Annuity Immediate Questions And Answers – Annuity Immediate: Questions & Answers is a comprehensive guide to understanding the intricacies of this financial instrument. Annuities immediate, also known as deferred annuities, are a popular investment option for individuals seeking a steady stream of income during retirement.

Understanding how annuities are treated for tax purposes is important. Annuity Is Income 2024 explains the tax implications of annuity payments and how they can affect your overall financial planning.

This guide delves into the key features, types, applications, and considerations associated with annuities immediate, providing valuable insights for informed decision-making.

Whether you are a seasoned investor or just starting your financial planning journey, this resource will equip you with the knowledge to understand the complexities of annuities immediate and make informed choices that align with your financial goals.

Contents List

- 1 Annuity Immediate: A Comprehensive Guide: Annuity Immediate Questions And Answers

- 1.1 What is an Annuity Immediate?, Annuity Immediate Questions And Answers

- 1.2 Key Features of an Annuity Immediate

- 1.3 Calculating the Present Value of an Annuity Immediate

- 1.4 Types of Annuities Immediate

- 1.5 Applications of Annuities Immediate

- 1.6 Factors to Consider When Choosing an Annuity Immediate

- 1.7 Annuity Immediate vs. Annuity Due

- 1.8 Annuity Immediate in Practice

- 2 Summary

- 3 FAQs

Annuity Immediate: A Comprehensive Guide: Annuity Immediate Questions And Answers

An annuity immediate is a financial product that provides a series of regular payments for a specified period, starting one period after the purchase date. It’s essentially a stream of income that you can rely on for a certain amount of time, making it a popular choice for retirement planning, income generation, and other financial goals.

IFRS 17, a new accounting standard, has implications for variable annuities. Variable Annuity Ifrs 17 2024 provides an overview of the changes and how they affect the financial reporting of variable annuities.

This article will delve into the intricacies of annuity immediates, covering their definition, key features, calculation methods, types, applications, and factors to consider when choosing one.

What is an Annuity Immediate?, Annuity Immediate Questions And Answers

An annuity immediate is a financial product that provides a series of regular payments for a specified period, starting one period after the purchase date. In simpler terms, it’s like a stream of income that you can rely on for a certain amount of time.

Before committing to an immediate annuity, it’s crucial to consider the potential drawbacks. Immediate Annuity Drawback explores the limitations and risks associated with this type of annuity.

- Fixed Annuity Immediate:These annuities provide a fixed amount of payment for the duration of the contract. This predictability makes them ideal for those seeking a steady income stream.

- Variable Annuity Immediate:These annuities offer payments that fluctuate based on the performance of an underlying investment portfolio. They provide the potential for higher returns but also come with greater risk.

- Indexed Annuity Immediate:These annuities offer payments linked to the performance of a specific market index, such as the S&P 500. They provide some growth potential while offering protection against significant losses.

Imagine a scenario where you’re planning for retirement. You purchase an annuity immediate that will provide you with a monthly payment for the next 20 years. This provides you with a reliable income stream during your retirement years, ensuring financial stability.

The 59.5 rule, as explained in Annuity 59.5 Rule 2024 , allows for early withdrawals from certain retirement accounts without penalty. Understanding this rule can help you make informed decisions about accessing your retirement savings.

Key Features of an Annuity Immediate

Annuity immediates are characterized by several key features that determine their structure and value.

Calculating annuity values on a TI-84 calculator can be helpful for financial planning. Calculate Annuity On Ti 84 2024 provides step-by-step instructions and examples to help you master this calculation.

- Payment Period:This refers to the frequency of the payments, which can be monthly, quarterly, annually, or even semi-annually. The payment period impacts the total number of payments received over the annuity’s term.

- Term of the Annuity:This refers to the total duration of the payment stream, expressed in years or periods. The term determines the total number of payments you will receive.

- Discount Rate:This is the rate of return used to calculate the present value of the annuity’s future payments. The discount rate reflects the time value of money, meaning that money received today is worth more than the same amount received in the future.

