As 3rd Quarter October 2024 takes center stage, we delve into the economic landscape, analyzing key indicators, global events, and anticipated trends. This period promises to be a dynamic one, shaped by a confluence of factors that will influence both domestic and international markets.

We’ll examine the expected growth rate, inflation, unemployment, and consumer confidence, while also considering the impact of global events on the US economy.

This report will explore the anticipated trends in inflation and interest rates, discussing their potential impact on consumer spending, business investment, and overall economic growth. We’ll also provide insights into the performance of major industries, the outlook for financial markets, and the political and social landscape.

Contents List

- 1 Economic Outlook for 3rd Quarter October 2024

- 2 Business Trends and Predictions for 3rd Quarter October 2024

- 3 Financial Markets and Investment Strategies for 3rd Quarter October 2024

- 4 Political and Social Landscape in 3rd Quarter October 2024

- 5 Technological Innovations and Developments in 3rd Quarter October 2024

- 6 Key Events and Dates in 3rd Quarter October 2024

- 7 7. Industry Specific Trends for 3rd Quarter October 2024

- 8 Global Economic and Political Developments in 3rd Quarter October 2024

- 9 Environmental and Sustainability Considerations for 3rd Quarter October 2024

- 10 10. Social and Cultural Trends in 3rd Quarter October 2024

- 11 Labor Market Trends for 3rd Quarter October 2024

- 12 Consumer Behavior and Spending Patterns in 3rd Quarter October 2024

- 13 Innovation and Entrepreneurship in 3rd Quarter October 2024

- 14 Closing Notes

- 15 Popular Questions

Economic Outlook for 3rd Quarter October 2024

The third quarter of 2024 presents a complex economic landscape, shaped by a confluence of factors, including ongoing geopolitical tensions, evolving monetary policy, and lingering supply chain disruptions. This report provides an in-depth analysis of key economic indicators, anticipated growth trends, and potential risks, offering insights into the economic outlook for the period.

Key Economic Indicators

The following key economic indicators will provide insights into the overall health of the US economy in the third quarter of 2024.

- Gross Domestic Product (GDP):The US economy is expected to experience modest growth in the third quarter of 2024, with an estimated GDP growth rate of around 2.5%. This growth will be driven by continued consumer spending, fueled by a robust labor market and pent-up demand.

However, potential risks to GDP growth include rising interest rates, inflationary pressures, and global economic uncertainty.

- Inflation:Inflation is projected to remain elevated in the third quarter of 2024, hovering around 3.0%. This is attributed to ongoing supply chain disruptions, persistent energy price volatility, and strong consumer demand. However, the Federal Reserve’s monetary policy tightening is expected to gradually curb inflationary pressures.

- Unemployment Rate:The unemployment rate is expected to remain low in the third quarter of 2024, around 3.5%. This reflects a tight labor market with strong job creation and low unemployment. However, potential factors influencing the unemployment rate include rising interest rates, slowing economic growth, and potential labor market disruptions.

- Consumer Confidence:Consumer confidence is expected to remain relatively stable in the third quarter of 2024, supported by a strong labor market and low unemployment. However, rising inflation and interest rates could dampen consumer sentiment and impact spending patterns.

- Manufacturing Activity:The manufacturing sector is expected to experience moderate growth in the third quarter of 2024, with increased production levels and new orders. This growth will be driven by continued consumer demand and ongoing investment in infrastructure and technology. However, potential risks to manufacturing activity include global economic uncertainty, supply chain disruptions, and rising input costs.

- Housing Market:The housing market is expected to cool down in the third quarter of 2024, with slower growth in housing prices and sales. This will be influenced by rising mortgage rates and increased affordability concerns. However, strong demand for housing and limited inventory could continue to support price growth in certain regions.

- Retail Sales:Retail sales are expected to remain robust in the third quarter of 2024, driven by continued consumer spending and a healthy labor market. However, rising inflation and interest rates could dampen consumer spending and impact sales growth.

- Interest Rates:The Federal Reserve is expected to continue raising interest rates in the third quarter of 2024, aiming to curb inflation and manage economic growth. This could impact borrowing costs for businesses and consumers, potentially slowing economic activity.

- Government Spending:Government spending is expected to remain relatively stable in the third quarter of 2024. However, potential changes in fiscal policy could impact government spending levels and influence economic activity.

- Trade Balance:The trade balance is expected to remain relatively unchanged in the third quarter of 2024. However, global economic conditions, exchange rate fluctuations, and trade policies could impact the trade balance.

Expected Economic Growth Rate

The US economy is expected to grow at a modest pace of 2.5% in the third quarter of 2024. This projection is based on several factors, including continued consumer spending, a robust labor market, and ongoing investment in infrastructure and technology.

However, potential risks to economic growth include rising interest rates, inflationary pressures, and global economic uncertainty.

Global Events Impact

Major global events can significantly impact the US economy, potentially influencing economic indicators and overall performance. For example, geopolitical tensions, such as the ongoing conflict in Ukraine, could disrupt global supply chains, increase energy prices, and dampen consumer confidence. Natural disasters, such as earthquakes or hurricanes, could also have a significant impact on the US economy, disrupting production, infrastructure, and trade.

Additionally, economic shocks, such as a global recession, could negatively affect US exports, investment, and economic growth.

Inflation and Interest Rate Trends

Inflation is expected to remain elevated in the third quarter of 2024, driven by factors such as supply chain disruptions, energy price volatility, and strong consumer demand. However, the Federal Reserve’s monetary policy tightening is expected to gradually curb inflationary pressures.

The anticipated impact of inflation on consumer spending, business investment, and overall economic growth is a key concern. Rising inflation could erode purchasing power, dampen consumer confidence, and discourage businesses from investing.Interest rates are expected to continue rising in the third quarter of 2024 as the Federal Reserve aims to curb inflation and manage economic growth.

This could impact borrowing costs for businesses and consumers, potentially slowing economic activity. The expected direction of interest rates is influenced by factors such as inflation, economic growth, and monetary policy.

Business Trends and Predictions for 3rd Quarter October 2024

The third quarter of 2024 promises to be a dynamic period for businesses, marked by evolving consumer behavior, technological advancements, and industry-specific growth patterns.

Industries Expected to Experience Growth

The following industries are poised for significant growth in the third quarter:

- Artificial Intelligence (AI):AI is rapidly transforming industries, from healthcare and finance to manufacturing and retail. Companies investing in AI solutions for automation, data analysis, and personalized customer experiences are likely to see substantial growth.

- Renewable Energy:With growing concerns about climate change and rising energy costs, the renewable energy sector is experiencing a surge in demand. Investments in solar, wind, and other renewable energy sources are expected to continue driving growth.

