5 Year Immediate Annuity offers a guaranteed income stream for a set period, providing financial stability and peace of mind. It’s a valuable tool for individuals seeking predictable cash flow, especially during retirement or for specific financial goals. This type of annuity differs from others in its short-term nature, offering a focused solution for a specific time frame.

Imagine having a reliable income source for the next five years, regardless of market fluctuations. A 5 Year Immediate Annuity provides just that, with fixed payments that can be used for living expenses, debt repayment, or even special projects.

This structured approach allows you to budget effectively and plan for the future with confidence.

Once you’ve annuitized your variable annuity, you’ll receive regular payments. You can learn more about this process in Variable Annuity After Annuitization 2024. If you’re looking for a variable annuity, you might consider working with a life insurance company.

Check out Variable Annuity Life Insurance Co 2024 for more information.

Contents List

Understanding 5-Year Immediate Annuities

A 5-Year Immediate Annuity is a type of insurance product that provides a guaranteed stream of income for a fixed period of five years. This annuity begins paying out immediately after the initial premium is paid, offering a reliable source of income for a set duration.

Unlike other annuity types, such as deferred annuities, which start payments at a future date, immediate annuities provide an instant income stream, making them suitable for specific financial goals and situations.

Examples of Suitable Scenarios

- Bridge Financing:Individuals transitioning from one income source to another, such as retirement or job change, can use a 5-Year Immediate Annuity to bridge the gap in their finances. The guaranteed income stream provides stability during this period of transition.

- Short-Term Income Needs:If you have a specific short-term financial goal, like paying off debt or funding a home renovation, a 5-Year Immediate Annuity can provide a reliable income stream to achieve it. The fixed payments can be allocated towards these specific objectives.

- Income Supplement:Individuals who rely on Social Security or other retirement income sources may find a 5-Year Immediate Annuity useful as a supplemental income stream. It can help boost their overall monthly income and provide financial security.

Key Features and Benefits

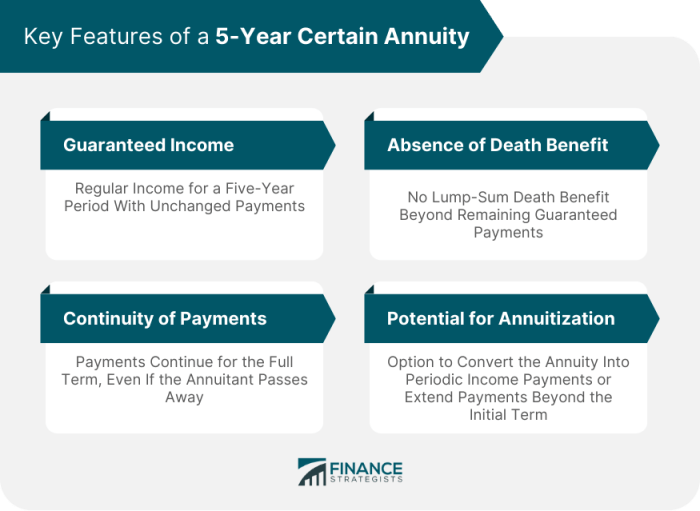

5-Year Immediate Annuities offer a number of key features and benefits that make them an attractive option for certain financial planning needs.

Guaranteed Income Stream

The most significant advantage of a 5-Year Immediate Annuity is its guaranteed income stream. Once the initial premium is paid, the annuity contract guarantees regular payments for five years, regardless of market fluctuations or interest rate changes. This provides peace of mind and financial stability for the annuitant.

Remember, the interest earned on an annuity is usually taxable. You can find more details about this in Is Annuity Interest Taxable 2024. For those who speak Hindi, you can learn about immediate annuities in Immediate Annuity Ka Hindi.

Fixed Payment Schedule

5-Year Immediate Annuities typically have a fixed payment schedule, meaning the amount of each payment remains consistent throughout the five-year period. This predictability allows individuals to budget effectively and plan for future expenses with certainty. The fixed payments make it easier to manage cash flow and avoid unexpected financial surprises.

For a guaranteed income stream, you might consider a Annuity 5 Year Payout 2024. This type of annuity pays out a fixed amount for a set period of time. If you’re looking for a variable annuity, you might consider Variable Annuity Northwestern Mutual 2024.

They offer a variety of options, including investment choices and guarantees.

Potential Tax Advantages

The tax treatment of annuity payments can vary depending on the specific type of annuity and the individual’s tax situation. In some cases, a portion of the annuity payments may be considered tax-free, which can provide tax advantages and reduce the overall tax burden.

Considerations and Risks

While 5-Year Immediate Annuities offer several benefits, it’s essential to consider potential risks and factors that can influence the payout amounts and overall value of the annuity.

Annuity Rates

Annuity rates are determined by factors such as the annuitant’s age, gender, and the prevailing interest rates in the market. Higher annuity rates generally result in larger payout amounts, while lower rates lead to smaller payments. It’s crucial to compare rates from different annuity providers to secure the most favorable terms.

