Immediate Annuity Rate, a financial tool that can provide a steady stream of income during retirement, is a powerful option for those seeking financial security. Imagine a reliable source of income that doesn’t rely on market fluctuations or investment risk.

For those in the UK, there are specific tools to help calculate annuity payouts. Annuity Calculator Uk 2020 2024 provides a guide to annuity calculators tailored for the UK market, helping you understand your potential retirement income.

This is what an immediate annuity offers, providing a predictable income stream for life.

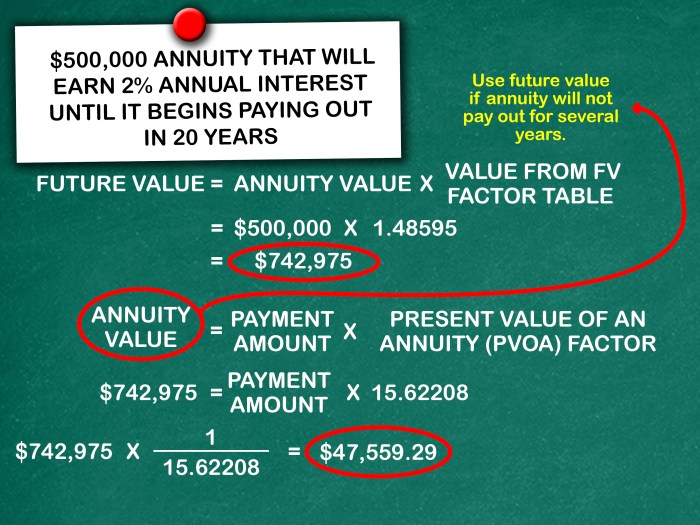

Calculating the potential payouts of an annuity can seem complex, but there’s a formula to guide you. Calculating Annuity Formula 2024 breaks down the process, making it easier to understand how your annuity payments are determined.

The immediate annuity rate is determined by a complex set of factors, including interest rates, age, and the amount of the initial investment. Understanding these factors is crucial for making informed decisions about your retirement planning.

If you’re a participant in the Thrift Savings Plan (TSP), you might be considering an annuity option. Calculating Tsp Annuity 2024 explains how to calculate annuity payouts based on your TSP balance, providing valuable insights for retirement planning.

Contents List

Immediate Annuity Rate: Definition and Basics

An immediate annuity rate is a crucial aspect of retirement planning, particularly for individuals seeking guaranteed income streams. This rate determines the amount of regular payments you’ll receive from an immediate annuity, a financial product that converts a lump sum into a series of guaranteed payments starting immediately.

Looking for an annuity that provides a set period of payouts? A Annuity 5 Year Payout 2024 article can help you understand the mechanics and considerations of annuities with a fixed payout duration.

In simple terms, it represents the return on your investment, outlining how much income you can expect for each dollar invested.

Exploring different annuity options can be overwhelming. 5 Annuity 2024 highlights five key types of annuities, providing a starting point for your research and understanding.

What is an Immediate Annuity Rate?

An immediate annuity rate is the annual percentage rate (APR) used to calculate the amount of income you will receive from an immediate annuity. It is a key factor in determining the value of an immediate annuity, as it directly impacts the amount of income you will receive.

Wondering about the minimum age to purchase an immediate annuity? Immediate Annuity Minimum Age provides information on age requirements for immediate annuities, helping you determine if you’re eligible for this type of financial product.

Real-World Example

Imagine you have $100,000 to invest in an immediate annuity. An annuity provider offers an immediate annuity rate of 5%. This means you would receive $5,000 in annual payments, calculated as $100,000 x 0.05 = $5,000. This income stream is guaranteed for the rest of your life, providing a reliable source of income during retirement.

An annuity is often referred to as the “flip side” of a lump-sum payment. An Annuity Is Sometimes Called The Flip Side Of 2024 explores this concept, explaining how annuities provide a steady stream of income instead of a one-time payout.

Factors Influencing Immediate Annuity Rates

Several factors contribute to the immediate annuity rate offered by providers. These include:

- Interest Rates:As interest rates rise, annuity providers can offer higher rates, as they can earn more on their investments. Conversely, when interest rates fall, annuity rates tend to decline.

- Age and Gender:Annuity providers typically offer higher rates to older individuals, as they have a shorter life expectancy. Similarly, women generally receive higher rates than men due to their longer life expectancy.

- Health:Some annuity providers may consider your health status when determining the rate, offering higher rates to individuals with longer life expectancies. However, this practice is less common.

- Annuity Type:Different types of immediate annuities, such as fixed, variable, or indexed annuities, come with varying rates. The specific features and risks associated with each type influence the offered rate.

- Investment Performance:For variable annuities, the performance of the underlying investments impacts the annuity rate. Strong investment returns can lead to higher rates, while poor performance can result in lower rates.

- Market Conditions:Economic conditions, inflation, and overall market volatility can affect the immediate annuity rate. Providers may adjust rates based on these factors to reflect the current market environment.