Looking for information on annuities with a principal amount of $200,000? Annuity 200k 2024 explores the options available and helps you make informed decisions about your retirement savings.

Calculating the Present Value of an Annuity Immediate

The present value (PV) of an annuity immediate represents the current value of all future payments, discounted back to the present using the appropriate discount rate.

Calculating the present value of an annuity is essential for financial planning. Calculating Annuity Present Value 2024 provides a comprehensive guide to understanding and calculating this important financial metric.

PV = PMT

Choosing between an annuity and an IRA requires careful consideration of your financial goals and risk tolerance. Annuity Vs Ira 2024 compares these two popular retirement savings options to help you make the best choice for your situation.

- [1

- (1 + r)^-n] / r

Where:

- PV = Present Value

- PMT = Payment Amount

- r = Discount Rate

- n = Number of Periods

For instance, let’s say you’re considering an annuity immediate that pays $1,000 per year for 10 years, with a discount rate of 5%. To calculate the present value, we can use the formula:

PV = $1,000 – [1 – (1 + 0.05)^-10] / 0.05 = $7,721.73

This means that the present value of the annuity immediate is $7,721.73. This represents the amount you would need to invest today at a 5% discount rate to receive $1,000 per year for the next 10 years.

If you’re considering a Brighthouse Variable Annuity, understanding the surrender period is essential. Brighthouse Variable Annuity Series Xtra Surrender Period 2024 provides a clear explanation of the terms and conditions related to withdrawing funds.

Types of Annuities Immediate

Annuity immediates come in various forms, each with its own features and suitability for different financial goals.

| Type | Features | Advantages | Disadvantages |

|---|---|---|---|

| Fixed Annuity Immediate | Provides a fixed payment amount for the duration of the contract. | Predictable income stream, low risk. | Limited growth potential, may not keep pace with inflation. |

| Variable Annuity Immediate | Payments fluctuate based on the performance of an underlying investment portfolio. | Potential for higher returns, flexibility in investment choices. | Higher risk, payments can be unpredictable. |

| Indexed Annuity Immediate | Payments linked to the performance of a specific market index. | Potential for growth, protection against significant losses. | Returns may be limited, may not keep pace with inflation. |

The decision-making process for selecting the right type of annuity immediate involves considering factors such as your risk tolerance, investment goals, and financial situation.

Applications of Annuities Immediate

Annuity immediates are versatile financial tools with various applications in financial planning.

- Retirement Planning:Annuity immediates can provide a steady stream of income during retirement, ensuring financial security and peace of mind.

- Income Generation:Individuals can use annuity immediates to generate a regular income stream from their savings, supplementing other income sources.

- Estate Planning:Annuity immediates can be used to create a legacy for loved ones, providing them with a guaranteed income stream after your passing.

Factors to Consider When Choosing an Annuity Immediate

Selecting the right annuity immediate requires careful consideration of several factors.

- Terms and Conditions:Carefully review the annuity contract to understand the terms, fees, and other provisions. Pay attention to the payment schedule, interest rate, and any guarantees offered.

- Interest Rates:Interest rates play a crucial role in determining the annuity’s value. Higher interest rates generally lead to higher payments. However, interest rates can fluctuate over time, impacting the overall return on your investment.

- Inflation:Inflation erodes the purchasing power of money over time. Consider the potential impact of inflation on the annuity’s payments, especially if you are looking for long-term income security.

- Investment Returns:For variable annuities, the investment returns depend on the performance of the underlying portfolio. Consider your investment goals and risk tolerance when choosing a variable annuity.

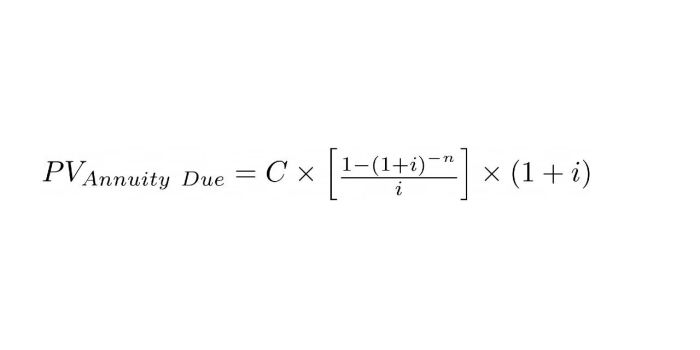

Annuity Immediate vs. Annuity Due

While annuity immediates are common, it’s essential to understand the differences between them and annuity dues.