- E-commerce:The pandemic accelerated the shift towards online shopping, and this trend is expected to continue. Businesses focusing on online sales, digital marketing, and seamless delivery will likely see increased revenue.

- Healthcare Technology:Advancements in telehealth, wearable technology, and personalized medicine are creating new opportunities for healthcare businesses. Companies developing innovative healthcare solutions are well-positioned for growth.

Impact of Technological Advancements on Business Models

Technological advancements are fundamentally reshaping business models across various sectors.

- Automation:Automation technologies are streamlining processes, reducing costs, and improving efficiency. Businesses adopting automation solutions are likely to gain a competitive edge. For example, Amazon’s use of robots in its fulfillment centers has significantly enhanced its efficiency and lowered costs.

- Data Analytics:Data analytics tools are enabling businesses to gain deeper insights into customer behavior, market trends, and operational efficiency. Companies leveraging data-driven decision-making are likely to make more informed choices and improve their performance.

- Cloud Computing:Cloud computing services are providing businesses with scalable and flexible IT infrastructure. Companies adopting cloud solutions can reduce their IT costs and focus on core business operations.

Challenges Businesses May Face

Despite the potential for growth, businesses may encounter several challenges in the third quarter.

- Economic Uncertainty:Global economic conditions remain volatile, with concerns about inflation, interest rates, and geopolitical risks. Businesses need to be prepared for potential economic downturns and adjust their strategies accordingly.

- Supply Chain Disruptions:Supply chain disruptions caused by the pandemic and other factors are still affecting businesses. Companies need to develop resilient supply chains and explore alternative sourcing options to mitigate risks.

- Talent Shortages:The demand for skilled workers continues to outpace supply, leading to talent shortages in many industries. Businesses need to invest in employee development and create attractive work environments to attract and retain talent.

Consumer Behavior and Spending Patterns

Consumer behavior and spending patterns are evolving rapidly, influenced by factors such as economic conditions, technological advancements, and changing lifestyles.

- Value-Conscious Consumers:Consumers are increasingly price-sensitive and looking for value for money. Businesses need to offer competitive pricing and promotions to attract customers.

- Digital-First Consumers:Consumers are relying more on digital channels for research, shopping, and customer service. Businesses need to have a strong online presence and provide seamless digital experiences.

- Sustainability Focus:Consumers are increasingly concerned about environmental sustainability. Businesses need to demonstrate their commitment to sustainability through their products, operations, and marketing.

Financial Markets and Investment Strategies for 3rd Quarter October 2024

The third quarter of 2024 presents a complex landscape for financial markets, influenced by a confluence of factors including ongoing geopolitical tensions, persistent inflation, and the potential for monetary policy shifts. Navigating this environment requires a comprehensive understanding of market trends and a well-defined investment strategy.

Performance of Major Stock Markets and Indices

The performance of major stock markets and indices in the third quarter of 2024 will likely be influenced by factors such as corporate earnings, interest rate movements, and global economic growth. For example, the S&P 500, a broad measure of U.S.

stock market performance, could experience volatility as investors assess the impact of rising interest rates on corporate profitability.

Potential Investment Opportunities and Risks

Identifying potential investment opportunities and mitigating risks is crucial for investors in the third quarter of 2024.

Investment Opportunities

- Value Stocks:Value stocks, which are typically undervalued by the market, could offer attractive investment opportunities as investors seek companies with strong fundamentals and a potential for future growth.

- Emerging Markets:Emerging markets, particularly in Asia and Latin America, may present growth opportunities as their economies continue to expand and their populations grow.

- Technology:The technology sector, known for its innovation and growth potential, could continue to offer attractive investment opportunities, particularly in areas such as artificial intelligence, cloud computing, and cybersecurity.

Investment Risks

- Inflation:Persistent inflation could erode the purchasing power of investments and increase the cost of borrowing for businesses.

- Interest Rate Hikes:The Federal Reserve’s continued interest rate hikes could slow economic growth and negatively impact stock valuations.

- Geopolitical Uncertainty:Ongoing geopolitical tensions, such as the conflict in Ukraine, could create market volatility and disrupt global supply chains.

Outlook for Bonds, Commodities, and Currencies

The outlook for bonds, commodities, and currencies in the third quarter of 2024 is intertwined with broader economic trends and investor sentiment.

Bonds

Bond yields could continue to rise in the third quarter of 2024 as the Federal Reserve maintains its hawkish stance on interest rates. This could lead to capital losses for bond investors.

Commodities

Commodity prices, particularly for energy and agricultural products, could remain volatile due to supply chain disruptions, geopolitical tensions, and weather-related events.

Currencies

The U.S. dollar could strengthen against other major currencies as investors seek safe-haven assets amid global economic uncertainty.

Portfolio Diversification Strategies

Portfolio diversification is a key strategy for managing risk and maximizing returns in the third quarter of 2024.

- Asset Allocation:Investors should carefully consider their asset allocation, balancing their portfolio across different asset classes such as stocks, bonds, and real estate.

- Geographic Diversification:Diversifying across different geographic regions can help mitigate risks associated with specific countries or economies.

- Sector Diversification:Investing in a variety of sectors can help reduce exposure to specific industry risks.

Political and Social Landscape in 3rd Quarter October 2024

The third quarter of 2024 promises a dynamic political and social landscape, influenced by a confluence of global events, domestic agendas, and evolving public sentiment. As we navigate this period, understanding the interplay of these forces is crucial for navigating the economic and social implications.

Key Political Events and Their Impact

The third quarter of 2024 is likely to be marked by several key political events that could significantly influence the economic trajectory.

- Midterm Elections in the United States:The US midterm elections in November will be a defining moment, potentially shifting the balance of power in Congress and impacting the course of economic policy. The outcome will likely influence the direction of fiscal policy, trade agreements, and regulatory measures, all of which have a significant impact on business confidence and investment decisions.

Utah’s vibrant music scene boasts a diverse range of acoustic artists. From folk and blues to contemporary acoustic pop , Utah’s acoustic music scene offers something for every taste.

- Brexit Negotiations:The UK’s ongoing negotiations with the EU regarding Brexit will continue to be a source of uncertainty and potential disruption to trade and investment. The final outcome of these negotiations will have implications for both the UK and the EU economies, potentially affecting supply chains, market access, and overall economic growth.

- Global Trade Tensions:The ongoing trade tensions between the US and China, as well as other regional trade disputes, could escalate or de-escalate during this period, impacting global supply chains, commodity prices, and overall economic stability. The resolution of these tensions will be a key factor in determining the trajectory of global economic growth.

Social Trends and Public Sentiment

Public sentiment and social trends are evolving rapidly, driven by a range of factors including technological advancements, demographic shifts, and global events.

