Does An Immediate Annuity Have A Surrender Period? This question is crucial for anyone considering this type of investment. Immediate annuities, known for their guaranteed income streams, often come with surrender periods. These periods, typically spanning a few years, impose penalties if you withdraw your funds before the specified timeframe.

Annuities can be structured for different periods, such as a 3-year term. If you’re curious about how a 3-year annuity works , you can find detailed explanations and examples online.

Understanding these surrender periods is essential for making informed financial decisions.

Before investing in a variable annuity, it’s crucial to ask the right questions to ensure it aligns with your financial goals. You can find a list of important questions to ask about variable annuities online to help guide your decision-making process.

Immediate annuities offer a predictable income stream, making them appealing for retirees or those seeking financial stability. However, the existence of surrender periods adds a layer of complexity. These periods are designed to protect insurance companies from excessive early withdrawals, ensuring they have enough time to recoup their investment.

There are various types of annuities available, each with its own characteristics. The 9 Annuity is just one example, offering specific features and benefits. It’s essential to carefully compare different annuity options to find the best fit for your needs.

The length of the surrender period can vary depending on factors such as the annuitant’s age, the type of annuity, and the insurance company.

If you’re working with annuities, understanding how to calculate their future value is essential. You can find tools and guides online that help you calculate the future value of an annuity due , allowing you to project your potential returns.

Contents List

Immediate Annuities: An Overview

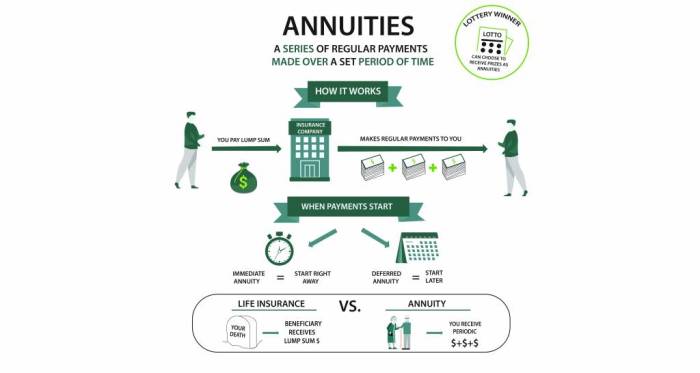

An immediate annuity is a type of financial product that provides a stream of regular payments to an individual, starting immediately upon purchase. These annuities are designed to provide a guaranteed income stream for life, making them a popular choice for retirees or those seeking financial security in their later years.

Variable annuities often include a death benefit, providing a payout to your beneficiaries upon your passing. The specific details of the death benefit can vary depending on the annuity contract. It’s essential to understand these terms to ensure your loved ones are adequately protected.

How Immediate Annuities Work

Immediate annuities operate on a simple principle. You invest a lump sum of money with an insurance company, and in return, they agree to pay you a fixed amount of money at regular intervals for the rest of your life.

If you’re in Singapore and want to explore annuity options, there are helpful tools available to you. You can use an annuity calculator to estimate your potential payouts and make informed decisions about your financial future.

The payments can be structured in various ways, such as monthly, quarterly, or annually, and can be adjusted for inflation. The amount of the payment depends on factors like the size of your investment, your age, and the prevailing interest rates.

Annuity is a financial product that provides regular payments for a specific period of time. You can learn more about the definition of an annuity in 2024 by visiting this link. It’s a valuable tool for retirement planning and can help ensure a steady income stream during your golden years.

The insurance company plays a crucial role in immediate annuities. They assume the risk of your longevity, ensuring that you receive payments for as long as you live. This risk is mitigated by the insurance company’s ability to pool funds from multiple annuity holders and invest them in a diversified portfolio.

In India, the National Pension System (NPS) offers annuity options as part of its retirement planning scheme. Learn more about annuity options within NPS and how they can contribute to your long-term financial security.

Real-World Examples

- A retired teacher with a significant savings nest egg might purchase an immediate annuity to provide a steady income stream for living expenses.

- An individual who has inherited a large sum of money might use part of it to buy an immediate annuity to supplement their existing retirement income.

- A person seeking to protect their family from financial hardship in the event of their death could purchase an immediate annuity with a death benefit clause, ensuring that their loved ones receive a lump sum payment upon their passing.

Surrender Periods in Annuities

A surrender period in an annuity refers to the period during which you cannot withdraw your principal investment without incurring a surrender charge. This period is typically designed to protect the insurance company from losses that could arise if too many policyholders withdraw their funds early on.

Kemper offers variable annuities, which can provide growth potential while offering income security. You can learn more about Kemper Variable Annuity and its features by exploring their website.

Purpose of Surrender Periods

Surrender periods are intended to discourage early withdrawals and help the insurance company maintain a stable pool of funds for paying out annuity benefits. By imposing a penalty for early withdrawal, they discourage policyholders from cashing out their annuities during periods of market volatility or when they may need the funds for unexpected expenses.

When considering annuities, it’s important to understand their tax implications. The Income Tax Act outlines how annuities are treated for tax purposes. Consulting a financial advisor can help you navigate these complexities.

