Immediate Annuity RMD offers a compelling strategy for retirees seeking guaranteed income streams. This type of annuity allows individuals to convert a lump sum of savings into a steady stream of payments, providing financial security and peace of mind. By leveraging an immediate annuity, retirees can satisfy their Required Minimum Distributions (RMDs) while simultaneously creating a reliable income source for their golden years.

Want to compare annuity payouts with a lump sum? You can find a helpful tool on Annuity Calculator Vs Lump Sum 2024. This can help you determine which option is right for your financial goals.

This approach can help individuals navigate the complexities of retirement planning and ensure a comfortable and financially sound future.

If you’re looking for information on a specific type of annuity, you can find details on 4 Annuity 2024. This resource can help you understand the nuances of different annuity options.

Immediate annuities can be particularly advantageous for individuals seeking to minimize tax liabilities associated with RMDs. By structuring the annuity payments strategically, retirees can potentially reduce their tax burden and maximize their after-tax income. Moreover, immediate annuities offer a range of options, including fixed, variable, and indexed annuities, allowing individuals to tailor their investment strategy to their specific risk tolerance and financial goals.

Looking for a financial calculator to help you with your annuity calculations? Check out Financial Calculator Annuity 2024 for a comprehensive list of calculators. It’s a great resource for anyone who wants to explore annuity options.

Contents List

Immediate Annuity Basics

An immediate annuity is a type of insurance contract that provides a stream of guaranteed income payments for life, starting immediately after the purchase. It’s a popular option for retirees looking to convert a lump sum of money into a reliable income stream.

Figuring out how much annuity you’ll receive for a lump sum of $40,000 in 2024? You can explore the details of annuity calculations on How Much Annuity For 40 000 2024. This will give you a better idea of how much you can expect to receive each year.

This article will delve into the specifics of immediate annuities, exploring their features, advantages, disadvantages, and how they can be used to satisfy Required Minimum Distributions (RMDs) for retirement accounts.

What is an Immediate Annuity?

An immediate annuity is a financial product that converts a lump sum of money into a stream of regular payments, typically monthly, starting immediately after the purchase. This makes it a valuable tool for retirees seeking guaranteed income for life.

Not sure what an annuity is? You can find a clear definition on Annuity What Is The Meaning 2024. This will help you understand the basics of annuities and how they work.

Unlike traditional investments, immediate annuities offer a guaranteed stream of payments, regardless of market fluctuations, making them a reliable source of income in retirement.

Curious about the key features of variable annuities? You can find information on A Variable Annuity Has Which Of The Following Characteristics 2024. This can help you decide if a variable annuity is right for you.

Key Characteristics of an Immediate Annuity

- Guaranteed Income Payments:Immediate annuities provide a fixed or variable stream of income for life, regardless of market performance.

- Immediate Payments:Payments begin immediately after the annuity is purchased, providing a quick source of income.

- Lump Sum Investment:You purchase an immediate annuity with a lump sum of money, typically from retirement savings or other assets.

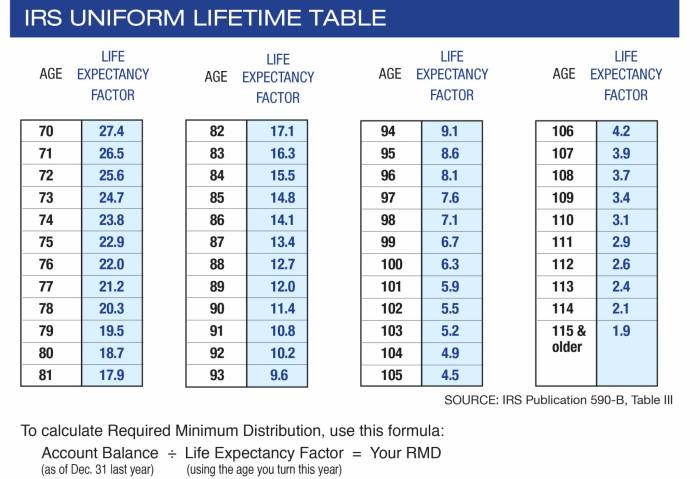

- Life Expectancy Based:The amount of your monthly payments and the duration of your annuity are based on your life expectancy.

Immediate vs. Deferred Annuities

Immediate annuities differ from deferred annuities in terms of when the payments begin. In a deferred annuity, payments are delayed until a future date, often after a specified period of time or upon reaching a certain age. Immediate annuities, on the other hand, begin payments immediately after purchase.

Curious about how variable annuities work? You can learn about the subaccounts that are part of a variable annuity on Variable Annuity Subaccounts 2024. This can give you a better understanding of how variable annuities are structured.

Advantages of Immediate Annuities

- Guaranteed Income:Immediate annuities provide a guaranteed stream of income for life, protecting you from market volatility and ensuring a consistent source of funds.

- Income for Life:Payments continue for as long as you live, offering financial security and peace of mind in retirement.

- Tax Advantages:In some cases, the income from an immediate annuity may be partially tax-deferred, depending on the type of annuity and the specific terms.

- Simplicity:Immediate annuities are relatively straightforward to understand and manage, providing a simple way to convert assets into income.

