An Immediate Variable Annuity offers a unique approach to retirement income, combining the security of guaranteed payments with the potential for growth in a market-linked investment. It’s an attractive option for individuals seeking to diversify their retirement portfolio and potentially enhance their income stream.

Choosing the best variable annuity product can be a challenge. To help you make an informed decision, you can explore the different options and compare features on Best Variable Annuity Products 2024.

Immediate Variable Annuities work by allowing you to invest your funds in a variety of sub-accounts, each linked to a specific investment strategy. The value of your annuity will fluctuate based on the performance of these sub-accounts, providing the potential for growth but also the risk of loss.

Calculating an annuity involves a specific formula. If you’re interested in understanding the math behind it, you can find information on Annuity Calculation Formula 2024 to guide you through the process.

The guaranteed payments provide a safety net, ensuring you receive a consistent income stream regardless of market fluctuations.

Contents List

- 1 What is an Immediate Variable Annuity?

- 2 Benefits of an Immediate Variable Annuity

- 3 Risks Associated with Immediate Variable Annuities

- 4 Comparison with Other Retirement Income Options

- 5 Factors to Consider When Choosing an Immediate Variable Annuity

- 6 Illustrations and Examples: An Immediate Variable Annuity

- 7 Final Thoughts

- 8 Question & Answer Hub

What is an Immediate Variable Annuity?

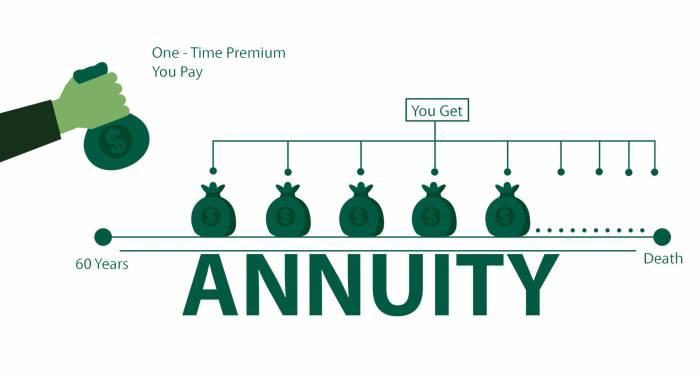

An immediate variable annuity is a type of annuity contract that provides you with a stream of income payments that begin immediately upon purchase. Unlike a traditional variable annuity, which grows over time and allows you to defer income payments, an immediate variable annuity starts paying you right away.

The amount of income you receive is based on the performance of the underlying investments, which are typically mutual funds or sub-accounts.

How an Immediate Variable Annuity Works

When you purchase an immediate variable annuity, you make a lump-sum payment to the insurance company. The insurance company then invests your money in a portfolio of assets, such as stocks, bonds, or mutual funds. The value of your annuity will fluctuate based on the performance of these investments.

Your income payments are calculated based on the value of your annuity at the time of purchase, and they can be adjusted over time to reflect changes in the value of your investment portfolio.

One of the key benefits of annuities is tax-deferred growth. If you’re interested in understanding this aspect, you can find information on Is Annuity Tax Deferred 2024 to learn how it works.

Key Features and Characteristics

- Immediate Income Payments:One of the key features of an immediate variable annuity is that you begin receiving income payments immediately after purchasing the contract. This makes it a suitable option for those who need immediate income, such as retirees or those who have recently sold their home.

Variable annuities offer a way to potentially grow your savings, but the death benefit taxation can be complex. If you’re looking for information about Variable Annuity Death Benefit Taxation 2024 , it’s important to understand how these benefits are taxed.

- Investment Growth Potential:The value of your annuity can grow over time based on the performance of the underlying investments. This potential for growth can help to offset inflation and maintain the purchasing power of your income stream.

- Guaranteed Minimum Income:Some immediate variable annuities offer a guaranteed minimum income benefit. This feature ensures that you will receive at least a certain amount of income each year, even if the value of your investment portfolio declines. This provides a safety net against market downturns.

