30 Year Mortgage Rates Today 2024: Navigating the ever-changing landscape of mortgage rates can feel overwhelming, especially in a year like 2024. The Federal Reserve’s recent actions have caused fluctuations, leaving many wondering what the future holds for their homeownership dreams.

A reverse mortgage can be a helpful option for homeowners who are 62 or older and want to tap into their home equity. Learn more about AAG Reverse Mortgage in 2024 to see if it’s a good fit for your financial situation.

This guide explores the current 30-year mortgage rate trends, the factors influencing them, and strategies for making informed decisions.

Understanding the forces at play is crucial for making informed decisions. We’ll delve into the connection between mortgage rates and home affordability, exploring how changes in rates impact monthly payments and the overall housing market. We’ll also uncover the key factors that influence individual mortgage rates, empowering you to navigate the process effectively.

A mortgage loan is a significant financial commitment. Understanding the different types of mortgage loans available can help you choose the right one for your needs. Explore Mortgage Loans in 2024 and find the best fit for your situation.

Contents List

Current 30-Year Mortgage Rate Trends: 30 Year Mortgage Rates Today 2024

Understanding current 30-year mortgage rates is crucial for anyone planning to buy a home in 2024. These rates fluctuate based on various economic factors and Federal Reserve policies, influencing affordability and homebuyer decisions. This article delves into the current trends, historical data, and factors affecting these rates.

Rocket Mortgage is a popular online lender known for its digital-first approach. Check out the latest information on Rocket Mortgage Rates in 2024 to see if they offer competitive rates for your situation.

Overview of Current 30-Year Mortgage Rates

As of [date], the average 30-year fixed-rate mortgage is hovering around [current rate]%. This rate has been [trending up/down] in recent months, influenced by [mention specific economic factors and Fed policies]. For instance, [provide an example of how a specific economic indicator or Fed policy influenced rates].

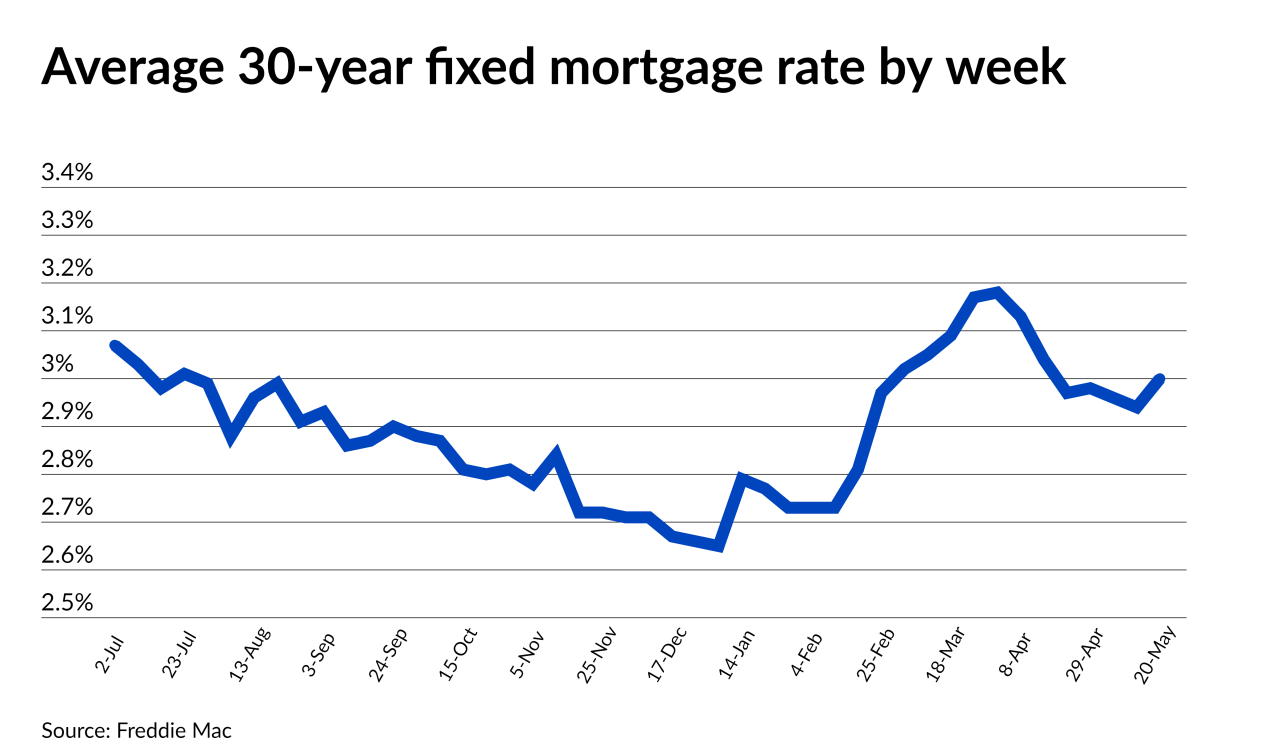

Historical Data and Comparisons

To understand the current rate environment, it’s helpful to look at historical data. Over the past year, 30-year mortgage rates have [mention overall trend, e.g., fluctuated significantly/remained relatively stable]. In [month/year], rates reached a peak of [peak rate]%, while in [month/year] they dipped to a low of [low rate]%.