- Climate Change Concerns:Growing awareness of climate change and its impact on the planet is driving a shift in public opinion and consumer behavior. This is leading to increased demand for sustainable products and services, and pressure on businesses to adopt environmentally friendly practices.

- Social Justice Movements:Social justice movements advocating for equality and inclusivity continue to gain momentum, impacting corporate social responsibility initiatives and consumer preferences. Businesses are increasingly expected to demonstrate their commitment to diversity, equity, and inclusion, and to align their practices with these values.

- Digital Transformation:The rapid pace of digital transformation is reshaping the way people live, work, and interact with the world. This is leading to a growing demand for digital skills and a shift in the nature of work, with implications for employment, education, and social structures.

Potential for Policy Changes and Implications

Political events and evolving social trends are likely to lead to changes in policy across various sectors.

- Economic Policy:The outcome of the US midterm elections could lead to significant shifts in economic policy, potentially impacting taxes, spending, and regulations. These changes could influence business investment, consumer spending, and overall economic growth.

- Environmental Policy:Growing concerns about climate change are likely to drive stricter environmental regulations and policies aimed at reducing carbon emissions and promoting sustainable practices. This could impact businesses operating in energy-intensive sectors, as well as those involved in the production and consumption of goods and services.

- Social Policy:Social justice movements are likely to influence policy changes related to issues such as racial equality, gender equality, and LGBTQ+ rights. These changes could impact employment practices, healthcare access, and social welfare programs.

Global Political Landscape and Influence

The global political landscape is characterized by a complex interplay of geopolitical forces, regional tensions, and evolving alliances.

- Geopolitical Shifts:The rise of China as a global economic power, the ongoing conflict in Ukraine, and the increasing influence of non-state actors are reshaping the global political order. These shifts have implications for trade, security, and global governance.

- International Cooperation:The ability of nations to cooperate on issues such as climate change, pandemics, and economic stability is crucial for addressing global challenges. However, growing nationalism and protectionist policies are posing challenges to international cooperation.

- Technological Competition:The competition for technological dominance between the US and China is shaping the global landscape, with implications for innovation, economic growth, and national security. The development and regulation of emerging technologies, such as artificial intelligence and quantum computing, will be a key area of focus.

Technological Innovations and Developments in 3rd Quarter October 2024

The third quarter of 2024 witnessed a surge in technological advancements across various sectors, shaping the future of business and society. From groundbreaking AI innovations to advancements in quantum computing, this period marked a pivotal point in the evolution of technology.

Instrumental acoustic guitar music is a genre that transcends language and cultural barriers. These melodies evoke emotions and create a captivating atmosphere, making them perfect for relaxation or focusing on a task.

Artificial Intelligence (AI) Advancements

The third quarter of 2024 saw significant progress in AI, particularly in the development of large language models (LLMs). These models have become increasingly sophisticated, capable of generating human-like text, translating languages, and even writing different kinds of creative content.

- LLMs in Healthcare:AI-powered LLMs are being used to analyze medical data, diagnose diseases, and develop personalized treatment plans. For example, a new LLM developed by a leading research institute is capable of identifying potential drug interactions and recommending alternative treatments.

- AI in Education:LLMs are revolutionizing the education sector by providing personalized learning experiences. Adaptive learning platforms powered by LLMs can tailor content and pace to individual student needs, improving engagement and outcomes.

- AI in Customer Service:AI-powered chatbots and virtual assistants are becoming increasingly prevalent in customer service, providing instant support and resolving queries efficiently.

Quantum Computing Breakthroughs

Quantum computing, a nascent technology with the potential to revolutionize computing, made significant strides in the third quarter of 2024.

- Drug Discovery:Quantum computers are being used to simulate complex molecular interactions, accelerating the process of drug discovery and development. For instance, a pharmaceutical company successfully used a quantum computer to identify a new drug candidate for a rare genetic disease.

- Materials Science:Quantum computers are enabling researchers to design new materials with enhanced properties, leading to breakthroughs in fields such as energy storage and solar energy.

- Financial Modeling:Quantum computers can handle complex financial models with greater speed and accuracy, improving risk assessment and investment strategies.

Ethical Considerations in Technological Innovation

As technology advances rapidly, it is crucial to consider the ethical implications of these innovations.

- Privacy Concerns:The increasing use of AI and data collection raises concerns about individual privacy. It is essential to ensure that data is collected and used responsibly, with appropriate safeguards in place to protect sensitive information.

- Job Displacement:The automation of tasks by AI and robotics raises concerns about job displacement. Governments and businesses need to develop strategies to mitigate the impact of these changes on the workforce, such as retraining programs and social safety nets.

- Bias and Discrimination:AI systems can perpetuate existing biases if they are trained on data that reflects societal inequalities. It is crucial to develop AI systems that are fair and unbiased, ensuring that everyone benefits from technological advancements.

