30 Year Interest Rates 2024: What to Expect is a crucial topic for anyone considering a mortgage or investment in the housing market. The current 30-year interest rate environment is influenced by a complex interplay of factors, including inflation, economic growth, and Federal Reserve policy.

For those looking for a longer-term mortgage, 20 Year Mortgage Rates 2024 can be a good alternative. These mortgages have a longer repayment term than traditional 30-year loans.

Understanding these dynamics is essential for making informed financial decisions.

Keeping an eye on Current Arm Rates 2024 is important for those considering an adjustable-rate mortgage (ARM). These rates can fluctuate over time, so it’s essential to understand the potential risks and benefits.

The historical context of 30-year interest rates in recent years provides valuable insight into potential future trends. As we delve into the predictions for 2024, we’ll explore expert forecasts and market trends, examining the potential impact of economic indicators like inflation, unemployment, and GDP growth on interest rates.

It’s beneficial to track Daily Mortgage Rates 2024 to see how they change. This information can help you identify potential opportunities to lock in a favorable rate.

We’ll also compare and contrast different predictions and their underlying rationales.

Rocket Mortgage is a popular lender, and they offer a variety of home equity loan options. Check out Rocket Mortgage Home Equity Loan 2024 to see if it’s a good fit for your needs.

Final Conclusion

Navigating the fluctuating landscape of 30-year interest rates requires a proactive approach. By understanding the factors driving these fluctuations, we can develop strategies for managing financial risk and making informed decisions. Whether you’re a borrower looking to secure a mortgage or an investor seeking opportunities in the housing market, staying informed about 30-year interest rates is crucial for achieving your financial goals.

Understanding Home Loan Interest Rates 2024 is crucial when seeking a mortgage. These rates can vary depending on factors like credit score, loan type, and market conditions.

Questions Often Asked: 30 Year Interest Rates 2024

What is the current 30-year interest rate?

If you’re looking to refinance your mortgage in 2024, understanding the current 30 Year Refinance Rates 2024 is crucial. It’s essential to compare rates from different lenders to find the best deal.

The current 30-year interest rate fluctuates daily. To get the most up-to-date information, it’s best to consult a financial advisor or a reputable mortgage lender.

Ready to take the next step and apply for a home loan? Apply For Home Loan 2024 offers resources and information to guide you through the process.

How do interest rates affect my mortgage payments?

If you’re eligible, a Va Home Loan 2024 can be a great option for veterans. These loans offer competitive rates and benefits specifically designed for those who have served in the military.

