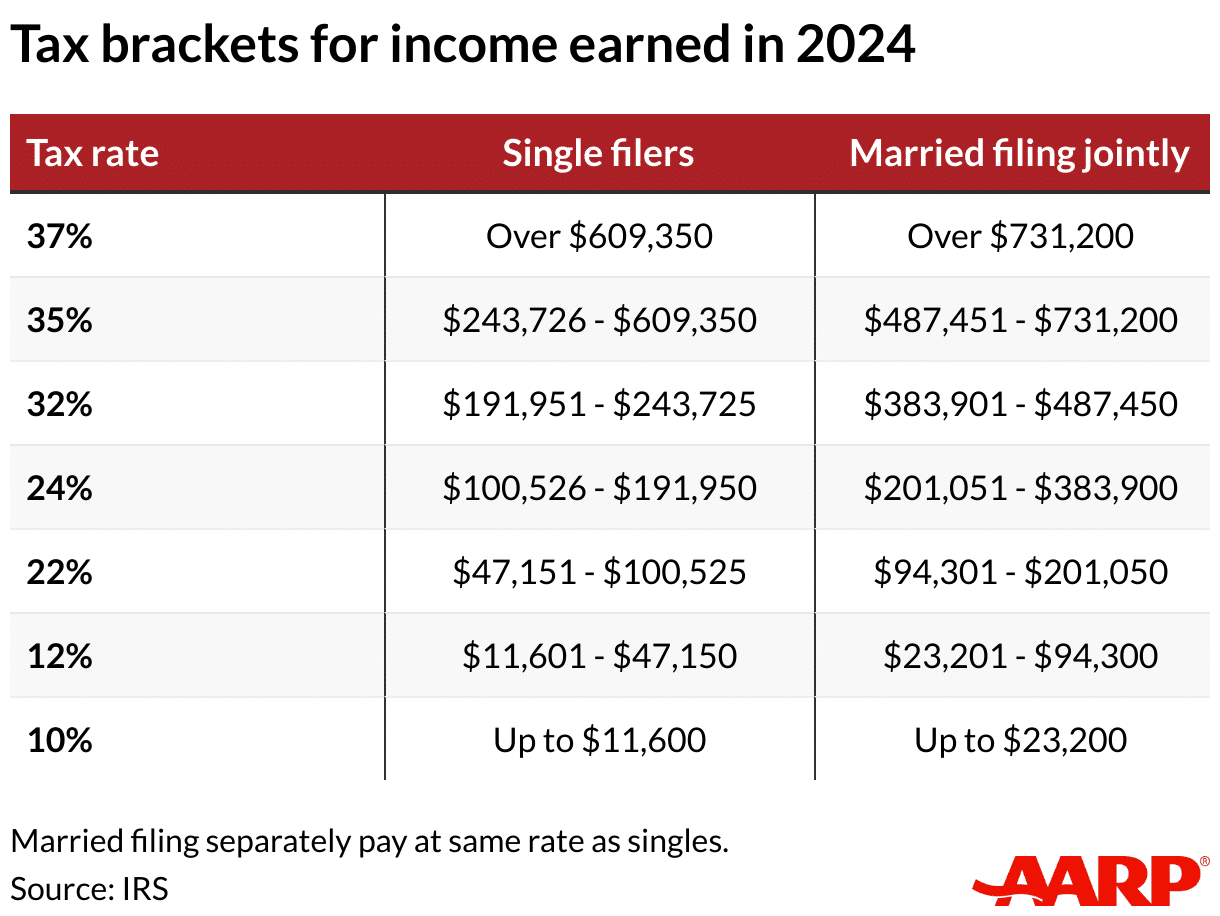

The 2024 tax code is currently subject to ongoing discussions and potential changes. While the exact details remain uncertain, it’s important to understand the current framework and the potential adjustments that could impact tax brackets. The current tax code features seven tax brackets, each with its own tax rate.

The October deadline for filing taxes is quickly approaching. Make sure you’re prepared by learning how to file taxes by the October 2024 deadline and avoid any penalties.

The 2024 tax code may see adjustments to these brackets, potentially impacting the thresholds at which income transitions to higher tax rates.

It’s important to note that these are just potential changes, and the final tax code for 2024 may differ. Staying informed about the latest updates and consulting with a tax professional is crucial for accurate tax planning.

2024 Tax Brackets for Different Income Levels

This section will provide an overview of the 2024 tax brackets for different income levels. Understanding these brackets is crucial for determining your tax liability and planning your finances.