Surrender Periods for Different Annuity Types

The length of the surrender period can vary depending on the type of annuity. Immediate annuities typically have shorter surrender periods compared to deferred annuities, which allow you to defer payments for a set period before receiving income. This is because immediate annuities are designed for immediate income, and the insurance company has already started paying out benefits.

Equivest offers a variable annuity series known as Series 100. You can learn more about the features and benefits of Equivest Variable Annuity Series 100 by visiting their website or contacting their financial advisors.

Surrender Charges and Their Impact

Surrender charges are fees that are levied when you withdraw your principal investment from an annuity before the end of the surrender period. These charges are typically expressed as a percentage of the original investment and can vary depending on the annuity type and the insurance company.

Annuity is a broad term that encompasses various types of financial products. You can learn more about the different series of annuities available, their features, and how they can benefit your financial planning.

Types of Surrender Charges

- Front-end Load:This charge is applied when you initially purchase the annuity and is typically a percentage of the premium paid. It is often used to cover the insurance company’s administrative costs and sales commissions.

- Back-end Load:This charge is applied when you withdraw your investment before the end of the surrender period. It is typically a percentage of the original investment that decreases over time, becoming smaller as the surrender period approaches its end.

- Surrender Charge Schedule:This is a table that Artikels the specific surrender charges that apply at different points in the surrender period. The charges are usually highest at the beginning of the period and decrease gradually over time.

Financial Implications of Surrender Charges

Surrender charges can significantly impact the overall return on your annuity investment. If you withdraw your investment early, you may lose a substantial portion of your principal to surrender charges, reducing the amount you receive. It’s important to carefully consider the potential financial implications of surrendering an annuity before the end of the surrender period.

Examples of Surrender Charges

Imagine you invest $100,000 in an immediate annuity with a 10-year surrender period and a back-end load of 8% in the first year, decreasing by 1% each year thereafter. If you withdraw your investment after five years, you would incur a surrender charge of 3% (8% – 5%).

Variable annuities can be classified into different categories, including Class C. A Class C Variable Annuity has specific fee structures and investment options. It’s important to carefully review the details before making any investment decisions.

This means you would lose $3,000 of your original investment, reducing your payout to $97,000.

Understanding how to calculate an annuity rate is crucial for making informed financial decisions. You can find helpful resources and guides on calculating annuity rates online, allowing you to estimate your potential returns.

Factors Influencing Surrender Periods

Table: Factors Influencing Surrender Periods

| Factor | Impact on Surrender Period |

|---|---|

| Age of the Annuitant | Older annuitants may have shorter surrender periods, as they are expected to have a shorter life expectancy. |

| Type of Annuity | Immediate annuities typically have shorter surrender periods than deferred annuities. |

| Insurance Company | Different insurance companies may have varying surrender period policies. |

| Interest Rate Environment | In a high-interest rate environment, surrender periods may be shorter, as insurance companies can attract investors with higher yields. |

Alternatives to Immediate Annuities

Table: Immediate Annuities vs. Alternatives

| Investment Option | Surrender Period | Potential Benefits |

|---|---|---|

| Immediate Annuity | Typically shorter | Guaranteed income for life, protection from longevity risk |

| Fixed Annuities | May have surrender periods | Guaranteed interest rates, principal protection |

| Variable Annuities | May have surrender periods | Potential for higher returns, investment flexibility |

| Certificates of Deposit (CDs) | Fixed term, early withdrawal penalties | Guaranteed interest rates, FDIC insured |

| Bonds | Maturity dates, potential for capital gains or losses | Income stream, diversification |

Considerations for Annuity Holders

Checklist for Annuity Purchases, Does An Immediate Annuity Have A Surrender Period

- Understand the surrender period and any applicable surrender charges.

- Consider your long-term financial goals and how the annuity fits into your overall financial plan.

- Evaluate the financial strength and reputation of the insurance company issuing the annuity.

- Compare the annuity’s features and costs with other investment options.

- Consult with a qualified financial advisor to receive personalized advice and guidance.

Last Point: Does An Immediate Annuity Have A Surrender Period

Before diving into an immediate annuity, it’s crucial to understand the surrender period and its implications. This includes carefully considering the potential financial impact of early withdrawals and exploring alternative investment options. Consulting with a financial advisor can provide valuable insights and help you navigate the complexities of annuity investments.

Ultimately, understanding the nuances of surrender periods empowers you to make informed decisions that align with your financial goals and risk tolerance.

For individuals seeking additional protection for their loved ones, variable annuities often include death benefit options. An enhanced death benefit can provide a larger payout to your beneficiaries in the event of your passing.

FAQ Explained

What happens if I withdraw my funds before the surrender period ends?

You will likely face a surrender charge, which is a penalty imposed for early withdrawal. The amount of the charge varies depending on the annuity contract and the time remaining in the surrender period.

Are surrender periods the same for all immediate annuities?

No, surrender periods can vary significantly based on factors like the annuitant’s age, the type of annuity, and the insurance company.

What are some alternatives to immediate annuities?

Alternatives include traditional retirement accounts (IRAs and 401(k)s), fixed-income investments like bonds, and other types of annuities with different surrender periods.

How can I determine the surrender period for a specific annuity?

The surrender period should be clearly Artikeld in the annuity contract. It’s essential to read the contract carefully before making any investment decisions.