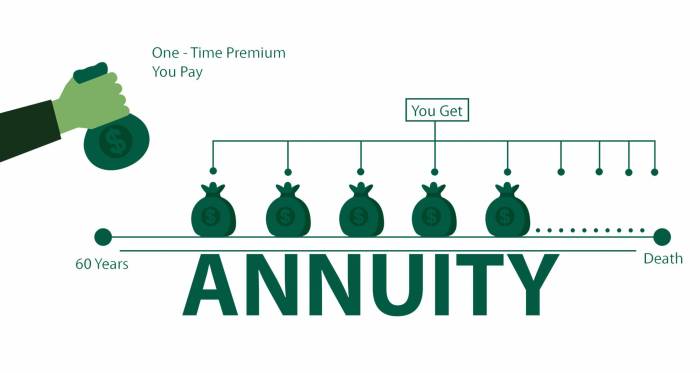

Immediate Annuity Single Premium, a financial product designed to provide guaranteed income streams for life, offers a unique approach to retirement planning. It allows individuals to convert a lump sum into a steady stream of payments, providing financial security and peace of mind during their golden years.

This type of annuity is particularly attractive for those seeking to eliminate the risk of outliving their savings and ensure a predictable income stream. It’s a valuable tool for individuals who want to simplify their retirement finances and enjoy the freedom of knowing their essential expenses are covered.

Contents List

- 1 What is an Immediate Annuity Single Premium?

- 2 Key Features of an Immediate Annuity Single Premium

- 3 Benefits of an Immediate Annuity Single Premium

- 4 Risks and Considerations of Immediate Annuity Single Premiums

- 5 Types of Immediate Annuity Single Premiums

- 6 Choosing the Right Immediate Annuity Single Premium

- 7 Immediate Annuity Single Premium in Retirement Planning

- 8 Tax Implications of Immediate Annuity Single Premiums

- 9 Last Word

- 10 Top FAQs

What is an Immediate Annuity Single Premium?

An immediate annuity single premium is a type of annuity contract that provides a stream of guaranteed income payments starting immediately after you make a lump-sum payment. This single premium is essentially the total amount you invest in the annuity.

In simpler terms, you trade a lump sum of money for a guaranteed income stream for life or a specific period.

Definition of an Immediate Annuity Single Premium

An immediate annuity single premium is a financial product that provides regular payments to an individual, typically for life or a set period, in exchange for a single, upfront payment. It’s designed to provide a predictable and reliable income stream, particularly during retirement.

An annuity can provide a steady stream of income, but it’s essential to understand the different types available. To learn more about the distinction between immediate and deferred annuities, you can find information here.

Examples of Immediate Annuity Single Premiums in Real-World Scenarios

Imagine you have a significant sum of money, say $100,000, and you’re looking for a secure way to generate income in retirement. You could purchase an immediate annuity single premium with this amount. The insurance company would then start paying you a monthly income based on your age, the premium amount, and the chosen payment period.Another example is a person who has received a large inheritance.

An annuity can be part of a qualified retirement plan, offering tax advantages. To determine if an annuity qualifies as a plan in 2024, you can find more information here.

They might choose to invest a portion of the inheritance in an immediate annuity single premium to ensure a consistent income stream for their later years.

Understanding the tax implications of an annuity is crucial. To determine if an annuity is taxable or not in 2024, you can find helpful information here. This will help you make informed financial decisions.

Key Features of an Immediate Annuity Single Premium

Immediate annuity single premiums are characterized by several key features that set them apart from other financial products.

Variable annuity contracts often include various guarantees to protect your investment. To learn about the guarantees typically found in variable annuity contracts in 2024, you can find more information here.

Primary Characteristics of Immediate Annuities

- Guaranteed Income:The primary feature of an immediate annuity is that it provides guaranteed income payments for a specific period or for life. This means you can rely on a predictable income stream, regardless of market fluctuations.

- Single Premium Payment:You make a single, lump-sum payment to purchase the annuity, which determines the amount of income you receive. This is different from other annuities that may involve periodic payments or flexible contributions.

- Immediate Payments:The income payments begin immediately after you make the single premium payment, offering instant income generation. This is a key advantage for individuals who need immediate income.

Key Features Differentiating Immediate Annuities

Immediate annuities differ from other financial products, such as traditional savings accounts or investments, in several ways. They provide a guaranteed income stream, while investments offer potential for growth but no guaranteed returns. Additionally, immediate annuities are typically less flexible than traditional investments, as they lock in your investment for a set period or for life.

If you’re looking to receive an annuity payment of $10,000 per month in 2024, you can find information about how to achieve this here. This can help you plan for your financial future.

Comparison with Other Types of Annuities

- Deferred Annuities:Deferred annuities allow you to invest a lump sum or make regular contributions over time, but the income payments don’t begin immediately. Instead, they start at a later date, often at retirement.

