How Does Immediate Annuity Work? Imagine a guaranteed income stream for life, free from market fluctuations and investment risks. That’s the promise of an immediate annuity, a financial product designed to provide a steady flow of income during retirement. This article delves into the intricacies of immediate annuities, exploring how they function, their advantages and disadvantages, and how they can fit into your overall retirement planning strategy.

Are you considering converting your variable annuity to a Roth IRA? The Convert Variable Annuity To Roth Ira 2024 guide can help you understand the process and its potential benefits.

An immediate annuity is a type of insurance contract where you exchange a lump sum of money for a series of regular payments that begin immediately. These payments can be for a fixed period, such as 10 or 20 years, or for the rest of your life.

If you’re looking to invest in a variable annuity for a five-year term, check out this guide on 5 Year Variable Annuity 2024. This type of annuity can provide you with potential growth, but it’s important to understand the risks involved.

The amount of each payment is determined by factors such as your age, the amount of your investment, and the chosen payout period. Immediate annuities offer a unique approach to retirement planning, providing a guaranteed income stream that can help you navigate the uncertainties of later life.

Schwab offers a helpful tool for estimating annuity payments. The Annuity Calculator Schwab 2024 allows you to input various factors to get a personalized estimate.

Contents List

- 1 What is an Immediate Annuity?

- 2 How Immediate Annuities Work

- 3 Advantages of Immediate Annuities

- 4 Disadvantages of Immediate Annuities

- 5 Choosing the Right Immediate Annuity

- 6 Immediate Annuities vs. Other Retirement Income Options

- 7 Real-World Examples and Case Studies

- 8 Conclusive Thoughts

- 9 Expert Answers: How Does Immediate Annuity Work

What is an Immediate Annuity?

An immediate annuity is a type of insurance product that provides a guaranteed stream of income for life. Once you purchase an immediate annuity, you receive regular payments, typically monthly, for as long as you live. These payments are based on the amount you invest and the chosen payout period.

If you’re interested in variable annuities in Japan, explore the Variable Annuity Japan 2024 resource. It provides insights into the Japanese annuity market.

Key Features of Immediate Annuities

Immediate annuities differ from other types of annuities, such as deferred annuities, in several key ways:

- Immediate Payments:Payments begin immediately after you purchase the annuity. This makes them a good option for those who need a guaranteed income stream right away.

- Guaranteed Income:The annuity contract guarantees a fixed amount of income for life, regardless of market fluctuations. This provides peace of mind knowing you’ll receive regular payments.

- No Investment Risk:Unlike stocks or bonds, immediate annuities don’t carry the risk of losing your principal. The payments are based on the initial investment, not on market performance.

Real-World Examples of Immediate Annuities

Immediate annuities can be suitable in various situations. Here are some examples:

- Retirement Income:Immediate annuities can provide a steady stream of income to supplement your retirement savings.

- Long-Term Care:If you’re concerned about the costs of long-term care, an immediate annuity can help provide financial security.

- Estate Planning:Immediate annuities can be used to create a guaranteed income stream for beneficiaries, even after your death.

How Immediate Annuities Work

Purchasing an immediate annuity is a straightforward process. Here’s how it works:

Purchasing an Immediate Annuity

- Choose an Annuity Provider:You’ll need to select a reputable insurance company that offers immediate annuities.

- Determine the Purchase Amount:Decide how much you want to invest in the annuity. The larger the purchase amount, the higher your monthly payments will be.

- Select a Payout Period:Choose the duration of your annuity payments. Options include a fixed period (e.g., 10 years) or lifetime payments.

- Finalize the Contract:Once you’ve chosen the payout period and other terms, you’ll sign the annuity contract.

Calculating Payments

The amount of your monthly payments depends on the purchase amount and the payout period. The longer the payout period, the lower your monthly payments will be. Insurance companies use actuarial tables to calculate these payments based on your age, health, and other factors.

The Annuity 2000 Basic Mortality Table 2024 is a key tool for determining annuity payments. It’s used to estimate how long someone is likely to live, which directly impacts the payout amount.

Payout Options

Immediate annuities offer different payout options to meet your specific needs. Here are some common choices:

- Fixed Payments:You receive a fixed amount of income each month for the chosen payout period.

- Variable Payments:Your monthly payments can fluctuate based on the performance of an underlying investment portfolio.

- Joint Life Payments:Payments continue until the last surviving annuitant dies. This option is often chosen by couples.

