The 2024 tax brackets and rates for all filing statuses are a crucial aspect of financial planning, as they directly impact your tax liability. Understanding these brackets and rates allows you to make informed decisions about your income, expenses, and tax strategies.

This guide will break down the tax brackets and rates for each filing status, providing insights into the tax implications of different income levels.

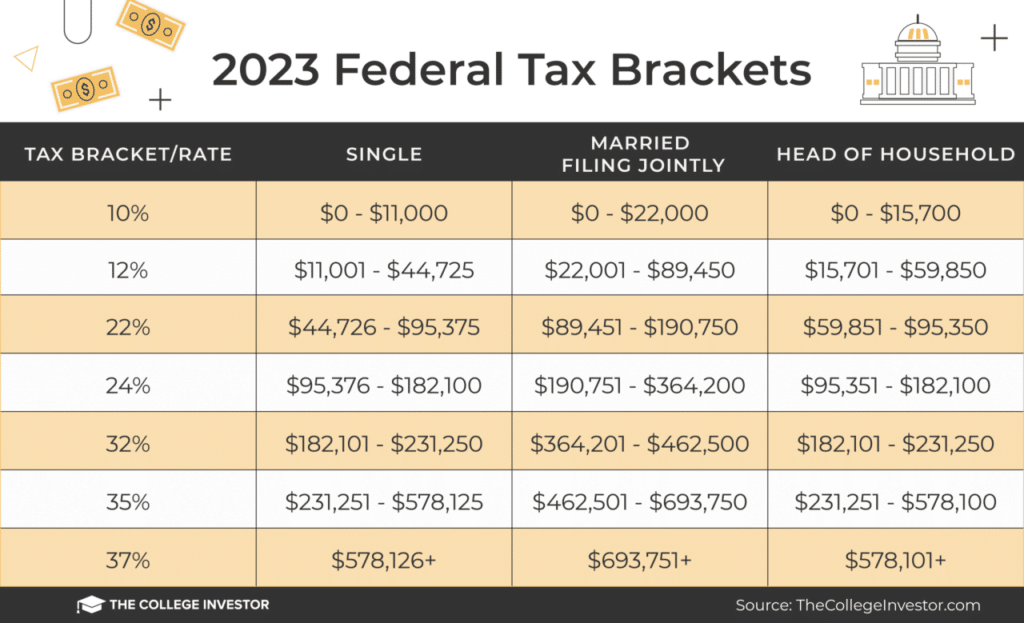

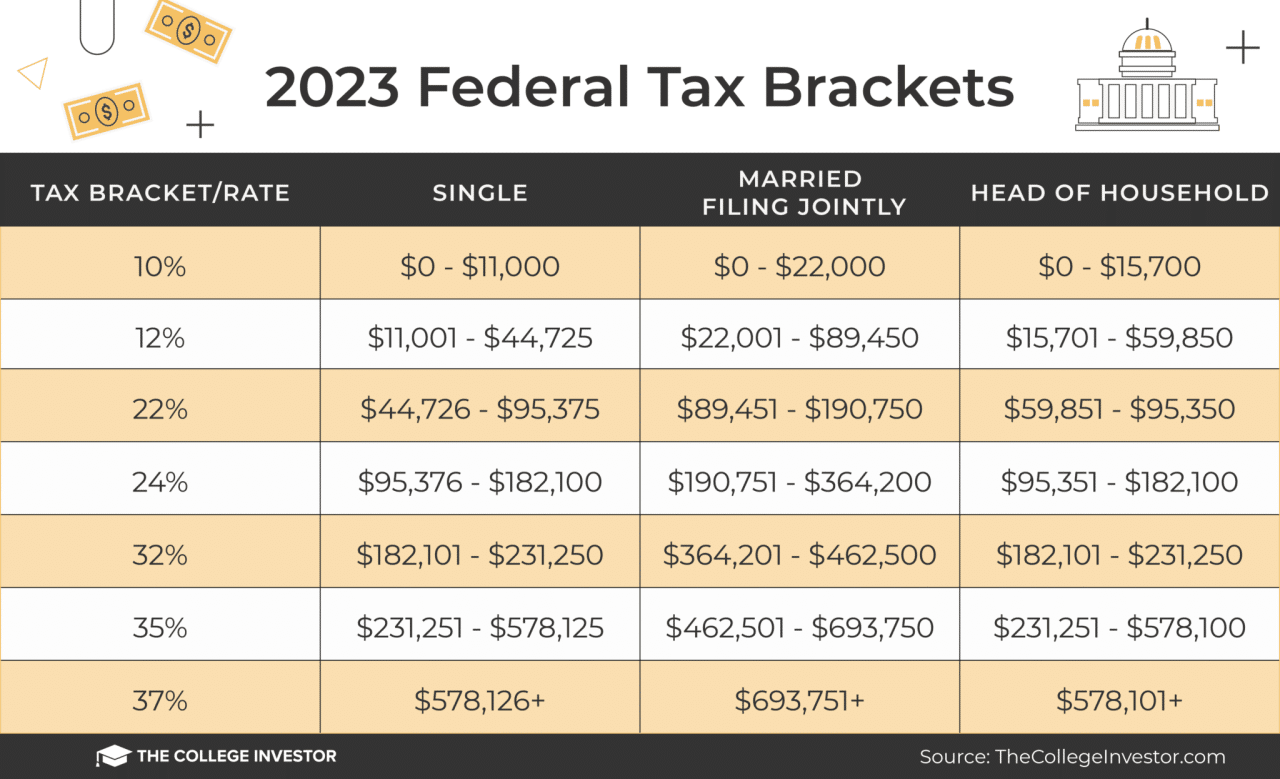

The Internal Revenue Service (IRS) sets tax brackets to determine the amount of federal income tax you owe. These brackets are based on your taxable income and filing status. As your income rises, you move into higher tax brackets, resulting in a higher tax rate on the portion of your income within that bracket.

The 2024 tax year introduces some changes to these brackets, making it essential to stay informed.

Contents List

- 1 Introduction to 2024 Tax Brackets and Rates

- 2 2024 Tax Brackets and Rates for Single Filers

- 3 2024 Tax Brackets and Rates for Married Filing Jointly

- 4 2024 Tax Brackets and Rates for Married Filing Separately

- 5 2024 Tax Brackets and Rates for Head of Household

- 6 2024 Tax Brackets and Rates for Qualifying Widow(er)s

- 7 Standard Deduction and Personal Exemptions

- 8 Tax Credits and Other Deductions: 2024 Tax Brackets And Rates For All Filing Statuses

- 9 Implications of Tax Brackets and Rates

- 10 Conclusive Thoughts

- 11 Expert Answers

Introduction to 2024 Tax Brackets and Rates