A cash-out refinance can allow you to access some of your home’s equity. This can be a useful option for home improvements, debt consolidation, or other financial needs. Learn more about Cash Out Refinance in 2024 to see if it’s the right choice for you.

Comparing these historical rates to the current [current rate]%, it’s evident that [summarize the key observation regarding historical rates compared to current rates].

Understanding the Impact of Mortgage Rates

Mortgage rates play a significant role in home affordability and the housing market dynamics. Understanding how these rates influence monthly payments and buyer behavior is essential for making informed decisions.

A second mortgage can be a helpful option if you need additional financing. Learn more about Second Mortgages in 2024 and consider if it’s a suitable choice for your circumstances.

Relationship Between Mortgage Rates and Home Affordability

Higher mortgage rates make homes less affordable. This is because a higher rate increases the total interest paid over the life of the loan, resulting in higher monthly payments. For example, a [rate] percentage point increase on a $300,000 mortgage can translate to an additional [amount] in monthly payments.

This can significantly impact a buyer’s ability to qualify for a mortgage or the size of the home they can afford.

Impact of Mortgage Rates on Monthly Payments

Changes in mortgage rates directly affect monthly mortgage payments. A higher rate leads to a larger portion of each payment going towards interest, leaving less for principal repayment. Conversely, lower rates result in smaller monthly payments, freeing up more money for other expenses.

If you’re thinking about refinancing your current mortgage, it’s important to consider the current market conditions. You might be able to lower your monthly payments or get a shorter loan term. Check out the latest information on Home Refinance in 2024 and see if it’s right for you.

To illustrate, a [rate]% increase on a [loan amount] mortgage could lead to an additional [amount] in monthly payments, impacting a borrower’s budget.

VA loans offer competitive rates for eligible veterans. Keep an eye on VA Loan Rates in 2024 to see how they compare to other loan options.

Impact on Housing Market and Homebuyer Behavior

Rising mortgage rates can cool the housing market by reducing demand. When rates increase, homes become less affordable, leading to fewer buyers and potentially slower price growth. This can create a more balanced market, but it can also make it more challenging for first-time homebuyers to enter the market.

Conversely, falling rates can stimulate demand, leading to increased home sales and potential price appreciation.

Factors Affecting Individual Mortgage Rates

While the average 30-year mortgage rate provides a general benchmark, individual borrowers often experience varying rates based on specific factors. These factors can significantly impact the cost of borrowing and the overall affordability of a mortgage.

Refinancing your mortgage can be a smart move if you want to lower your monthly payments, shorten your loan term, or access your home equity. Get the latest information on Refinance in 2024 to see if it’s right for you.

Key Factors Influencing Individual Rates

- Credit Score:A higher credit score typically translates to lower interest rates. Lenders view borrowers with strong credit histories as less risky, making them eligible for more favorable terms. For example, a borrower with a credit score of 740 might qualify for a rate [amount]% lower than someone with a score of 620.

- Loan Amount:Larger loan amounts often come with higher interest rates. Lenders may perceive larger loans as carrying more risk, potentially leading to a higher rate. For instance, a [loan amount] mortgage might have a slightly higher rate than a [loan amount] mortgage.

FHA loans are known for their flexible requirements, making them a popular choice for first-time homebuyers. Get the latest information on FHA Loans in 2024 to see if they’re right for you.

- Loan-to-Value (LTV) Ratio:The LTV ratio represents the loan amount as a percentage of the home’s value. A higher LTV ratio, indicating a larger loan relative to the home’s value, often leads to higher rates. For example, a borrower with a 90% LTV might face a higher rate than someone with a 80% LTV.

Finding the lowest mortgage rates can save you a significant amount of money over the life of your loan. Check out Lowest Mortgage Rates in 2024 to compare rates and find the best deal.

Role of Mortgage Lenders

Mortgage lenders play a crucial role in determining individual mortgage rates. Different lenders have varying lending criteria, risk tolerances, and pricing models. Some lenders may offer more competitive rates to attract borrowers, while others may prioritize lower risk and charge higher rates.

It’s essential to compare rates from multiple lenders to find the best fit.

Refinance rates are constantly changing, so it’s important to stay up-to-date. You can find the latest information on Home Refinance Rates in 2024 to see if refinancing is a good option for you.

Tips for Securing a Favorable Rate

- Improve Your Credit Score:Work on improving your credit score by paying bills on time, keeping credit utilization low, and avoiding unnecessary credit inquiries.

- Shop Around for Rates:Compare rates from multiple lenders to find the most competitive offer. Online mortgage marketplaces can be a valuable resource for this process.