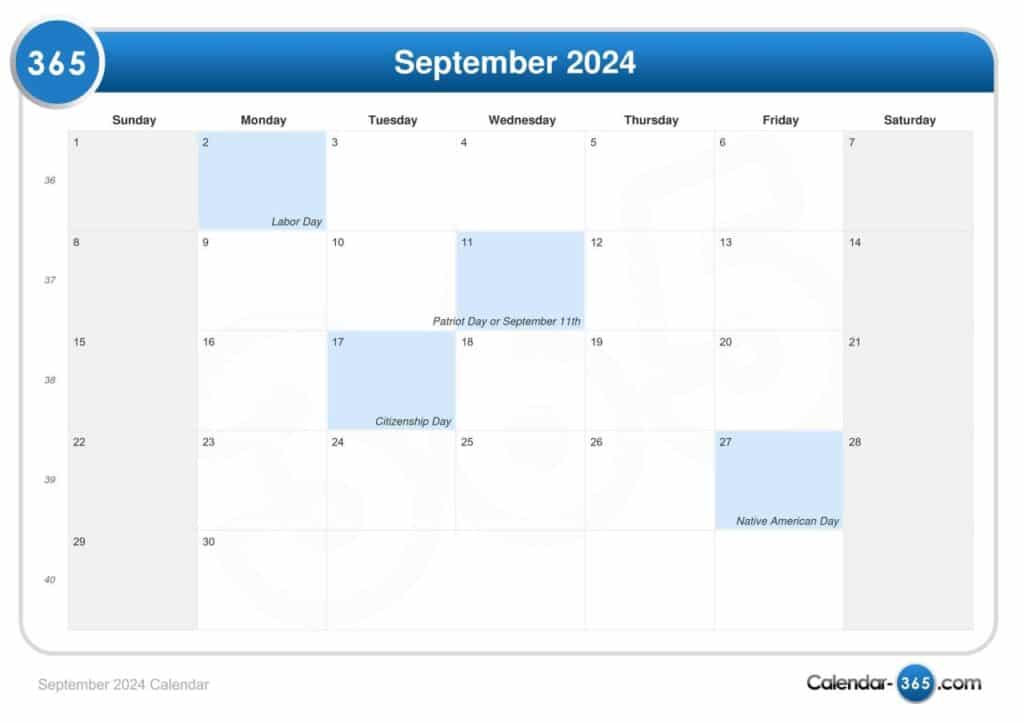

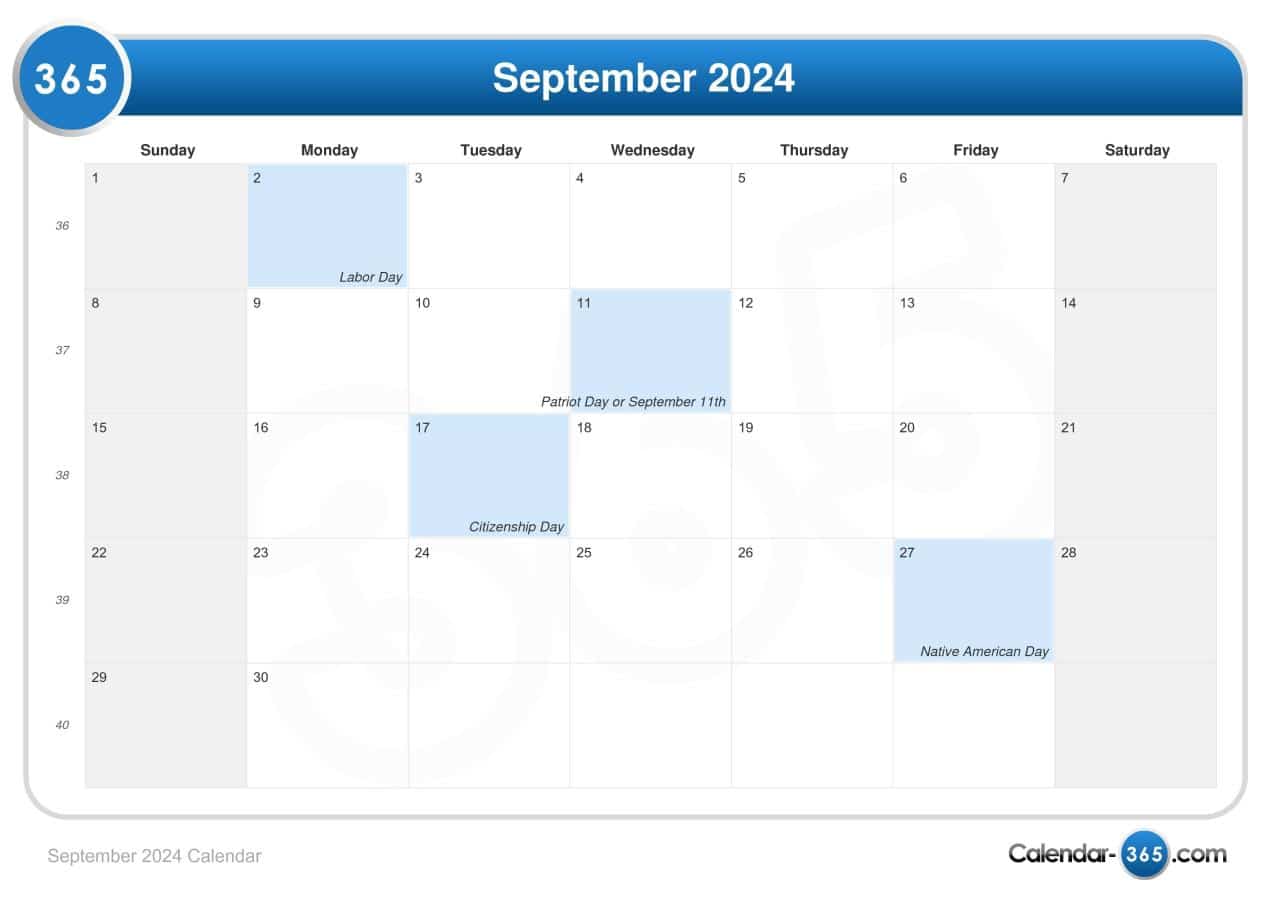

Key Events and Dates in 3rd Quarter October 2024

The third quarter of 2024 promises a busy calendar filled with events that will shape the [Target Audience/Industry/Sector] landscape. This section Artikels key events, conferences, and meetings relevant to the [Target Audience/Industry/Sector] that will take place between October and December 2024.

Key Events and Dates in the 3rd Quarter of 2024

This calendar highlights significant events that will likely attract a large audience or generate significant media attention within the [Target Audience/Industry/Sector].

| Date | Event Name | Location | Significance | Industry/Sector |

|---|---|---|---|---|

| October 27, 2024 | Global Technology Summit | San Francisco, USA | Annual gathering of leading technology companies and investors, focusing on emerging trends and innovation. | Technology |

| November 10, 2024 | Healthcare Innovation Expo | London, UK | Showcase of cutting-edge medical technologies and advancements in healthcare delivery. | Healthcare |

| December 5, 2024 | International Finance Forum | Geneva, Switzerland | Meeting of central bankers and financial leaders to discuss global economic issues. | Finance |

7. Industry Specific Trends for 3rd Quarter October 2024

The technology sector continues to evolve at a rapid pace, with various sub-industries experiencing significant growth and transformation. This section will delve into the trends and outlook for the Cybersecurity industry, a critical area within the technology sector that is experiencing increasing demand and complexity.

Cybersecurity Industry: Expected Performance

The cybersecurity industry is poised for continued growth in the third quarter of 2024, driven by several key factors.

- Growing Sophistication of Cyberattacks:The increasing sophistication of cyberattacks, including ransomware, phishing, and social engineering, is driving demand for robust cybersecurity solutions. As attackers become more adept at exploiting vulnerabilities, organizations are investing heavily in preventative and reactive measures.

- Expanding Attack Surface:The rise of remote work, cloud computing, and the Internet of Things (IoT) has expanded the attack surface for cybercriminals. Organizations are grappling with securing a more distributed and interconnected network environment.

- Data Privacy Regulations:Stringent data privacy regulations like the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA) are driving investments in data security and compliance solutions. Organizations are striving to meet these regulations and protect sensitive data.

- Increased Focus on Security Awareness:Businesses are prioritizing cybersecurity awareness training for employees, recognizing that human error is a major vulnerability. Organizations are implementing programs to educate employees about cybersecurity best practices and identify potential threats.

