Immediate Annuity IRA RMDs offer a unique solution for retirees seeking guaranteed income streams and a structured approach to managing Required Minimum Distributions (RMDs) from their Individual Retirement Accounts (IRAs). This strategy combines the security of an annuity with the flexibility of IRA withdrawals, allowing individuals to create a sustainable retirement income plan that aligns with their specific needs and goals.

Calculating annuity values can be a tedious task, but with the right tools, it becomes a breeze. Learn how to easily calculate annuity values using Excel in 2024 by reading this guide on calculating annuity value in Excel 2024.

Immediate annuities, in essence, convert a lump sum of money into a stream of regular payments that can continue for life. This predictable income stream provides financial security and peace of mind, shielding retirees from the uncertainties of market volatility and potential longevity risk.

Variable annuities offer different options to suit individual needs and risk tolerance. Learn about the various options available in variable annuities in this article on Variable Annuity Options in 2024.

By incorporating an immediate annuity into their IRA RMD strategy, retirees can effectively manage their tax obligations, optimize their retirement income, and ensure a steady flow of funds throughout their golden years.

Calculating the present value (PV) factor of an annuity is a key step in determining its worth. Learn how to calculate the PV factor for an annuity in this article on How To Calculate Annuity Pv Factor in 2024.

Contents List

Understanding Immediate Annuities

Immediate annuities, also known as single-premium immediate annuities (SPIAs), are financial products that provide a guaranteed stream of income for life. They are particularly popular among retirees seeking a reliable and predictable source of income to cover their expenses. An immediate annuity is a contract where you exchange a lump sum of money for a stream of regular payments, typically monthly, that begins immediately.

Immediate annuities provide a guaranteed stream of income starting right away. Learn how these annuities work and their potential benefits in this article on How Does Immediate Annuity Work.

This can be a valuable tool for retirement income planning, as it provides a guaranteed income stream that can help cover essential expenses like housing, healthcare, and food.

Annuity can be a complex financial product, but understanding real-life examples can make it easier to grasp. This article on Annuity Examples In Real Life in 2024 provides practical scenarios that illustrate how annuities can be used in various situations.

Key Features of Immediate Annuities, Immediate Annuity Ira Rmd

Immediate annuities come in various forms, each with its own set of features. Here are some of the key features you should be aware of:

- Fixed Annuities:These annuities provide a fixed payment amount for life, regardless of market fluctuations. This option is ideal for those seeking a predictable income stream.

- Variable Annuities:Variable annuities offer payments that fluctuate based on the performance of the underlying investment portfolio. This option can potentially provide higher payouts but comes with greater investment risk.

Benefits of Immediate Annuities

Immediate annuities offer several benefits that can make them a valuable addition to your retirement plan:

- Guaranteed Income Stream:One of the biggest advantages of immediate annuities is the guarantee of regular payments for life. This provides peace of mind, knowing that you’ll have a steady income stream to rely on, regardless of how long you live.

- Protection Against Longevity Risk:Immediate annuities can help mitigate the risk of outliving your savings. Since they provide lifetime income, you don’t have to worry about running out of money in your later years.

- Tax Advantages:The payments you receive from an immediate annuity are typically taxed as ordinary income. However, the portion of the payment that represents a return of your principal is tax-free.

Immediate Annuities and IRA RMDs

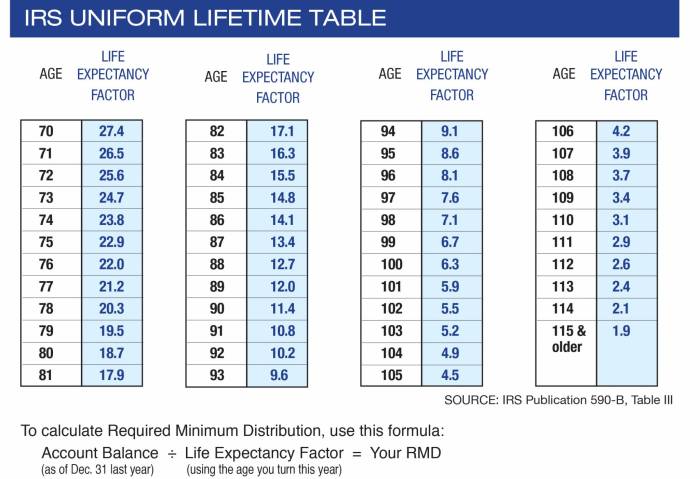

Immediate annuities can play a significant role in managing Required Minimum Distributions (RMDs) from your IRA. As you reach age 72, you are required to withdraw a minimum amount from your IRA each year, based on your age and the account balance.

