The Immediate Annuity Formula sets the stage for this enthralling narrative, offering readers a glimpse into a world where financial security and retirement planning intertwine. Immediate annuities, often considered a cornerstone of retirement income strategies, provide a steady stream of guaranteed payments for life.

This formula, the heart of these financial instruments, unveils the intricate calculations behind these payments, revealing the factors that influence their amount and duration.

Understanding the immediate annuity formula is essential for anyone seeking to secure their financial future. By delving into its components, you gain insights into how interest rates, age, and life expectancy affect the amount of income you can expect to receive.

There’s a lot of discussion about the features of variable annuities in 2024. This article explores some of the key things to consider, including Variable Annuities Have 2024.

This knowledge empowers you to make informed decisions about your retirement savings and ensure a comfortable and fulfilling post-career life.

Knowing how much you need to deposit to reach your desired annuity payment is essential. This article explains how to Calculate Annuity Deposit 2024.

Contents List

Introduction to Immediate Annuities

An immediate annuity is a financial product that provides a stream of regular payments to an individual, starting immediately upon purchase. It is a popular choice for retirees seeking a guaranteed income stream for life. This article will delve into the concept of immediate annuities, exploring their purpose, key characteristics, and how they work.

When calculating the present value of an annuity, it’s helpful to understand the formula behind it. You can find a detailed explanation of the Formula Annuity Certain 2024 in this article.

Defining Immediate Annuities

An immediate annuity is a contract between an individual and an insurance company where the individual makes a lump-sum payment to the insurer in exchange for a guaranteed stream of regular payments. These payments, known as annuity payments, are typically made monthly, but can also be paid quarterly, semi-annually, or annually.

The annuity payments continue for the life of the annuitant, or for a specified period of time, depending on the type of annuity chosen.

Ready to start receiving regular payments from your retirement savings? Learn more about Buy A Immediate Annuity and how it can work for you.

Key Characteristics of Immediate Annuities

Immediate annuities possess several key characteristics that distinguish them from other financial products:

- Guaranteed Payments:Immediate annuities provide a guaranteed income stream for life or a predetermined period. The insurer assumes the risk of longevity, ensuring that payments continue even if the annuitant lives longer than expected.

- Lump-Sum Payment:To purchase an immediate annuity, the individual must make a lump-sum payment to the insurance company. This payment is used to fund the annuity payments.

- No Market Risk:Unlike investments in stocks or bonds, immediate annuities do not carry market risk. The payments are guaranteed, regardless of fluctuations in the financial markets.

- Flexibility:Immediate annuities offer various payment options, including monthly, quarterly, semi-annual, and annual payments. Individuals can choose the payment frequency that best suits their needs.

The Immediate Annuity Formula

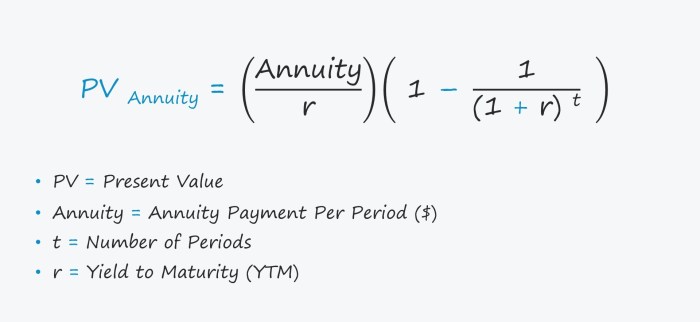

The immediate annuity formula is used to calculate the amount of the regular annuity payments. It takes into account the lump-sum payment, the interest rate, and the annuitant’s life expectancy.

Components of the Immediate Annuity Formula

The immediate annuity formula is based on the following components:

- Lump-Sum Payment (PV):This represents the initial amount paid to the insurance company to purchase the annuity.

- Interest Rate (i):The interest rate reflects the return on the investment, which determines the amount of the annuity payments.

- Annuity Factor (a):This factor is based on the annuitant’s age and life expectancy. It represents the present value of a stream of payments over a specific period.

