Immediate Annuity Payout Rates are a crucial aspect of retirement planning, offering a guaranteed stream of income for life. Understanding how these rates are calculated and the factors that influence them is essential for making informed decisions about your financial future.

Variable annuities offer a range of payout options to suit different retirement goals. For a comprehensive overview, read this article on Variable Annuity Payout Options 2024.

Annuity payout rates are determined by various factors, including your age, gender, health, and the type of annuity you choose. The higher your age and the lower your life expectancy, the higher your payout rate will be. This is because the insurance company assumes you will live for a shorter period, thus needing to pay out less overall.

The term “annuity” has a specific meaning in the financial world. To understand its definition, you can check out this article on Annuity 7 Letters 2024.

Similarly, annuity rates can be influenced by interest rates, as higher rates generally lead to lower payouts.

Annuity payments are considered income for tax purposes. For a detailed explanation, check out this article on Is Annuity Income 2024.

Contents List

- 1 Understanding Immediate Annuity Payout Rates

- 2 How Immediate Annuities Work

- 3 Factors Affecting Payout Rates

- 4 Comparing Immediate Annuity Payout Rates

- 5 Using Immediate Annuities for Retirement Income: Immediate Annuity Payout Rates

- 6 Considerations for Immediate Annuities

- 7 Final Wrap-Up

- 8 Clarifying Questions

Understanding Immediate Annuity Payout Rates

Immediate annuities are a type of financial product that provides a guaranteed stream of income for life. When you purchase an immediate annuity, you give a lump sum of money to an insurance company in exchange for regular payments that begin immediately.

An annuity with a large principal, like $2 million, can provide a substantial income stream in retirement. To explore the potential payouts, you can check out this article on Annuity 2 Million 2024.

The amount of each payment is determined by the payout rate, which is the percentage of your principal that you receive each year.

Annuity payments are generally subject to taxation. To learn more about the tax implications of annuities, refer to this resource on Annuity Is Taxable 2024.

Factors Influencing Payout Rates

Several factors influence the payout rate for immediate annuities, including:

- Age:The older you are when you purchase an annuity, the higher your payout rate will be. This is because you have a shorter life expectancy, meaning the insurance company has to pay out less money over time.

- Gender:Women typically have longer life expectancies than men, so they generally receive lower payout rates for the same amount of money.

- Health:If you are in good health, you can expect a higher payout rate. Insurance companies consider your health because it impacts your life expectancy. If you have health conditions that shorten your life expectancy, you may receive a lower payout rate.

While variable annuities offer growth potential, they also carry inherent risks. To understand these risks better, read this article on Variable Annuity Risk 2024.

- Interest Rates:Payout rates are also influenced by current interest rates. When interest rates are high, insurance companies can invest your money and earn a higher return, which allows them to offer higher payout rates.

How Immediate Annuities Work

The process of purchasing an immediate annuity is relatively straightforward. You simply choose an insurance company, provide them with a lump sum of money, and they begin making regular payments to you. The payments can be made monthly, quarterly, or annually, and they can be structured to last for a specific period or for the rest of your life.

Types of Immediate Annuities

There are several different types of immediate annuities available, each with its own unique features and benefits. Some common types include:

- Single Premium Immediate Annuity (SPIA):This is the most common type of immediate annuity. You make a single lump-sum payment, and the insurance company begins making payments immediately.

- Fixed Annuity:This type of annuity provides a fixed payment amount for the life of the contract. The payment amount is guaranteed not to change, regardless of market fluctuations.

- Variable Annuity:With a variable annuity, your payments are tied to the performance of a specific investment portfolio. The amount of your payments can fluctuate depending on the performance of the investments.

- Indexed Annuity:Indexed annuities offer a guaranteed minimum payment, but they also have the potential to earn higher returns based on the performance of a specific index, such as the S&P 500.

Factors Affecting Payout Rates

Payout rates for immediate annuities are determined by a complex set of factors. Understanding these factors can help you compare different annuity options and make an informed decision.

The rates associated with variable annuities can fluctuate over time. To stay informed about recent rates, check out this article on Variable Annuity Rates 2021 2024.

Interest Rates and Payout Rates

Interest rates play a significant role in determining payout rates. When interest rates are high, insurance companies can earn a higher return on their investments, which allows them to offer higher payout rates. Conversely, when interest rates are low, payout rates tend to be lower.

Variable annuities can offer protection against market downturns, making them a popular choice for retirement planning. To learn more about the specifics, check out this article on Variable Annuity Insurance 2024.

Mortality Rates and Annuity Payouts

Mortality rates are also a key factor influencing annuity payouts. Insurance companies use mortality tables to estimate how long their policyholders will live. These tables are based on historical data and are adjusted regularly to reflect changes in life expectancy.

If you’re looking for a guaranteed income stream in retirement, an immediate annuity might be the right choice for you. To better understand this type of annuity, explore this article on Immediate Annuity Meaning Insurance.

When mortality rates are high, insurance companies have to pay out more money over time, so they offer lower payout rates.

Comparing Immediate Annuity Payout Rates

It’s essential to compare payout rates from different insurance companies before purchasing an immediate annuity. Payout rates can vary significantly depending on the insurer, the type of annuity, and your individual circumstances.

If you’re considering a $2 million annuity, you might be wondering about the potential payout. For a breakdown of potential income, check out this article on How Much Does A 2 Million Annuity Pay 2024.