The 2024 tax year is approaching, and it’s essential for taxpayers to understand the tax brackets and rates that will apply to their income. This information helps individuals determine their tax liability and plan their finances accordingly. Tax brackets are ranges of income that are taxed at different rates.

The higher your income falls within a bracket, the higher the tax rate you’ll pay on that portion of your income. This system is designed to be progressive, meaning higher earners pay a larger percentage of their income in taxes.

Tax Filing Statuses

Taxpayers can file their taxes using different filing statuses, each with its own set of tax brackets and deductions. The most common filing statuses include:

- Single:For individuals who are unmarried and not filing as head of household.

- Married Filing Jointly:For married couples who choose to file their taxes together.

- Married Filing Separately:For married couples who choose to file their taxes individually.

- Head of Household:For unmarried individuals who pay more than half the costs of supporting a qualifying child or dependent.

- Qualifying Widow(er) with Dependent Child:For surviving spouses who maintain a household for a qualifying child.

2024 Tax Brackets and Rates for Single Filers

Single filers in 2024 will face a range of tax rates based on their taxable income. The tax brackets and corresponding rates are designed to ensure that individuals with higher incomes contribute a larger percentage of their earnings to the government.

Thinking about a Roth 401k? You’ll want to know the contribution limits. The what is the 401k contribution limit for 2024 for Roth can help you plan your retirement savings strategy.