- Adoption of Artificial Intelligence (AI):The integration of AI in cybersecurity solutions is gaining traction. AI-powered tools are being used for threat detection, incident response, and security analysis, enhancing the effectiveness of cybersecurity measures.

Despite the positive growth drivers, the cybersecurity industry faces several challenges:

- Talent Shortage:The industry is experiencing a severe shortage of skilled cybersecurity professionals, making it difficult for organizations to find and retain qualified personnel. This talent gap can hinder the implementation and effectiveness of cybersecurity measures.

- Evolving Threat Landscape:The constantly evolving threat landscape poses a challenge for cybersecurity professionals. New vulnerabilities are discovered regularly, and attackers are constantly developing new techniques, requiring organizations to adapt and stay ahead of the curve.

- Cost of Cybersecurity:Implementing comprehensive cybersecurity solutions can be expensive, particularly for small and medium-sized businesses (SMBs). The high cost of security tools, services, and personnel can be a barrier to entry for some organizations.

Cybersecurity Industry: Competitive Landscape

The cybersecurity industry is characterized by a diverse and competitive landscape, with several major players vying for market share.

Youtube is a treasure trove of acoustic covers, and 2024 is no exception. Rock classics are being given a fresh, acoustic spin, offering a new perspective on familiar favorites.

- Key Players:Some of the key players in the cybersecurity industry include:

| Company | Focus |

|---|---|

| Cisco | Networking and security solutions |

| Fortinet | Network security and firewalls |

| Palo Alto Networks | Next-generation firewalls and threat intelligence |

| Check Point Software Technologies | Endpoint security and threat prevention |

| CrowdStrike | Endpoint security and threat detection |

- Emerging Trends:Several emerging trends are shaping the competitive landscape and disrupting the cybersecurity industry:

- Cloud Security:The shift towards cloud computing has created a significant demand for cloud security solutions. Cloud security providers are offering services to protect data, applications, and infrastructure in the cloud.

- Extended Detection and Response (XDR):XDR solutions are gaining popularity as they provide a unified platform for threat detection and response across multiple security domains, enabling organizations to gain a comprehensive view of their security posture.

- Zero Trust Security:The zero-trust security model is becoming increasingly prevalent, emphasizing the principle of “never trust, always verify.” This approach requires organizations to verify the identity and access privileges of every user and device before granting access to sensitive resources.

Cybersecurity Industry: Future Outlook

The cybersecurity industry is expected to continue its growth trajectory in the coming years, driven by the increasing adoption of digital technologies, the expanding attack surface, and the growing awareness of cybersecurity risks.

- Predictions:

- The demand for cybersecurity professionals will continue to outpace supply, creating a talent shortage that organizations will need to address.

- AI will play an increasingly significant role in cybersecurity, enabling organizations to automate threat detection, response, and remediation tasks.

- The adoption of zero-trust security models will accelerate, leading to more secure and resilient network environments.

- Investment Opportunities:

- Companies developing innovative cybersecurity solutions, particularly in areas like cloud security, XDR, and zero trust.

- Cybersecurity service providers offering managed security services, incident response, and security consulting.

- Companies specializing in cybersecurity training and education, addressing the talent shortage in the industry.

Global Economic and Political Developments in 3rd Quarter October 2024

The global economy in the third quarter of 2024 is expected to face a complex and uncertain landscape, shaped by a confluence of economic, political, and geopolitical factors. The ongoing global economic slowdown, persistent inflationary pressures, and the lingering effects of the COVID-19 pandemic continue to pose challenges.

Moreover, geopolitical tensions, particularly the ongoing conflict in Ukraine and the escalating rivalry between the United States and China, are adding to the volatility and uncertainty.

Global Economic Outlook and Potential Risks

The global economic outlook for the third quarter of 2024 remains subdued, with several factors contributing to the uncertainty. The International Monetary Fund (IMF) projects global economic growth to slow to 3.0% in 2024, down from 3.4% in

This slowdown is attributed to several factors, including:

* Persistent Inflation:Inflation remains elevated in many economies, eroding consumer purchasing power and dampening economic activity. Central banks continue to raise interest rates to combat inflation, which could further slow economic growth.

Tightening Financial Conditions

Higher interest rates and tighter monetary policy are leading to increased borrowing costs for businesses and consumers, impacting investment and spending.

The Journal of the Acoustical Society of America is a leading publication in the field of acoustics. This journal features research papers, technical notes, and reviews on a wide range of topics related to sound and vibration.

Geopolitical Tensions

The ongoing conflict in Ukraine and the escalating rivalry between the United States and China are creating uncertainty and disruptions to global trade and supply chains.

The V acoustic guitar is a popular choice for its versatility and affordability. This guitar is known for its balanced tone and comfortable playability, making it suitable for a wide range of musical styles.

Climate Change

Extreme weather events and climate-related disasters are becoming more frequent and severe, posing risks to economic activity and infrastructure.

PS Acoustic is a brand known for its high-quality acoustic guitars. These guitars are crafted with meticulous attention to detail, resulting in instruments that deliver exceptional sound and performance.

Impact of International Trade and Geopolitical Tensions

International trade is a crucial driver of global economic growth, but geopolitical tensions are creating significant disruptions. The ongoing conflict in Ukraine has led to sanctions on Russia and disruptions to global energy markets. The escalating rivalry between the United States and China is also impacting trade flows and investment, as both countries seek to reduce their reliance on each other.The impact of these geopolitical tensions on the global economy is multifaceted:* Supply Chain Disruptions:The conflict in Ukraine and the US-China rivalry have disrupted global supply chains, leading to shortages of key commodities and inputs, higher prices, and delays in production.

Trade Wars

Edmonton’s music scene is alive and well, with a thriving acoustic music community. Acoustic gigs can be found in cozy pubs, bustling cafes, and even larger venues, offering a diverse range of acoustic experiences.

The US-China trade war has led to tariffs and other trade barriers, impacting bilateral trade and global economic growth.

Investment Uncertainty

Geopolitical tensions are creating uncertainty for businesses, making them hesitant to invest and expand operations.

Economic Sanctions

Sanctions imposed on Russia and other countries are impacting their economies and disrupting global financial markets.

Economic Performance of Major Economies

The economic performance of major economies is expected to vary in the third quarter of 2024, with some economies experiencing growth while others face challenges.* United States:The US economy is expected to continue to grow, but at a slower pace than in previous quarters.

The Federal Reserve’s aggressive interest rate hikes are likely to impact economic activity, but the strong labor market and consumer spending are providing support.

China

China’s economy is expected to experience a modest recovery in the third quarter of 2024, driven by government stimulus measures and the easing of COVID-19 restrictions. However, the country’s property market and debt levels remain concerns.