Disadvantages of Immediate Annuities

- Limited Flexibility:Once you purchase an immediate annuity, you typically cannot access the principal amount or change the payment structure. This can limit your flexibility in managing your finances.

- Potential for Lower Returns:In some cases, immediate annuities may offer lower returns than other investment options, particularly in a rising market.

- Risk of Interest Rate Changes:Fixed immediate annuities are susceptible to interest rate changes, which can affect the value of your annuity over time.

- Life Expectancy Considerations:The longevity of your annuity payments is based on your life expectancy, so if you live longer than expected, you may receive less income than anticipated.

Immediate Annuity and Required Minimum Distributions (RMDs)

Required Minimum Distributions (RMDs) are mandatory withdrawals from retirement accounts, such as 401(k)s and traditional IRAs, that must be taken starting at age 72. Immediate annuities can be a useful tool for satisfying RMD obligations, providing a structured and predictable way to withdraw funds while potentially minimizing tax implications.

If you’re looking for a light-hearted take on annuities, check out Annuity Jokes 2024 for a chuckle. It’s a fun way to learn about annuities while having a good laugh.

How Immediate Annuities Can Satisfy RMDs

An immediate annuity can be purchased with a portion or all of your RMD amount. The annuity payments then satisfy your RMD requirements, ensuring you meet the IRS guidelines while generating a guaranteed income stream. This can be especially beneficial if you’re concerned about managing RMD withdrawals or want to ensure a consistent income source during retirement.

Looking for information on annuities with a specific interest rate? You can find details on 6 Percent Annuity 2024. This can help you understand the potential returns of different annuity options.

Tax Implications of Using an Immediate Annuity for RMDs

The tax implications of using an immediate annuity to meet RMD obligations depend on the specific type of annuity and the terms of your contract. In general, a portion of your annuity payments may be considered taxable income, while another portion may be considered a return of your principal investment.

Want to learn more about the features of variable annuities? You can find detailed information on Variable Annuity Features 2024. This can help you make an informed decision about whether a variable annuity is right for you.

It’s important to consult with a financial advisor to understand the tax implications specific to your situation.

Want to understand the joint life living benefit offered by variable annuities? You can learn more on Variable Annuity Joint Life Living Benefit 2024. This feature can be particularly helpful for couples.

Structuring an Immediate Annuity for RMDs

There are several ways to structure an immediate annuity to address your RMD obligations. For example, you could:

- Purchase a single premium immediate annuity:This involves using a lump sum to purchase an annuity that begins payments immediately.

- Purchase a multi-year guaranteed annuity:This option provides guaranteed payments for a specific period, such as 10 or 20 years, after which you may receive payments for life.

- Purchase a joint and survivor annuity:This type of annuity provides payments for the lifetime of both you and your spouse, ensuring income even after one of you passes away.

Factors to Consider When Choosing an Immediate Annuity

Choosing the right immediate annuity is crucial for maximizing its benefits and ensuring it aligns with your retirement goals. Several factors need careful consideration, including the type of annuity, interest rates, payment options, and guarantees.

Wondering if an annuity guarantees a certain income stream? You can find information on Is Annuity Certain 2024. This will help you understand the level of certainty associated with annuities.

Types of Immediate Annuities

Immediate annuities are available in various forms, each with its own characteristics and benefits. Some common types include:

- Fixed Immediate Annuity:This type provides a fixed, guaranteed monthly payment for life. It’s a good option for those seeking predictable income and stability.

- Variable Immediate Annuity:This type offers a variable monthly payment, with the amount fluctuating based on the performance of the underlying investment portfolio. It may offer the potential for higher returns but also carries greater risk.

- Indexed Immediate Annuity:This type offers a monthly payment that is tied to the performance of a specific index, such as the S&P 500. It provides a balance between fixed and variable income, offering potential for growth while still providing some protection from market downturns.

Interested in how variable annuity sales have been trending? You can find data on Variable Annuity Sales 2019 2024. This can provide insight into the popularity of variable annuities in recent years.

Key Factors to Consider, Immediate Annuity Rmd

- Interest Rates:Interest rates can significantly impact the amount of your monthly payments. Higher interest rates generally result in higher payouts.

- Payment Options:Annuities offer various payment options, such as monthly, quarterly, or annual payments. Choose the option that best suits your cash flow needs.

- Guarantees:Some annuities offer guarantees, such as a minimum guaranteed payment or a death benefit. These features can provide additional security and peace of mind.

- Fees and Expenses:Annuities may have associated fees and expenses, such as surrender charges or administrative fees. Be sure to understand these costs before purchasing an annuity.

Comparison Table of Annuity Options

| Annuity Type | Features | Benefits | Considerations |

|---|---|---|---|

| Fixed Immediate Annuity | Guaranteed monthly payments, fixed interest rate | Predictable income, stability, guaranteed payments for life | Potential for lower returns compared to variable annuities, susceptible to interest rate changes |

| Variable Immediate Annuity | Variable monthly payments based on investment performance | Potential for higher returns, investment flexibility | Higher risk, potential for lower returns, no guaranteed payments |

| Indexed Immediate Annuity | Payments tied to the performance of a specific index | Potential for growth, protection from market downturns, guaranteed minimum payments | May not match the performance of the index, potential for lower returns than variable annuities |

Planning for an Immediate Annuity

Planning for an immediate annuity involves careful consideration of your financial goals, risk tolerance, and retirement income needs. It’s essential to consult with a financial advisor to develop a comprehensive plan that aligns with your specific circumstances.