2024 Tax Brackets and Rates for Single Filers

The following table Artikels the 2024 tax brackets and rates for single filers:

| Tax Bracket | Taxable Income Range | Tax Rate |

|---|---|---|

| 1 | $0

|

10% |

| 2 | $10,951

If you’re married filing jointly, your standard deduction will be higher than if you were filing separately. The standard deduction for married filing jointly in 2024 can help you reduce your tax liability. If you’re a qualifying widow(er), you might have a different standard deduction than other taxpayers. Check out the standard deduction for qualifying widow(er) in 2024 to see how it applies to you.

|

12% |

| 3 | $46,276

Students might have a different standard deduction than other taxpayers. The standard deduction for students in 2024 can help you determine your tax liability. The standard deduction is a key part of your tax return. Knowing the what is the standard deduction for 2024 can help you determine your tax liability and plan accordingly.

|

22% |

| 4 | $101,751

Even if you’re divorced, you might still be able to contribute to a Roth IRA. The Roth IRA contribution limit 2024 for divorced individuals can help you save for retirement.

|

24% |

| 5 | $192,151

As an independent contractor, you’ll need to complete a W9 form to provide your tax information. The W9 Form October 2024 for independent contractors is essential for getting paid accurately and avoiding any tax issues.

|

32% |

| 6 | $578,126

|

35% |

| 7 | $1,000,001+ | 37% |

Example:A single filer with a taxable income of $50,000 will fall into the third tax bracket and will pay 22% on the portion of their income exceeding $46,275.

2024 Tax Brackets and Rates for Married Filing Jointly

Married couples filing jointly have their combined income taxed at the rates Artikeld by the IRS. This filing status is beneficial for couples where both individuals have income, as it often results in lower tax liability compared to filing separately.

Tax Brackets and Rates for Married Filing Jointly in 2024

The tax brackets and rates for married couples filing jointly in 2024 are as follows:

| Tax Bracket | Taxable Income | Tax Rate |

|---|---|---|

| 10% | $0

The amount you can contribute to your 401k can vary depending on your income. Understanding the what are the 401k contribution limits for 2024 for different income levels is important for maximizing your retirement savings.

|

10% |

| 12% | $20,801

|

12% |

| 22% | $83,201

|

22% |

| 24% | $178,001

|

24% |

| 32% | $340,001

|

32% |

| 35% | $436,001

|

35% |

| 37% | $647,851+ | 37% |

Benefits of Filing Jointly

Filing jointly offers several advantages for married couples, including:

- Lower Tax Liability:Filing jointly often results in a lower overall tax burden, especially when both spouses have income. This is because the tax brackets are wider for married couples filing jointly compared to single filers.

- Access to More Deductions and Credits:Some deductions and credits are only available to married couples filing jointly. For example, the Earned Income Tax Credit (EITC) is generally more generous for married couples.

- Potential for Tax Savings:Filing jointly allows couples to take advantage of deductions and credits that may not be available if they file separately, potentially leading to significant tax savings.

Drawbacks of Filing Jointly

While filing jointly generally benefits married couples, there are some potential drawbacks:

- Joint Liability for Taxes:Both spouses are jointly responsible for the entire tax liability, even if one spouse earns significantly more than the other. This means that if one spouse fails to pay their share of taxes, the IRS can pursue the other spouse for the entire amount.

- Impact on Deductions and Credits:Certain deductions and credits may be phased out or reduced based on the couple’s combined income. This could impact their overall tax savings.

- Potential for Higher Taxes in Certain Situations:In some cases, filing separately may result in a lower tax liability, especially if one spouse has a high income and the other has a low income. This is because the tax rates are generally lower for single filers in the lower income brackets.

2024 Tax Brackets and Rates for Married Filing Separately

Married couples who choose to file their taxes separately are subject to the same tax brackets as single filers, but their income is halved for the purpose of calculating their tax liability. This means that each spouse is treated as a single filer, and their tax liability is calculated based on their individual income.