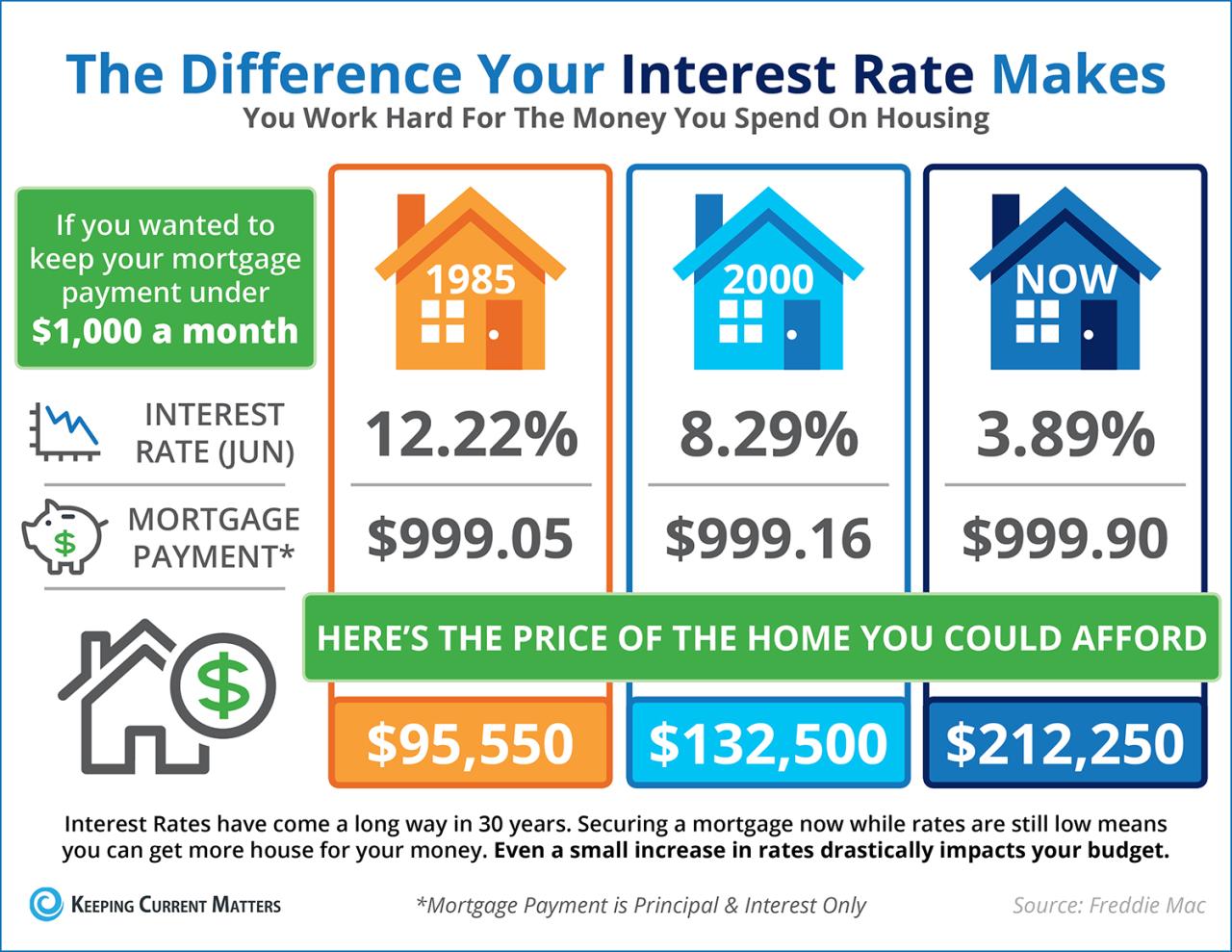

Higher interest rates result in higher monthly mortgage payments. Conversely, lower interest rates lead to lower payments. The impact of interest rate changes on your monthly payment will depend on the amount of your mortgage and the loan term.

Staying updated on the latest Current 30 Year Mortgage Rates 2024 is essential for making informed decisions. These rates fluctuate regularly, so it’s important to monitor them closely.

Should I lock in a rate now or wait?

If you’re considering a shorter-term mortgage, a 2 Year Fixed Rate Mortgage 2024 might be worth exploring. These mortgages offer a fixed rate for a shorter period, which can be beneficial in certain situations.

The decision to lock in a rate or wait depends on your individual circumstances and risk tolerance. If you’re concerned about rising interest rates, locking in a rate may be a good option. However, if you believe rates may fall, waiting could potentially lead to a lower rate.

What is the difference between a fixed-rate and an adjustable-rate mortgage?

A Home Equity Conversion Mortgage 2024 , or HECM, can be a valuable tool for seniors who need to access their home equity. It allows you to convert your home’s equity into cash, providing financial flexibility.

A fixed-rate mortgage has a fixed interest rate for the entire loan term, while an adjustable-rate mortgage has an interest rate that can change over time. Fixed-rate mortgages provide stability, while adjustable-rate mortgages can offer lower initial rates.

When considering a home equity loan, you might want to explore Equity Home Loan 2024 options. These loans allow you to borrow against your home’s equity, providing funds for various purposes.

Understanding Interest Rates Mortgage Rates 2024 is essential for making informed decisions about your mortgage. By staying informed about current rates and trends, you can find the best financing options for your needs.