The Immediate Annuity Ladder, a powerful retirement income strategy, allows you to build a steady stream of guaranteed income throughout your golden years. Imagine a ladder where each rung represents a different annuity, each with its own maturity date and payout schedule.

Calculating annuity payments can be helpful in planning your retirement. The UK government provides a useful tool: Annuity Calculator Gov Uk 2024.

This structured approach provides a reliable and predictable income stream, helping you navigate the uncertainties of retirement.

Annuity payments are subject to taxation. Learn about the tax implications of annuities by visiting Annuity Is Taxable Or Not 2024.

An Immediate Annuity Ladder involves purchasing a series of immediate annuities, each with a different start date. This ladder-like structure ensures that you receive a consistent income flow for a defined period, regardless of market fluctuations. The strategy is particularly beneficial for individuals seeking a guaranteed income stream, a hedge against inflation, and a way to minimize longevity risk.

Joint ownership is an option for annuities, allowing two individuals to share benefits. Explore the details of Annuity Joint Ownership 2024.

Contents List

- 1 What is an Immediate Annuity Ladder?

- 2 How an Immediate Annuity Ladder Functions

- 3 Advantages of an Immediate Annuity Ladder

- 4 Disadvantages of an Immediate Annuity Ladder

- 5 Considerations for Using an Immediate Annuity Ladder

- 6 Immediate Annuity Ladder vs. Other Investment Strategies

- 7 Case Studies and Real-World Examples: Immediate Annuity Ladder

- 8 Resources and Further Information

- 9 Final Summary

- 10 FAQ Section

What is an Immediate Annuity Ladder?

An immediate annuity ladder is a strategy for generating retirement income that involves purchasing a series of immediate annuities, each with a different payout start date. Imagine a staircase where each step represents a different annuity, and each step is spaced out over time.

Variable annuities can provide additional protection with optional living benefits. Explore these features and how they can benefit you by visiting Variable Annuity Optional Living Benefits 2024.

That’s essentially what an immediate annuity ladder is. This approach allows you to receive regular income payments for a specified period, often throughout your retirement.

Understanding how variable annuities are taxed is crucial for financial planning. For more information, visit Variable Annuity Taxation 2024.

Definition of an Immediate Annuity Ladder

An immediate annuity ladder is a strategy where an individual purchases a series of immediate annuities, each with a different payout start date, to create a stream of income over a longer period. The ladder structure allows for income payments to begin immediately and continue for a predetermined period, often for the remainder of the individual’s lifetime.

Calculating annuity payments involves a specific formula. You can find details about Formula For Calculating The Annuity Payment 2024.

Example of an Immediate Annuity Ladder

Let’s say you’re 65 years old and have $100,000 to invest. You could choose to purchase three immediate annuities:

- Annuity 1: $30,000, with payments starting immediately.

- Annuity 2: $40,000, with payments starting in five years.

- Annuity 3: $30,000, with payments starting in ten years.

This ladder structure provides you with income starting right away, while also ensuring future income streams as you age. By staggering the start dates, you can create a more stable and predictable income stream throughout your retirement years.

Fees associated with variable annuities can vary. It’s important to understand these costs before investing. You can find information about Variable Annuity Fees 2024.

How an Immediate Annuity Ladder Functions

Steps Involved in Setting Up an Immediate Annuity Ladder

Setting up an immediate annuity ladder involves several steps:

- Determine your income needs:Calculate how much income you’ll need each year to cover your expenses during retirement.

- Choose annuity types:Decide which types of annuities best suit your needs. This could include fixed, variable, or indexed annuities.

- Select payout options:Choose the payout options for each annuity, such as a fixed period or lifetime payments.

- Determine the ladder structure:Decide on the number of annuities, the amount of each annuity, and the payout start dates.

- Purchase the annuities:Once you’ve determined the ladder structure, you can purchase the annuities from an insurance company.

Types of Annuities for an Annuity Ladder

Various types of annuities can be used in an immediate annuity ladder, each offering different features and risk profiles:

- Fixed annuities:These provide a guaranteed, fixed rate of return, offering predictable income payments. However, the return may not keep pace with inflation.

