EV tax credit eligibility requirements in 2024 have undergone significant changes, creating both opportunities and challenges for those seeking

Wondering who will receive stimulus checks in October 2024? You can find out more about it here.

to purchase an electric vehicle. The revised guidelines aim to promote domestic manufacturing and battery sourcing, while also setting income limitations for eligible buyers.

Thi

While there are potential benefits, there are also drawbacks to a stimulus in October 2024. You can find out more about them here.

Keep an eye on these key events in October 2024 that could affect businesses here.

s guide provides a comprehensive overview of the key factors that determine whether you qualify for this valuable financial incentive.

Navigating the complex world of EV tax credit eligibility can be daunting, but understanding the intricacies of vehicle requirements, buyer qualifications, and manufacturer regulations is crucial. This in-depth exploration will equip you with the knowledge necessary to make informed decisions about your electric vehicle purchase.

Contents List

EV Tax Credit Eligibility Overview

The EV tax credit is a federal tax incentive designed to encourage the purchase of electric vehicles (EVs) and reduce greenhouse gas emissions. The credit has been around for several years, undergoing significant changes in recent legislation. Understanding the eligibility requirements is crucial for individuals and businesses considering an EV purchase.

Purpose and History

The EV tax credit was initially introduced in 2009 as part of the American Recovery and Reinvestment Act. Its primary goal was to stimulate the EV market, promote energy independence, and reduce dependence on fossil fuels. The credit has been modified several times over the years, with changes in eligibility criteria, credit amounts, and limitations.

If you’re looking for the amount and payment schedule for the October 2024 tax rebate, you can find it here.

Eligibility Requirements for 2024

The most recent changes to the EV tax credit were enacted in the Inflation Reduction Act of These changes significantly impacted eligibility requirements, particularly regarding vehicle assembly, battery sourcing, and income limitations. For the 2024 tax year, the following criteria must be met to qualify for the EV tax credit:

Key Changes in Recent Legislation

The Inflation Reduction Act of 2022 introduced several key changes to the EV tax credit:

- Vehicle Assembly:The vehicle must be assembled in North America to qualify for the full tax credit.

- Battery Sourcing:A significant portion of the battery components must be sourced from North America or countries with free trade agreements with the United States.

- Income Limitations:The tax credit is phased out for individuals with higher incomes.

- Manufacturer Caps:A cap has been placed on the number of EVs that a manufacturer can sell before the tax credit is phased out.

To see if you qualify for the Virginia tax rebate in October 2024, check out the eligibility requirements here.

Vehicle Requirements

The EV tax credit applies to a specific set of electric vehicles that meet the defined criteria. Understanding these requirements is essential for potential buyers.

The global political landscape is always shifting, and you can get a glimpse of what October 2024 might hold here.

Eligible EV Models

The list of eligible EV models for the 2024 tax credit is subject to change as manufacturers adjust their production and sourcing practices. However, as of today, some of the qualifying vehicles include:

- Tesla Model 3

- Chevrolet Bolt

- Ford Mustang Mach-E

- Hyundai Kona Electric

- Kia Niro EV

MSRP Limitations

To qualify for the full tax credit, the MSRP (Manufacturer’s Suggested Retail Price) of the vehicle must be below a certain threshold. This threshold may vary depending on the vehicle type and the specific model.

Taylor Swift’s net worth from her investments is quite impressive, and you can find out more about it here.

Vehicle Assembly and Manufacturing

The vehicle must be assembled in North America to qualify for the full tax credit. Additionally, the vehicle’s battery components must meet specific sourcing requirements, with a significant portion sourced from North America or countries with free trade agreements with the United States.

Homeowners are eagerly awaiting the potential October 2024 tax rebate, and you can find all the details about it here.

Buyer Requirements

The EV tax credit is not available to everyone. Certain requirements must be met by the buyer to be eligible.

Income Limitations

The tax credit is phased out for individuals with higher incomes. The specific income thresholds are based on filing status and may change from year to year.

Vehicle Ownership and Usage

The vehicle must be owned and used primarily in the United States. This means that the vehicle cannot be leased or used primarily for commercial purposes.

Prior EV Purchases

Individuals who have previously claimed the EV tax credit for another vehicle may not be eligible for the credit again. There are exceptions to this rule, such as purchasing a used EV.

Inflation is a key factor in determining the potential for a stimulus in October 2024, and you can read more about its impact here.

Manufacturer Requirements

To qualify for the EV tax credit, manufacturers must meet specific requirements related to domestic production and battery sourcing.

Qualifying Manufacturers

Only manufacturers that meet the requirements for domestic production and battery sourcing are eligible to have their vehicles qualify for the EV tax credit. These requirements are subject to change as the legislation evolves.

Domestic Production and Battery Sourcing

A significant portion of the vehicle and its battery components must be produced in North America or in countries with free trade agreements with the United States. The exact percentages for these requirements are Artikeld in the legislation.

There are potential benefits to a stimulus in October 2024, and you can learn more about them here.

Manufacturer Caps

A cap has been placed on the number of EVs that a manufacturer can sell before the tax credit is phased out. This cap is designed to prevent a single manufacturer from dominating the EV market and to ensure that the tax credit benefits a wider range of manufacturers.