Freelancers need to be aware of the W9 Form and its requirements. Learn more about the W9 Form October 2024 for freelancers to ensure you’re compliant with tax regulations.

2024 Tax Brackets for Different Filing Statuses

The 2024 tax brackets are determined based on your filing status and taxable income. The following table displays the tax brackets for each filing status:

| Filing Status | Income Range | Tax Rate | Amount of Tax Owed |

|---|---|---|---|

| Single | $0

|

10% | $0

|

| Single | $10,275

|

12% | $1,027.50

|

| Single | $41,775

|

22% | $4,810.50

|

| Single | $89,075

|

24% | $17,439.50

|

| Single | $170,050

Small business owners may have different IRA contribution limits than other individuals. Learn more about the IRA contribution limits for small business owners in 2024 to maximize your retirement savings.

|

32% | $34,799.50

|

| Single | $215,950

|

35% | $55,799.50

|

| Single | $539,900+ | 37% | $175,499.50+ |

| Married Filing Jointly | $0

|

10% | $0

Students may be eligible for a standard deduction, but it’s important to understand the specific rules and requirements. Learn more about the standard deduction for students in 2024 to see if you qualify.

|

| Married Filing Jointly | $20,550

|

12% | $2,055

|

| Married Filing Jointly | $83,550

|

22% | $9,627

|

| Married Filing Jointly | $178,150

|

24% | $33,297

Small businesses have different contribution limits than individual employees, so make sure you check out the 401k contribution limits for 2024 for small businesses to ensure you’re taking advantage of the maximum contribution possible.

|

| Married Filing Jointly | $340,100

|

32% | $69,627

|

| Married Filing Jointly | $431,900

Failing to comply with W9 Form requirements can result in penalties. Learn more about the W9 Form October 2024 penalties for non-compliance to avoid any potential issues.

|

35% | $111,597

|

| Married Filing Jointly | $647,850+ | 37% | $208,997+ |

| Married Filing Separately | $0

|

10% | $0

|

| Married Filing Separately | $10,275

|

12% | $1,027.50

|

| Married Filing Separately | $41,775

It’s important to know the limits for your contributions to your 401k, especially with the new year approaching. Take a look at the 2024 401k contribution limits for employees to make sure you’re maximizing your retirement savings.

|

22% | $4,810.50

|

| Married Filing Separately | $89,075

The standard deduction can change each year, so it’s essential to understand the updated amounts. Review the standard deduction changes for 2024 to see how they might affect your tax liability.

|

24% | $17,439.50

|

| Married Filing Separately | $170,050

|

32% | $34,799.50

|

| Married Filing Separately | $215,950

|

35% | $55,799.50

|

| Married Filing Separately | $539,900+ | 37% | $175,499.50+ |

| Head of Household | $0

|

10% | $0

|

| Head of Household | $18,200

|

12% | $1,820

The federal tax brackets and personal exemption can change each year, so it’s essential to stay informed. Check out the 2024 federal tax brackets and personal exemption to see how they might affect your tax liability.

|

| Head of Household | $85,575

|

22% | $9,869

|

| Head of Household | $178,150

|

24% | $33,297

|

| Head of Household | $340,100

|

32% | $69,627

|

| Head of Household | $431,900

The mileage rate for business travel can change, so it’s crucial to stay informed. Find out if the mileage rate is changing in October 2024 and adjust your calculations accordingly.

|

35% | $111,597

|

| Head of Household | $647,850+ | 37% | $208,997+ |

| Qualifying Widow(er) | $0

|

10% | $0

|

| Qualifying Widow(er) | $20,550

|

12% | $2,055

|

| Qualifying Widow(er) | $83,550

|

22% | $9,627

|

| Qualifying Widow(er) | $178,150

|

24% | $33,297

|

| Qualifying Widow(er) | $340,100

|

32% | $69,627

|

| Qualifying Widow(er) | $431,900

|

35% | $111,597

|

| Qualifying Widow(er) | $647,850+ | 37% | $208,997+ |

Impact of Income Levels on Tax Liability

As your income increases, you move into higher tax brackets. This means that the percentage of your income subject to taxation increases, leading to a higher tax liability. For example, if you are single and earn $50,000, you will be taxed at a rate of 12% on the first $10,275 of your income, 22% on the income between $10,275 and $41,775, and 22% on the remaining amount.

Factors Affecting Tax Liability

Your tax liability is not solely determined by your income level. Several other factors play a crucial role in shaping your overall tax burden. Understanding these factors is essential for optimizing your tax strategy and minimizing your tax liability.