Resources for Comparing Payout Rates

Several resources can help you compare payout rates from different insurance companies. These resources include:

- Annuity Comparison Websites:Many websites allow you to compare payout rates from different insurance companies based on your age, gender, and other factors.

- Insurance Company Websites:Most insurance companies provide payout rate information on their websites. You can use this information to compare rates from different insurers.

- Financial Advisors:A financial advisor can help you compare payout rates and choose the annuity that best meets your needs.

Table Comparing Payout Rates, Immediate Annuity Payout Rates

The following table provides an example of how payout rates can vary based on age and annuity type. It’s important to note that these rates are for illustrative purposes only and may not reflect actual payout rates from any specific insurance company.

| Age | Fixed Annuity Payout Rate | Variable Annuity Payout Rate |

|---|---|---|

| 65 | 5.0% | 4.5% |

| 70 | 5.5% | 5.0% |

| 75 | 6.0% | 5.5% |

Using Immediate Annuities for Retirement Income: Immediate Annuity Payout Rates

Immediate annuities can be a valuable tool for retirement planning. They can provide a guaranteed stream of income for life, which can help you cover your essential expenses and maintain your lifestyle in retirement.

Guaranteed Income Streams

One of the main benefits of immediate annuities is that they provide a guaranteed income stream. This means that you can be confident that you will receive regular payments for the rest of your life, regardless of market fluctuations or your health status.

Knowing whether an annuity is qualified or nonqualified is essential for tax planning purposes. For more information on this distinction, refer to this resource on Is An Annuity Qualified Or Nonqualified 2024.

Supplementing Other Retirement Income Sources

Immediate annuities can be used to supplement other retirement income sources, such as Social Security or retirement savings. For example, you might use an immediate annuity to cover a portion of your monthly expenses, allowing you to withdraw less from your retirement savings.

Jackson National Life is a prominent provider of variable annuities. To explore their offerings, you can visit their website or read this article on Jackson Variable Annuity 2024.

Considerations for Immediate Annuities

While immediate annuities can be a valuable tool for retirement planning, it’s important to understand the potential risks and limitations associated with them.

Potential Risks and Limitations

- Interest Rate Risk:If interest rates rise after you purchase an annuity, you may receive a lower payout rate than you would have if you had purchased the annuity at a later date.

- Inflation Risk:The purchasing power of your annuity payments can be eroded by inflation. If inflation is high, your payments may not keep pace with the rising cost of living.

- Longevity Risk:If you live longer than expected, your annuity payments may run out before you die.

Factors to Consider

Before purchasing an immediate annuity, it’s important to consider the following factors:

- Your Financial Goals:What are your retirement income needs? How much income do you need to cover your expenses?

- Your Risk Tolerance:How comfortable are you with the potential for market fluctuations? Are you willing to accept a lower payout rate in exchange for a guaranteed income stream?

- Your Health:Your health can impact your life expectancy, which in turn can affect your payout rate.

Professional Advice

It’s always a good idea to seek professional advice before purchasing an immediate annuity. A financial advisor can help you understand the different types of annuities available, compare payout rates, and determine if an annuity is the right investment for you.

Deferred annuities provide flexibility in retirement planning. To learn more about the specifics of deferred annuities, check out this article on Annuity Is Deferred 2024.

Final Wrap-Up

Immediate annuities can be a valuable tool for retirement planning, providing a secure income stream that you can rely on for life. However, it’s important to carefully consider the risks and limitations associated with these products before making a decision.

Consulting with a financial advisor can help you determine if an immediate annuity is the right choice for your individual circumstances.

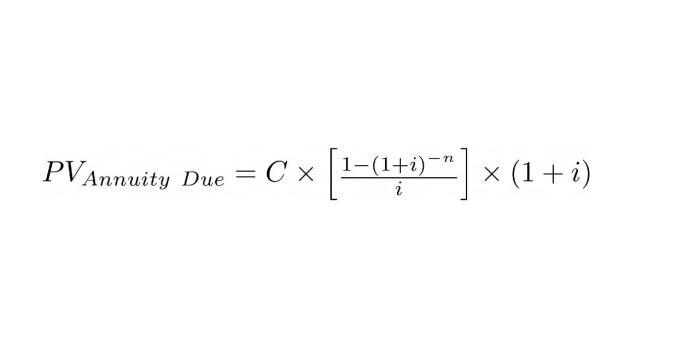

For a visual understanding of annuity formulas, check out this helpful video on Annuity Formula Youtube 2024. It’s a great way to grasp the concepts.

Clarifying Questions

What are the different types of immediate annuities?

There are several types of immediate annuities, including fixed annuities, variable annuities, and indexed annuities. Each type has its own unique features and benefits.

How do I choose the right immediate annuity for me?

The best immediate annuity for you will depend on your individual circumstances, including your age, health, risk tolerance, and financial goals. It’s important to compare rates from different providers and seek professional advice before making a decision.

What are the risks associated with immediate annuities?

Understanding the impact of 12b-1 Fees Variable Annuity 2024 is crucial for investors. These fees can affect your returns, so it’s important to consider them when choosing a variable annuity.

One risk associated with immediate annuities is that the insurance company may become insolvent, leaving you without your guaranteed income. Another risk is that interest rates could rise, reducing the value of your annuity payments.