2024 Tax Bracket Changes Compared to 2023: The upcoming year could bring significant changes to your tax obligations. With proposed adjustments to tax brackets, it’s crucial to understand how these changes might affect your finances. Whether you’re a high-income earner, middle-class worker, or low-income individual, these shifts in tax policy could impact your tax liability, financial planning, and even your spending habits.

This guide delves into the proposed 2024 tax bracket changes, comparing them to the current 2023 brackets. We’ll explore the potential impact on different income levels, analyze the economic implications, and provide valuable tips for tax planning in the new year.

Join us as we navigate the complexities of tax law and shed light on what these changes could mean for you.

Contents List

Overview of 2023 Tax Brackets

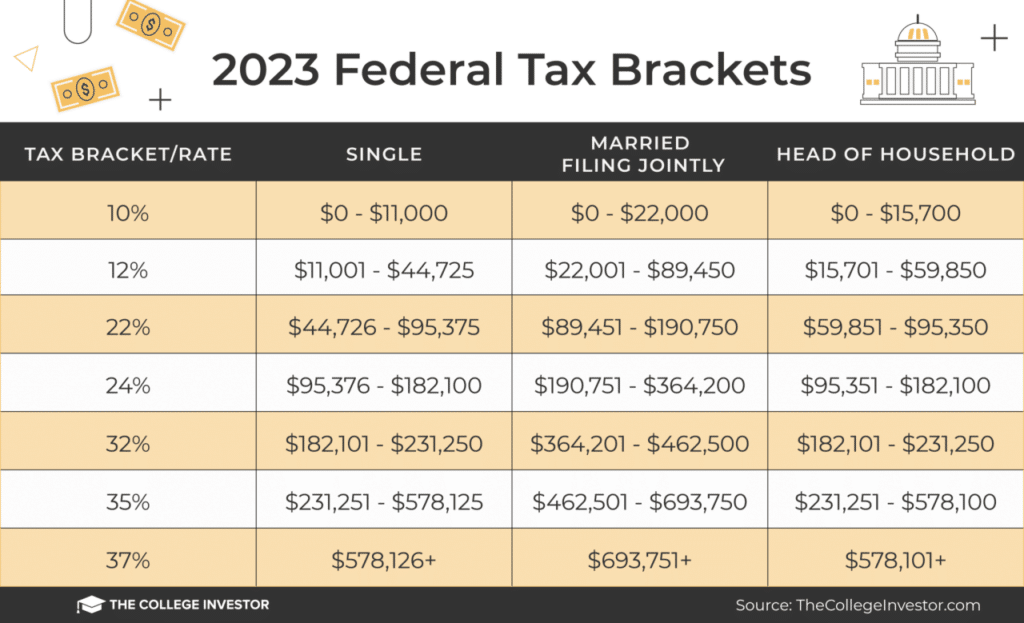

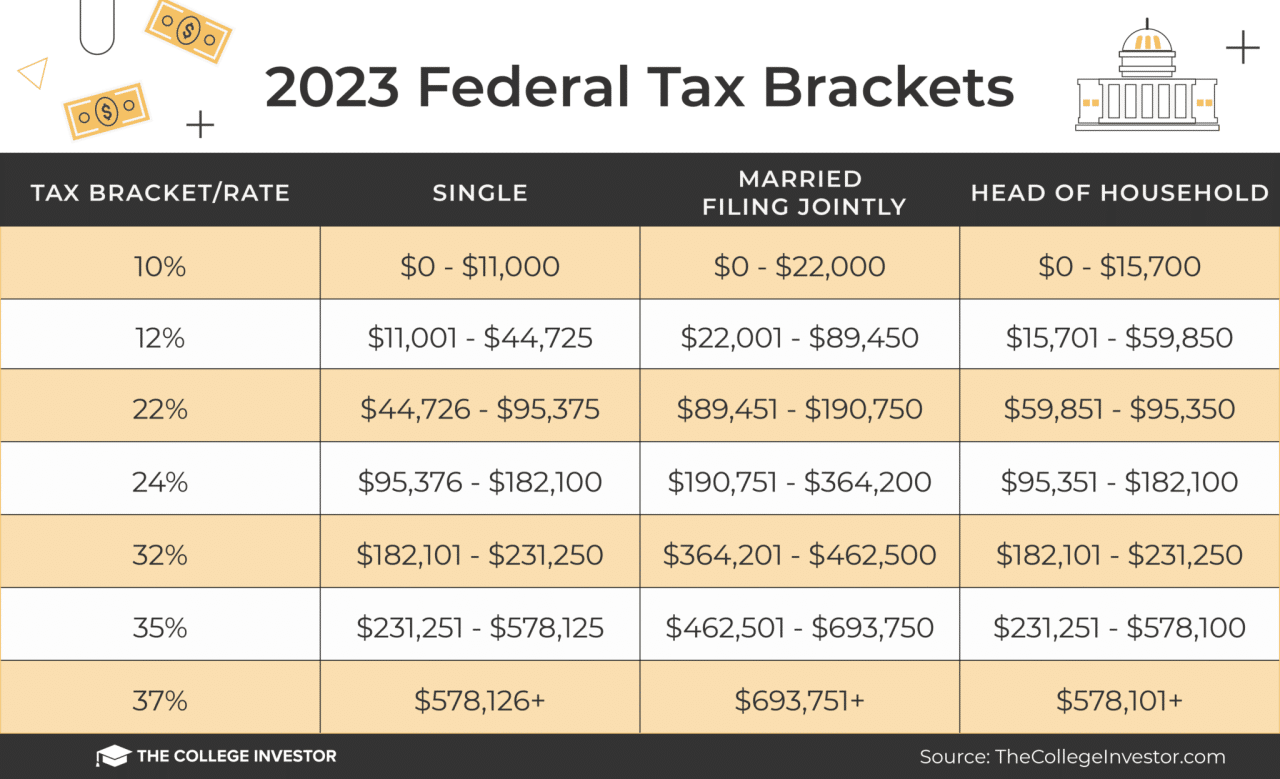

The 2023 tax year saw several tax bracket changes for individuals, impacting the amount of taxes owed based on income levels. Understanding these changes is crucial for taxpayers to accurately calculate their tax liability and plan their financial strategies.

Tax Brackets for Single Filers, Married Filing Jointly, and Head of Household

The 2023 tax brackets were designed to progressively tax higher earners, meaning those with higher incomes pay a larger percentage of their income in taxes. Here’s a breakdown of the tax brackets for different filing statuses:

| Filing Status | Tax Bracket | Tax Rate |

|---|---|---|

| Single Filers | $0

|

10% |

| $11,001

If you’re a trust, you’ll need to fill out a W9 form when you’re paid by someone. The W9 form for trusts is updated each year, so it’s important to use the most recent version. You can find the W9 form for trusts for October 2024 here.

|

12% | |

$44,726

|

22% | |

$95,376

|

24% | |

$182,101

|

32% | |

| $231,251

If you’re moving, you might be able to deduct some of your expenses. The mileage rate for moving expenses can vary, so it’s important to know what it is for October 2024. You can find the mileage rate for moving expenses for October 2024 here.

|

35% | |

| $578,126+ | 37% | |

| Married Filing Jointly | $0

The October 2024 tax deadline is approaching, so it’s a good time to start getting your taxes together. There are a few things you can do to make the process easier. You can find some tax preparation tips for the October 2024 deadline here.

|

10% |

$22,001

|

12% | |

$89,451

|

22% | |

$190,751

|

24% | |

$364,201

|

32% | |

$462,751

|

35% | |

| $693,751+ | 37% | |

| Head of Household | $0

If you’re filing your taxes as married filing jointly, you can take advantage of the standard deduction. The amount of the standard deduction can vary, so it’s a good idea to check what it is for 2024. You can find the standard deduction for married filing jointly in 2024 here.