Deductions

Deductions are expenses you can subtract from your gross income to reduce your taxable income. By claiming eligible deductions, you lower the amount of income subject to taxation, resulting in a lower tax bill.

Deductions directly reduce your taxable income, leading to lower tax liability.

Here are some common deductions:

- Standard Deduction:This is a fixed amount you can deduct instead of itemizing your deductions. The standard deduction amount varies based on your filing status.

- Itemized Deductions:This allows you to deduct specific expenses, such as medical expenses, mortgage interest, and charitable contributions, exceeding a certain threshold. These deductions can be more beneficial than the standard deduction if your itemized expenses are significant.

- Homeownership Deductions:Deductions related to homeownership, such as mortgage interest and property taxes, can significantly reduce your tax liability.

Credits, 2024 tax bracket calculator for different income levels

Tax credits are direct reductions to your tax liability, unlike deductions, which only reduce your taxable income. Credits are often more valuable than deductions because they directly reduce your tax bill.

Tax credits directly reduce your tax liability, offering greater tax savings than deductions.

Here are some common tax credits:

- Earned Income Tax Credit (EITC):This credit is available to low- and moderate-income working individuals and families. The amount of the credit depends on your income level and number of qualifying children.

- Child Tax Credit:This credit is available for each qualifying child under 17 years old. The amount of the credit is $2,000 per child, with a portion refundable.

- American Opportunity Tax Credit (AOTC):This credit is available for the first four years of post-secondary education. It provides a tax credit of up to $2,500 per student.

Exemptions

Exemptions are deductions for yourself, your spouse, and any dependents you claim on your tax return. These deductions reduce your taxable income, ultimately lowering your tax liability.

Married couples have specific IRA contribution limits, so it’s important to understand these rules. Check out the IRA contribution limits for married couples in 2024 to maximize your retirement savings.

Exemptions directly reduce your taxable income, similar to deductions, but they are specific to individuals and dependents.

It’s crucial to know the maximum amount you can contribute to your 401k each year. Find out the maximum 401k contribution for 2024 to ensure you’re taking full advantage of your retirement savings options.

Here are some common exemptions:

- Personal Exemption:This exemption is for yourself and your spouse, allowing you to deduct a certain amount from your taxable income. The personal exemption was suspended from 2018 to 2025 under the Tax Cuts and Jobs Act.

- Dependent Exemption:This exemption is available for each qualifying dependent, including children, elderly parents, and other individuals who meet specific criteria. This exemption was also suspended from 2018 to 2025.

Flowchart Illustrating Tax Liability Calculation

The following flowchart illustrates the decision-making process involved in calculating tax liability:

| Step | Decision | Action |

|---|---|---|

| 1 | Determine Gross Income | Add all sources of income, including wages, salaries, interest, dividends, and capital gains. |

| 2 | Choose Deduction Method | Decide between the standard deduction and itemized deductions. |

| 3 | Calculate Deductions | Subtract eligible deductions from gross income to arrive at adjusted gross income (AGI). |

| 4 | Determine Exemptions | Subtract exemptions from AGI to calculate taxable income. |

| 5 | Apply Tax Brackets | Calculate tax liability based on the applicable tax brackets and taxable income. |

| 6 | Apply Credits | Subtract eligible tax credits from tax liability. |

| 7 | Calculate Final Tax Liability | The remaining amount after applying credits represents your final tax liability. |

This flowchart demonstrates the interconnectedness of income, deductions, credits, and exemptions in determining your tax liability.

Using a Tax Bracket Calculator

Tax bracket calculators are valuable tools for understanding how your income will be taxed and estimating your tax liability. They can help you make informed financial decisions and plan for your future.

Using a Tax Bracket Calculator: A Step-by-Step Guide

Tax bracket calculators are user-friendly and can be used to estimate your tax liability based on your income, deductions, and credits. Here’s a step-by-step guide to using a tax bracket calculator:

- Choose a reputable tax bracket calculator: Several online tax bracket calculators are available, so choose one that is reliable and accurate. Look for calculators that are updated with the latest tax laws and regulations.

- Enter your income information: The calculator will typically ask for your total income, including salary, wages, interest, dividends, and other sources of income.

- Input deductions and credits: You may be eligible for certain deductions and credits that can reduce your tax liability. Common deductions include standard deduction, itemized deductions, and student loan interest. Some common credits include child tax credit, earned income tax credit, and American opportunity tax credit.

- Select your filing status: Your filing status determines how your income is taxed. The most common filing statuses are single, married filing jointly, married filing separately, and head of household.

- Review your results: The calculator will display your estimated tax liability, including your tax bracket, marginal tax rate, and total taxes owed.

