Immediate Gift Annuity – Immediate Gift Annuities offer a unique opportunity to combine financial security with charitable giving. By contributing a lump sum to a qualified charity, you receive guaranteed payments for life, creating a steady stream of income. This arrangement not only benefits your personal finances but also allows you to support causes you care about.

Excel is a powerful tool for calculating growing annuities. You can find a guide on how to do this in 2024 here.

Unlike deferred gift annuities, where payments begin at a later date, immediate gift annuities provide payments starting immediately. This makes them a particularly attractive option for individuals seeking reliable income in retirement or those looking to make a significant charitable impact while securing their financial future.

Contents List

- 1 What is an Immediate Gift Annuity?

- 2 How Immediate Gift Annuities Work

- 3 Benefits of Immediate Gift Annuities

- 4 Considerations for Immediate Gift Annuities

- 5 Examples of Immediate Gift Annuities

- 6 How to Find an Immediate Gift Annuity

- 7 Ultimate Conclusion: Immediate Gift Annuity

- 8 Frequently Asked Questions

What is an Immediate Gift Annuity?

An immediate gift annuity is a type of charitable donation that provides you with a stream of income for life in exchange for a lump-sum contribution to a qualified charity. This type of annuity is often used by individuals who are looking for a way to support a charitable cause while also receiving a guaranteed income stream.

Definition and Purpose

An immediate gift annuity is a contract between you and a charitable organization. You make a one-time donation to the charity, and in return, the charity agrees to pay you a fixed amount of money each year for the rest of your life.

Knowing how to calculate annuity deposits in 2024 is essential for financial planning. You can find a helpful guide here.

The payments are typically made in monthly, quarterly, or annual installments. The purpose of an immediate gift annuity is to provide you with a reliable source of income while also supporting a charitable cause.

Immediate Gift Annuity vs. Deferred Gift Annuity

The key difference between an immediate gift annuity and a deferred gift annuity is the timing of the payments. With an immediate gift annuity, you begin receiving payments immediately after you make your donation. With a deferred gift annuity, payments begin at a later date, such as after you reach a certain age or after a certain number of years.

Deferred gift annuities are typically used by individuals who are looking to maximize their tax benefits and defer income until a later date.

While annuities are not life insurance, they do share some similarities. You can learn more about how they differ here.

Key Features of an Immediate Gift Annuity

Here are some of the key features of an immediate gift annuity:

- Guaranteed income for life:The payments are guaranteed for the rest of your life, regardless of how long you live. This can provide you with peace of mind and financial security.

- Tax benefits:Immediate gift annuities offer several tax benefits. You can deduct a portion of your donation from your taxable income in the year you make the donation, and the payments you receive are generally taxed as ordinary income. The tax benefits can vary depending on your age and the amount of your donation.

- Flexibility:You can choose the payment amount and frequency that best suits your needs. You can also choose to make your donation to a specific charity or to a pooled fund.

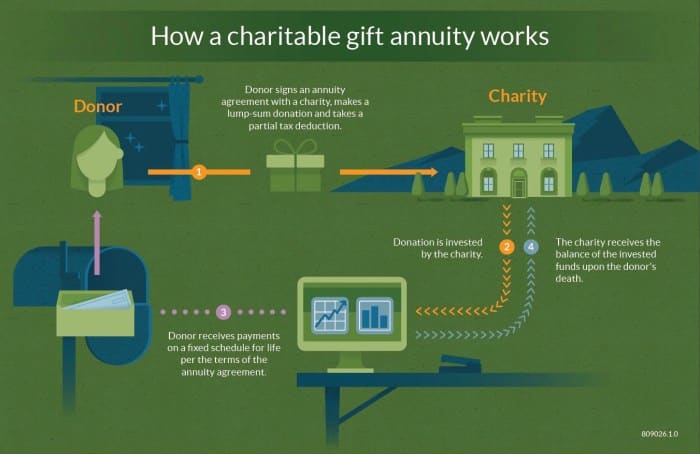

How Immediate Gift Annuities Work

Setting up an immediate gift annuity is a straightforward process. You simply need to contact a reputable charitable organization that offers immediate gift annuities and provide them with some basic information, such as your age, the amount of your donation, and your preferred payment frequency.