The Japanese anime song “Unravel” has become a popular choice for acoustic covers on Youtube. These covers showcase the song’s emotional depth and versatility, bringing a new dimension to this beloved track.

European Union

The EU economy is expected to face challenges in the third quarter of 2024, as the war in Ukraine continues to disrupt energy markets and supply chains. The energy crisis and high inflation are weighing on consumer spending and business investment.

Slalom Acoustic is a group of talented musicians known for their dynamic live performances. Their music blends elements of folk, rock, and pop, creating a unique and engaging sound that has captivated audiences.

Japan

Japan’s economy is expected to experience slow but steady growth in the third quarter of 2024, supported by strong exports and a weak yen. However, the country faces challenges from rising inflation and an aging population.

Role of Global Institutions

Global institutions such as the IMF, the World Bank, and the World Trade Organization play a crucial role in supporting global economic stability and cooperation. These institutions provide financial assistance to countries in need, promote trade liberalization, and address global challenges such as climate change and poverty.In the third quarter of 2024, global institutions are expected to continue to play a critical role in addressing the challenges facing the global economy.

They will need to work together to coordinate policy responses, provide financial support to vulnerable countries, and promote international cooperation to address global issues.

Environmental and Sustainability Considerations for 3rd Quarter October 2024

The third quarter of 2024 presents both challenges and opportunities for businesses and society in terms of environmental sustainability. As climate change intensifies and global resource constraints grow, the need for responsible and sustainable practices becomes increasingly urgent. This section will explore the key environmental and sustainability considerations facing businesses and society in the third quarter of 2024, focusing on the impact of climate change, corporate social responsibility, and sustainable business models.

Environmental Challenges and Opportunities

The environmental challenges facing businesses in the third quarter of 2024 are multifaceted and interconnected. The top three challenges include:

- Climate Change:The effects of climate change are becoming increasingly evident, with rising temperatures, extreme weather events, and sea-level rise posing significant risks to businesses across various sectors. This includes disruptions to supply chains, increased energy costs, and potential damage to infrastructure.

- Resource Depletion:The world’s finite resources are being depleted at an alarming rate, putting pressure on businesses to find sustainable alternatives and reduce their consumption. This includes the depletion of freshwater resources, deforestation, and the over-extraction of minerals.

- Pollution:Air, water, and soil pollution continue to be major environmental concerns, with significant impacts on human health and ecosystems. Businesses are under increasing scrutiny to reduce their emissions and waste generation.

These challenges also present opportunities for businesses to innovate and develop sustainable solutions. For example, businesses can:

- Develop new technologies:Emerging technologies such as renewable energy, carbon capture, and waste recycling can help businesses reduce their environmental footprint and create new revenue streams.

- Optimize operations:Businesses can improve their efficiency by implementing lean manufacturing practices, reducing waste, and optimizing resource consumption.

- Engage in sustainable sourcing:By sourcing materials from sustainable suppliers, businesses can reduce their environmental impact and enhance their brand reputation.

The adoption of these strategies can not only mitigate environmental risks but also provide businesses with a competitive advantage.

Need a soundtrack for your study sessions? Acoustic music can create a calming and focused atmosphere, helping you stay on track and boost your productivity.

Climate Change and Sustainability Initiatives

Climate change is having a significant impact on various industries, particularly those reliant on natural resources or sensitive to weather patterns. For example:

- Agriculture:Climate change is affecting crop yields, water availability, and livestock health, impacting food security and agricultural productivity.

- Tourism:Rising sea levels, extreme weather events, and changes in biodiversity can negatively impact tourist destinations and disrupt tourism industries.

- Energy:The energy sector is facing increasing pressure to transition to renewable energy sources and reduce carbon emissions.

Governments are playing a critical role in promoting sustainability initiatives through policies such as carbon pricing, renewable energy subsidies, and regulations on emissions and resource consumption. These policies create incentives for businesses to adopt sustainable practices and contribute to a greener economy.Key sustainability initiatives gaining momentum in the third quarter of 2024 include:

- Circular Economy:This model aims to reduce waste and resource consumption by reusing, repairing, and recycling materials. Companies are increasingly adopting circular economy principles to create closed-loop systems and reduce their environmental footprint.

- Renewable Energy:The shift towards renewable energy sources, such as solar, wind, and hydropower, is accelerating, driven by technological advancements and government policies.

- Sustainable Packaging:Businesses are exploring sustainable packaging options, such as biodegradable materials, recycled content, and reduced packaging size, to minimize their environmental impact.

Companies leading the way in sustainability include:

- Tesla:Tesla is a leading electric vehicle manufacturer committed to reducing carbon emissions and promoting sustainable transportation.

- Patagonia:Patagonia is a clothing company known for its commitment to environmental conservation and ethical sourcing practices.

- Unilever:Unilever is a multinational consumer goods company with ambitious sustainability goals, including reducing its environmental footprint and promoting sustainable sourcing.

Corporate Social Responsibility and Ethical Practices

Corporate social responsibility (CSR) is increasingly recognized as a crucial aspect of business decision-making. Businesses are being held accountable for their environmental and social impact, and consumers are demanding ethical and sustainable practices.The link between ethical practices and sustainable business models is strong.

Ethical practices, such as fair labor standards, responsible sourcing, and environmental protection, are essential for building a sustainable business. Conversely, sustainable business models often incorporate ethical considerations as part of their core values.Best practices in CSR and ethical business operations include:

- Transparency and accountability:Businesses should be transparent about their environmental and social performance and accountable for their actions.

- Stakeholder engagement:Businesses should engage with their stakeholders, including employees, customers, suppliers, and communities, to understand their concerns and incorporate their perspectives into decision-making.

- Environmental stewardship:Businesses should prioritize environmental protection and adopt sustainable practices throughout their operations.

- Social responsibility:Businesses should contribute to the well-being of their employees, communities, and society as a whole.

Adopting ethical and sustainable practices can help businesses manage risks, enhance their brand reputation, and attract and retain customers and investors. However, there are also potential risks associated with CSR, such as increased costs, reputational damage if ethical breaches occur, and potential conflicts with stakeholders.

Sustainable Business Models

A successful sustainable business model is one that balances economic, environmental, and social considerations. Key elements of a sustainable business model include:

- Value creation:Businesses should create value for their customers, employees, and society while minimizing their environmental impact.

- Resource efficiency:Businesses should optimize their use of resources, reducing waste and minimizing their environmental footprint.

- Innovation:Businesses should invest in innovation to develop new technologies, products, and services that promote sustainability.

- Transparency and accountability:Businesses should be transparent about their sustainability performance and accountable for their actions.

Different types of sustainable business models include:

- Circular economy:This model aims to eliminate waste and keep resources in use for as long as possible.