How Immediate Annuity Rates Are Calculated

Calculating an immediate annuity rate involves a complex process that takes into account various factors. The goal is to determine a rate that ensures the annuity provider can meet its obligations to pay out guaranteed income streams to annuitants while also maintaining profitability.

Wondering about the specifics of an annuity contingent? You can find detailed information on Annuity Contingent Is 2024. This article delves into the intricacies of annuity contingencies, helping you understand their role in financial planning.

Key Components of Calculation

- Lump Sum Investment:The amount of money you invest in the immediate annuity is the starting point for calculating the rate.

- Annuitant’s Life Expectancy:The provider estimates how long you are expected to live based on your age, gender, and health. This determines the total number of payments you will receive.

- Discount Rate:This rate reflects the provider’s cost of capital and expected investment returns. It is used to discount future payments back to their present value.

- Administrative Expenses:The provider’s operating costs, such as marketing, management, and insurance, are factored into the calculation.

- Profit Margin:The provider aims to make a profit on the annuity, so a margin is included in the rate calculation.

Calculation Methods

There are several methods used to calculate immediate annuity rates, each with its own advantages and disadvantages:

| Method | Advantages | Disadvantages |

|---|---|---|

| Traditional Annuity Rate Method: This method uses a fixed interest rate to calculate the annuity payment, based on the lump sum investment and the annuitant’s life expectancy. | Simple and straightforward to calculate. | May not reflect market conditions accurately, as interest rates can fluctuate. |

| Market-Based Annuity Rate Method: This method considers current market conditions, such as interest rates and investment returns, to determine the annuity rate. | More responsive to market changes, offering potentially higher rates in favorable conditions. | May be more complex to calculate and subject to greater volatility. |

| Actuarial Annuity Rate Method: This method uses sophisticated actuarial models to estimate the annuitant’s life expectancy and calculate the annuity rate based on various factors. | Provides a more accurate reflection of individual risk and life expectancy. | Can be complex and require specialized expertise. |

Factors Affecting Immediate Annuity Rates

The immediate annuity rate is influenced by a range of factors, both internal and external. Understanding these factors can help you make informed decisions about investing in an immediate annuity.

A common question about annuities is their tax implications. Is A Single Life Annuity Taxable 2024 explores the taxability of single-life annuities, providing clarity on how these payments are treated for tax purposes.

Primary Factors

- Interest Rates:As mentioned earlier, interest rates have a direct impact on immediate annuity rates. When interest rates rise, annuity providers can offer higher rates, as they can earn more on their investments. Conversely, when interest rates fall, annuity rates tend to decline.

If you’re seeking an annuity that complies with Medicaid requirements, a Immediate Annuity Medicaid Compliant article provides valuable insights. This resource explores the specifics of annuities that meet Medicaid criteria.

- Inflation:Inflation erodes the purchasing power of money over time. To account for inflation, annuity providers may adjust their rates to ensure that the payments maintain their real value. Higher inflation rates generally lead to higher annuity rates.

- Mortality Rates:The likelihood of individuals living longer than expected affects the annuity rate. If mortality rates are lower than anticipated, annuity providers may need to offer higher rates to cover their obligations. Conversely, higher mortality rates can lead to lower rates.

- Market Volatility:Market fluctuations can impact the annuity rate, especially for variable annuities. During periods of high market volatility, providers may offer lower rates to mitigate their risk. Conversely, stable markets can lead to higher rates.

Impact of Interest Rates

Interest rates play a crucial role in determining immediate annuity rates. When interest rates rise, annuity providers can invest their funds at higher returns, allowing them to offer more attractive rates to annuitants. This creates a positive correlation between interest rates and annuity rates.

Conversely, when interest rates fall, annuity providers earn lower returns on their investments, leading to lower annuity rates.

Calculating the yearly payments you’ll receive from an annuity can be done using a dedicated tool. Annuity Calculator Yearly Payment 2024 provides a guide to using annuity calculators, helping you estimate your potential income stream.

Age Group Impact

The age group of the annuitant significantly influences the immediate annuity rate. Younger individuals have a longer life expectancy, meaning they will receive payments for a longer period. To account for this increased risk, annuity providers typically offer lower rates to younger annuitants.

Conversely, older individuals have a shorter life expectancy, leading to higher annuity rates. This is because the provider has to pay out fewer payments over a shorter period.

Have questions about annuity calculations? Annuity Calculation Questions And Answers 2024 provides a comprehensive resource, addressing common queries and offering clarity on various aspects of annuity calculations.

Understanding the Risks and Benefits of Immediate Annuities

Immediate annuities can be a valuable tool for retirement planning, but it’s essential to understand both their potential risks and benefits before making an investment decision.

Risks

- Interest Rate Risk:If interest rates rise after you purchase an immediate annuity, you may miss out on higher returns. This is because your annuity rate is fixed at the time of purchase.

- Inflation Risk:Inflation can erode the purchasing power of your annuity payments over time. If inflation is higher than anticipated, your payments may not keep pace with the rising cost of living.