Tax Brackets and Rates for Married Filing Separately

The tax brackets and rates for married filing separately in 2024 are as follows:

| Income Range | Tax Rate |

|---|---|

$0

|

10% |

$10,951

|

12% |

$46,276

|

22% |

| $101,751

Your age can affect your IRA contribution limits. The IRA contribution limits for 2024 by age can help you understand how much you can contribute based on your age.

|

24% |

| $192,151

If you’re a freelancer, you might be able to extend your tax filing deadline to October 2024. Check out this article to learn more about the tax extension deadline October 2024 for freelancers and how it can benefit you.

|

32% |

$578,126

|

35% |

| Over $1,000,000 | 37% |

Comparing Filing Separately and Jointly

Filing separately can be advantageous in certain situations, such as when one spouse has significantly higher income than the other or when there are significant differences in deductions or credits. However, it is important to note that filing separately generally results in a higher overall tax liability compared to filing jointly.

For example, a couple with a combined income of $200,000 would likely pay more in taxes if they filed separately than if they filed jointly. This is because the tax brackets are progressive, meaning that higher income earners pay a higher percentage of their income in taxes.

When deciding whether to file separately or jointly, it is crucial to consider the individual circumstances of each couple and to consult with a tax professional to determine the most advantageous filing status.

2024 Tax Brackets and Rates for Head of Household

The Head of Household filing status offers lower tax rates than single filers but higher rates than married couples filing jointly. This status is available to unmarried individuals who pay more than half the costs of keeping a home for a qualifying child or dependent.

2024 Tax Brackets and Rates for Head of Household

The following table Artikels the 2024 tax brackets and rates for Head of Household filers:

| Tax Bracket | Taxable Income | Tax Rate |

|---|---|---|

| 1 | $0

If you’re contributing to a traditional 401k, you’ll want to know the contribution limits for 2024. The 401k contribution limits for 2024 for traditional 401k can help you save for retirement.

|

10% |

| 2 | $10,951

|

12% |

| 3 | $46,276

|

22% |

| 4 | $101,751

|

24% |

| 5 | $192,151

|

32% |

| 6 | $578,126

|

35% |

| 7 | $1,000,001+ | 37% |

Eligibility Criteria for Head of Household Filing Status

To qualify for Head of Household filing status, taxpayers must meet the following criteria:* Unmarried:You must be unmarried at the end of the tax year. This includes being legally separated or divorced.

Paying More Than Half of Household Expenses

You must pay more than half the costs of keeping up a home for a qualifying child or dependent.

Qualifying Child or Dependent

You must have a qualifying child or dependent living with you for more than half the year. A qualifying child must be:

Your son, daughter, stepchild, foster child, adopted child, or a descendant of any of them (for example, a grandchild).

Under 19 years old at the end of the year or under 24 years old at the end of the year and a full-time student.

Wondering how much you can contribute to your Roth IRA in 2024 if you’re a head of household? The Roth IRA contribution limit 2024 for head of household might be different than you expect, so it’s good to be informed.

Your brother, sister, stepbrother, stepsister, half-brother, half-sister, or a descendant of any of them (for example, a niece or nephew).

A foster child or a child you are legally obligated to support.

Advantages of Filing as Head of Household, 2024 tax brackets and rates for all filing statuses

Filing as Head of Household offers several advantages compared to single filing status:* Lower Tax Rates:Head of Household filers generally pay lower tax rates than single filers.

Higher Standard Deduction

The standard deduction for Head of Household filers is higher than for single filers. This means you can deduct more expenses before you start paying taxes.

Saving for retirement? You might be curious about the maximum amount you can contribute to your 401k in 2024. Find out the what is the 401k contribution limit for 2024 to maximize your retirement savings.

Larger Child Tax Credit

The Child Tax Credit for Head of Household filers is the same as for married couples filing jointly. This can significantly reduce your tax liability if you have children.

2024 Tax Brackets and Rates for Qualifying Widow(er)s

Qualifying widow(er)s are eligible for a special tax filing status that allows them to use the same tax brackets and rates as married filing jointly, even though they are not currently married. This status is available for two years after the death of a spouse, provided the surviving spouse remains unmarried and has a dependent child living in their home.