Want to see how variable annuity rates have fluctuated over the years? You can find information on Variable Annuity Rates 2020 2024. This can give you a better understanding of how variable annuity rates have changed over time.

Steps Involved in Planning

- Determine Your Income Needs:Calculate your projected expenses in retirement and determine how much income you’ll need from your annuity.

- Assess Your Assets:Evaluate your available funds and determine how much you can allocate to an immediate annuity.

- Consider Your Risk Tolerance:Determine your comfort level with market volatility and choose an annuity type that aligns with your risk profile.

- Research Annuity Providers:Compare different annuity providers and their offerings, including interest rates, fees, and guarantees.

- Seek Professional Advice:Consult with a financial advisor to discuss your specific circumstances and receive personalized guidance on choosing the right annuity.

Importance of Consulting a Financial Advisor

A financial advisor can provide valuable insights and guidance on choosing the right immediate annuity for your needs. They can help you:

- Analyze your financial situation:Assess your income, expenses, assets, and liabilities to develop a comprehensive plan.

- Determine your income requirements:Calculate how much income you’ll need from your annuity to meet your retirement goals.

- Evaluate annuity options:Compare different annuity providers and their offerings to find the best fit for your needs.

- Develop a customized plan:Create a personalized retirement plan that incorporates an immediate annuity and addresses your specific financial goals.

Tips for Maximizing Benefits

- Shop Around:Compare annuity providers and their offerings to find the best interest rates, fees, and guarantees.

- Consider Joint and Survivor Annuities:If you have a spouse, a joint and survivor annuity can provide income for both of you, ensuring financial security even after one of you passes away.

- Maximize Your Payments:Choose a payment option that best suits your cash flow needs and maximizes your monthly income.

- Seek Tax Advice:Consult with a tax professional to understand the tax implications of your annuity payments and minimize your tax liability.

Immediate Annuity and Retirement Planning

Immediate annuities can be a valuable component of a comprehensive retirement plan, providing a guaranteed income stream that complements other retirement assets and helps address specific planning needs.

Need a helping hand with annuity calculations? You can find an Excel-based annuity calculator to help you with your calculations on Annuity Calculator Xls 2024. It’s a handy tool for those who want to explore different annuity scenarios.

Incorporating Immediate Annuities into Retirement Plans

Immediate annuities can be integrated into retirement plans in various ways, depending on your individual circumstances and goals. Some common strategies include:

- Income Replacement:Using an immediate annuity to replace a portion of your pre-retirement income, ensuring a steady stream of funds for essential expenses.

- Supplementing Other Income Sources:Combining annuity payments with other retirement income sources, such as Social Security or pension benefits, to create a diversified income stream.

- Addressing Specific Needs:Utilizing an annuity to address specific retirement needs, such as covering healthcare expenses or funding travel plans.

Guaranteed Income in Retirement

One of the primary benefits of immediate annuities is their ability to provide guaranteed income during retirement. This is particularly valuable in an uncertain economic environment, where market fluctuations can impact the value of other investments. With an immediate annuity, you can rest assured that you’ll receive a consistent stream of payments, regardless of market conditions.

Addressing Retirement Planning Needs

Immediate annuities can be used to address a variety of retirement planning needs, including:

- Income Security:Providing a guaranteed income stream that protects you from market volatility and ensures a reliable source of funds.

- Longevity Risk:Addressing the risk of outliving your retirement savings by providing a lifetime stream of income.

- Estate Planning:Leaving a legacy for your loved ones by providing a stream of income for them after your death.

- Healthcare Expenses:Covering the rising costs of healthcare in retirement, ensuring you have adequate funds to meet your medical needs.

Ultimate Conclusion

Immediate annuities can be a valuable tool for retirees seeking to ensure a steady income stream and meet their RMD obligations. By carefully considering the various types of annuities available, their associated risks and benefits, and consulting with a financial advisor, individuals can make informed decisions that align with their retirement planning goals.

Whether seeking guaranteed income, tax optimization, or a combination of both, immediate annuities offer a compelling option for individuals looking to secure their financial future during retirement.

Question Bank: Immediate Annuity Rmd

How do immediate annuities work?

An immediate annuity converts a lump sum of money into a stream of regular payments that begin immediately. You receive payments for a set period (e.g., a certain number of years or for life).

What are the tax implications of using an immediate annuity for RMDs?

The payments you receive from an immediate annuity are typically taxed as ordinary income. However, the portion of the payment that represents your original investment (principal) is generally tax-free.

Are there any penalties for withdrawing from an immediate annuity before the designated period?

Yes, withdrawing from an immediate annuity before the designated period may result in penalties, including surrender charges and taxes. It’s essential to consult with a financial advisor before making any withdrawals.