Tips for Accurate Input

To ensure accurate results, it is important to input your information carefully and accurately. Here are some tips:

- Gather all relevant documents: Before using the calculator, gather all your income documents, including your W-2, 1099 forms, and any other income statements. This will help you enter your income information accurately.

- Double-check your information: Carefully review all the information you enter into the calculator to avoid errors.

- Consider professional advice: If you have complex financial circumstances or are unsure about your tax obligations, it is advisable to consult with a tax professional for personalized advice.

Comparing Tax Bracket Calculators

Several tax bracket calculators are available online, each with unique features and functionalities. Here’s a comparison of some popular calculators:

| Calculator | Features | Pros | Cons |

|---|---|---|---|

| TaxAct | Comprehensive tax bracket calculator, including federal and state taxes. Allows for deductions and credits. Provides personalized tax advice. | User-friendly interface. Accurate and up-to-date information. Comprehensive features. | May require a paid subscription for advanced features. |

| TurboTax | Offers a free tax bracket calculator. Provides estimates for federal and state taxes. Includes common deductions and credits. | Easy to use. Free version available. Accurate calculations. | Limited features in the free version. May require a paid subscription for advanced features. |

| H&R Block | Offers a free tax bracket calculator. Provides estimates for federal and state taxes. Includes common deductions and credits. | Simple and straightforward. Free version available. Accurate calculations. | Limited features in the free version. May require a paid subscription for advanced features. |

Tax Planning Strategies

Tax planning involves proactively taking steps to minimize your tax liability throughout the year. By understanding the various deductions, credits, and exemptions available, you can optimize your tax situation and keep more of your hard-earned money.

Deductions for Different Income Levels

Deductions are expenses you can subtract from your taxable income, reducing your tax liability. The types of deductions you can claim depend on your income level and personal circumstances.

- Standard Deduction: The standard deduction is a fixed amount you can claim instead of itemizing deductions. It varies based on your filing status and age. The standard deduction for 2024 is higher than in previous years, offering significant savings for many taxpayers.

- Itemized Deductions: If you choose to itemize, you can deduct specific expenses, such as medical expenses, mortgage interest, charitable donations, and state and local taxes. Itemizing is often beneficial for taxpayers with significant medical expenses or those who have made large charitable contributions.

- Homeownership Deductions: Homeowners can deduct mortgage interest and property taxes, which can significantly reduce their tax liability. These deductions are especially valuable for those with higher mortgage balances and property taxes.

- Retirement Contributions: Contributions to traditional IRA or 401(k) accounts are deductible, reducing your taxable income and saving you on taxes in the present. However, you will pay taxes on withdrawals in retirement.

- Education Expenses: Deductions for education expenses, such as student loan interest and tuition, are available to help offset the cost of higher education. These deductions can be especially helpful for students and recent graduates.

Tax Credits

Tax credits directly reduce the amount of tax you owe. Unlike deductions, which lower your taxable income, credits are subtracted directly from your tax liability.

If you’re over 50, you may be eligible for catch-up contributions to your 401k, allowing you to save even more for retirement. Check out the 401k contribution limits for 2024 for over 50 to see how much you can contribute.

- Earned Income Tax Credit (EITC): The EITC is a refundable tax credit for low-to-moderate-income working individuals and families. The credit amount varies based on income, filing status, and the number of qualifying children. This credit can significantly reduce or even eliminate your tax liability.

The standard mileage rate can fluctuate throughout the year, so it’s essential to use the most current rate for your business expense calculations. Check out the standard mileage rate for October 2024 to ensure your calculations are accurate.

- Child Tax Credit: The Child Tax Credit provides a tax credit for each qualifying child under 17 years old. The credit amount is partially refundable, meaning you can receive a portion of the credit back even if you owe no taxes.

- American Opportunity Tax Credit: The American Opportunity Tax Credit is available for the first four years of post-secondary education. This credit is partially refundable and can significantly reduce the cost of college for eligible students.

- Premium Tax Credit: The Premium Tax Credit helps individuals and families afford health insurance through the Affordable Care Act marketplaces. The credit amount is based on income and household size.

Exemptions

Exemptions are personal deductions that reduce your taxable income.

- Personal Exemption: While the personal exemption was suspended for 2018-2025, it could be reinstated in the future. When in effect, it provides a fixed deduction for each individual on your tax return.

- Dependent Exemption: Like the personal exemption, the dependent exemption was suspended for 2018-2025. When in effect, it provides a deduction for each dependent you claim on your tax return.