An annuity due is similar to an annuity immediate, but the payments start at the beginning of each period instead of at the end. This slight difference impacts the present value calculation, as the first payment is received earlier.

Looking for insights into the performance of Jackson Variable Annuities in 2024? You can find detailed reviews and analysis in this article: Jackson Variable Annuity Reviews 2024. This resource provides valuable information to help you make informed decisions about your financial future.

| Feature | Annuity Immediate | Annuity Due |

|---|---|---|

| Payment Schedule | Payments start at the end of each period. | Payments start at the beginning of each period. |

| Present Value | Lower present value than an annuity due. | Higher present value than an annuity immediate. |

| Advantages | Lower upfront cost. | Higher upfront cost but higher overall return. |

| Disadvantages | Lower overall return. | Higher upfront cost. |

Annuity Immediate in Practice

Annuity immediates have proven to be valuable tools for individuals seeking financial security and income generation.

Planning for retirement income often involves understanding how variable annuity payments work. Variable Annuity Payments 2024 offers insights into the factors influencing payment amounts and strategies for maximizing your returns.

For instance, a retiree might purchase an annuity immediate to provide a guaranteed income stream for their living expenses. Alternatively, someone with a large lump sum might invest in an annuity immediate to generate a regular income stream for their children’s education or other long-term goals.

For those seeking protection for loved ones, a variable annuity with a death benefit can be a valuable option. Variable Annuity With Death Benefit 2024 discusses the features and benefits of these types of annuities.

However, it’s important to remember that annuity immediates are not risk-free. Factors such as interest rate changes, inflation, and the financial stability of the issuing company can impact the value of your investment. Careful planning and research are essential to ensure that an annuity immediate aligns with your financial goals and risk tolerance.

Choosing the right annuity can be challenging, but 5 Annuity 2024 offers a comprehensive guide to help you navigate the options available in the market.

Summary

Understanding annuities immediate is crucial for anyone seeking to secure their financial future. By carefully considering the different types, features, and applications of annuities immediate, individuals can make informed decisions that align with their unique financial circumstances. This guide has provided a comprehensive overview of annuities immediate, equipping readers with the knowledge to navigate the complexities of this financial instrument and make sound choices for their retirement planning and beyond.

FAQs

What is the difference between an annuity immediate and an annuity due?

The primary difference lies in the timing of payments. An annuity immediate makes payments at the end of each period, while an annuity due makes payments at the beginning of each period. This difference affects the present value calculation and the overall value of the annuity.

How do interest rates affect the value of an annuity immediate?

Interest rates have a significant impact on the present value of an annuity immediate. Higher interest rates generally lead to a higher present value, as the future payments are discounted at a higher rate. Conversely, lower interest rates result in a lower present value.

Are there any tax implications associated with annuities immediate?

Understanding the liquidity of variable annuities in 2024 is crucial for investors. Explore Variable Annuity Liquidity 2024 to learn about the factors affecting access to your funds and how to manage your investments effectively.

Yes, there are tax implications associated with annuities immediate. The interest earned on the annuity is generally taxable as ordinary income. However, the principal amount may be tax-deferred until the annuity payments begin.

An immediate annuity contract, as described in Immediate Annuity Contract , offers a guaranteed stream of income starting immediately. It’s a popular choice for retirees seeking a reliable source of income.

What are some common risks associated with annuities immediate?

Some common risks associated with annuities immediate include interest rate risk, inflation risk, and the potential for the insurance company issuing the annuity to become insolvent.

Is an annuity immediate suitable for everyone?

Annuities immediate are not suitable for everyone. It is important to carefully consider your individual financial circumstances, risk tolerance, and financial goals before investing in an annuity immediate.