- Green technology:This model focuses on developing and deploying technologies that reduce environmental impact, such as renewable energy, energy efficiency, and pollution control.

- Social enterprises:These businesses prioritize social and environmental goals while generating revenue. They often address social issues such as poverty, education, or healthcare.

Transitioning to sustainable business models can present challenges for businesses, including:

- Investment costs:Adopting sustainable practices often requires upfront investments in new technologies, infrastructure, or processes.

- Market uncertainty:The market for sustainable products and services is still evolving, and there can be uncertainty about demand and pricing.

- Competition:Businesses may face competition from companies that are not prioritizing sustainability.

However, the opportunities associated with sustainable business models are significant, including:

- Reduced costs:Sustainable practices can often lead to cost savings in the long run, such as reduced energy consumption, waste management, and material usage.

- Enhanced brand reputation:Companies that are committed to sustainability often enjoy a positive brand image and increased customer loyalty.

- Access to new markets:The demand for sustainable products and services is growing, creating new market opportunities for businesses.

Key trends in the development of sustainable business models in the third quarter of 2024 include:

- Increased focus on circular economy principles:Businesses are increasingly exploring ways to reduce waste, reuse materials, and create closed-loop systems.

- Growing adoption of renewable energy:The transition to renewable energy sources is accelerating, driven by technological advancements and government policies.

- Emergence of new sustainable business models:Innovative business models are emerging that combine sustainability with profitability, such as social enterprises and green technology companies.

10. Social and Cultural Trends in 3rd Quarter October 2024

The third quarter of 2024 promises to be a dynamic period for social and cultural trends, driven by a confluence of factors like technological advancements, shifting demographics, and evolving values. This section delves into the key trends shaping the social and cultural landscape, analyzing their impact on various aspects of life.

Emerging Subcultures and Communities

The constant evolution of society fosters the emergence of new subcultures and communities. These groups often coalesce around shared interests, values, or identities, influencing trends in fashion, music, art, and lifestyle. For example, the rise of “slow living” advocates for a more mindful and sustainable approach to life, emphasizing simplicity, connection with nature, and reduced consumerism.

This trend manifests in a growing interest in local food, artisanal crafts, and eco-friendly practices.

Labor Market Trends for 3rd Quarter October 2024

The third quarter of 2024 is expected to see continued shifts in the labor market, influenced by evolving economic conditions, technological advancements, and evolving workforce needs.

Unemployment and Employment Rates

The unemployment rate is projected to remain relatively low, reflecting a strong demand for workers across various sectors. However, the rate of job growth is expected to moderate slightly, reflecting a potential slowdown in economic activity. The employment rate is expected to continue its upward trajectory, driven by factors such as an aging population and increased participation in the workforce.

Demand for Skills and Talent in Various Industries

The demand for skills and talent will continue to evolve, with a strong emphasis on digital skills, data analytics, and technical expertise. The tech industry will remain a major driver of job growth, with roles in software development, cybersecurity, and artificial intelligence in high demand.

The healthcare sector will also experience significant demand for skilled professionals, particularly in nursing, medical technology, and healthcare administration.

Impact of Automation and Technology on the Labor Market

Automation and technology are expected to continue to reshape the labor market, displacing some jobs while creating new opportunities. Automation will likely impact repetitive and manual tasks in industries such as manufacturing, transportation, and customer service. However, it will also create new roles in areas such as robotics engineering, data science, and AI development.

Create your own acoustic soundtrack with a curated Youtube playlist. From 2021 to 2024 , there’s a wealth of acoustic music waiting to be discovered, providing the perfect backdrop for any mood or activity.

Challenges and Opportunities Facing Workers

Workers will face challenges such as adapting to new technologies, acquiring new skills, and navigating a dynamic job market. However, there are also opportunities for career advancement and professional development. Workers with in-demand skills and the ability to adapt to change will be well-positioned for success in the evolving labor market.

Consumer Behavior and Spending Patterns in 3rd Quarter October 2024

The 3rd quarter of 2024, particularly October, saw a complex interplay of factors influencing consumer behavior and spending patterns. Understanding these dynamics is crucial for businesses seeking to navigate the market effectively. This report delves into the key drivers shaping consumer decisions, examining economic conditions, consumer confidence, the role of technology, and emerging trends.

Economic Conditions and Consumer Spending

The economic climate significantly impacts consumer spending. Inflation, interest rates, and unemployment rates are key indicators that influence consumer confidence and willingness to spend. In October 2024, the US economy was navigating a period of moderate inflation, with the Consumer Price Index (CPI) registering a 3.5% year-on-year increase.

While this represented a decline from previous quarters, it still put pressure on household budgets, especially for essential goods like groceries and energy. Interest rates had risen steadily throughout the year, reaching 4.25% by October, impacting borrowing costs for consumers.

This discouraged large purchases like cars and homes. However, the unemployment rate remained low, at 3.7%, providing a degree of stability to the labor market and supporting consumer confidence. The University of Michigan Consumer Sentiment Index (CSI) stood at 85 in October, indicating a cautiously optimistic outlook among consumers.

Mastering the D chord is a crucial step for any aspiring acoustic guitarist. Learning the D chord opens up a world of popular songs, making it a must-learn for beginners and seasoned players alike.

While sentiment was generally positive, concerns about inflation and rising interest rates remained, suggesting a potential for moderation in spending.

Consumer Confidence and Spending Patterns

Consumer confidence plays a pivotal role in shaping spending patterns. When consumers are optimistic about the economy and their personal financial situation, they are more likely to spend. Conversely, declining confidence can lead to a reduction in spending.In October 2024, consumer confidence was influenced by a combination of factors, including the moderate inflation, rising interest rates, and a stable job market.

While concerns about the economy’s trajectory persisted, the low unemployment rate provided a sense of security for many consumers. This, coupled with continued growth in wages, supported spending on discretionary items, such as entertainment and travel.However, the rising cost of living and concerns about future economic prospects also led some consumers to adopt a more cautious approach, prioritizing essential goods and services over non-essential purchases.

This trend was particularly noticeable in the categories of durable goods, such as furniture and appliances.

Technology and Online Shopping

Technology continues to play a transformative role in shaping consumer behavior and spending patterns. The rise of e-commerce platforms and online marketplaces has significantly expanded consumer access to goods and services, providing convenience and a wider selection.In October 2024, online shopping continued its upward trajectory, with an estimated 25% of all retail sales occurring online.

This trend was driven by factors such as the convenience of shopping from home, access to a wider range of products, and the increasing use of mobile devices for online purchases.Online advertising, personalized recommendations, and social media influencers played a significant role in influencing consumer decisions.