Inflation

Inflation can erode the purchasing power of annuity payments over time. As prices rise, the fixed payment amount may not keep pace with the cost of living, potentially reducing the real value of the annuity. This is a key consideration, especially for long-term annuities.

If you’re in the UK, you can use a Annuity Calculator Uk 2020 2024 to estimate your potential income stream. When it comes to immediate annuities, you can withdraw funds right away, as explained in Immediate Annuity Withdrawal.

Early Withdrawal or Death

5-Year Immediate Annuities typically have surrender charges or penalties for early withdrawals. If you need to access your funds before the five-year term is complete, you may face financial penalties. Additionally, if the annuitant dies before the end of the five-year period, the beneficiary may receive only a portion of the remaining payments or a lump sum payment based on the remaining annuity value.

For couples, a Joint Immediate Annuity Calculator can help determine the best plan for your needs. If you’re in the US, you can explore variable annuities by visiting Variable Annuity Usa 2024.

Comparison with Other Financial Products

5-Year Immediate Annuities can be compared to other financial products, such as traditional savings accounts and bonds, to understand their relative advantages and disadvantages.

Savings Accounts and Bonds

Traditional savings accounts offer liquidity and easy access to funds, but they generally provide lower interest rates compared to annuities. Bonds offer higher potential returns but carry more risk, as their value can fluctuate based on market conditions. 5-Year Immediate Annuities provide a guaranteed income stream with a fixed payment schedule, offering a balance between risk and return.

Using Annuities in Conjunction with Other Products

5-Year Immediate Annuities can be used in conjunction with other financial instruments to create a diversified portfolio. For example, an individual might invest in a 5-Year Immediate Annuity for guaranteed income while also holding a portion of their assets in stocks or real estate for potential growth.

Choosing the Right Annuity

Selecting the right 5-Year Immediate Annuity involves careful consideration of various factors and comparing options from different providers.

Annuity Provider Comparison

| Provider | Annuity Rate | Payment Frequency | Surrender Charges | Death Benefit |

|---|---|---|---|---|

| Provider A | [Annuity Rate] | [Payment Frequency] | [Surrender Charges] | [Death Benefit] |

| Provider B | [Annuity Rate] | [Payment Frequency] | [Surrender Charges] | [Death Benefit] |

| Provider C | [Annuity Rate] | [Payment Frequency] | [Surrender Charges] | [Death Benefit] |

Factors to Consider, 5 Year Immediate Annuity

- Annuity Rate:Compare rates from different providers to secure the most favorable terms.

- Payment Frequency:Choose a payment frequency that aligns with your budgeting needs and financial goals.

- Surrender Charges:Understand the penalties for early withdrawals to avoid unexpected financial consequences.

- Death Benefit:Determine the death benefit provisions and how they will affect your beneficiaries.

- Financial Strength of Provider:Choose a reputable and financially stable provider to ensure the security of your investment.

Tips for Negotiating Favorable Terms

- Shop Around:Compare quotes from multiple annuity providers to find the best rates and terms.

- Negotiate:Don’t be afraid to negotiate with providers to secure favorable terms, such as lower surrender charges or higher annuity rates.

- Read the Fine Print:Carefully review the annuity contract before signing to understand all terms and conditions.

Last Point: 5 Year Immediate Annuity

While a 5 Year Immediate Annuity can be a valuable financial tool, it’s essential to weigh the pros and cons carefully. Understanding the nuances of annuity rates, potential inflation risks, and early withdrawal penalties is crucial. Ultimately, whether a 5 Year Immediate Annuity is right for you depends on your individual financial goals and risk tolerance.

If you’re considering a Brighthouse Variable Annuity Series Xc 2024, you’ll need to understand the Annuity Exclusion Ratio 2024 to figure out how much of your payments will be tax-free. This ratio can change each year, so it’s important to stay informed.

To calculate your annual payment, you can use a Calculating Annuity Annual Payment 2024 tool, which will factor in your age, principal, and interest rate.

By carefully considering your options and seeking professional advice, you can make an informed decision that aligns with your financial aspirations.

Detailed FAQs

What happens if I die before the 5-year period ends?

If you pass away before the 5-year term is complete, your beneficiaries will receive the remaining payments, or a lump sum payment depending on the specific terms of your annuity contract.

Thinking about rolling over your variable annuity to a 401k? You can find out more about the process in Variable Annuity Rollover To 401k 2024. Variable annuities offer a variety of benefits, such as potential growth, tax-deferred earnings, and death benefit options.

You can read more about these benefits in Variable Annuity Benefits 2024.

Can I withdraw money from the annuity before the 5-year period?

Early withdrawals are typically allowed, but they may incur penalties and reduce the overall payout. It’s important to review the contract terms carefully before making any withdrawals.

How does inflation affect the value of my annuity payments?

Inflation can erode the purchasing power of your annuity payments over time. While some annuities offer inflation protection, it’s essential to factor in the potential impact of inflation when considering this type of investment.