5 Year Fixed Mortgage Rates 2024 are a hot topic for potential homebuyers. Understanding these rates is crucial for making informed financial decisions. This year has seen fluctuations in the housing market, making it more important than ever to stay informed about the current landscape of mortgage rates.

For those seeking the stability of a fixed rate, exploring the Best Fixed Rate Home Loans 2024 can be a good strategy. You’ll have predictable monthly payments for the life of the loan.

This guide will delve into the factors influencing 5-year fixed mortgage rates, providing insights into the current market and offering tips for securing a favorable rate. We’ll explore the benefits and drawbacks of fixed-rate mortgages, compare them to other options, and analyze predictions for future rates.

For homeowners over 62, a Aag Reverse Mortgage 2024 might be a valuable option. This type of loan allows you to tap into your home’s equity without making monthly payments.

By understanding the dynamics at play, you can navigate the mortgage market with confidence and make the best choice for your financial future.

Keeping an eye on the Current Home Loan Interest Rates 2024 can help you make informed decisions about your mortgage financing. Rates fluctuate, so it’s important to stay informed.

Closing Notes: 5 Year Fixed Mortgage Rates 2024

In conclusion, 5-year fixed mortgage rates in 2024 present a unique set of challenges and opportunities for homebuyers. By understanding the factors influencing rates, comparing options, and taking proactive steps, you can secure a favorable mortgage that aligns with your financial goals.

If you have a home equity loan and want to lower your monthly payments, consider a Refinance Home Equity Loan 2024. You may be able to get a better interest rate and potentially save money.

Remember to stay informed about market trends and consult with financial experts for personalized guidance.

A Home Equity Line Of Credit Interest Rates 2024 can be a good option for homeowners who need flexible access to funds. It’s essentially a revolving line of credit secured by your home’s equity.

Detailed FAQs

What is a 5-year fixed mortgage rate?

Active military personnel and veterans can often find attractive financing options. Be sure to check out the Current Va Loan Rates 2024 to see if a VA loan is right for you.

A 5-year fixed mortgage rate means your interest rate stays the same for the first five years of your mortgage term. This provides stability and predictability in your monthly payments.

The process of getting a Mortgage Loan 2024 can be complex, but it’s an essential step for many homebuyers. It’s crucial to shop around and compare rates from different lenders.

How often do mortgage rates change?

Mortgage rates are influenced by various economic factors and can fluctuate daily or even hourly. It’s essential to stay updated on current market trends.