- Longevity Risk:If you live longer than expected, your annuity payments may run out before you die. This risk is mitigated by purchasing a lifetime annuity, which guarantees payments for the rest of your life.

- Provider Risk:There is a risk that the annuity provider may become insolvent or unable to meet its obligations. This is a relatively small risk, as most annuity providers are regulated and backed by insurance guarantees.

Benefits

- Guaranteed Income:Immediate annuities provide a guaranteed stream of income for life, offering peace of mind and financial security in retirement.

- Inflation Protection:Some immediate annuities offer inflation protection, which adjusts payments to keep pace with rising prices. This helps to preserve the purchasing power of your income over time.

- Tax Advantages:Annuity payments are typically taxed as ordinary income, but there are tax advantages for certain types of annuities, such as qualified longevity annuities.

- Flexibility:Immediate annuities offer a range of options, such as different payment frequencies and payout periods, allowing you to tailor the product to your specific needs.

Comparison to Other Investment Options, Immediate Annuity Rate

| Investment Option | Advantages | Disadvantages |

|---|---|---|

| Immediate Annuities: | Guaranteed income, inflation protection, tax advantages, flexibility. | Interest rate risk, inflation risk, longevity risk, limited growth potential. |

| Stocks: | High growth potential, potential for dividends. | Volatility, risk of capital loss. |

| Bonds: | Lower risk than stocks, potential for interest income. | Lower returns than stocks, interest rate risk. |

| Real Estate: | Potential for appreciation, rental income. | High initial investment, illiquidity. |

Using Immediate Annuities for Retirement Planning

Immediate annuities can be a valuable tool for supplementing retirement income and ensuring financial security during your golden years. By converting a lump sum into a guaranteed income stream, you can reduce the risk of outliving your savings and enjoy peace of mind knowing that you have a reliable source of income for life.

Variable annuities offer investment flexibility. Variable Annuity Etf 2024 delves into the use of ETFs within variable annuities, exploring how these investment vehicles can enhance your portfolio.

Supplementing Retirement Income

Immediate annuities can provide a stable and predictable income stream that can supplement other sources of retirement income, such as Social Security, pensions, and savings withdrawals. This can help you maintain your desired lifestyle and cover essential expenses during retirement.

Step-by-Step Guide

- Assess Your Retirement Income Needs:Determine how much income you will need to cover your expenses during retirement, taking into account factors such as housing, healthcare, travel, and entertainment.

- Calculate Your Annuity Investment:Determine how much money you can afford to invest in an immediate annuity, considering your overall retirement savings and risk tolerance.

- Compare Annuity Providers:Shop around and compare annuity rates and features offered by different providers to find the best deal for your needs.

- Choose an Annuity Type:Select the type of immediate annuity that best suits your circumstances, such as a fixed, variable, or indexed annuity. Consider your risk tolerance and investment goals.

- Purchase the Annuity:Once you’ve selected an annuity provider and type, you can purchase the annuity and receive your first payment.

Retirement Income Scenario

Imagine a 65-year-old individual with $200,000 in savings. They decide to invest $100,000 in an immediate annuity with a rate of 4%. This would provide them with a guaranteed annual income of $4,000 for life. If they also receive $20,000 per year from Social Security and have $10,000 in annual expenses from savings, they would have a total annual retirement income of $34,000.

This income stream provides a solid foundation for their retirement, ensuring financial security and peace of mind.

When considering your retirement options, it’s natural to weigh the pros and cons of different investment strategies. A Variable Annuity Or Roth Ira 2024 article provides a helpful comparison, outlining the features and benefits of each approach.

Last Recap

Immediate annuities can be a valuable addition to your retirement planning toolkit, offering a consistent and predictable income stream that can help you achieve your financial goals. By carefully considering the risks and benefits, you can make an informed decision about whether an immediate annuity is the right fit for your unique situation.

The terms “annuity” and “pension” are often used interchangeably, but there are key distinctions. Is Annuity Same As Pension 2024 sheds light on these differences, helping you make informed decisions about your retirement income.

Question Bank: Immediate Annuity Rate

How do I choose the right immediate annuity?

Choosing the right immediate annuity depends on your individual needs and financial goals. It’s important to consider factors like your age, health, and desired income stream. Consulting with a financial advisor can help you make an informed decision.

Are there any tax implications for immediate annuities?

Yes, there are tax implications for immediate annuities. The income you receive from an annuity is typically taxed as ordinary income. However, there may be tax advantages depending on the type of annuity and your individual circumstances. It’s essential to consult with a tax professional for personalized advice.

What happens if I die before receiving all the income from my annuity?

If you die before receiving all the income from your annuity, your beneficiary may receive a lump sum payment or a continuation of the income stream, depending on the terms of the annuity contract. This is a factor to consider when choosing an annuity.

Are immediate annuities right for everyone?

Immediate annuities may not be suitable for everyone. They are typically best suited for individuals who are nearing retirement or who are seeking a guaranteed income stream. It’s important to weigh the risks and benefits carefully before making a decision.