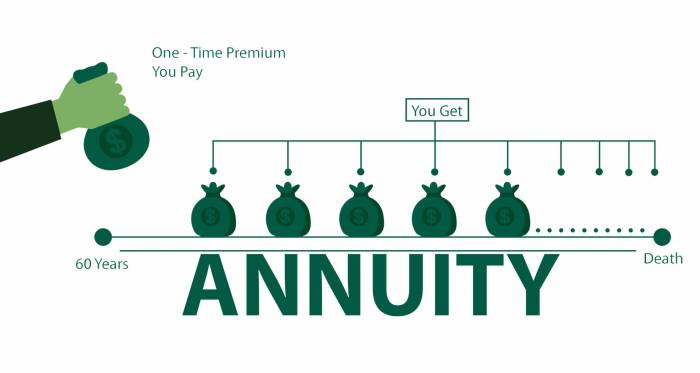

Immediate Annuity Start Date marks the beginning of your guaranteed income stream, offering financial security and peace of mind. Unlike a deferred annuity, which starts payments at a later date, an immediate annuity provides regular payments from the moment you purchase it.

Annuity and pension plans are often compared, but they have distinct features. If you’re looking for clarity, you might want to read about Is Annuity Same As Pension 2024.

This can be a valuable tool for retirees, individuals seeking supplemental income, or those with specific financial goals.

Variable annuities can offer potential growth, but they also come with risks. If you’re considering this option, it’s important to understand Variable Annuity 2024 and its implications.

The start date of your immediate annuity is determined by factors such as your age, the amount of your initial investment, and the chosen payment options. Understanding these factors and exploring the different types of immediate annuities available is crucial to finding the right fit for your individual circumstances.

Contents List

- 1 Immediate Annuity Start Date: Definition and Basics

- 2 Benefits of an Immediate Annuity Start Date

- 3 Factors Influencing the Immediate Annuity Start Date

- 4 Types of Immediate Annuities

- 5 Considerations When Choosing an Immediate Annuity Start Date

- 6 The Role of an Insurance Agent or Financial Advisor: Immediate Annuity Start Date

- 7 End of Discussion

- 8 FAQ Section

Immediate Annuity Start Date: Definition and Basics

An immediate annuity is a type of insurance product that provides a stream of guaranteed income payments to the annuitant starting immediately upon purchase. It’s a popular choice for individuals looking to secure their retirement income or cover essential expenses.

Immediate annuities and annuities due are different types of annuities with varying payment structures. If you’re interested in learning more, you might want to explore Immediate Annuity And Annuity Due.

Unlike a deferred annuity, where payments begin at a later date, an immediate annuity offers a guaranteed income stream right away.

Key Features of an Immediate Annuity

- Start Date:The immediate annuity start date is the day the first payment is made, which is typically the day after the purchase. This is the key differentiator from a deferred annuity, where payments begin at a later date.

- Payment Frequency:Annuity payments can be received monthly, quarterly, semi-annually, or annually, depending on the chosen payment schedule.

- Duration:The duration of the annuity can be for a fixed period or for the lifetime of the annuitant, providing a sense of financial security.

Examples of Suitable Situations

- Retirement Income:Immediate annuities can provide a steady stream of income for retirees, supplementing other retirement savings.

- Essential Expenses:They can help cover essential expenses such as housing, healthcare, and utilities, ensuring financial stability during retirement.

- Legacy Planning:Immediate annuities can be used to provide a guaranteed income stream for beneficiaries after the annuitant’s death.

Benefits of an Immediate Annuity Start Date

The immediate start date of an annuity offers several advantages, making it an attractive option for many individuals.

Annuity products are often compared to life insurance, but there are important differences. To understand the distinction, you might want to read about Is Annuity A Life Insurance Policy 2024.

Guaranteed Income for Retirement

An immediate annuity provides a guaranteed income stream that cannot be outlived. This eliminates the worry of outliving your savings and ensures a steady income for retirement.

Fixed annuities can provide guaranteed income payments. If you’re looking for this type of security, you may want to research 4 Fixed Annuity 2024.

Income Security

The guaranteed payments provide financial security, protecting against market volatility and inflation. It offers peace of mind knowing that you will receive a regular income, regardless of market fluctuations.

Variable annuities can be a complex investment product. If you’re unfamiliar with them, it’s helpful to understand What’s Variable Annuity 2024 before making any decisions.

Protection of Savings

By converting a lump sum into an annuity, you can protect your savings from potential market losses and ensure that your principal is not at risk. This can be particularly beneficial for individuals who are risk-averse.

Factors Influencing the Immediate Annuity Start Date

Several factors can affect the start date of an immediate annuity, influencing the amount of income received and the overall value of the annuity.

Age of the Annuitant

The older the annuitant, the higher the annuity factor, resulting in a larger income stream. This is because life expectancy decreases with age, making the insurer’s risk lower.

An enhanced death benefit can provide additional peace of mind for your loved ones. If you’re considering this option, you may want to research Variable Annuity Enhanced Death Benefit 2024.