2024 Tax Brackets and Rates for Qualifying Widow(er)s

The following table summarizes the income ranges and tax percentages for each bracket for qualifying widow(er)s in 2024:

| Income Range | Tax Rate |

|---|---|

$0

|

10% |

$10,951

|

12% |

$46,276

|

22% |

$101,751

|

24% |

$192,151

|

32% |

$578,126

|

35% |

| $693,751+ | 37% |

Standard Deduction and Personal Exemptions

The standard deduction is a fixed amount that taxpayers can subtract from their taxable income. This deduction is intended to help offset the cost of basic living expenses. Personal exemptions, on the other hand, were a deduction that taxpayers could claim for themselves, their spouse, and each dependent.

However, the Tax Cuts and Jobs Act of 2017 suspended personal exemptions from 2018 through 2025.

Standard Deduction Amounts for 2024

The standard deduction amount for 2024 varies depending on your filing status. Here are the standard deduction amounts for each filing status:

| Filing Status | Standard Deduction |

|---|---|

| Single | $13,850 |

| Married Filing Jointly | $27,700 |

| Married Filing Separately | $13,850 |

| Head of Household | $20,800 |

| Qualifying Widow(er) | $27,700 |

Impact of the Standard Deduction on Tax Liability

The standard deduction can significantly impact your tax liability. The higher your standard deduction, the lower your taxable income and, therefore, the less tax you owe. For example, a single filer with a taxable income of $40,000 would owe less tax if the standard deduction were $13,850 than if it were $12,000.

Personal Exemptions in 2024

Personal exemptions are no longer allowed in 2024. The Tax Cuts and Jobs Act of 2017 suspended personal exemptions from 2018 through 2025. Prior to their suspension, personal exemptions allowed taxpayers to deduct a certain amount for themselves, their spouse, and each dependent.

This deduction reduced taxable income, ultimately lowering tax liability. However, as they are currently suspended, they do not play a role in calculating your tax liability for 2024.

Tax Credits and Other Deductions: 2024 Tax Brackets And Rates For All Filing Statuses

Tax credits and deductions can significantly reduce your tax liability, and understanding these options can help you maximize your tax savings. These are valuable tools that can potentially lower your overall tax bill, so it’s essential to explore them carefully.

Tax Credits

Tax credits are direct reductions to your tax liability, dollar for dollar. This means that for every $1 of credit you qualify for, your tax bill goes down by $1. Several tax credits are available to taxpayers in 2024, offering potential savings based on specific circumstances.

Earned Income Tax Credit (EITC)

The EITC is a refundable tax credit for low- and moderate-income working individuals and families. This means that even if your tax liability is $0, you may still receive a refund based on your EITC eligibility. The EITC amount is based on your income, filing status, and the number of qualifying children.

For example, in 2024, a single filer with three qualifying children could receive a maximum EITC of $7,430.

It’s important to be aware of the IRA contribution limits for 2024. Check out the what are the IRA contribution limits for 2024 to ensure you’re maximizing your retirement savings.

The EITC is a valuable tool for low- and moderate-income families, potentially putting more money back in their pockets.

Child Tax Credit (CTC)

The CTC is a nonrefundable tax credit for taxpayers with qualifying children under the age of 17. This credit can help offset the costs of raising a child, and its value is determined by the child’s age and the taxpayer’s income.

In 2024, the CTC is worth up to $2,000 per qualifying child.

Partnerships also need to complete W9 forms for tax purposes. Learn more about the W9 Form October 2024 for partnerships and how to fill it out correctly.

The CTC can be claimed even if you owe no taxes, but the amount received is limited to your tax liability.

Other Potential Tax Credits

Other tax credits may be available, depending on your individual circumstances. These include:

- American Opportunity Tax Credit: This credit is available for qualified education expenses for the first four years of higher education.

- Lifetime Learning Credit: This credit can help offset the costs of college courses, including courses taken to improve job skills.

- Premium Tax Credit: This credit helps individuals and families afford health insurance through the Marketplace.