- Variable annuities:These allow your annuity payments to fluctuate based on the performance of underlying investments. They offer the potential for higher returns but also carry greater risk.

- Indexed annuities:These offer a return linked to a specific index, such as the S&P 500. They provide some protection against inflation while still offering the potential for growth.

Factors to Consider When Designing an Annuity Ladder

Several key factors should be considered when designing an immediate annuity ladder:

- Age and life expectancy:Your age and life expectancy play a crucial role in determining the ladder’s structure and the length of annuity payments.

- Risk tolerance:Your risk tolerance will influence the types of annuities you choose and the amount of each annuity.

- Income needs:Determine your income needs for each stage of retirement to ensure the ladder provides sufficient income.

- Investment goals:Your investment goals, such as growth or preservation of capital, will impact the ladder’s structure and the annuities chosen.

Advantages of an Immediate Annuity Ladder

Potential Benefits of an Immediate Annuity Ladder

Immediate annuity ladders offer several potential advantages:

- Guaranteed income:Fixed annuities provide guaranteed income payments for a specified period, offering financial security during retirement.

- Income diversification:By purchasing multiple annuities with different payout start dates, you can diversify your income streams and reduce the impact of market fluctuations.

- Inflation protection:Some annuities, like indexed annuities, offer protection against inflation, ensuring your income keeps pace with rising prices.

- Longevity protection:Lifetime annuities provide income payments for as long as you live, offering protection against outliving your savings.

- Simplified retirement planning:Annuities can simplify retirement planning by providing a predictable income stream, reducing the need for complex investment management.

Comparison to Traditional Investment Strategies

Compared to traditional investment strategies, immediate annuity ladders offer several advantages:

- Guaranteed income:Traditional investments, like stocks and bonds, do not provide guaranteed income, making it difficult to predict future income streams.

- Reduced risk:Annuities can reduce investment risk by providing guaranteed income and protection against market volatility.

- Simplified management:Annuities require less active management than traditional investments, freeing up time and effort for other activities.

Managing Risk and Generating Income

Immediate annuity ladders can help manage risk and generate income by:

- Diversifying income streams:Spreading your annuity purchases over time reduces reliance on a single investment and mitigates risk.

- Providing guaranteed income:Annuities offer guaranteed income payments, ensuring a steady stream of income regardless of market fluctuations.

- Protecting against outliving your savings:Lifetime annuities provide income for as long as you live, reducing the risk of outliving your retirement savings.

Disadvantages of an Immediate Annuity Ladder

Potential Drawbacks of an Immediate Annuity Ladder

While immediate annuity ladders offer benefits, they also have potential drawbacks:

- Lower potential returns:Compared to investments with higher risk, annuities typically offer lower potential returns. You may be sacrificing potential growth for guaranteed income.

- Limited flexibility:Once you purchase an annuity, you typically cannot access the principal, limiting your flexibility to adjust your retirement plan.

- Interest rate risk:Fixed annuities are subject to interest rate risk, meaning that if interest rates rise, your annuity payments may become less valuable.

- Insurance company risk:Annuities are backed by insurance companies, so there is a risk that the insurance company may become insolvent and unable to fulfill its obligations.

Risks Associated with Immediate Annuities and Annuity Ladders

Several risks are associated with immediate annuities and annuity ladders:

- Market risk:Variable annuities are subject to market risk, meaning that the value of your annuity can fluctuate based on the performance of underlying investments.

- Inflation risk:Fixed annuities do not offer protection against inflation, so your income payments may lose value over time.

- Longevity risk:If you live longer than expected, your annuity payments may not be sufficient to cover your expenses for the rest of your life.

Limitations of an Immediate Annuity Ladder Compared to Other Investment Options

Immediate annuity ladders have limitations compared to other investment options:

- Limited growth potential:Annuities typically offer lower potential returns than investments like stocks and bonds.

- Lack of control:Once you purchase an annuity, you typically have limited control over how your money is invested.

- Potential for illiquidity:You may not be able to access the principal of an annuity without penalties, limiting your liquidity.

Considerations for Using an Immediate Annuity Ladder

Factors to Consider Before Implementing an Immediate Annuity Ladder

Before implementing an immediate annuity ladder, consider these factors:

- Financial goals:Determine your financial goals for retirement, such as income generation, longevity protection, or legacy planning.