Amount of the Initial Investment

The larger the initial investment, the higher the annuity payments. This is a direct correlation between the amount invested and the income received.

Variable annuities are subject to specific disclosure requirements. If you’re interested in this area, you might want to check out A Variable Annuity Disclosure Is Required To Contain 2024.

Chosen Payment Options

The frequency and duration of payments can impact the start date. For example, a monthly payment option for a lifetime will result in a smaller initial payment compared to a lump sum payment for a fixed period.

Growing annuities can provide increasing income payments over time. If you’re interested in this type of annuity, you might want to explore Calculating Growing Annuity 2024.

Annuity Factor, Immediate Annuity Start Date

The annuity factor is a key determinant of the annuity start date and the amount of income received. It is a multiplier that reflects the annuitant’s age, gender, and the chosen payment options. A higher annuity factor results in larger income payments.

An annuity is a financial product that provides regular income payments. If you’re curious about this concept, you might want to learn more about Annuity Is What 2024.

Types of Immediate Annuities

Immediate annuities come in different types, each with unique features and payment structures. Understanding these types is crucial for selecting the best option for your individual needs.

Fixed and variable annuities offer different features and benefits. If you’re considering either type, it’s helpful to understand Fixed Variable Annuity 2024.

Types of Immediate Annuities

| Type | Characteristics | Benefits | Risks |

|---|---|---|---|

| Fixed Annuity | Provides a guaranteed fixed income stream for a specific period or lifetime. | Guaranteed income, predictable payments. | Returns may not keep up with inflation. |

| Variable Annuity | Income payments fluctuate based on the performance of the underlying investment portfolio. | Potential for higher returns, growth potential. | Risk of losing principal, volatility in payments. |

| Indexed Annuity | Income payments are linked to the performance of a specific market index, such as the S&P 500. | Potential for higher returns, protection against market downturns. | Limited upside potential, potential for lower returns than a variable annuity. |

Considerations When Choosing an Immediate Annuity Start Date

Selecting the right start date for your immediate annuity is crucial to ensure that it aligns with your financial goals and needs.

Annuity loans can be a way to access your annuity funds. If you’re considering this option, you may want to explore Calculate Annuity Loan 2024.

Factors to Consider

- Income Needs:Determine how much income you require to cover your essential expenses and desired lifestyle.

- Risk Tolerance:Assess your comfort level with market volatility and potential for loss. This will influence your choice of annuity type.

- Long-Term Financial Objectives:Consider your long-term financial goals, such as legacy planning or providing for future generations.

Questions to Ask Yourself

- What are my income needs in retirement?

- What is my risk tolerance?

- What are my long-term financial objectives?

- How long do I expect to live?

- Do I have other sources of income?

The Role of an Insurance Agent or Financial Advisor: Immediate Annuity Start Date

Consulting with a qualified insurance agent or financial advisor is essential when choosing an immediate annuity start date.

Expert Guidance

- Understanding Your Options:They can explain the different types of annuities and their features, helping you choose the best option for your needs.

- Selecting the Right Annuity:They can assess your financial situation and goals to recommend the most suitable annuity product.

- Determining the Optimal Start Date:They can help you determine the most appropriate start date that aligns with your individual circumstances.

Value of Professional Guidance

An insurance agent or financial advisor can provide valuable insights and guidance, ensuring that you make informed decisions about your annuity purchase. They can help you navigate the complexities of annuity products and ensure that your investment meets your financial objectives.

End of Discussion

Choosing an immediate annuity with a start date that aligns with your financial goals and needs can provide a sense of security and stability for your future. By carefully considering your options, consulting with a qualified professional, and understanding the intricacies of immediate annuities, you can make an informed decision that sets you on the path to a financially secure tomorrow.

MetLife is a well-known provider of annuities, and they offer a range of options. If you’re interested in a variable annuity, you might want to learn more about Variable Annuity Metlife 2024.

FAQ Section

What are the potential risks associated with immediate annuities?

Like any financial product, immediate annuities carry some risks. The primary risk is that the insurance company issuing the annuity may become insolvent, potentially jeopardizing your payments. It’s important to choose a reputable and financially sound insurance company.

Retirement planning can be a daunting task. Finding the right annuity for your needs is crucial. If you’re looking for guidance, consider exploring What Annuity Is The Best For Retirement 2024.

Additionally, the interest rate environment can affect the value of your annuity, potentially leading to lower payments than anticipated.

Can I withdraw my principal investment from an immediate annuity?

Generally, you cannot withdraw your principal investment from an immediate annuity. These annuities are designed to provide a stream of income, not a lump-sum return. However, some annuities may offer partial withdrawal options, but these are typically limited and may come with penalties.

What are the tax implications of immediate annuities?

Annuity income can be a valuable source of retirement income, but it’s essential to understand how it works. If you’re considering an annuity, you might be wondering is annuity income 2024 a good choice for you.

The tax treatment of immediate annuities depends on the specific type of annuity and the tax laws in your jurisdiction. It’s essential to consult with a tax advisor to understand the tax implications of your chosen annuity.