Once the contract is signed, you will begin receiving your annuity payments.

Setting Up an Immediate Gift Annuity

- Contact a charitable organization:Choose a charitable organization that offers immediate gift annuities and contact them to discuss your interest in setting up an annuity.

- Provide information:The organization will ask you for some basic information, such as your age, the amount of your donation, and your preferred payment frequency.

- Sign a contract:Once you have provided the necessary information, the organization will draft a contract for you to review and sign. The contract will Artikel the terms of the annuity, including the payment amount, the payment frequency, and the tax benefits.

- Make your donation:Once the contract is signed, you will need to make your donation to the charity. The donation can be made in cash, securities, or other assets.

- Begin receiving payments:Once the donation is received, you will begin receiving your annuity payments according to the terms of the contract.

Payment Process

The payments are typically made in monthly, quarterly, or annual installments. The amount of each payment is determined by a number of factors, including your age, the amount of your donation, and the interest rate. The payments are generally tax-free for a portion of the payment and taxed as ordinary income for the remainder.

The HP10bii calculator can be a great tool for calculating annuities. If you need to figure out how to do this in 2024, check out this guide here.

Factors Determining Payment Amount

The following factors determine the amount of your annuity payments:

- Your age:The older you are, the higher the annuity payment will be. This is because you are expected to live for a shorter period of time.

- The amount of your donation:The larger your donation, the higher the annuity payment will be.

- Interest rates:The interest rate used to calculate the annuity payments is based on current market rates.

Benefits of Immediate Gift Annuities

Immediate gift annuities offer a number of benefits to both the donor and the charity.

An annuity doesn’t necessarily require a single payment. You can find more information about this topic here.

Tax Benefits

Immediate gift annuities offer significant tax benefits to donors. You can deduct a portion of your donation from your taxable income in the year you make the donation. This deduction can reduce your tax liability and provide you with a tax savings.

The amount of the deduction is based on your age and the amount of your donation.

Steady Stream of Income

Immediate gift annuities can provide you with a steady stream of income for life. This can be especially beneficial for individuals who are looking for a reliable source of income in retirement or who are concerned about outliving their savings.

Whether or not an annuity is good for you depends on your individual financial goals. To learn more about the benefits of annuities in 2024, visit this link here.

Charitable Benefits

Immediate gift annuities can also benefit charitable organizations. The charity receives a lump-sum donation, which they can use to fund their programs and services. The charity also receives a portion of the annuity payments, which can help to support their long-term financial sustainability.

An immediate annuity provides income payments right away. Learn more about immediate annuities here.

Considerations for Immediate Gift Annuities

Before you decide to set up an immediate gift annuity, there are a few important considerations to keep in mind.

Variable annuities offer potential for growth but also come with risk. Learn more about the characteristics of variable annuities in 2024 here.

Potential Risks

Immediate gift annuities do carry some potential risks. The main risk is that you may not receive as much income as you expected. This can happen if interest rates fall or if you live longer than expected.

Determining Suitability

Immediate gift annuities are not right for everyone. They are typically best suited for individuals who are in good health and who have a long life expectancy. You should also consider your financial goals and your risk tolerance before making a decision.

Variable annuities offer flexibility but come with certain characteristics. Find out more about variable annuity characteristics in 2024 here.

Types of Immediate Gift Annuities

There are several different types of immediate gift annuities available. The type of annuity you choose will depend on your individual needs and preferences.

Calculating annuity due payments in 2024 can be a bit tricky. Check out this guide for help here.

- Fixed annuity:A fixed annuity provides you with a guaranteed payment amount for life. The payment amount does not change, regardless of how interest rates fluctuate.

- Variable annuity:A variable annuity provides you with a payment amount that fluctuates based on the performance of a specific investment portfolio. The payment amount can go up or down depending on the market conditions.

- Indexed annuity:An indexed annuity provides you with a payment amount that is linked to the performance of a specific index, such as the S&P 500. The payment amount can go up or down based on the performance of the index.

