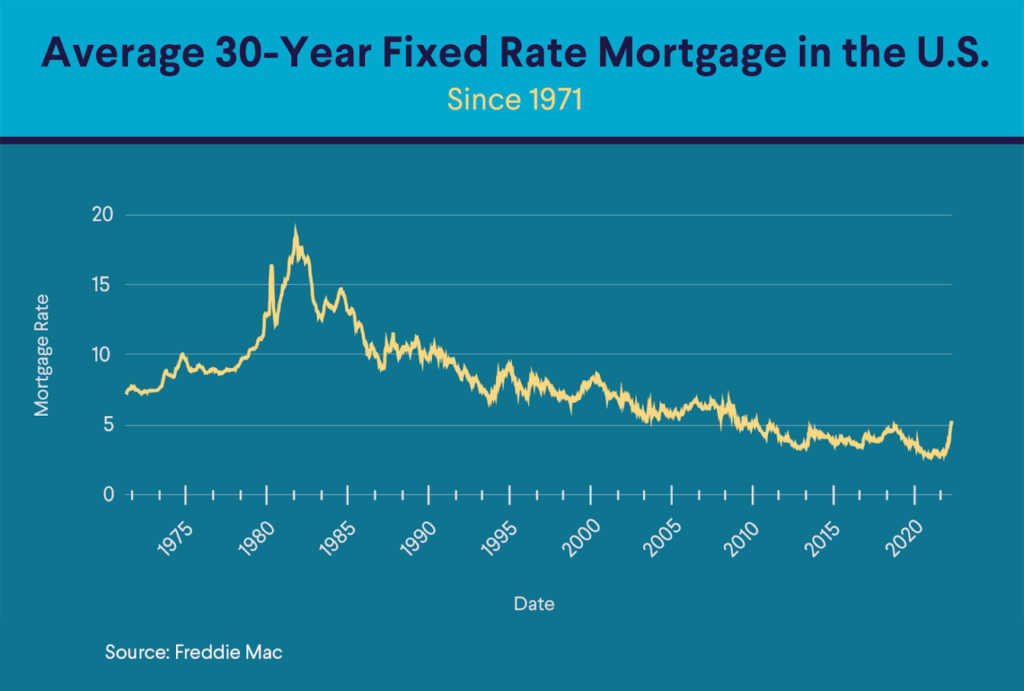

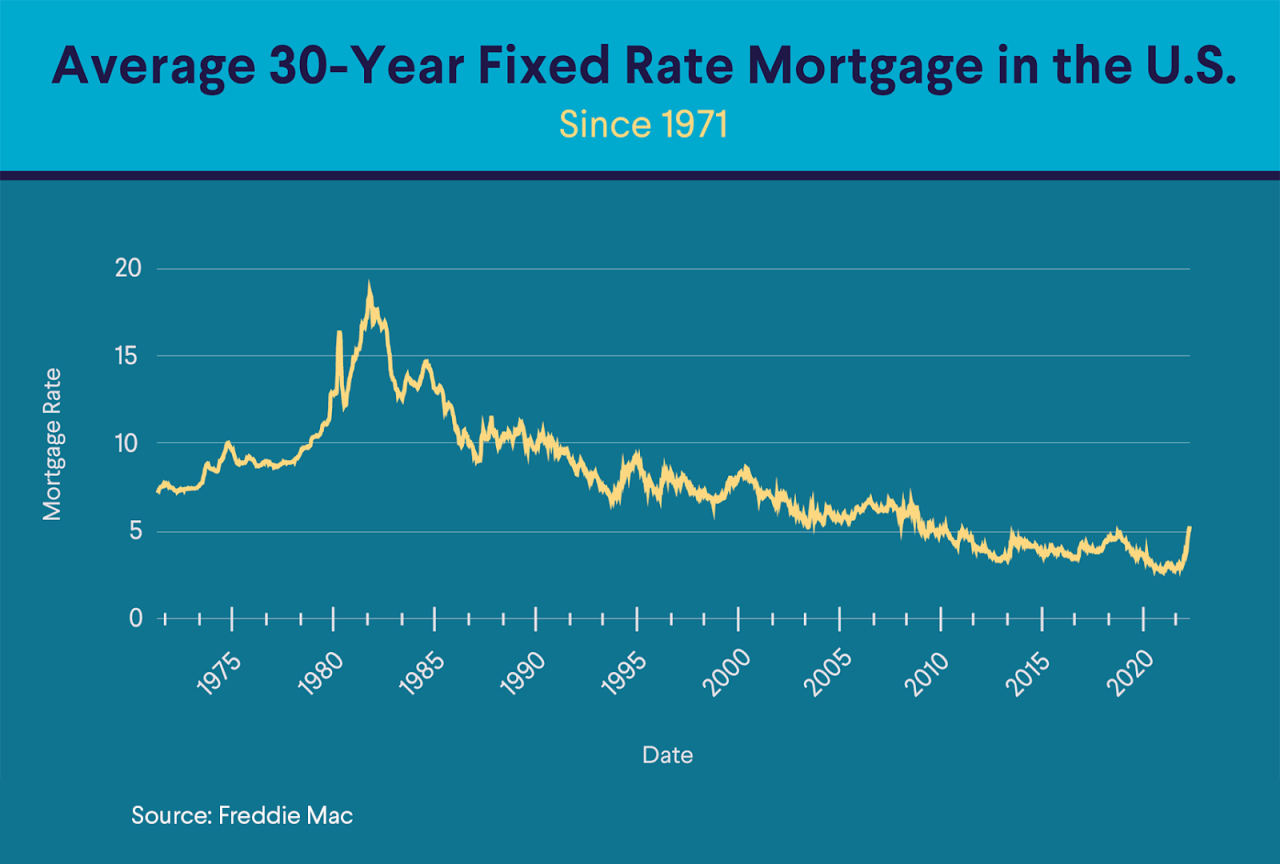

30 Mortgage Rates 2024 are a critical factor shaping the housing market landscape. As interest rates fluctuate, homebuyers grapple with affordability challenges and strategize to secure favorable financing. This guide delves into the complexities of 30-year mortgage rates, exploring their historical trends, potential future scenarios, and the impact on both borrowers and the economy.

A cash-out refinance allows you to tap into your home’s equity. This can be useful for home improvements, debt consolidation, or other financial goals.

Understanding the forces driving mortgage rates is crucial for making informed decisions. Economic conditions, Federal Reserve policies, and market sentiment all play a role in determining interest rates. Historical data provides valuable insights into past trends, while expert analysis helps predict future scenarios.

Coast Capital is a credit union that offers mortgage services, and their mortgage rates can be competitive. It’s worth comparing their rates to other lenders.

By analyzing these factors, we can gain a clearer picture of the potential trajectory of 30-year mortgage rates in 2024 and beyond.

If you’re a mortgage lender, generating mortgage leads is crucial for business growth. There are various strategies and tools available to help you attract potential clients.

Concluding Remarks: 30 Mortgage Rates 2024

In conclusion, 30-year mortgage rates remain a key determinant of homeownership affordability and overall economic activity. While navigating the complexities of fluctuating interest rates can be challenging, understanding the underlying factors and adopting strategic approaches can empower both homebuyers and investors.

For eligible veterans, VA interest rates can be a valuable perk. These rates are often lower than conventional loans, making homeownership more accessible.

By staying informed and adaptable, we can navigate the housing market with confidence and achieve our financial goals.

If you’re looking for a mortgage that aligns with Islamic principles, Islamic mortgages are an option. These mortgages typically involve a profit-sharing arrangement rather than interest payments.

Questions and Answers

What are the key factors influencing 30-year mortgage rates?