Advantages of Immediate Annuities

Immediate annuities offer several advantages for those seeking guaranteed income in retirement:

Guaranteed Income Stream

The most significant advantage of immediate annuities is the guaranteed income stream they provide. You’ll receive regular payments for life, regardless of market fluctuations or your health. This can help you budget for essential expenses and avoid running out of money in retirement.

Protection Against Longevity Risk, How Does Immediate Annuity Work

Longevity risk is the risk of outliving your savings. Immediate annuities help mitigate this risk by providing income for as long as you live. You won’t have to worry about your savings running out before you do.

To figure out how much your annuity payments will be, check out the Calculate Annuity Amount 2024 guide. It explains the steps involved in calculating the total amount you’ll receive.

Tax Implications

The tax implications of immediate annuities can be advantageous. The income you receive from an annuity is generally taxed as ordinary income, but the principal you invested is not taxed until it is withdrawn.

There are many different types of annuities available. Check out the 8 Annuities 2024 article to learn about some of the most common options.

Disadvantages of Immediate Annuities

While immediate annuities offer advantages, they also have some drawbacks to consider:

Loss of Principal

If you die before receiving all of your annuity payments, your beneficiary will not receive the remaining principal. This means you could lose a portion of your investment.

For those in India, the Annuity Calculator Hdfc 2024 is a useful tool for estimating annuity payments. It takes into account factors like your age and investment amount.

Interest Rate Changes

Interest rate changes can impact the value of your annuity. If interest rates rise after you purchase an annuity, your payments may be lower than if you had purchased the annuity at a later date.

To get a better grasp on how annuities work, take a look at this Calculate Annuity Example 2024 article. It breaks down a hypothetical scenario to illustrate how annuity payments are calculated.

Limited Access to Principal

Once you purchase an immediate annuity, you generally cannot access the principal. This can be a disadvantage if you need to withdraw funds for an unexpected expense.

If you’re considering an immediate annuity and are also on Medicaid, it’s important to understand the potential implications. The Immediate Annuity And Medicaid article can help you navigate this complex situation.

Choosing the Right Immediate Annuity

Selecting the right immediate annuity requires careful consideration of your financial situation and goals. Here are some key factors to consider:

Key Factors to Consider

| Factor | Description |

|---|---|

| Annuity Provider | Choose a reputable insurance company with a strong financial rating. |

| Purchase Amount | Determine how much you can afford to invest in the annuity. |

| Payout Period | Select a payout period that aligns with your life expectancy and income needs. |

| Payout Options | Choose a payout option that best suits your financial situation and risk tolerance. |

| Fees and Charges | Compare fees and charges among different annuity providers. |

Annuity Providers and Offerings

Several insurance companies offer immediate annuities. It’s essential to compare offerings from different providers to find the best fit for your needs.

Class B variable annuities often come with lower fees, but they may also have restrictions on withdrawals. Learn more about Class B Variable Annuity 2024 to see if it’s the right fit for you.

- Aetna:Offers a range of immediate annuity products, including fixed and variable options.

- Prudential:Provides immediate annuities with various payout options and guaranteed income features.

- New York Life:Offers immediate annuities with flexible payment periods and lifetime income guarantees.

Negotiating Terms

You may be able to negotiate some terms of your annuity contract, such as the payout period or the interest rate. It’s always advisable to shop around and compare offers from multiple providers before making a decision.

For those who prefer spreadsheets, the Calculating Annuity Payments In Excel 2024 guide can help you streamline your calculations. It provides formulas and examples to make the process easier.

Immediate Annuities vs. Other Retirement Income Options

Immediate annuities are just one of many retirement income options. It’s essential to compare them to other strategies to determine the best fit for your circumstances.

Thinking about starting to withdraw from your annuity? The Annuity 59.5 Rule 2024 outlines the regulations surrounding early withdrawals, so it’s crucial to familiarize yourself with the rules.

Comparison with Traditional Retirement Accounts

Immediate annuities differ from traditional retirement accounts like 401(k)s and IRAs in several ways:

- Guaranteed Income:Immediate annuities provide guaranteed income for life, while traditional retirement accounts offer investment growth potential but no guaranteed income.

- Investment Risk:Immediate annuities have no investment risk, while traditional retirement accounts are subject to market fluctuations.

- Access to Funds:Immediate annuities typically have limited access to the principal, while traditional retirement accounts allow for withdrawals (often with tax implications).