While annuities and IRAs are both retirement savings vehicles, they have distinct differences. Learn more about the key differences between these two options in this article on Is Annuity The Same As Ira in 2024.

Failing to meet these requirements can result in penalties.

Northwestern Mutual is a well-known financial services company that also offers variable annuities. Explore the features and benefits of Northwestern Mutual’s variable annuities in this article on Variable Annuity Northwestern Mutual in 2024.

Comparing Immediate Annuities with Other Retirement Income Strategies

When considering how to manage your IRA RMDs, immediate annuities are a valuable option to consider, alongside other retirement income strategies. Here’s a comparison:

- Traditional IRA Withdrawals:Taking direct withdrawals from your IRA can expose you to market volatility and the risk of outliving your savings. It can also be difficult to predict your future income needs.

- Annuities:Immediate annuities provide a guaranteed income stream for life, protecting you from longevity risk and market fluctuations. They can also help simplify your RMD planning.

How Immediate Annuities Can Help Manage RMDs

Immediate annuities can be used to satisfy your RMD requirements in several ways:

- Purchase an Annuity with Your RMD:You can use your annual RMD to purchase an immediate annuity, which will then provide you with a guaranteed income stream for life.

- Use an Annuity to Cover Your RMD:If you have already purchased an immediate annuity, you can use a portion of your annuity payments to satisfy your RMD requirements.

Tax Implications of Using Immediate Annuities for RMDs

The tax implications of using immediate annuities for RMDs depend on the type of annuity you choose and the terms of the contract. Here are some key points to consider:

- Taxability of Annuity Payments:The payments you receive from an immediate annuity are typically taxed as ordinary income. However, the portion of the payment that represents a return of your principal is tax-free.

- Tax Treatment of RMDs:The RMDs you withdraw from your IRA are also taxed as ordinary income.

Choosing the Right Immediate Annuity

Selecting the right immediate annuity involves carefully considering your individual circumstances and financial goals. There are various factors to weigh, such as your age, health, income needs, and risk tolerance.

Understanding the interest rate associated with your annuity is crucial for making informed financial decisions. This article on Calculating Annuity Interest Rate in 2024 will guide you through the process of calculating your annuity’s interest rate.

Factors to Consider When Selecting an Immediate Annuity

Here are some of the key factors to consider when choosing an immediate annuity:

- Payout Options:Immediate annuities offer a variety of payout options, such as a fixed monthly payment, a joint life annuity (where payments continue after the death of the first annuitant), or a period certain annuity (where payments are guaranteed for a specific period of time).

Annuity is often described as the “flip side” of a traditional investment, providing a guaranteed income stream in retirement. Learn more about this unique investment strategy in this article on An Annuity Is Sometimes Called The Flip Side Of 2024.

- Interest Rates:The interest rate offered on an immediate annuity will determine the amount of your monthly payments. It’s important to compare interest rates from different insurance companies.

- Fees:Immediate annuities may have various fees associated with them, such as administrative fees, surrender charges, and mortality charges. Be sure to carefully review the fees before purchasing an annuity.

Types of Immediate Annuities

There are several different types of immediate annuities available, each with its own characteristics. Here are a few examples:

- Single Premium Immediate Annuity (SPIA):This is the most common type of immediate annuity, where you make a single lump sum payment in exchange for a guaranteed income stream for life.

- Deferred Income Annuity (DIA):This type of annuity allows you to defer your income payments for a specific period of time, typically 10 to 20 years. This can be a good option if you are not ready to receive income payments immediately.

- Guaranteed Lifetime Withdrawal Benefit (GLWB):This type of annuity provides a guaranteed minimum withdrawal benefit, which means you can withdraw a certain amount each year, even if the underlying investment portfolio performs poorly.

Step-by-Step Guide for Purchasing an Immediate Annuity

If you’re considering purchasing an immediate annuity, follow these steps:

- Determine Your Income Needs:Start by assessing your income needs in retirement. How much money will you need each month to cover your expenses?

- Compare Annuities from Different Providers:Shop around and compare annuities from different insurance companies. Look at the interest rates, fees, and payout options offered by each provider.

- Consult with a Financial Advisor:It’s a good idea to consult with a financial advisor to discuss your individual circumstances and ensure that an immediate annuity is the right choice for you.

- Purchase the Annuity:Once you’ve selected an annuity, you’ll need to complete the purchase process. This typically involves providing personal information, signing the annuity contract, and making the initial premium payment.

