3 Year Annuity Calculator 2024 sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. This guide provides a comprehensive overview of 3-year annuities, a popular investment option that offers predictable income streams and potential tax advantages.

Java is a powerful programming language that can be used to calculate annuities. Find out how to calculate annuities using Java on Calculate Annuity Java 2024.

We’ll delve into the intricacies of annuity calculations, explore the factors influencing returns, and demonstrate how a calculator can be used to make informed financial decisions.

A $600,000 annuity is a significant financial commitment. If you’re considering this type of annuity, you can find information about its features and potential benefits on Annuity 600k 2024.

Whether you’re planning for retirement, saving for a specific goal, or simply looking for a reliable way to manage your cash flow, understanding 3-year annuities can be invaluable. By understanding the key concepts, benefits, and potential drawbacks, you can determine if this investment strategy aligns with your financial objectives.

The BA II Plus calculator is a powerful tool for calculating annuities. If you’re looking for guidance on how to use this calculator for this purpose, you can find a detailed guide on Calculate Annuity Using Ba Ii Plus 2024.

Contents List

Understanding 3-Year Annuities

A 3-year annuity is a financial instrument that provides a stream of fixed payments over a period of three years. It is a popular investment option for individuals seeking a guaranteed return and a predictable income stream. This article will delve into the key features, factors influencing calculations, benefits, and drawbacks of 3-year annuities, as well as their applications and real-world examples.

Excel is a popular spreadsheet program that can be used to calculate annuities. Learn how to use Excel for this purpose on Calculate Annuity On Excel 2024.

Concept of a 3-Year Annuity

A 3-year annuity is a contract where an individual or entity invests a lump sum amount, known as the principal, with a financial institution. In return, the investor receives regular payments over a period of three years. These payments can be made monthly, quarterly, semi-annually, or annually, depending on the terms of the annuity contract.

Key Features of a 3-Year Annuity

- Fixed or Variable Interest Rates:3-year annuities can offer either fixed or variable interest rates. Fixed interest rates provide a predictable return, while variable rates fluctuate based on market conditions.

- Payment Frequency:The frequency of payments can vary, with options ranging from monthly to annual. Investors can choose the payment frequency that best suits their financial needs.

- Potential Tax Implications:Interest earned on 3-year annuities may be subject to taxation. The specific tax implications depend on the jurisdiction and the type of annuity.

Comparison with Other Investment Options

3-year annuities can be compared to other investment options such as fixed deposits and bonds. While fixed deposits offer guaranteed returns, they typically have lower interest rates compared to annuities. Bonds also provide fixed interest payments, but their value can fluctuate in the market.

An annuity can be a valuable source of income for a 60-year-old man. To learn more about annuities for this age group, visit Annuity 60 Year Old Man 2024.

The choice between a 3-year annuity and other investment options depends on factors such as risk tolerance, investment goals, and time horizon.

Khan Academy is a popular online learning platform that offers resources on a variety of topics, including annuities. You can find educational materials about annuities on Annuity Khan Academy 2024.

Factors Influencing Annuity Calculations: 3 Year Annuity Calculator 2024

The total payout or future value of a 3-year annuity is determined by several factors, including the principal amount, interest rate, and payment frequency. Understanding how these variables influence the calculations is crucial for making informed investment decisions.

Understanding how to calculate annuity payments is essential for planning your financial future. You can learn about the process of calculating these payments on Calculating Annuity Payments 2024.

Variables Affecting Annuity Calculations

- Principal Amount:The larger the principal amount, the higher the total payout. This is a straightforward relationship, as the interest earned is calculated based on the principal.

- Interest Rate:A higher interest rate leads to a larger total payout. This is because the interest earned on the principal is compounded over the three-year period.

- Payment Frequency:More frequent payments, such as monthly payments, result in a higher total payout. This is due to the compounding effect of interest earned on each payment.

Impact of Variable Changes

Changes in any of these variables can significantly affect the final outcome of the annuity. For instance, increasing the interest rate by even a small percentage can lead to a substantial increase in the total payout over three years. Similarly, choosing a more frequent payment frequency can enhance the overall return.

Annuity calculations can be done using a variety of calculators. Learn the basics of how to use a calculator for these calculations on How To Calculate Annuity On Calculator 2024.

