Who qualifies for the EV tax credit in 2024? The answer depends on a variety of factors, including your income, the vehicle you purchase, and where it was assembled. The Inflation Reduction Act of 2022 brought significant changes to the EV tax credit, creating both new opportunities and limitations for potential buyers.

Military families may be eligible for a tax rebate in October 2024, but the specifics of the program are still being determined. October 2024 Tax Rebate for Military Families The rebate is intended to help military families offset the costs of living and healthcare.

Understanding these changes is crucial for anyone considering an electric vehicle purchase in 2024.

This guide will delve into the specific requirements for claiming the EV tax credit in 2024, covering everything from income limitations and vehicle eligibility to the amount of the credit and the process of claiming it. We’ll also explore the potential impact of the tax credit on the adoption of electric vehicles and the broader automotive industry.

Contents List

- 1 Eligibility Requirements for the EV Tax Credit in 2024: Who Qualifies For The EV Tax Credit In 2024

- 2 Vehicle Eligibility for the EV Tax Credit in 2024

- 3 Tax Credit Amount for Eligible Vehicles

- 4 Claiming the EV Tax Credit on Tax Returns

- 5 Impact of the EV Tax Credit on Electric Vehicle Adoption

- 6 Conclusion

- 7 Common Queries

Eligibility Requirements for the EV Tax Credit in 2024: Who Qualifies For The EV Tax Credit In 2024

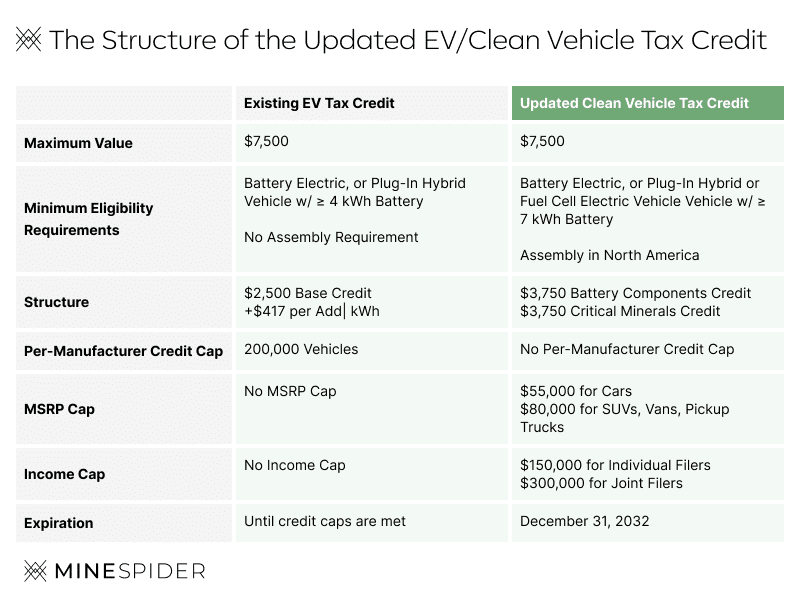

The EV tax credit, a federal incentive designed to encourage the adoption of electric vehicles, has undergone significant changes in 2024. These changes affect both the eligibility criteria and the amount of the tax credit available. To qualify for the EV tax credit in 2024, individuals and families must meet specific requirements related to their income, the vehicle they purchase, and the date of purchase.

Income Limitations

The EV tax credit is subject to income limitations, which vary depending on the filer’s tax status. The following table Artikels the maximum modified adjusted gross income (MAGI) for claiming the full tax credit in 2024:

| Tax Filing Status | Maximum MAGI |

|---|---|

| Single Filers | $150,000 |

| Married Filing Jointly | $300,000 |

| Head of Household | $225,000 |

Individuals exceeding these income thresholds may still be eligible for a partial tax credit, with the amount gradually phasing out based on their MAGI. For example, if a single filer’s MAGI is between $150,000 and $225,000, they will receive a reduced tax credit amount.

Taylor Swift’s net worth is estimated to be around $600 million. Taylor Swift’s net worth breakdown Her wealth comes from her music sales, touring, endorsements, and other ventures.