Calculating Immediate Annuity Payments

The formula for calculating immediate annuity payments is as follows:

Annuity Payment = Lump-Sum Payment / Annuity Factor

To calculate the annuity payment, the following steps can be taken:

- Determine the lump-sum payment (PV).

- Identify the interest rate (i) offered by the insurance company.

- Calculate the annuity factor (a) based on the annuitant’s age and life expectancy. This factor can be obtained from annuity tables or using online calculators.

- Divide the lump-sum payment (PV) by the annuity factor (a) to determine the annuity payment.

Factors Influencing Immediate Annuity Payments

Several factors can influence the amount of annuity payments an individual receives. These factors include interest rates, age and life expectancy, and gender.

Variable annuity rates can fluctuate, so it’s important to stay informed. Learn more about Variable Annuity Rates 2024 and what they mean for your investment.

Impact of Interest Rates

Interest rates play a crucial role in determining annuity payments. Higher interest rates generally lead to larger annuity payments. This is because the insurance company can earn a higher return on the lump-sum payment, allowing them to pay out more to the annuitant.

Conversely, lower interest rates result in smaller annuity payments.

When planning for retirement, it’s important to weigh your options. This article discusses the pros and cons of annuities compared to drawdown strategies, including Is Annuity Better Than Drawdown 2024.

Age and Life Expectancy

Annuity payments are also influenced by the annuitant’s age and life expectancy. Younger individuals with longer life expectancies generally receive smaller annuity payments than older individuals with shorter life expectancies. This is because the insurance company needs to spread the payments over a longer period for younger annuitants.

Gender Differences, Immediate Annuity Formula

Historically, women have tended to live longer than men. As a result, insurance companies may offer lower annuity payments to women than to men of the same age. This is because women are expected to receive payments for a longer period, requiring the insurance company to set aside more funds.

If you’re considering an annuity through the National Pension System (NPS), you’ll need to know how to calculate your payments. This article covers the basics of Calculate Annuity Nps 2024.

Types of Immediate Annuities

Immediate annuities are available in various types, each with its own characteristics and benefits. Some common types include fixed, variable, and indexed annuities.

Sometimes there are restrictions on how much you can invest in a variable annuity. Find out more about Variable Annuity Blocks 2024 and what it means for your investment strategy.

Fixed Annuities

Fixed annuities provide a guaranteed, fixed income stream for life or a specified period. The payment amount is determined at the time of purchase and remains unchanged throughout the term of the annuity. Fixed annuities offer predictable income and protection against market fluctuations.

Calculating the present value of an annuity can be a useful tool for financial planning. This article explains how to Calculate Annuity Of Present Value 2024.

Variable Annuities

Variable annuities offer a payment stream that fluctuates based on the performance of an underlying investment portfolio. The annuitant chooses from a range of investment options, such as stocks, bonds, or mutual funds. The payment amount varies depending on the performance of the chosen investments.

Stay up-to-date on the latest developments in the variable annuity market with our Variable Annuity News 2024 section.

Variable annuities offer the potential for higher returns, but also carry greater investment risk.

Indexed Annuities

Indexed annuities link the annuity payments to the performance of a specific market index, such as the S&P 500. The payments may increase or decrease based on the index’s performance, but are capped at a certain rate. Indexed annuities offer a balance between guaranteed income and potential growth.

Variable annuities often come with management and expense fees. This article provides insights into Variable Annuity M&E Fees 2024 and how they can impact your returns.

Considerations for Purchasing an Immediate Annuity

Before purchasing an immediate annuity, it is essential to consider several factors to ensure that it aligns with your financial goals and risk tolerance.

If you’re using a financial calculator like the BA II Plus, you can easily calculate annuity payments. This article provides a step-by-step guide on how to Calculate Annuity With Ba Ii Plus 2024.

Key Factors to Consider

- Financial Goals:Determine how an immediate annuity can help you achieve your financial goals, such as providing a guaranteed income stream for retirement or supplementing your existing income.

- Risk Tolerance:Evaluate your comfort level with risk. Fixed annuities offer no market risk, while variable and indexed annuities carry greater risk.

- Life Expectancy:Consider your life expectancy and how long you need the annuity payments to last.