Examples of Different Scenarios, 3 Year Annuity Calculator 2024

To illustrate the impact of variable changes, consider the following scenarios:

- Scenario 1: Higher Interest Rate– If the interest rate is increased from 5% to 6%, the total payout at the end of three years will be higher. This is because the interest earned on the principal is compounded at a faster rate.

- Scenario 2: More Frequent Payments– If payments are made monthly instead of annually, the total payout will be higher. This is because the interest earned on each monthly payment is compounded more frequently.

Using a 3-Year Annuity Calculator

A 3-year annuity calculator is a useful tool for estimating the future value of an annuity. It simplifies the calculations by allowing users to input the relevant data and receive an instant result.

Annuity payments are a form of fixed income, meaning they are paid out at regular intervals, usually monthly. You can find out more about this on Is Annuity Fixed Income 2024.

Purpose and Functionality

The calculator takes into account the principal amount, interest rate, payment frequency, and other relevant factors to calculate the total payout or future value of the annuity. It can also be used to compare different annuity options and determine the most suitable one based on individual needs and financial goals.

Steps Involved in Using the Calculator

- Input Relevant Data:Begin by entering the principal amount, interest rate, payment frequency, and any other required information.

- Interpret the Results:The calculator will display the total payout or future value of the annuity, along with other relevant information such as the total interest earned.

Step-by-Step Guide

To demonstrate the calculator’s interface and features, consider a hypothetical example:

- Step 1:Access the 3-year annuity calculator online or through a financial software application.

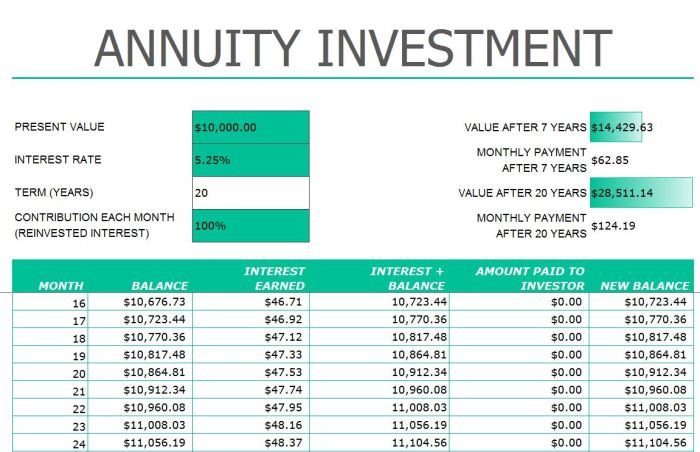

- Step 2:Enter the principal amount, interest rate, and payment frequency. For instance, assume a principal amount of $10,000, an interest rate of 5%, and monthly payments.

- Step 3:The calculator will display the total payout or future value of the annuity, which in this case would be approximately $11,597.

Benefits and Drawbacks of 3-Year Annuities

3-year annuities offer both potential benefits and drawbacks. It is important to weigh these factors carefully before making an investment decision.

Calculating the cash flows of an annuity is an important step in understanding its financial implications. You can find more information about calculating annuity cash flows on Calculating Annuity Cash Flows 2024.

Benefits of 3-Year Annuities

- Guaranteed Returns:Fixed interest rate annuities provide guaranteed returns, offering investors a predictable income stream.

- Predictable Income Streams:Annuities provide regular payments over a fixed period, allowing investors to plan their finances effectively.

- Tax Advantages:In some jurisdictions, interest earned on annuities may be subject to favorable tax treatment.

Drawbacks of 3-Year Annuities

- Limited Liquidity:Annuities are generally less liquid than other investments, as they have a fixed term. Investors may face penalties if they withdraw funds before maturity.

- Potential for Inflation Erosion:If inflation rates rise, the purchasing power of the fixed annuity payments may decline over time.

- Possibility of Lower Returns:Annuities may offer lower returns compared to other investment options, such as stocks or mutual funds.

Advantages and Disadvantages Table

| Advantages | Disadvantages |

|---|---|

| Guaranteed returns | Limited liquidity |

| Predictable income streams | Potential for inflation erosion |

| Tax advantages | Possibility of lower returns |

Applications and Real-World Examples

3-year annuities have various applications in financial planning and investment strategies. Individuals and businesses utilize them for different purposes, depending on their specific needs and goals.

Not sure how to use a financial calculator to determine an annuity? You can learn about the steps involved and the necessary inputs on How To Calculate Annuity Using Financial Calculator 2024.