Vehicle Purchase Date and First Use

The EV tax credit is only available for vehicles purchased and first used after December 31, 2022. This means that vehicles purchased before this date are not eligible for the tax credit, even if they meet all other requirements.

Vehicle Assembly Location

The 2024 changes to the EV tax credit include modifications for vehicles assembled outside of North America. To qualify for the full tax credit, vehicles must be assembled in North America. This includes vehicles manufactured by both domestic and foreign companies.

A recession in October 2024 would likely have a negative impact on the stock market, as investors become more risk-averse. What will a recession in October 2024 mean for the stock market? However, the stock market is notoriously unpredictable, and it’s impossible to say for sure what will happen.

However, there are exceptions for certain vehicles with a high percentage of North American-sourced parts. The specific requirements for these exceptions are Artikeld in the Internal Revenue Code.

Individuals with disabilities may be eligible for a tax rebate in October 2024, but the specifics of the program are still being determined. October 2024 Tax Rebate for Individuals with Disabilities The rebate is intended to help individuals with disabilities offset the costs of living and healthcare.

Vehicle Gross Vehicle Weight Rating (GVWR)

The EV tax credit also applies to vehicles with a modified gross vehicle weight rating (GVWR). However, the maximum tax credit amount for these vehicles is capped at $7,500. Vehicles with a GVWR exceeding 14,000 pounds are not eligible for the tax credit.

The deadline for Virginia’s tax rebate in October 2024 is still unknown, but you can find out more information about it by visiting the Virginia Department of Taxation website. Virginia tax rebate deadline for October 2024 The rebate is designed to help residents with the rising cost of living, and it’s likely to be a popular program.

Vehicle Eligibility for the EV Tax Credit in 2024

To qualify for the EV tax credit, the vehicle must meet specific requirements, including the vehicle type, manufacturer, and battery capacity.

Eligible Vehicle Models

The following is a comprehensive list of eligible vehicle models for the EV tax credit in 2024. This list is subject to change, so it is recommended to consult the latest information from the IRS or the manufacturer.

- Tesla Model 3

- Tesla Model Y

- Chevrolet Bolt EUV

- Ford Mustang Mach-E

- Hyundai Kona Electric

- Kia Niro EV

- Nissan Leaf

- Volkswagen ID.4

- Rivian R1T

- Lucid Air

This list includes both domestic and foreign-manufactured vehicles. The eligibility criteria for vehicles manufactured by domestic and foreign companies are Artikeld below.

The Virginia tax rebate program is expected to have a significant impact on tax refunds in October 2024. Virginia tax rebate impact on my October 2024 tax refund Eligible residents can expect to receive a rebate check in the mail, which could help offset the costs of living and save money.

Domestic and Foreign Manufacturers

Vehicles manufactured by domestic companies, such as General Motors, Ford, and Tesla, are generally eligible for the EV tax credit if they meet all other requirements. However, the eligibility of vehicles manufactured by foreign companies is subject to the assembly location requirements discussed earlier.

For example, a vehicle manufactured by a foreign company but assembled in North America would qualify for the tax credit.

SUVs, Vans, and Pickup Trucks, Who qualifies for the EV tax credit in 2024

The EV tax credit is available for a wide range of vehicle types, including SUVs, vans, and pickup trucks. However, the tax credit amount may vary depending on the vehicle’s GVWR. Vehicles with a GVWR exceeding 14,000 pounds are not eligible for the tax credit.

October 2024 is expected to bring a wave of new healthcare innovations, including advancements in gene editing, artificial intelligence, and personalized medicine. October 2024 Healthcare Innovations These innovations have the potential to revolutionize the way we diagnose, treat, and prevent diseases.

Battery Capacity and Driving Range

The EV tax credit does not have specific requirements for battery capacity or driving range. However, the tax credit amount may be influenced by these factors. Vehicles with larger battery capacities and longer driving ranges may qualify for a higher tax credit amount.