- Risk tolerance:Assess your risk tolerance and choose annuity types that align with your comfort level.

- Time horizon:Consider your retirement time horizon and the length of time you’ll need income payments.

- Tax implications:Understand the tax implications of annuities, as payments may be subject to taxes.

- Health and life expectancy:Consider your health and life expectancy when choosing payout options, such as lifetime or fixed period payments.

Tips for Choosing the Right Annuities

Here are some tips for choosing the right annuities for your needs:

- Shop around:Compare annuity products from different insurance companies to find the best rates and features.

- Consider your needs:Choose annuity types that align with your income needs, risk tolerance, and investment goals.

- Understand the terms and conditions:Carefully review the terms and conditions of any annuity before purchasing it.

- Seek professional advice:Consult with a financial advisor to ensure you’re making informed decisions about annuities.

Decision-Making Process for Using an Immediate Annuity Ladder

The decision-making process for using an immediate annuity ladder can be illustrated in a flowchart:

- Assess your financial goals:What are your retirement income needs and goals?

- Evaluate your risk tolerance:How comfortable are you with investment risk?

- Consider your time horizon:How long will you need income payments?

- Research annuity products:Compare different annuity types and features.

- Seek professional advice:Consult with a financial advisor to discuss your options.

- Make an informed decision:Choose the annuity ladder structure that best suits your needs.

Immediate Annuity Ladder vs. Other Investment Strategies

Comparison with Other Popular Investment Strategies

Immediate annuity ladders can be compared to other popular investment strategies, such as:

- Stocks and bonds:Stocks and bonds offer potential for growth but do not provide guaranteed income.

- Real estate:Real estate can provide rental income and appreciation potential, but it also involves higher risk and management responsibilities.

- Annuities:Annuities offer guaranteed income but typically have lower potential returns than stocks and bonds.

- Traditional IRAs and 401(k)s:Traditional IRAs and 401(k)s offer tax-deferred growth but do not provide guaranteed income.

Pros and Cons of Different Investment Approaches

| Investment Approach | Pros | Cons |

|---|---|---|

| Immediate Annuity Ladder | Guaranteed income, reduced risk, simplified management | Lower potential returns, limited flexibility, interest rate risk |

| Stocks and Bonds | Potential for growth, liquidity | Volatility, no guaranteed income, active management required |

| Real Estate | Rental income, potential for appreciation | Higher risk, management responsibilities, illiquidity |

| Traditional IRAs and 401(k)s | Tax-deferred growth, potential for long-term growth | No guaranteed income, potential for market volatility |

Suitability for Financial Goals and Risk Tolerances

The suitability of an immediate annuity ladder depends on your financial goals and risk tolerance:

- For individuals seeking guaranteed income:Immediate annuity ladders can provide a reliable source of income during retirement.

- For individuals with a low risk tolerance:Annuities can reduce investment risk and provide peace of mind.

- For individuals with a long time horizon:Annuity ladders can provide income for a longer period, offering longevity protection.

- For individuals with a short time horizon:Annuities may not be suitable for short-term goals, as they typically have limited flexibility.

Case Studies and Real-World Examples: Immediate Annuity Ladder

Examples of Successful Implementations

Many individuals have successfully used immediate annuity ladders to generate retirement income. For example, a retired teacher with a $500,000 nest egg might choose to purchase three annuities: a $150,000 annuity with immediate payments, a $200,000 annuity with payments starting in five years, and a $150,000 annuity with payments starting in ten years.

Variable annuities can be invested in exchange-traded funds (ETFs). Find out more about Variable Annuity Etf 2024 and its potential benefits.

This ladder structure would provide a steady stream of income throughout retirement, ensuring financial security and flexibility.

Annuity products are designed to provide a steady stream of income during retirement. Learn more about Annuity Is Primarily Used To Provide 2024.

Impact on Retirement Income

Immediate annuity ladders can have a significant impact on retirement income. By providing guaranteed income payments, they can reduce the need to withdraw from other retirement savings, potentially leading to greater long-term wealth accumulation.

If you’re looking for the meaning of “annuity” in Tamil, you can find the translation and explanation on Annuity Meaning In Tamil 2024.