- Death Benefit:Most immediate variable annuities include a death benefit that provides a lump-sum payment to your beneficiary upon your death. This can help to protect your loved ones from financial hardship.

Benefits of an Immediate Variable Annuity

Immediate variable annuities can offer several benefits for individuals seeking retirement income. They can provide a consistent stream of income, potential for investment growth, and tax advantages.

Potential Benefits

- Guaranteed Income Stream:An immediate variable annuity provides a guaranteed stream of income, which can be a valuable source of financial security in retirement. You can rely on receiving regular payments, regardless of market fluctuations.

- Potential for Investment Growth:By investing in a variable annuity, you have the potential to grow your retirement savings over time. This can help to offset inflation and maintain the purchasing power of your income stream.

- Tax Advantages:Income payments from an immediate variable annuity are generally taxed as ordinary income. However, the growth of your investment portfolio within the annuity is tax-deferred. This means you won’t pay taxes on the investment gains until you start receiving income payments.

Risks Associated with Immediate Variable Annuities

Immediate variable annuities, like any investment, carry inherent risks. It’s crucial to understand these risks before making a decision.

Joint ownership in an annuity allows for flexibility in how the payments are distributed. If you’re considering this option, you can find information on Annuity Joint Ownership 2024 to understand the benefits and considerations.

Potential for Loss of Principal

Since the value of your annuity is tied to the performance of the underlying investments, there is a risk of losing some or all of your principal if the market declines. This is a key consideration, especially for individuals who rely on their annuity for essential income.

Annuities come in various forms, each with its own features and benefits. To learn more about the different types, you can explore Annuity Kinds 2024 and find the one that best suits your needs.

Impact of Inflation

Inflation can erode the purchasing power of your annuity income over time. If the rate of inflation exceeds the rate of return on your investment portfolio, the real value of your income payments will decrease. This is a particular concern for individuals who have a long life expectancy.

Comparison with Other Retirement Income Options

Immediate variable annuities are just one of many retirement income options available. It’s important to compare them with other options to determine which best suits your needs and risk tolerance.

Deferred annuities involve a period of growth before payments begin. If you’re looking to calculate the value of a deferred annuity, you can find resources on How To Calculate A Deferred Annuity 2024 to help you understand the process.

Comparison Table

| Retirement Income Option | Income Payments | Investment Growth Potential | Tax Advantages | Risk |

|---|---|---|---|---|

| Immediate Variable Annuity | Immediate, variable based on investment performance | Potential for growth based on market performance | Tax-deferred growth, taxed as ordinary income upon receipt | Risk of loss of principal, impact of inflation |

| Traditional IRA | Deferred, withdrawals taxed as ordinary income | Potential for growth based on market performance | Tax-deductible contributions, tax-deferred growth | Risk of loss of principal, impact of inflation |

| 401(k) | Deferred, withdrawals taxed as ordinary income | Potential for growth based on market performance | Tax-deductible contributions, tax-deferred growth | Risk of loss of principal, impact of inflation |

| Fixed Annuity | Guaranteed, fixed amount | Limited or no growth potential | Tax-deferred growth, taxed as ordinary income upon receipt | Low risk of loss of principal, low potential for growth |

Factors to Consider When Choosing an Immediate Variable Annuity

When deciding whether an immediate variable annuity is right for you, carefully consider several key factors.

Variable annuities often invest in mutual funds, providing diversification and potential growth. To learn more about Variable Annuity Mutual Fund 2024 , you can explore the different fund options available within variable annuities.

Insurer’s Financial Strength and Track Record, An Immediate Variable Annuity

The financial strength and track record of the insurance company issuing the annuity are crucial. You want to choose a company with a strong reputation for financial stability and a history of paying claims. Look for ratings from independent agencies like A.M.

Immediate annuities provide income payments immediately after you purchase them. If you’re considering this option, you can find information on Immediate Annuity Now to understand how it works.