Pros and Cons of Immediate Annuities

Here’s a comparison of the pros and cons of immediate annuities versus other investment options:

| Option | Pros | Cons |

|---|---|---|

| Immediate Annuities | Guaranteed income, no investment risk, longevity protection | Loss of principal, limited access to funds, interest rate sensitivity |

| Traditional Retirement Accounts (401k, IRA) | Potential for growth, tax advantages, flexibility | Investment risk, potential for loss, limited guaranteed income |

| Other Investment Options (Stocks, Bonds) | Potential for high returns, liquidity | Investment risk, volatility, no guaranteed income |

Real-World Examples and Case Studies

Immediate annuities have helped many individuals secure their retirement income. Here are some real-world examples and case studies:

Successful Use of Immediate Annuities

- Mary, a retired teacher, used an immediate annuity to supplement her Social Security benefits.She wanted a guaranteed income stream to cover her essential expenses, and the annuity provided her with peace of mind knowing she would receive regular payments for life.

- John, a successful entrepreneur, purchased an immediate annuity to create a legacy for his family.He wanted to ensure his wife would have a steady income after his death, and the annuity provided him with a guaranteed stream of payments for his beneficiaries.

Case Studies

Case studies can illustrate the potential benefits and drawbacks of immediate annuities in different financial situations. For example, a case study could examine the impact of an immediate annuity on a retiree’s overall financial plan, considering factors such as income needs, investment portfolio, and life expectancy.

If you’re looking for a long-term financial solution, a Annuity 30 Years 2024 might be worth exploring. These annuities provide a steady stream of income for a significant period of time.

Integration into a Comprehensive Retirement Plan

Immediate annuities can be integrated into a comprehensive retirement plan as part of a diversified strategy. They can provide a guaranteed income stream while other investments in the portfolio offer potential for growth.

Understanding the Calculating An Annuity Factor 2024 is crucial when working with annuities. This factor helps determine the present value of future annuity payments.

Conclusive Thoughts

Understanding the intricacies of immediate annuities is crucial for making informed financial decisions. While they offer a guaranteed income stream and protection against longevity risk, they also come with potential drawbacks such as the loss of principal and limitations on access to funds.

Carefully evaluating your financial goals, risk tolerance, and the specific features of different annuity contracts is essential before making a decision. By weighing the advantages and disadvantages, you can determine if an immediate annuity is the right fit for your retirement planning needs.

Expert Answers: How Does Immediate Annuity Work

What are the different types of payout options for immediate annuities?

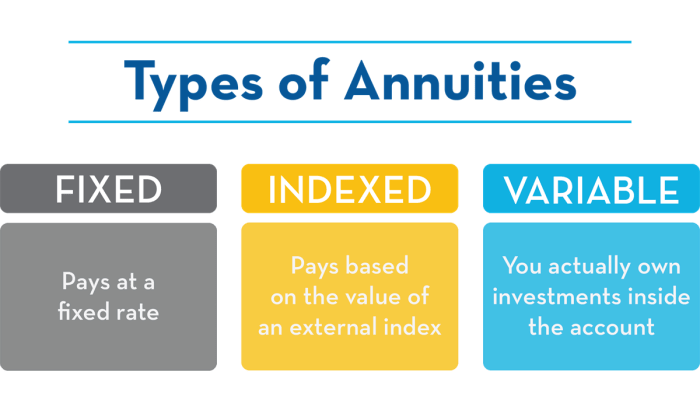

Immediate annuities offer various payout options, including fixed, variable, and indexed annuities. Fixed annuities provide a guaranteed, predictable income stream, while variable annuities offer potential for growth but also carry investment risk. Indexed annuities link payouts to the performance of a specific index, such as the S&P 500.

How can I find the right immediate annuity provider?

Researching reputable annuity providers is crucial. Look for companies with a strong track record, competitive rates, and transparent terms and conditions. Consider consulting with a financial advisor to get personalized recommendations based on your specific needs.

Can I withdraw my principal from an immediate annuity after purchasing it?

Generally, you cannot access the principal amount invested in an immediate annuity once it is purchased. This is because the annuity contract converts your lump sum into a stream of guaranteed payments.

What are the tax implications of immediate annuities?

The tax treatment of immediate annuities can vary depending on the type of annuity and the specific terms of the contract. It’s essential to consult with a tax professional to understand the tax implications of your particular situation.