Real-World Scenarios

Here are some real-world scenarios illustrating the application of immediate annuity ladders:

- A couple nearing retirement:A couple nearing retirement with a large nest egg could use an annuity ladder to provide a guaranteed income stream, reducing their reliance on market investments and ensuring financial security.

- An individual with a long life expectancy:An individual with a long life expectancy could use a ladder structure to provide income for a longer period, offering longevity protection and peace of mind.

- A retiree seeking to reduce investment risk:A retiree seeking to reduce investment risk could use fixed annuities within a ladder structure to create a stable income stream.

Resources and Further Information

Reputable Sources for Further Information

For more information on immediate annuity ladders, consult these reputable sources:

- The American College of Financial Services: https://www.theamericancollege.edu/

- The National Association of Insurance Commissioners (NAIC): https://www.naic.org/

- The Securities and Exchange Commission (SEC): https://www.sec.gov/

Websites, Articles, and Books

Several websites, articles, and books offer detailed explanations of immediate annuity ladders:

- Investopedia: https://www.investopedia.com/

- The Wall Street Journal: https://www.wsj.com/

- “Retirement Planning for Dummies” by Jonathan D. Pond:This book provides comprehensive guidance on retirement planning, including information on annuities.

Key Resources for Individuals Interested in Learning More, Immediate Annuity Ladder

| Resource | Description |

|---|---|

| Financial Advisor | Provides personalized advice on annuity ladders and other retirement planning strategies. |

| Insurance Company Websites | Offer information on annuity products and rates. |

| Retirement Planning Books and Articles | Provide in-depth information on retirement planning, including annuity ladders. |

Final Summary

By understanding the intricacies of the Immediate Annuity Ladder, you can make informed decisions about your retirement income strategy. While there are potential drawbacks to consider, the benefits of guaranteed income, inflation protection, and longevity risk management make this strategy a valuable tool for many retirees.

Annuity and IRA are different financial instruments with unique characteristics. If you’re wondering about the distinctions, you can find answers on Is Annuity Same As Ira 2024.

Remember to consult with a financial advisor to determine if an Immediate Annuity Ladder aligns with your specific financial goals and risk tolerance.

FAQ Section

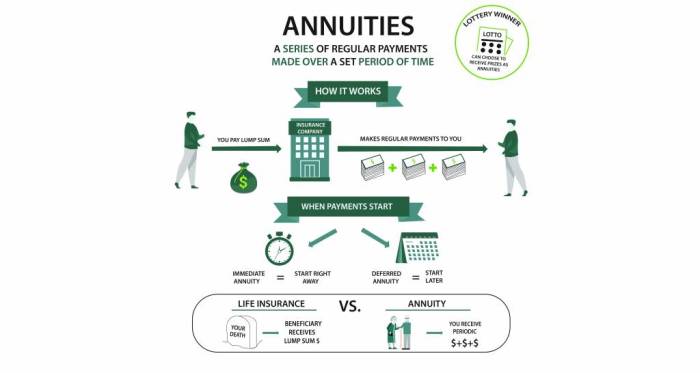

What is the difference between an immediate annuity and a deferred annuity?

Annuity funds are a popular investment option, and understanding the basics is crucial. You can learn more about Annuity Funds and how they work in 2024.

An immediate annuity starts providing income payments immediately after purchase, while a deferred annuity has a delay period before payments begin. This delay allows the annuity to grow tax-deferred.

Variable annuities offer a range of guarantees, but understanding what they cover is important. Check out A Variable Annuity Guarantees Which Of The Following 2024 to learn more.

How does an Immediate Annuity Ladder affect my estate planning?

Annuities generally do not pass on to beneficiaries upon death, so consider this factor when planning your estate. However, some annuities offer death benefit options.

Can I adjust my Immediate Annuity Ladder after it’s set up?

Once an annuity is purchased, it is generally difficult to modify. However, some companies may offer limited flexibility for adjustments.

Annuity payments can be structured in different ways, including ordinary annuities. Learn more about Annuity Is Ordinary 2024 and its characteristics.

The TI-84 calculator is a useful tool for calculating annuity payments. You can find resources and instructions on Calculate Annuity On Ti 84 2024.