The political implications of a stimulus in October 2024 are complex. What are the political implications of a stimulus in October 2024? It could be seen as a way to boost the economy and help voters, but it could also be criticized as a wasteful spending program.

It is important to consult the latest information from the IRS to determine the specific requirements for battery capacity and driving range.

The debt ceiling could have a significant impact on the possibility of a stimulus in October 2024. How will the debt ceiling affect the possibility of a stimulus in October 2024? If the debt ceiling is not raised, the government may be unable to borrow money to fund a stimulus program.

Tax Credit Amount for Eligible Vehicles

The amount of the EV tax credit varies depending on the vehicle’s type and purchase date. The following table summarizes the tax credit amounts available for different types of eligible vehicles in 2024.

The potential for a stimulus check in October 2024 has sparked a political debate. October 2024 stimulus check political debate Some argue that it is necessary to stimulate the economy, while others believe it would be irresponsible and could lead to inflation.

| Vehicle Type | Tax Credit Amount |

|---|---|

| Passenger Cars (GVWR ≤ 14,000 lbs) | $7,500 |

| SUVs, Vans, and Pickup Trucks (GVWR ≤ 14,000 lbs) | $7,500 |

| Vehicles with a Modified GVWR (≤ 14,000 lbs) | $7,500 |

The maximum tax credit amount available for 2024 is $7,500. This amount is subject to change in future years, so it is important to consult the latest information from the IRS.

Factors Influencing Tax Credit Amount

Several factors influence the amount of the EV tax credit, including the vehicle’s price, battery capacity, and assembly location. Vehicles with a higher price tag may qualify for a lower tax credit amount. Similarly, vehicles with larger battery capacities and longer driving ranges may qualify for a higher tax credit amount.

The assembly location of the vehicle also plays a role, with vehicles assembled in North America generally qualifying for a higher tax credit amount.

Tax Credit Amounts Before and After 2024 Changes

The EV tax credit has undergone significant changes in 2024. Before these changes, the tax credit amount was based on the vehicle’s battery capacity and driving range. Vehicles with larger battery capacities and longer driving ranges qualified for a higher tax credit amount.

However, the 2024 changes have simplified the tax credit structure, with a fixed tax credit amount of $7,500 for most eligible vehicles. This change has made the tax credit more accessible to a wider range of consumers.

Claiming the EV Tax Credit on Tax Returns

Claiming the EV tax credit on tax returns is a straightforward process. The following steps provide a guide for claiming the tax credit.

It is still unclear whether Virginia will offer a tax rebate in October 2024. Is there a Virginia tax rebate for October 2024 The state government will likely make an announcement about the program in the coming months.

Step-by-Step Guide

- Gather the necessary documentation, including the vehicle purchase agreement, the vehicle identification number (VIN), and any other relevant information.

- Complete Form 8936, “Credit for Qualified Electric Vehicles,” and attach it to your tax return.

- File your tax return using the appropriate method, such as through tax software or by filing a paper return.

- The IRS will process your tax return and issue the tax credit as a refund or reduce your tax liability.

Documentation Required for Claiming the Tax Credit

The following table Artikels the necessary documentation required for claiming the EV tax credit.

The Virginia tax rebate program for October 2024 is designed to help residents offset the rising cost of living. Virginia tax rebate program details for October 2024 The program provides a one-time payment to eligible residents, and the amount of the payment is based on income level.

| Document | Description |

|---|---|

| Vehicle Purchase Agreement | A document outlining the purchase details, including the purchase date and the vehicle’s VIN. |

| Vehicle Identification Number (VIN) | A unique identifier for the vehicle. |

| Manufacturer’s Statement | A document confirming the vehicle’s eligibility for the tax credit. |

| Proof of Assembly Location | Documentation verifying that the vehicle was assembled in North America. |

Methods for Claiming the Tax Credit

Individuals can claim the EV tax credit through various methods, including tax software, paper returns, and through their tax preparer. Tax software allows individuals to easily claim the credit by entering the required information. Paper returns require individuals to complete Form 8936 and attach it to their tax return.