- Consider a Larger Down Payment:A larger down payment can lead to a lower LTV ratio, potentially resulting in a more favorable rate.

- Negotiate with the Lender:Don’t be afraid to negotiate with the lender to see if you can secure a lower rate. Highlight your strong credit history and any other factors that make you a desirable borrower.

Strategies for Managing Mortgage Rates

In today’s fluctuating rate environment, borrowers have options to manage their mortgage costs and potentially secure more favorable terms. Understanding the differences between fixed and adjustable-rate mortgages and exploring strategies for locking in rates can be beneficial.

Fixed-Rate vs. Adjustable-Rate Mortgages (ARMs), 30 Year Mortgage Rates Today 2024

Fixed-rate mortgages provide a predictable monthly payment for the life of the loan. The interest rate remains constant, offering stability and peace of mind. ARMs, on the other hand, have an initial fixed rate period, followed by a period where the rate adjusts periodically based on market conditions.

Looking to get a better grasp on the current mortgage landscape? Understanding today’s rates is a good starting point. Keep an eye on Mortgage Rates Today in 2024 to make informed decisions about your home financing.

ARMs can offer lower initial rates, making them attractive for borrowers who plan to sell or refinance before the rate adjusts. However, they carry the risk of higher payments if interest rates rise.

Choosing the right mortgage company can make a big difference in your home buying experience. Compare different lenders and their offerings. Explore Mortgage Companies in 2024 and find the best fit for your needs.

Strategies for Locking in a Favorable Rate

- Rate Locks:A rate lock guarantees a specific interest rate for a set period. This can protect borrowers from rising rates, especially if they are unsure about market conditions. Rate locks typically come with a fee and a specific time limit.

If you’re a veteran, you may be eligible for a VA home loan, which offers benefits like no down payment and competitive rates. Explore the details of VA Home Loans in 2024 and see if you qualify.

- Refinancing:Refinancing involves obtaining a new mortgage to replace an existing one. If rates have fallen since the initial mortgage was taken out, refinancing can lower monthly payments and potentially save money over the life of the loan. However, refinancing comes with closing costs and may not be worthwhile if rates are expected to rise significantly.

Getting pre-approved for a mortgage can give you a head start in the home buying process. It shows sellers you’re serious and can help you get a better idea of what you can afford. Learn more about Mortgage Prequalification in 2024 and start your journey towards homeownership.

Tips for Managing Mortgage Payments and Minimizing Interest Costs

- Make Extra Payments:Making extra payments towards the principal can significantly reduce the total interest paid over the life of the loan. Even small extra payments can make a difference.

- Consider a Shorter Loan Term:A 15-year mortgage typically has a lower interest rate than a 30-year mortgage, leading to faster principal repayment and lower overall interest costs. However, monthly payments will be higher.

- Shop Around for Lower Interest Rates:Periodically check rates from other lenders to see if you can qualify for a lower rate. You may be able to refinance to take advantage of better rates if available.

Current Market Outlook for Mortgage Rates

Predicting future mortgage rates is inherently challenging, but analyzing current economic conditions and expert opinions can provide insights into potential trends.

Economic Climate and Impact on Rates

The current economic climate is [describe current economic conditions, e.g., volatile/stable/recessionary/inflationary]. [Mention specific economic indicators, e.g., inflation, unemployment, GDP growth] are influencing interest rate expectations. For instance, [provide an example of how a specific economic indicator is impacting rate expectations].

Expert Predictions and Forecasts

Experts and economists are [mention overall sentiment regarding future rates, e.g., divided/optimistic/pessimistic]. Some predict [mention specific rate forecasts, e.g., a gradual increase/a decline/a significant jump] in the coming months and years, citing [mention specific reasons for their predictions, e.g., inflation concerns/Fed policy/economic growth].

Others believe that rates will [mention alternative forecasts and reasons].

Opportunities and Challenges for Borrowers

The current market outlook presents both opportunities and challenges for borrowers. [Mention specific opportunities, e.g., potential for lower rates if economic conditions improve/ability to lock in current rates if concerned about future increases]. However, borrowers should also be aware of [mention potential challenges, e.g., potential for higher rates if inflation persists/difficulty qualifying for a mortgage if economic conditions deteriorate].

Staying informed about market trends and making informed decisions based on individual circumstances is crucial.

Final Wrap-Up

As you embark on your homeownership journey, remember that staying informed is key. By understanding the current market outlook and exploring strategies for managing mortgage rates, you can position yourself for success. Don’t hesitate to consult with a financial advisor or mortgage lender to discuss your individual circumstances and explore options tailored to your needs.

User Queries

What are the current 30-year mortgage rates?

Current 30-year mortgage rates fluctuate daily. It’s best to check with a reputable mortgage lender or online resources for the most up-to-date information.

How do I get the best mortgage rate?

Improving your credit score, shopping around for lenders, and considering a smaller down payment can help you secure a favorable rate.

What is a rate lock?

A rate lock guarantees a specific mortgage rate for a set period, protecting you from rate increases during that time.