Best or Standard & Poor’s to gauge the insurer’s financial health.

The premium for an immediate annuity is a crucial factor to consider. You can find information on Immediate Annuity Premium to understand how it’s calculated and how it impacts your income stream.

Fees and Expenses

Immediate variable annuities often come with fees and expenses. These can include administrative fees, investment management fees, and mortality and expense charges. Carefully review the prospectus to understand all the fees associated with the annuity. Compare fees among different insurers to find the most competitive options.

Illustrations and Examples: An Immediate Variable Annuity

Imagine you are 65 years old and have a lump sum of $100,000 that you want to use to generate retirement income. You decide to purchase an immediate variable annuity with a guaranteed minimum income benefit of 4% per year.

The annuity is invested in a portfolio of stocks and bonds. In the first year, the investment portfolio grows by 5%, and you receive an income payment of $4,500 (4% guaranteed minimum income plus 1% growth). In the second year, the investment portfolio declines by 2%, but you still receive your guaranteed minimum income of $4,000.

Deferred annuities offer a way to grow your savings over time before receiving payments. If you’re considering this option, you might be interested in understanding the concept of Annuity Is Deferred 2024 and how it works.

Over time, the value of your annuity will fluctuate based on market performance, but your income payments will remain stable thanks to the guaranteed minimum income benefit.

Variable annuities sometimes have surrender charges if you withdraw funds early. If you’re looking for a variable annuity without these charges, you can explore options on Variable Annuity No Surrender Charge 2024 to find a suitable product.

Potential Growth and Income Stream

| Year | Investment Growth | Income Payment |

|---|---|---|

| 1 | 5% | $4,500 |

| 2 | -2% | $4,000 |

| 3 | 8% | $4,800 |

| 4 | 3% | $4,300 |

| 5 | -1% | $4,000 |

Key Considerations

- Your Retirement Income Needs:How much income do you need to cover your expenses in retirement?

- Risk Tolerance:How comfortable are you with the potential for investment losses?

- Time Horizon:How long do you expect to live in retirement?

- Tax Situation:How will the tax implications of an immediate variable annuity affect your overall financial picture?

Final Thoughts

Deciding whether an Immediate Variable Annuity is right for you requires careful consideration of your risk tolerance, investment goals, and overall financial situation. While it offers the potential for growth and guaranteed income, it’s essential to understand the risks involved and to choose an annuity with a reputable insurer.

Annuities are a popular retirement vehicle, but they are voluntary. If you’re interested in learning more about Annuity Is A Voluntary Retirement Vehicle 2024 , you can explore the different options available to you.

Consulting with a financial advisor can help you determine if this option aligns with your individual retirement planning needs.

Question & Answer Hub

How does an Immediate Variable Annuity differ from a traditional annuity?

Immediate annuities provide income payments right away, making them a popular choice for retirees. They’re also known as “single premium immediate annuities” or “SPIA.” If you’re looking for more information, you can find details on Immediate Annuity Is Also Known As.

A traditional annuity provides fixed payments for a specific period, while an Immediate Variable Annuity offers payments that fluctuate based on the performance of underlying investments. This means you have the potential for higher returns but also the risk of lower payments.

What are the tax implications of an Immediate Variable Annuity?

The payments you receive from an Immediate Variable Annuity are typically taxed as ordinary income. However, the growth in your annuity may be tax-deferred until you start receiving payments. Consult with a tax professional to understand the specific tax implications of your annuity.

What are some factors to consider when choosing an Immediate Variable Annuity?

Important factors include the insurer’s financial strength, the annuity’s fees and expenses, the investment options available, and the guaranteed payment amount. You should also consider your risk tolerance and investment goals.

Calculating an annuity from your pension can be a crucial step in retirement planning. If you’re looking to understand the process, you can find resources on Calculate Annuity From Pension 2024 to guide you through the calculations.