Tax Planning Strategies for Different Income Levels

- Low-Income Individuals: Individuals with low incomes should take advantage of credits such as the Earned Income Tax Credit and the Child Tax Credit. They should also consider using the standard deduction if it provides a greater benefit than itemizing deductions.

IRA contribution limits can vary depending on your age. Check out the IRA contribution limits for 2024 by age to ensure you’re contributing the maximum amount allowed.

- Middle-Income Individuals: Middle-income individuals may benefit from a combination of deductions and credits, including the Child Tax Credit, the American Opportunity Tax Credit, and deductions for homeownership or retirement contributions.

- High-Income Individuals: High-income individuals often face higher tax rates and may benefit from maximizing deductions, such as those for mortgage interest, charitable donations, and business expenses. They should also explore strategies for tax-efficient investing, such as using Roth IRAs or other tax-advantaged accounts.

Maximizing Deductions and Credits

- Keep Detailed Records: Maintaining accurate and detailed records of your expenses and income is crucial for claiming all eligible deductions and credits. Organize receipts, invoices, and other documentation to support your claims.

- Consult a Tax Professional: A qualified tax professional can help you identify all available deductions and credits and develop a tax planning strategy tailored to your specific circumstances. They can also help you navigate complex tax laws and ensure you comply with all regulations.

Resources and Further Information

It’s crucial to stay informed about the latest tax regulations and guidelines to ensure accurate tax calculations and avoid potential penalties. This section provides valuable resources for accessing up-to-date information on 2024 tax brackets and related matters.

Official Government Websites

The official websites of the Internal Revenue Service (IRS) and state tax agencies offer comprehensive and reliable information on tax laws, regulations, and forms. These websites are the primary sources for accurate and up-to-date tax information.

- Internal Revenue Service (IRS):The IRS website (www.irs.gov) provides a wealth of information on federal taxes, including tax brackets, deductions, credits, and forms. It also offers interactive tools, publications, and guidance on various tax-related topics.

- State Tax Agencies:Each state has its own tax agency, which provides information on state income tax, sales tax, and other state-specific taxes. You can find the website of your state tax agency by searching online or through the IRS website.

Reputable Financial Institutions

Financial institutions, such as banks, credit unions, and investment firms, often offer resources and tools related to taxes and financial planning. Their websites may provide articles, calculators, and guides on tax-related matters.

- Banks and Credit Unions:Many financial institutions have websites with sections dedicated to tax information, including articles, calculators, and links to IRS resources. They may also offer tax preparation services.

- Investment Firms:Investment firms, such as brokerage houses and mutual fund companies, may provide resources on tax implications of investments, retirement planning, and other financial strategies.

Recommended Books, Articles, and Online Resources

Numerous books, articles, and online resources offer in-depth insights into tax planning and financial strategies. These resources can help you understand tax concepts, identify potential deductions and credits, and develop strategies to minimize your tax liability.

- Books:“The Total Money Makeover” by Dave Ramsey, “Rich Dad Poor Dad” by Robert Kiyosaki, “The Millionaire Next Door” by Thomas J. Stanley.

- Articles:Websites like Investopedia, The Balance, and NerdWallet offer articles on various tax-related topics, including tax brackets, deductions, credits, and investment strategies.

- Online Resources:Websites like TurboTax, H&R Block, and TaxAct offer online tax preparation tools and resources, including calculators, guides, and tips for filing taxes.

Final Conclusion

Armed with the knowledge of 2024 tax brackets and the strategies discussed in this guide, you can approach tax planning with confidence. Remember, understanding your tax obligations and utilizing available resources is essential for maximizing your financial well-being. Don’t hesitate to seek professional advice when needed, as navigating the intricacies of the tax code can be complex.

By taking proactive steps to manage your taxes, you can ensure that you are making the most of your hard-earned money.

Essential FAQs: 2024 Tax Bracket Calculator For Different Income Levels

What are the penalties for filing taxes late?

Penalties for late filing can vary, but generally include a percentage of the unpaid tax liability plus interest on the unpaid amount. The exact penalties can depend on factors like the length of the delay and the reason for the late filing.

How often are tax brackets adjusted?

Tax brackets are typically adjusted annually for inflation. The Internal Revenue Service (IRS) uses the Consumer Price Index (CPI) to determine the adjustment amount. These adjustments help ensure that taxpayers aren’t paying more in taxes due to inflation.

Can I use a tax bracket calculator for state income taxes?

While some tax bracket calculators may include state income tax information, many are focused on federal income tax. It’s essential to consult your state’s tax information for accurate calculations.