Tax preparers can also assist individuals in claiming the credit by completing the necessary forms and filing the tax return.

Implications for Different Tax Situations

The EV tax credit can have different implications for individuals and families with different tax situations. For example, individuals with a lower tax liability may receive the tax credit as a refund. Individuals with a higher tax liability may see a reduction in their tax liability.

It is important to consult with a tax professional to understand the specific implications of claiming the EV tax credit for your tax situation.

The exact date when the Virginia tax rebate will be issued in October 2024 is still unknown. When will the Virginia tax rebate be issued in October 2024 However, the state government is likely to announce the date in the coming months.

Impact of the EV Tax Credit on Electric Vehicle Adoption

The EV tax credit is a significant policy tool designed to promote the adoption of electric vehicles. The tax credit aims to make EVs more affordable for consumers, which can lead to increased demand and ultimately accelerate the transition to a cleaner transportation system.

There are several potential drawbacks to a stimulus in October 2024, such as increased inflation, potential for government overspending, and possible economic dependence on government aid. What are the potential drawbacks of a stimulus in October 2024? However, a stimulus could also be beneficial for the economy, boosting consumer spending and creating jobs.

Potential Impact on EV Adoption

The EV tax credit has the potential to significantly impact the adoption of electric vehicles. By reducing the upfront cost of EVs, the tax credit can make them more attractive to consumers who may otherwise have hesitated to purchase an EV.

This can lead to increased demand for EVs, which can stimulate the production and innovation of new electric vehicle models. The increased demand can also create new jobs in the electric vehicle industry and related sectors, contributing to economic growth.

Economic Benefits for Consumers, Businesses, and the Environment

The EV tax credit offers economic benefits for consumers, businesses, and the environment. For consumers, the tax credit reduces the cost of purchasing an EV, making them more affordable. For businesses, the tax credit can incentivize the production and sale of EVs, creating new opportunities for growth and investment.

For the environment, the tax credit can help reduce greenhouse gas emissions and improve air quality by promoting the adoption of cleaner transportation options.

Comparison with Other Incentives and Policies

The EV tax credit is one of several incentives and policies aimed at promoting electric vehicles. Other incentives include state-level rebates, tax breaks, and charging infrastructure development programs. The EV tax credit complements these other incentives by providing a nationwide federal incentive that can help overcome the challenges of adopting EVs in different regions.

Long-Term Effects on the Automotive Industry and Clean Transportation

The EV tax credit can have long-term effects on the automotive industry and the transition to a cleaner transportation system. The tax credit can encourage automakers to invest in research and development of new electric vehicle models, leading to advancements in technology and performance.

The increased demand for EVs can also drive the development of new charging infrastructure, making it easier for consumers to adopt EVs and contribute to a cleaner transportation system. The long-term effects of the EV tax credit can lead to a more sustainable and environmentally friendly transportation sector.

Conclusion

Navigating the EV tax credit landscape in 2024 can be complex, but understanding the requirements and eligibility criteria is essential for maximizing your savings. By carefully considering the income limitations, vehicle specifications, and other factors Artikeld in this guide, you can make an informed decision about whether an electric vehicle purchase aligns with your financial goals and environmental aspirations.

Common Queries

What is the maximum amount of the EV tax credit in 2024?

The Virginia tax rebate program has specific eligibility requirements for October 2024. Virginia tax rebate eligibility requirements for October 2024 For example, you must be a Virginia resident and have filed your taxes by the deadline.

The maximum amount of the EV tax credit in 2024 is $7,500. However, this amount may be reduced depending on the vehicle’s price and battery capacity.

Can I claim the EV tax credit if I lease an electric vehicle?

No, the EV tax credit is only available for the purchase of a new electric vehicle. It cannot be claimed for leased vehicles.

What if I purchase a used electric vehicle?

The EV tax credit is only available for the purchase of new electric vehicles. It does not apply to used vehicles.

How do I claim the EV tax credit on my tax return?

You can claim the EV tax credit on your federal income tax return using Form 8936. You will need to provide documentation such as the vehicle’s VIN and purchase receipt.