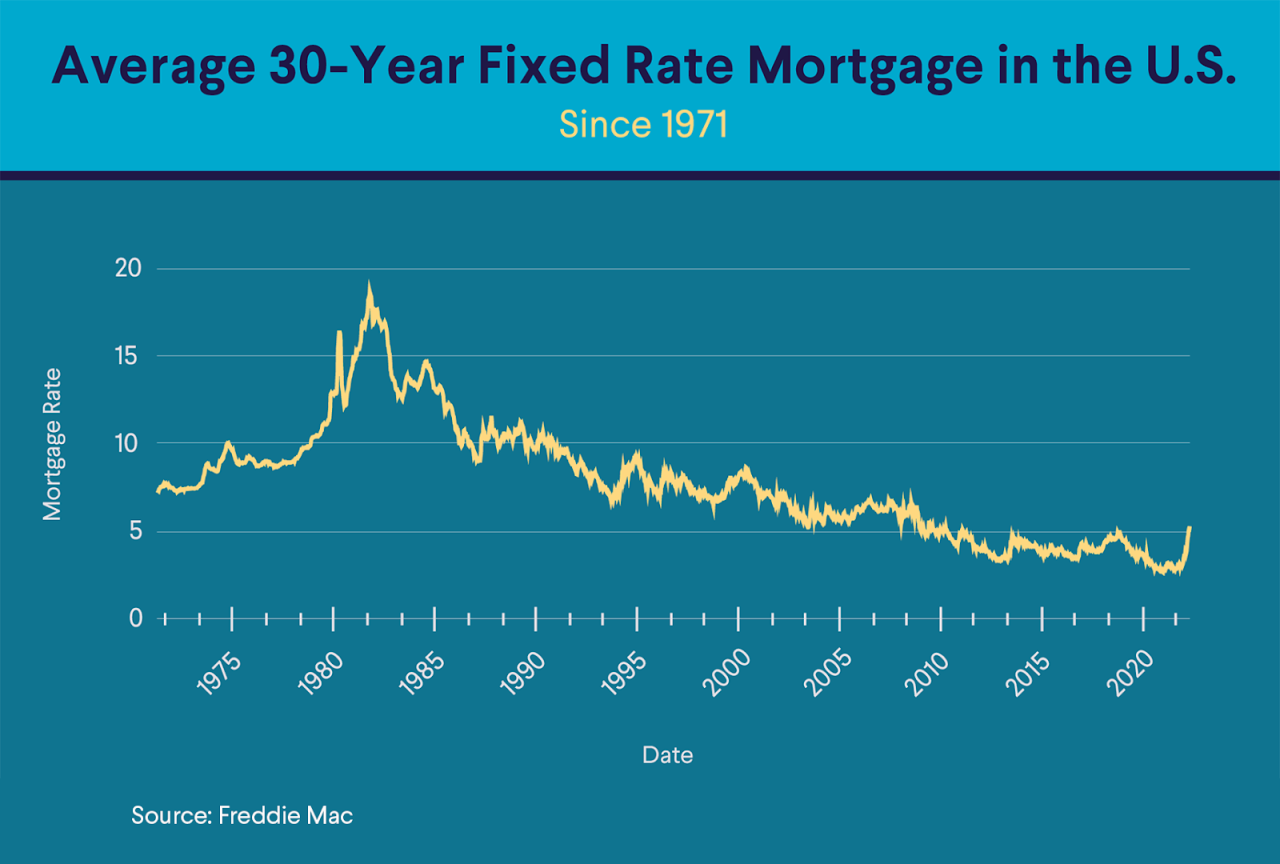

If you’re looking to buy a home in 2024, you’ll want to stay informed about the latest Average 30 Year Mortgage Rate Today 2024. These rates fluctuate, so it’s essential to stay up-to-date to make informed decisions.

What is the average 5-year fixed mortgage rate right now?

The average 5-year fixed mortgage rate can vary depending on your location and lender. It’s recommended to check with multiple lenders to get the most accurate information.

What are the benefits of a 5-year fixed mortgage?

If you have an FHA loan and want to access some of your home’s equity, consider an Fha Cash Out Refinance 2024. It’s a way to consolidate debt, make home improvements, or simply have some extra cash on hand.

The main benefit of a fixed-rate mortgage is that your payments remain consistent for the initial term, offering budget predictability and protection from rising interest rates.

What are the disadvantages of a 5-year fixed mortgage?

One potential drawback is that you may miss out on lower interest rates if they decrease after your fixed term expires. You might also have limited flexibility in making extra payments or paying off the mortgage early.

Understanding the current House Loan Interest Rates 2024 is crucial when planning your home purchase. These rates can vary significantly, impacting your monthly payments.

To get a sense of the current market, it’s helpful to check out the Mortgage Rates Today 2024. These rates are updated regularly, giving you a real-time snapshot of the market.

Finding the right lender can be a key factor in your home buying journey. It’s worth comparing offers from various Home Lenders 2024 to secure the best terms.

FHA loans are often a good option for first-time homebuyers. Keep an eye on the Fha Mortgage Rates 2024 to see if this type of loan is right for you.

If you need extra financing for your home purchase, consider a second mortgage. Research the 2nd Mortgage Rates 2024 to determine if this is a viable option for you.

Veterans and active military personnel should be aware of the Current Va Mortgage Rates 2024 to see if a VA loan can help them achieve their homeownership goals.