|

10% |

$18,801

|

12% | |

$82,501

|

22% | |

| $172,751

If you’re a married couple, you can each contribute to an IRA. The contribution limits for IRAs can change each year, so it’s important to know what they are for 2024. You can find the IRA contribution limits for married couples in 2024 here.

|

24% | |

$329,851

|

32% | |

$418,851

|

35% | |

| $578,126+ | 37% |

Standard Deduction Amounts

The standard deduction is a fixed amount that taxpayers can subtract from their adjusted gross income to reduce their taxable income. The standard deduction amounts for 2023 were:

| Filing Status | Standard Deduction |

|---|---|

| Single Filers | $13,850 |

| Married Filing Jointly | $27,700 |

| Head of Household | $20,800 |

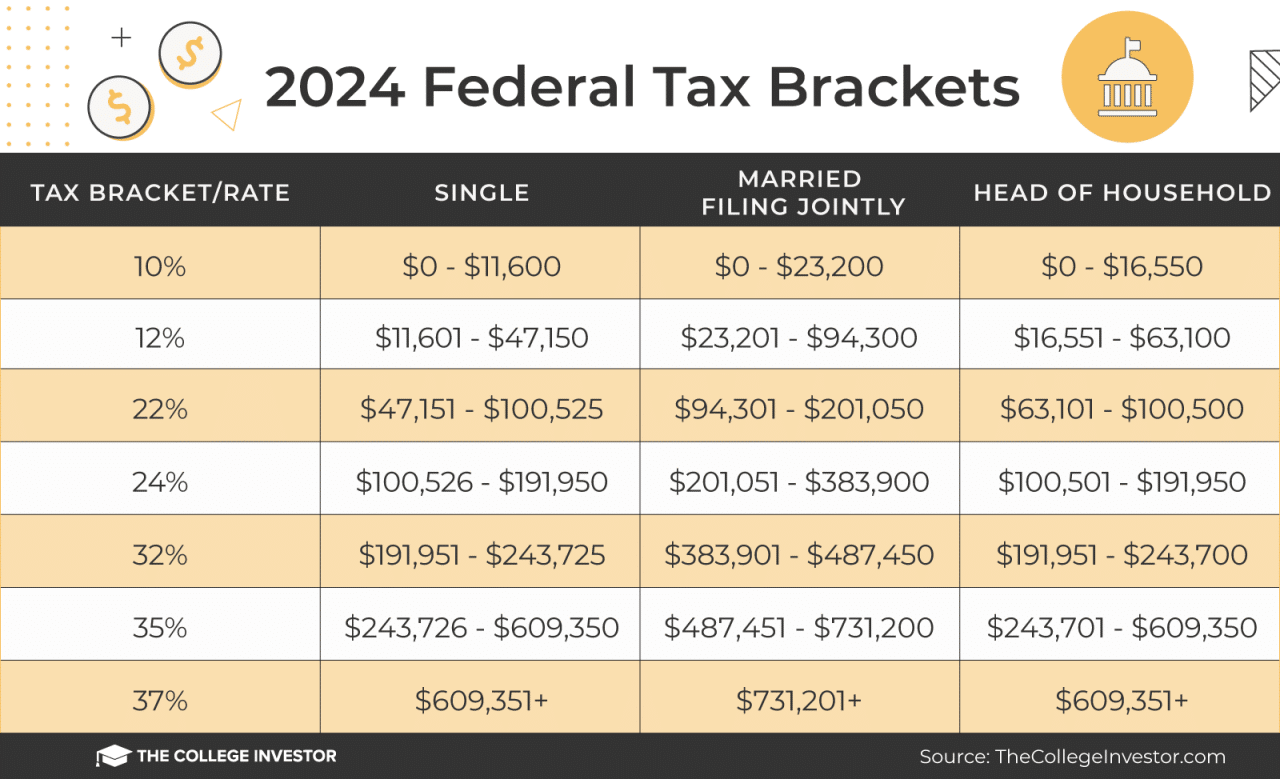

Proposed 2024 Tax Bracket Changes

While the 2024 tax brackets haven’t been officially announced yet, there are some proposed changes being discussed that could impact your tax liability. It’s important to note that these proposals are subject to change and may not be implemented in their current form.