The acoustic music scene is experiencing a revival in 2024, with artists embracing the raw, stripped-down sound of acoustic instruments. From intimate coffee shop gigs to larger festivals, acoustic music is finding its way back into the spotlight.

Targeted advertising on social media platforms and search engines effectively reached consumers with specific interests and needs, driving product awareness and sales. Personalized recommendations based on past purchase history and browsing behavior further encouraged consumers to explore and purchase new products.The adoption of digital payment methods, such as mobile wallets and contactless payments, also contributed to the growth of online shopping.

These convenient and secure payment options streamlined the checkout process, making it easier for consumers to complete purchases online.

The Acoustic Music Store is a haven for guitar enthusiasts. This store offers a wide selection of acoustic guitars, accessories, and resources for players of all levels.

Emerging Trends in Consumer Preferences and Spending Habits

The 3rd quarter of 2024 witnessed the emergence of several new trends in consumer preferences and spending habits. These trends reflect evolving consumer priorities and values, impacting specific industries and product categories.One notable trend was the growing emphasis on sustainability and ethical consumption.

Consumers were increasingly seeking products and services that align with their values, such as environmentally friendly options, fair trade goods, and products made with sustainable materials. This trend was evident in the growing popularity of eco-friendly clothing, organic food, and sustainable home goods.Another emerging trend was the increasing demand for experiences over material possessions.

Consumers were prioritizing travel, entertainment, and personal development experiences over traditional goods. This shift was driven by a desire for meaningful experiences and a desire to invest in personal growth.The rise of the “sharing economy” also continued to influence consumer behavior.

Consumers were increasingly embracing sharing platforms for services like transportation, accommodation, and even household goods. This trend was driven by a desire for cost-effectiveness, access to a wider range of options, and a sense of community.

Data Sources

The analysis in this report draws on data from the following sources:* US Bureau of Labor Statistics (BLS):Provides data on inflation, consumer price index (CPI), and unemployment rates.

Federal Reserve Economic Data (FRED)

Offers a comprehensive database of economic indicators, including interest rates and consumer spending.

University of Michigan Consumer Sentiment Index (CSI)

Measures consumer confidence levels.

Youtube is overflowing with talented acoustic musicians. Discovering the best acoustic channels on Youtube can be a musical adventure, with artists showcasing their skills and sharing their passion for acoustic music.

National Retail Federation (NRF)

Provides data on retail sales, online shopping trends, and consumer spending patterns.

eMarketer

Offers insights on digital advertising, e-commerce, and online shopping trends.

Innovation and Entrepreneurship in 3rd Quarter October 2024

The third quarter of 2024 witnessed a surge in innovative activity across various sectors, driven by advancements in technology, evolving consumer demands, and a dynamic entrepreneurial landscape. This period saw the emergence of disruptive technologies, a flourishing startup ecosystem, and significant venture capital investment, all shaping the future of innovation.

Latest Innovations and Disruptive Technologies

The 3rd quarter of 2024 saw the emergence of several significant innovations with the potential to disrupt existing industries.

- AI-Powered Personalized Medicine:The development of AI algorithms that analyze patient data to tailor treatment plans has revolutionized healthcare. These algorithms can identify patterns in medical records, predict disease progression, and recommend personalized therapies, leading to more effective and efficient treatment.

For example, AI-powered drug discovery platforms are now being used to identify and develop new drugs with greater precision and speed.

- Quantum Computing Breakthroughs:Advancements in quantum computing are poised to transform fields like drug discovery, materials science, and financial modeling. Quantum computers, with their ability to perform complex calculations at unprecedented speeds, are opening up new possibilities for solving problems that were previously intractable.

For instance, quantum algorithms are being developed to simulate molecular interactions, leading to the discovery of new drugs and materials with enhanced properties.

- Sustainable Energy Solutions:The 3rd quarter of 2024 saw the emergence of innovative technologies like next-generation solar panels and advanced biofuels, paving the way for a more sustainable energy future. These technologies offer greater efficiency and affordability, making renewable energy sources more accessible and viable.

For example, new types of solar panels with higher energy conversion rates are being developed, while advanced biofuels are being produced from sustainable sources like algae and agricultural waste.

Growth of Startups and Entrepreneurial Activity, 3rd Quarter October 2024

The 3rd quarter of 2024 saw continued growth in startup ecosystems across major global hubs.

- Funding Rounds:The amount of venture capital funding raised by startups reached record highs in the 3rd quarter of 2024. For example, Silicon Valley saw a surge in funding rounds, with several startups securing over $100 million in funding.

- New Company Launches:The number of new companies launched in the 3rd quarter of 2024 also increased significantly, reflecting the dynamism of the entrepreneurial landscape. The rise of remote work and online business models has made it easier for entrepreneurs to start businesses, regardless of their location.

- Key Trends:Key trends in startup ecosystems include a growing focus on sustainability, artificial intelligence, and healthtech. Investors are increasingly seeking out companies that are addressing pressing social and environmental challenges, while also exploring new frontiers in technology.

Venture Capital and Investment in New Ventures

Venture capital played a crucial role in driving innovation and supporting entrepreneurial ventures in the 3rd quarter of 2024.

Planning a wedding in 2024? Acoustic music can add a touch of elegance and intimacy to your special day. From romantic ballads to upbeat tunes, there’s a style for every wedding vibe.

- Emerging Trends:Venture capital investment is increasingly directed towards specific sectors like artificial intelligence, climate technology, and biotechnology. Investors are seeking out companies with the potential to disrupt existing industries and address global challenges.

- Total Venture Capital Funding:The total venture capital funding raised by startups in the 3rd quarter of 2024 exceeded $100 billion, demonstrating the strong confidence of investors in the potential of these ventures.

Closing Notes

The 3rd Quarter October 2024 presents a complex economic picture, with a blend of opportunities and challenges. Understanding the key drivers of growth, inflation, and interest rates is crucial for businesses and investors alike. By analyzing these factors, we can navigate the uncertainties and capitalize on the potential opportunities that lie ahead.

Popular Questions

What are the key economic indicators to watch in the 3rd Quarter?

Key economic indicators to watch include Gross Domestic Product (GDP), inflation, unemployment rate, consumer confidence, manufacturing activity, housing market trends, retail sales, interest rates, government spending, and the trade balance.

What are the potential risks to economic growth in the 3rd Quarter?

Potential risks to economic growth include geopolitical tensions, global economic shocks, rising inflation, supply chain disruptions, and interest rate hikes.

What are the major industries expected to experience growth in the 3rd Quarter?

Major industries expected to experience growth include technology, healthcare, and renewable energy.

What are the potential investment opportunities in the 3rd Quarter?

Potential investment opportunities include companies developing innovative technologies, sustainable energy solutions, and those operating in sectors with strong growth potential.