Real-World Examples

- Retirement Planning:Individuals nearing retirement can invest in 3-year annuities to generate a guaranteed income stream during their golden years.

- Saving for a Specific Goal:3-year annuities can be used to save for a specific goal, such as a down payment on a house, a child’s education, or a vacation.

- Managing Cash Flow:Businesses can use 3-year annuities to manage their cash flow and ensure a steady stream of income.

Evaluation of Different Scenarios

A 3-year annuity calculator can be used to evaluate different scenarios and determine the most suitable option. For example, an individual planning for retirement can use the calculator to compare different annuity options based on their principal amount, interest rate, and payment frequency.

The formula for calculating an annuity is a bit complex, but it can be broken down into its components. You can learn about the annuity formula on Annuity Formula Is 2024.

Suitable Investment Option

3-year annuities can be a suitable investment option for individuals or businesses seeking guaranteed returns, predictable income streams, and a relatively low-risk investment. They are particularly well-suited for short-term financial goals or individuals with a conservative investment approach.

If you’re in New Zealand and need an annuity calculator, there are resources available to help you. Check out Annuity Calculator Nz 2024 for more information.

Choosing the Right 3-Year Annuity

Selecting the right 3-year annuity involves considering several key factors to ensure that the chosen option aligns with individual needs and financial goals.

Factors to Consider

- Interest Rates:Compare interest rates offered by different providers to maximize returns. Look for annuities with competitive interest rates and favorable terms.

- Fees:Check for any fees associated with the annuity, such as administrative fees or early withdrawal penalties. Choose an annuity with minimal fees to maximize the overall return.

- Reputation of the Provider:Select a reputable financial institution with a strong track record and a commitment to customer service.

Types of 3-Year Annuities

The market offers various types of 3-year annuities, each with unique features and suitability for different needs. Some common types include:

- Fixed Annuities:Offer a fixed interest rate and guaranteed returns. Suitable for investors seeking a predictable income stream.

- Variable Annuities:Offer variable interest rates linked to market performance. Suitable for investors with a higher risk tolerance and potential for higher returns.

- Indexed Annuities:Offer returns linked to the performance of a specific index, such as the S&P 500. Suitable for investors seeking potential growth with some protection from market downturns.

Decision-Making Process

To guide readers through the decision-making process for selecting a 3-year annuity, consider the following checklist:

- Determine your financial goals:What are you saving for? How much do you need to save?

- Assess your risk tolerance:How comfortable are you with potential fluctuations in returns?

- Compare different annuity options:Consider interest rates, fees, and the reputation of the provider.

- Choose an annuity that aligns with your needs:Select an annuity that provides the desired level of guaranteed returns, income stream, and risk management.

Epilogue

In conclusion, 3-year annuities offer a unique blend of predictability and potential returns, making them an attractive option for investors seeking a balance between security and growth. By utilizing a 3-year annuity calculator and carefully considering your financial goals, you can make informed decisions that optimize your investment strategy.

Remember to weigh the benefits against the potential drawbacks and consult with a financial advisor to ensure that a 3-year annuity is the right choice for your specific circumstances.

While annuities can be a useful financial tool, there are some potential issues to be aware of. Read about some of the common concerns on Annuity Issues 2024.

Commonly Asked Questions

What are the different types of 3-year annuities?

There are various types of 3-year annuities available, including fixed annuities, variable annuities, and indexed annuities. Each type offers different features and risks, so it’s crucial to choose one that aligns with your investment goals and risk tolerance.

The monthly payout for a $80,000 annuity can vary depending on factors like interest rates and the duration of the annuity. You can get a more accurate estimate on How Much Does A 80 000 Annuity Pay Per Month 2024.

How do I find a reputable provider for a 3-year annuity?

Look for providers with a strong track record, positive customer reviews, and competitive interest rates. It’s also essential to understand the fees associated with the annuity and compare them across different providers.

Can I withdraw my money from a 3-year annuity before the term ends?

Most 3-year annuities have penalties for early withdrawals, so it’s important to consider your liquidity needs before investing. However, some providers offer options for partial withdrawals with limited penalties.

Are 3-year annuities subject to taxes?

Yes, the interest earned on 3-year annuities is generally taxable as ordinary income. However, some annuities may offer tax-deferred growth, meaning taxes are only paid when the funds are withdrawn.