Potential Impact of Proposed Changes

Proposed changes to the 2024 tax brackets could have varying impacts on different income levels. Here’s a potential breakdown:

Lower-income earners

If you’re over 50, you can contribute more to your 401(k) than someone who’s younger. The maximum contribution for 401(k)s for those over 50 can change each year, so it’s important to know what it is for 2024. You can find the maximum 401(k) contribution for 2024 for those over 50 here.

Some proposals suggest increasing the standard deduction or expanding the Earned Income Tax Credit, which could lead to lower tax burdens for individuals in the lower income brackets.

Middle-income earners

These individuals may see a slight decrease in their tax liability, particularly if the standard deduction is increased. However, the impact might be less significant compared to lower-income earners.

Higher-income earners

Figuring out your tax bracket for 2024 can be a bit confusing, but understanding how it works is crucial for planning your finances. You can find a breakdown of the tax brackets for 2024 here.

Proposals aimed at raising revenue may result in higher tax rates or expanded income thresholds for higher earners, potentially leading to increased tax liabilities.

If you’re contributing to a 401(k), you’ll want to know how much you can contribute each year. The 401(k) contribution limits can change each year, so it’s important to know what they are for 2024. You can find the 401(k) contribution limits for 2024 here.

Comparison of 2023 and Proposed 2024 Tax Brackets

It’s crucial to remember that these proposed changes are hypothetical. The final 2024 tax brackets will be determined by Congress and the President. Here’s a table comparing the 2023 tax brackets to the proposed 2024 tax brackets:

| Income Level | 2023 Tax Rate | Proposed 2024 Tax Rate |

|---|---|---|

$0

|

10% | 10% |

$10,951

|

12% | 12% |

| $46,276

If you’re contributing to a 401(k), you’ll want to know the contribution limits for 2024. The contribution limits for traditional 401(k)s can vary, so it’s important to check what they are. You can find the 401(k) contribution limits for 2024 for traditional 401(k)s here.

|

22% | 22% |

$101,751

|

24% | 24% |

$192,151

|

32% | 32% |

$578,126

|

35% | 35% |

| $693,751+ | 37% | 37% |

Note:This table reflects proposed changes and may not represent the final 2024 tax brackets.

Impact of Changes on Individual Taxpayers

The proposed tax bracket changes for 2024 could have significant implications for individuals across different income levels. These changes could affect how much tax individuals pay, and therefore their disposable income.

Impact on High-Income Earners

High-income earners, typically those earning above a certain threshold, could experience a greater impact from the proposed changes.

The changes might increase their tax liability, potentially leading to a decrease in their after-tax income.

This could be due to several factors:

- Increased Tax Rates:Higher tax brackets might be adjusted to encompass a larger portion of their income, leading to a higher overall tax burden.

- Changes in Deductions or Credits:Some deductions or credits specifically benefiting high-income earners might be adjusted or eliminated, further increasing their tax liability.

For example, a high-income earner earning $500,000 per year might see their tax liability increase by $10,000 if the top tax bracket is expanded to include a larger portion of their income. This could lead to a decrease in their disposable income, potentially affecting their spending habits and investment decisions.

Impact on Middle-Income Earners

Middle-income earners, those earning within a moderate range, could experience a mixed impact from the proposed changes.

While some changes might increase their tax liability, others could potentially reduce it.

This depends on the specific adjustments made to tax brackets, deductions, and credits.

- Potential Increase in Tax Liability:If the tax brackets are adjusted upwards, some middle-income earners might be pushed into higher tax brackets, leading to a higher tax burden.

- Potential Decrease in Tax Liability:Conversely, some middle-income earners might benefit from increased deductions or credits, resulting in a lower tax liability and potentially increased disposable income.

For example, a middle-income earner earning $75,000 per year might see a slight increase in their tax liability if the tax bracket for their income level is adjusted upwards. However, if the government introduces a new tax credit for families with children, they could see a decrease in their tax liability, potentially offsetting the increase due to the bracket adjustment.