Navigating the mortgage process can feel overwhelming, but there are resources to help. Check out guides and tips on getting a mortgage to simplify the journey.

The primary factors influencing 30-year mortgage rates include economic growth, inflation, Federal Reserve policy, investor sentiment, and global economic conditions.

Quicken Loans is a well-known mortgage lender, and their Rocket Mortgage platform offers a streamlined online application process. It’s worth exploring their offerings for a convenient mortgage experience.

How do rising mortgage rates impact home affordability?

Higher mortgage rates increase monthly payments, making homes less affordable for potential buyers. This can lead to decreased demand and slower housing market growth.

If you’re looking to buy a home in 2024, it’s important to stay up-to-date on interest rates and mortgage rates. These rates can fluctuate, so it’s beneficial to track them closely to find the best deal.

What are some strategies for securing a favorable mortgage rate?

Strategies include improving credit scores, shopping around for lenders, considering alternative financing options like ARMs, and potentially locking in a rate during periods of low interest rates.

For veterans, staying informed about VA loan rates today is essential. These rates can change daily, so it’s good to check frequently.

Conventional mortgages are a common type of loan, and conventional mortgage rates are influenced by various factors. Understanding these rates is important when comparing options.

Getting pre-approved for a mortgage can give you a better idea of how much you can borrow. Rocket Mortgage pre-approval is a popular option for streamlining this process.

If you’re considering a cash-out refinance, be sure to research cash-out refinance rates. These rates can vary depending on your credit score, loan amount, and other factors.

Refinancing your mortgage can potentially lower your monthly payments or shorten your loan term. Refinance rates are constantly changing, so it’s worth checking if refinancing makes sense for you.

A 5-year fixed mortgage offers predictable payments for a set period. 5-year fixed mortgage rates can be a good option if you prefer stability and want to lock in a rate.

If you’re a first-time homebuyer, there are resources available to help you navigate the process. First-time homebuyer mortgages often have special programs and down payment assistance options.