- Child and Dependent Care Credit: This credit can help offset the costs of childcare expenses.

- Residential Renewable Energy Credit: This credit can help offset the costs of installing solar panels or other renewable energy systems in your home.

Other Deductions

Deductions are expenses that can be subtracted from your adjusted gross income (AGI), potentially reducing your taxable income. This can result in lower taxes, as you are taxed on a smaller amount of income.

Standard Deduction

The standard deduction is a fixed amount that you can choose to deduct instead of itemizing your deductions. The amount of the standard deduction varies based on your filing status.

In 2024, the standard deduction for single filers is $13,850.

Itemized Deductions

If you choose to itemize your deductions, you can deduct certain expenses that exceed a specific threshold. Common itemized deductions include:

- Home Mortgage Interest: This deduction allows you to deduct the interest you pay on your home mortgage.

- State and Local Taxes (SALT): This deduction allows you to deduct up to $10,000 of your state and local taxes.

- Medical Expenses: You can deduct medical expenses that exceed 7.5% of your adjusted gross income.

- Charitable Contributions: You can deduct cash contributions to qualified charities.

Implications of Tax Brackets and Rates

Understanding the impact of tax brackets and rates on your finances is crucial for effective financial planning. Your tax liability, determined by your income level and the tax bracket you fall into, significantly affects your disposable income and savings potential.

This section explores how tax brackets influence financial decisions and highlights strategies for minimizing your tax burden.

Tax Liability and Financial Planning

Tax liability plays a critical role in your financial planning, as it directly affects your disposable income and savings. Knowing your tax bracket and how much you’ll owe in taxes allows you to make informed decisions about:

- Budgeting:You can accurately allocate your income by factoring in your tax liability. This ensures you have enough money for essential expenses and savings while avoiding unexpected tax burdens.

- Saving and Investing:Understanding your tax liability helps you determine how much you can save and invest after taxes. You can choose investments that minimize your tax burden while maximizing your returns.

- Retirement Planning:Your tax liability can impact your retirement savings strategy. Some retirement accounts offer tax advantages, such as tax-deferred growth or tax-free withdrawals, which can significantly enhance your long-term financial well-being.

Minimizing Tax Burden

While you can’t avoid paying taxes altogether, you can strategically minimize your tax burden through various methods:

- Tax Deductions and Credits:Taking advantage of eligible deductions and credits can significantly reduce your taxable income and ultimately lower your tax liability. Some common deductions include mortgage interest, charitable contributions, and state and local taxes. Credits, such as the Earned Income Tax Credit (EITC) and the Child Tax Credit, directly reduce your tax bill.

- Tax-Advantaged Accounts:Utilizing tax-advantaged accounts, such as 401(k)s, IRAs, and 529 plans, can help you save for retirement, education, or other goals while deferring or avoiding taxes on your earnings and withdrawals. These accounts offer significant tax benefits and can enhance your overall financial planning.

- Tax-Efficient Investing:Investing in tax-efficient ways can minimize your tax liability over time. For example, choosing investments with lower capital gains taxes or dividend yields can help you retain more of your investment returns. Consulting a financial advisor can provide personalized guidance on tax-efficient investment strategies.

Conclusive Thoughts

Navigating the 2024 tax brackets and rates can seem daunting, but with careful planning and a clear understanding of the different filing statuses, you can minimize your tax liability and optimize your financial situation. Remember to consult with a qualified tax professional for personalized advice and to ensure compliance with the latest tax regulations.

Expert Answers

What is the difference between a tax bracket and a tax rate?

A tax bracket refers to the income range that determines your tax liability. A tax rate is the percentage of your income that is taxed within a specific bracket.

How often are tax brackets adjusted?

Tax brackets are typically adjusted annually to account for inflation and other economic factors.

Can I change my filing status during the year?

You generally cannot change your filing status during the tax year. However, there may be exceptions in certain circumstances, so it’s best to consult with a tax professional.

What if my income falls into multiple tax brackets?

You will only pay the higher tax rate on the portion of your income that falls within that bracket. The rest of your income will be taxed at the lower rate.