If you’re driving for business, you might be able to deduct your mileage expenses. The mileage rate for October 2024 is updated periodically, so it’s important to know the current rate. You can find the latest mileage rate for October 2024 here.

Impact on Low-Income Earners

Low-income earners, those earning below a certain threshold, could experience a positive impact from the proposed changes.

It can be helpful to use a tax calculator to see how deductions and credits might affect your tax bill. There are online tax calculators that can help you estimate your taxes for October 2024. You can find a tax calculator for deductions and credits in October 2024 here.

The changes might potentially reduce their tax liability and increase their disposable income.

This could be due to:

- Expansion of Tax Credits:Existing tax credits targeted at low-income earners might be expanded, providing them with greater financial assistance and reducing their overall tax burden.

- Lower Tax Rates:The proposed changes might lower tax rates for lower income brackets, further reducing their tax liability and increasing their disposable income.

For example, a low-income earner earning $25,000 per year might see a reduction in their tax liability if the government expands the earned income tax credit or lowers the tax rate for their income bracket. This could lead to an increase in their disposable income, potentially improving their financial stability and quality of life.

Retirement planning can be complex, and it’s important to understand how taxes can affect your retirement income. You can use a tax calculator specifically designed for retirees to estimate your tax liability. You can find a tax calculator for retirees in October 2024 here.

Economic Implications of Tax Bracket Changes

Tax bracket changes can have a significant impact on the economy, influencing consumer spending, business investment, and government revenue. Understanding these potential effects is crucial for policymakers and individuals alike.

Potential Economic Effects of Tax Bracket Changes

The economic effects of tax bracket changes depend on the specific changes implemented and the overall economic context. For example, lowering the bottom tax bracket might stimulate consumer spending by putting more money in the pockets of low-income earners. This increased spending could lead to higher demand for goods and services, potentially boosting economic growth.

However, the impact could be limited if low-income earners use the additional income for necessities rather than discretionary spending.

Impact on Consumer Spending

Tax bracket changes can influence consumer spending by affecting disposable income. Lowering tax rates generally leads to increased disposable income, which can stimulate consumer spending. Conversely, raising tax rates can reduce disposable income, potentially leading to decreased consumer spending.

Impact on Business Investment

Tax bracket changes can also impact business investment. Lowering corporate tax rates can incentivize businesses to invest in new projects, equipment, and expansion. Conversely, raising corporate tax rates can discourage investment, as businesses may find it less profitable to invest in new projects.

Impact on Government Revenue

Tax bracket changes can have a significant impact on government revenue. Lowering tax rates generally leads to lower tax revenue, while raising tax rates can increase government revenue. The magnitude of the impact depends on the specific changes implemented, the elasticity of tax revenue, and the overall economic environment.

If you’re contributing to a Roth IRA, you’ll want to know the contribution limits for 2024. The contribution limits for Roth IRAs can vary, so it’s important to check what they are. You can find the IRA contribution limits for Roth IRAs in 2024 here.

Potential Economic Impact of Different Scenarios, 2024 tax bracket changes compared to 2023

The following table summarizes the potential economic impact of different scenarios regarding tax bracket changes:| Scenario | Consumer Spending | Business Investment | Government Revenue ||———————————————-|——————–|———————|——————–|| Keeping Tax Brackets the Same | No significant impact | No significant impact | No significant impact || Raising the Top Tax Bracket | Decrease | Decrease | Increase || Lowering the Bottom Tax Bracket | Increase | No significant impact | Decrease || Lowering Corporate Tax Rates | No significant impact | Increase | Decrease || Increasing Tax Rates Across All Brackets | Decrease | Decrease | Increase |It’s important to note that these are just potential impacts, and the actual effects may vary depending on various factors, including the specific tax bracket changes implemented, the overall economic environment, and consumer and business behavior.

If you’re driving for business, you might be able to deduct your mileage expenses. The mileage rate for October 2024 is updated periodically, so it’s important to know the current rate. You can find the standard mileage rate for October 2024 here.