Figuring out if your annuity income is taxable in 2024 can be tricky. You can find more information on the topic here.

Examples of Immediate Gift Annuities

Here are some examples of different types of immediate gift annuities:

Example 1: Fixed Annuity

You donate $100,000 to a charitable organization and choose to receive a fixed annuity payment of $5,000 per year for life. The payment amount is guaranteed and will not change, regardless of how interest rates fluctuate.

Example 2: Variable Annuity

You donate $100,000 to a charitable organization and choose to receive a variable annuity payment that is linked to the performance of a specific investment portfolio. The payment amount will fluctuate based on the performance of the portfolio. In a good year, you may receive a higher payment, while in a bad year, you may receive a lower payment.

The age of 70 1/2 is important when it comes to annuities. Learn more about annuities and the age of 70 1/2 in 2024 here.

Example 3: Indexed Annuity, Immediate Gift Annuity

You donate $100,000 to a charitable organization and choose to receive an indexed annuity payment that is linked to the performance of the S&P 500. The payment amount will fluctuate based on the performance of the index. If the index goes up, your payment amount will go up.

If the index goes down, your payment amount will go down.

Want to know how much a $2 million annuity might pay in 2024? You can find a helpful calculator here.

How to Find an Immediate Gift Annuity

Finding a reputable provider of immediate gift annuities is important. There are a number of resources available to help you find a provider.

Finding a Reputable Provider

- Contact your favorite charities:Many charities offer immediate gift annuities. Contact the charities you support and ask if they offer this type of program.

- Check with the American Council on Gift Annuities (ACGA):The ACGA is a non-profit organization that accredits charitable organizations that offer gift annuities. You can find a list of accredited organizations on the ACGA website.

- Talk to a financial advisor:A financial advisor can help you understand the different types of immediate gift annuities available and can recommend a provider that is right for you.

Resources and Organizations

Here are some resources and organizations that offer information on immediate gift annuities:

- American Council on Gift Annuities (ACGA):The ACGA is a non-profit organization that accredits charitable organizations that offer gift annuities. The ACGA website provides information on gift annuities, including a list of accredited organizations.

- National Committee for Responsive Philanthropy (NCRP):The NCRP is a non-profit organization that advocates for transparency and accountability in philanthropy. The NCRP website provides information on charitable giving, including gift annuities.

- Internal Revenue Service (IRS):The IRS website provides information on the tax benefits of charitable giving, including gift annuities.

Key Features of Different Providers

| Provider | Minimum Donation | Payment Options | Tax Benefits | Accreditation |

|---|---|---|---|---|

| Charity A | $10,000 | Monthly, quarterly, annually | Tax deduction, tax-free income | ACGA accredited |

| Charity B | $5,000 | Annually | Tax deduction, tax-free income | Not accredited |

| Charity C | $25,000 | Monthly, quarterly, annually | Tax deduction, tax-free income | ACGA accredited |

Ultimate Conclusion: Immediate Gift Annuity

Immediate Gift Annuities offer a compelling approach to both financial planning and charitable giving. They provide a reliable income stream while supporting organizations that make a difference in the world. By carefully considering your financial goals and charitable interests, you can determine if an immediate gift annuity is the right choice for you.

An annuity is not a pension, but it can be a valuable retirement income source. Find out more about the difference here.

Frequently Asked Questions

What are the tax benefits of an immediate gift annuity?

Immediate gift annuities offer tax benefits in the form of a charitable deduction for the portion of your contribution that exceeds the present value of your payments. This deduction can reduce your taxable income and potentially lower your tax liability.

How are payments from an immediate gift annuity taxed?

Life insurance and annuities are two different financial products. To learn more about variable annuities in 2024, you can visit this link here.

A portion of each payment you receive from an immediate gift annuity is considered tax-free, representing the return of your principal. The remaining portion is considered taxable income and is reported on your tax return.

How do I find a reputable provider of immediate gift annuities?

It’s crucial to work with a reputable provider specializing in immediate gift annuities. You can seek recommendations from financial advisors, charitable organizations, or research online resources like the American Council on Gift Annuities (ACGA).