- Payment Options:Explore the different payment options available, such as monthly, quarterly, semi-annual, or annual payments.

- Fees and Charges:Understand the fees and charges associated with the annuity, including surrender charges and administrative fees.

Potential Risks and Benefits

Immediate annuities offer both potential risks and benefits. It is important to weigh these carefully before making a decision.

Variable annuities can be a complex investment product. If you’re new to them, you might want to start with a basic understanding of what they are. Learn more about A Variable Annuity Is A 2024 in this article.

Risks

- Loss of Principal:With variable and indexed annuities, there is a risk of losing some or all of your principal if the underlying investments perform poorly.

- Inflation Risk:Fixed annuity payments do not adjust for inflation, which means their purchasing power may decline over time.

- Liquidity Risk:It may be difficult to access your funds from an annuity before the start of the payment period.

Benefits

- Guaranteed Income:Fixed annuities provide a guaranteed income stream for life or a specified period.

- Protection Against Market Risk:Fixed annuities offer protection against market fluctuations.

- Tax Advantages:Annuity payments may be taxed favorably, depending on the type of annuity.

Questions to Ask Before Purchasing

Before making a decision, it is essential to ask the following questions:

- What is the interest rate offered on the annuity?

- What are the fees and charges associated with the annuity?

- What is the surrender charge period?

- Are there any limitations on the payment options?

- What happens to the annuity payments if I die before receiving all of the payments?

Real-World Examples of Immediate Annuities

Immediate annuities can be used in various real-world scenarios to meet different financial needs. Here are some examples:

Hypothetical Scenarios

Imagine two individuals, Sarah and John, both aged 65, who have accumulated a lump sum of $100,000. They are looking to purchase an immediate annuity to provide a guaranteed income stream for retirement.

The “J” calculation is a key component in understanding annuity payments. This article explores the J Calculation 2024 and its implications.

- Sarahchooses a fixed annuity with a 4% interest rate. Her monthly annuity payment would be approximately $416.67.

- Johnopts for a variable annuity linked to the S&P 500 index. His monthly payment would fluctuate based on the index’s performance, but he has the potential for higher returns.

Comparison Table

Here is a table comparing the monthly payments of different annuity options, assuming a lump-sum payment of $100,000:

| Annuity Type | Interest Rate | Monthly Payment |

|---|---|---|

| Fixed Annuity | 4% | $416.67 |

| Fixed Annuity | 5% | $477.42 |

| Variable Annuity | (Based on Market Performance) | (Variable) |

| Indexed Annuity | (Linked to S&P 500) | (Variable) |

Real-World Examples

Many individuals use immediate annuities for retirement planning. For example, a retired teacher may purchase an immediate annuity to provide a steady income stream after leaving their job. Similarly, a business owner may use an immediate annuity to supplement their retirement savings.

Final Summary: Immediate Annuity Formula

As we conclude our exploration of the immediate annuity formula, we are left with a profound understanding of its role in shaping retirement income. By considering the factors that influence annuity payments and exploring the various types available, individuals can make well-informed decisions about their retirement planning.

This formula provides a powerful tool for securing financial stability and peace of mind, ensuring a future where income is guaranteed and life’s aspirations can be realized.

If you’re looking for information about variable annuities and whether you can get one at age 90 in 2024, check out this article on Variable Annuity Issue Age 90 2024. It covers the key considerations for those nearing retirement.

FAQ Overview

What are the risks associated with immediate annuities?

While immediate annuities offer guaranteed income, they also carry some risks. For example, interest rate changes can affect the amount of income you receive, and the potential for inflation can erode the purchasing power of your annuity payments over time.

Additionally, if you die early, your beneficiary may not receive the full value of the annuity.

How do I choose the right type of immediate annuity?

The best type of immediate annuity for you depends on your individual circumstances and financial goals. Consider factors such as your risk tolerance, desired income level, and life expectancy. It’s always wise to consult with a financial advisor to determine the most suitable option for your needs.

What are the tax implications of immediate annuities?

The tax treatment of immediate annuities can vary depending on the type of annuity and your individual circumstances. It’s important to consult with a tax professional to understand the tax implications of your specific situation.