Considerations for Tax Planning in 2024

The potential changes in tax brackets for 2024 present both challenges and opportunities for individuals and businesses to adjust their financial strategies. By proactively planning and adapting to these changes, taxpayers can potentially mitigate any negative impacts and even capitalize on potential benefits.

Strategies for Individuals

It’s important for individuals to understand how the proposed tax bracket changes may affect their personal income tax liability. Here are some key considerations and strategies for tax planning in 2024:

- Review Income and Deductions:Analyze your income sources and potential deductions to assess how the new tax brackets might affect your overall tax burden. For instance, if your income falls close to the threshold for a higher tax bracket, consider strategies to potentially reduce your income or increase eligible deductions.

If you’re self-employed, you have a bit more time to file your taxes than those who work for an employer. The October 2024 tax deadline for self-employed individuals is a bit later than the typical April deadline, so you have some extra time to get everything in order.

You can find more details about the deadline here.

This might involve adjustments to your retirement contributions, charitable giving, or other tax-advantaged strategies.

- Adjust Tax Withholdings:Review your tax withholdings from your paycheck to ensure they accurately reflect your anticipated tax liability under the new tax brackets. You can adjust your W-4 form to increase or decrease withholdings as needed. This will help avoid a large tax bill or refund at the end of the year.

- Maximize Tax-Advantaged Accounts:Take full advantage of tax-advantaged accounts like 401(k)s, IRAs, and Health Savings Accounts (HSAs). Contributions to these accounts are often tax-deductible, which can reduce your taxable income and potentially lower your overall tax liability.

- Consider Charitable Giving:If you are considering charitable donations, make sure to understand how the new tax brackets might affect the deductibility of these contributions. Consider making larger donations in years where your income is higher, maximizing the tax benefits.

Strategies for Businesses

Businesses need to be aware of how the proposed tax bracket changes could impact their operations and financial performance. Here are some considerations:

- Assess Tax Liability:Businesses should carefully assess their tax liability under the new tax brackets, particularly if their income falls close to the thresholds for higher rates. They might need to adjust their financial projections and business plans to account for potential changes in tax expenses.

- Optimize Business Structure:Businesses should review their current structure, such as sole proprietorship, partnership, or corporation, to determine if it remains the most tax-efficient option under the new tax regime. Consulting with a tax professional can help businesses identify potential opportunities for optimization.

- Plan for Investment Decisions:Businesses should consider the potential impact of tax changes on their investment decisions. For example, if certain types of investments are subject to higher taxes under the new regime, businesses might need to adjust their investment strategies.

- Review Employee Compensation:Businesses should review their employee compensation packages to ensure they remain competitive and tax-efficient under the new tax brackets. This might involve adjusting salaries, benefits, or other forms of compensation to minimize tax burdens for both the employer and employees.

Ultimate Conclusion: 2024 Tax Bracket Changes Compared To 2023

As we look ahead to 2024, understanding the proposed tax bracket changes is essential for both individuals and businesses. By staying informed and proactive, you can make informed financial decisions, optimize your tax strategy, and ensure a smooth transition into the new year.

Remember, this information is based on current proposals, and it’s crucial to stay updated as the tax landscape continues to evolve.

Question Bank

What are the main reasons for the proposed tax bracket changes?

Proposed tax bracket changes often stem from a variety of factors, including economic goals, political agendas, and revenue projections. The specific reasons behind any proposed changes should be clearly articulated by policymakers and debated publicly.

Will the standard deduction change in 2024?

The standard deduction is adjusted annually for inflation, so it’s likely to change in 2024. However, the specific amount of the adjustment will depend on inflation rates and may not be known until closer to the start of the tax year.

Are there any proposed changes to the tax credits for 2024?

Tax credits can also be subject to changes. It’s essential to stay informed about any proposed modifications to tax credits, as these can have a significant impact on your tax liability.

How can I get more information about the proposed tax bracket changes?

Reliable information on tax changes can be found on official government websites, such as the Internal Revenue Service (IRS), or through reputable financial news sources.