The Role of an Immediate Annuity in Retirement Planning

Immediate annuities can play a significant role in a comprehensive retirement plan, providing a guaranteed income stream and helping to mitigate longevity risk. By incorporating an immediate annuity into your retirement strategy, you can potentially achieve greater financial security and peace of mind.

If you’re looking for a variable annuity option, Transamerica’s L Share Variable Annuity might be worth considering. Learn more about the features and benefits of this annuity by reading this article on Transamerica L Share Variable Annuity in 2024.

Benefits of Incorporating an Immediate Annuity

Here are some of the potential benefits of incorporating an immediate annuity into your retirement plan:

- Guaranteed Income:An immediate annuity provides a guaranteed income stream for life, which can help cover your essential expenses and provide financial stability in retirement.

- Longevity Protection:Immediate annuities can help mitigate the risk of outliving your savings. Since they provide lifetime income, you don’t have to worry about running out of money in your later years.

- Investment Protection:Immediate annuities can provide protection against market volatility. Your payments are guaranteed, regardless of how the stock market performs.

- Simplified Retirement Planning:Immediate annuities can help simplify your retirement planning by providing a predictable income stream that you can rely on.

Hypothetical Retirement Scenario

Imagine a couple, John and Mary, who are both 65 years old and are about to retire. They have saved $500,000 for retirement and are looking for ways to generate income to cover their expenses. John and Mary are concerned about outliving their savings and want a guaranteed income stream to provide peace of mind.

Variable annuities can be a complex investment product, and choosing the right insurance company is crucial. This article on Variable Annuity Life Insurance Co in 2024 can help you understand the different companies offering variable annuities and their strengths and weaknesses.

They decide to purchase an immediate annuity with $250,000 of their savings. The annuity provides them with a guaranteed monthly payment of $1,500 for life. This income stream helps cover their essential expenses, such as housing, healthcare, and food.

The remaining $250,000 is invested in a diversified portfolio of stocks and bonds to provide potential growth and inflation protection.

Variable annuities can be a complex investment product, and choosing the right insurance company is crucial. This article on Variable Annuity Life Insurance Company in 2024 can help you understand the different companies offering variable annuities and their strengths and weaknesses.

By incorporating an immediate annuity into their retirement plan, John and Mary are able to achieve greater financial security and peace of mind. They have a guaranteed income stream to cover their essential expenses, and they have a diversified investment portfolio to provide potential growth and inflation protection.

MetLife’s Series L Variable Annuity is a popular option for those seeking a variable annuity with guaranteed income benefits. Explore the features and benefits of this annuity in this article on Metlife Series L Variable Annuity in 2024.

Final Conclusion: Immediate Annuity Ira Rmd

Understanding the intricacies of immediate annuities and their role in managing IRA RMDs is crucial for retirees seeking to build a robust and sustainable retirement income plan. By carefully considering their financial objectives, risk tolerance, and individual circumstances, individuals can determine if an immediate annuity is the right choice for them.

Consulting with a qualified financial advisor can provide valuable insights and guidance, ensuring that retirees make informed decisions that align with their long-term financial goals.

Quick FAQs

What are the different types of immediate annuities?

Vanguard, known for its low-cost index funds, also offers variable annuities. Discover the features and benefits of Vanguard’s variable annuities in this article on Variable Annuity Vanguard in 2024.

Immediate annuities come in various forms, including fixed annuities, variable annuities, and indexed annuities. Each type offers distinct features and risk-reward profiles, catering to different investment preferences and retirement goals.

How do immediate annuities affect my tax obligations?

dengan link yang terintegrasi:

Annuity taxation can be a bit confusing, especially with the ever-changing tax laws. To make sure you’re prepared for 2024, check out this article on how annuity is taxed in 2024. It provides a clear explanation of the different types of annuities and how they are taxed.

The tax implications of immediate annuities depend on the specific type of annuity and the individual’s tax situation. Generally, the payments received from an immediate annuity are taxed as ordinary income. However, the principal amount invested in the annuity is not taxed until it is withdrawn.

Can I withdraw my principal amount from an immediate annuity?

While immediate annuities provide a guaranteed income stream for life, it is typically not possible to withdraw the principal amount invested. However, some annuities may offer limited withdrawal options, which can be subject to penalties or fees.

What are the potential risks associated with immediate annuities?

As with any financial product, immediate annuities carry certain risks. These include the risk of interest rate fluctuations, inflation, and the potential for the annuity provider to become insolvent. It is important to carefully consider these risks before investing in an immediate annuity.