Tax Credit Calculation and Application: EV Tax Credit Eligibility Requirements In 2024

The EV tax credit is a significant financial incentive that can significantly reduce the cost of purchasing an electric vehicle.

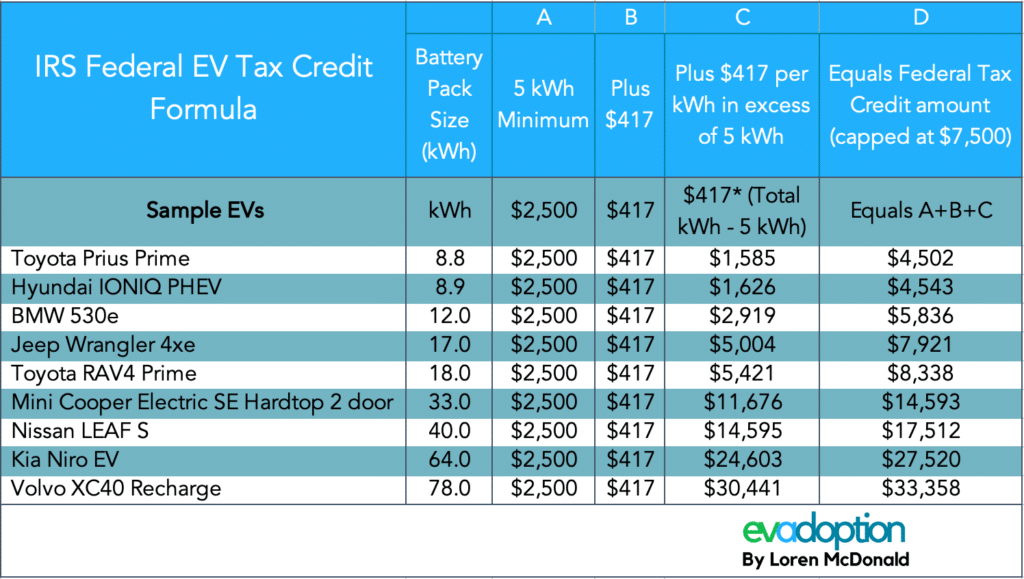

Amount of the Tax Credit

The amount of the tax credit available for 2024 varies depending on the vehicle type and the specific requirements met. The full credit amount may be available for vehicles that meet the domestic production and battery sourcing requirements.

Claiming the Tax Credit, EV tax credit eligibility requirements in 2024

To claim the EV tax credit, individuals must file Form 8936 with their federal income tax return. The form requires information about the vehicle, the purchase date, and the manufacturer.

Curious about what October 2024 holds for travel and tourism? Check out these predictions here.

Tax Credit Amounts for Different EV Types

The following table summarizes the tax credit amounts for different types of EVs:

| Vehicle Type | Tax Credit Amount |

|---|---|

| New EVs meeting all requirements | $7,500 |

| Used EVs meeting certain requirements | Up to $4,000 |

Impact of the EV Tax Credit

The EV tax credit is expected to have a significant impact on the EV market, encouraging the adoption of electric vehicles and promoting clean energy transportation.

Impact on EV Adoption

The tax credit is expected to make EVs more affordable for consumers, leading to increased demand and accelerating the transition to electric vehicles. This could lead to a reduction in greenhouse gas emissions and improve air quality.

Comparison to Other Incentives

The EV tax credit is one of several incentives available for clean energy vehicles. Other incentives include state-level rebates, tax credits, and other programs designed to encourage the adoption of EVs.

The debt ceiling is a major factor that could affect the possibility of a stimulus in October 2024, and you can find more information about it here.

Economic and Environmental Benefits

The EV tax credit is expected to have significant economic and environmental benefits. It is anticipated to create jobs in the EV industry, reduce dependence on foreign oil, and improve air quality.

For detailed information on the Virginia tax rebate program in October 2024, check out this link here.

Last Recap

As the landscape of EV tax credit eligibility evolves, staying informed is essential. By carefully considering the vehicle, buyer, and manufacturer requirements Artikeld in this guide, you can maximize your chances of claiming this valuable financial incentive. With the growing popularity of electric vehicles, understanding the intricacies of the EV tax credit program can significantly impact your decision-making process, ultimately contributing to a more sustainable and eco-friendly transportation future.

FAQs

What is the maximum amount of the EV tax credit for 2024?

The maximum amount of the EV tax credit for 2024 is $7,500. However, the final amount you receive may be less depending on factors such as the vehicle’s MSRP, manufacturing location, and battery sourcing.

Can I claim the EV tax credit if I purchased my electric vehicle before 2024?

No, the EV tax credit is only available for vehicles purchased after the new eligibility requirements went into effect in 2024.

The anticipation for October 2024 stimulus checks is high, and you can find out when we can expect them here.

What are the income limitations for claiming the EV tax credit?

The income limitations for claiming the EV tax credit vary depending on your filing status. For example, the income limit for single filers is $150,000, while the limit for married couples filing jointly is $300,000.

If you’re in Virginia, make sure to check out the eligibility requirements for the October 2024 tax rebate here to see if you qualify.