- Variable Annuities:Variable annuities offer the potential for growth but don’t guarantee income payments. The value of your annuity is tied to the performance of the underlying investments, which can fluctuate.

Benefits of an Immediate Annuity Single Premium

Immediate annuities offer several advantages, particularly for individuals seeking a guaranteed income stream.

An annuity number is a unique identifier for your annuity contract. To find information about annuity numbers in 2024, you can visit this link. This information can be helpful for managing your annuity.

Advantages of Investing in Immediate Annuities

- Guaranteed Income:The most significant benefit of an immediate annuity is the guaranteed income stream. This provides financial security and peace of mind, knowing you’ll receive regular payments for a set period or for life, regardless of market conditions.

- Predictability:Immediate annuities offer predictable income, allowing you to budget effectively and plan for future expenses with confidence. This can be especially valuable in retirement, where income sources may be less predictable.

- Longevity Protection:If you choose a lifetime annuity, you’ll receive payments for as long as you live. This protects you from outliving your savings and ensures a steady income stream even in your later years.

- Tax Advantages:In some cases, the income payments from an immediate annuity may be partially tax-deferred or tax-free, depending on the type of annuity and your individual circumstances. This can potentially reduce your overall tax liability.

Benefits for Individuals Seeking Guaranteed Income Streams

Immediate annuities are particularly well-suited for individuals seeking guaranteed income streams, such as retirees, those with significant lump sums, or those who want to protect their savings from market volatility. They can provide a stable and reliable income source, even in uncertain economic times.

The benefit base of a variable annuity is an essential factor to understand. To learn more about the variable annuity benefit base in 2024, you can find information here.

Table Summarizing Key Benefits of Immediate Annuities, Immediate Annuity Single Premium

| Benefit | Description |

|---|---|

| Guaranteed Income | Provides a steady stream of income for a specific period or for life. |

| Predictability | Offers predictable income payments, allowing for effective budgeting and financial planning. |

| Longevity Protection | Ensures income payments for as long as you live, protecting you from outliving your savings. |

| Tax Advantages | May offer tax-deferred or tax-free income payments, potentially reducing your overall tax liability. |

Risks and Considerations of Immediate Annuity Single Premiums

While immediate annuities offer several benefits, it’s essential to understand the potential risks and considerations before investing.

Potential Risks Associated with Immediate Annuities

- Interest Rate Risk:The interest rates at the time you purchase the annuity can significantly impact the amount of income you receive. If interest rates rise after you buy the annuity, you might receive a lower income payment than if you had purchased it at a later date when rates were higher.

If you’re considering an immediate annuity, understanding historical interest rates can be beneficial. You can find information about immediate annuity historical interest rates here. This can help you assess potential returns and make informed decisions.

- Inflation Risk:Inflation can erode the purchasing power of your income payments over time. If inflation rises faster than the growth of your annuity payments, your income may not keep pace with the rising cost of living.

- Longevity Risk:If you live longer than expected, your annuity payments may run out before you do, leaving you without a source of income. This is particularly a concern for individuals who purchase annuities with a fixed payment period.

- Insurer Risk:The financial stability of the insurance company issuing your annuity is crucial. If the insurer becomes insolvent, you may not receive your promised payments.

Factors Impacting the Return on an Immediate Annuity

Several factors can impact the return on an immediate annuity, including:

- Your Age:Younger individuals typically receive lower income payments than older individuals, as they are expected to live longer and receive payments for a longer period.

- Interest Rates:As mentioned earlier, interest rates at the time of purchase play a significant role in determining the income payment amount.

- Annuity Type:Different types of immediate annuities offer varying payment structures and features, which can impact your return.

Flowchart Illustrating the Decision-Making Process

[Flowchart illustrating the decision-making process for choosing an immediate annuity single premium. The flowchart should include steps such as:

- Determine your financial goals and needs.

- Consider your risk tolerance and investment horizon.

- Research and compare different annuity options.

- Evaluate the financial stability of the insurance company.

- Consult with a financial advisor.]

Types of Immediate Annuity Single Premiums

Immediate annuities come in various types, each offering unique features and benefits.

Variable annuities offer flexibility, but it’s important to consider hedging strategies. To learn more about variable annuity hedging strategies in 2024, you can find helpful information here.

List of Different Types of Immediate Annuities

- Fixed Annuity:Provides a fixed, guaranteed income payment for life or a set period. The payment amount is determined at the time of purchase and remains constant, regardless of market fluctuations.

- Variable Annuity:Offers income payments that fluctuate based on the performance of underlying investments. The value of your annuity can increase or decrease depending on market conditions.

- Indexed Annuity:Links the income payments to the performance of a specific index, such as the S&P 500. The payments may increase or decrease based on the index’s performance, providing potential for growth while offering some protection against market losses.

- Guaranteed Lifetime Withdrawal Benefit (GLWB):This type of annuity provides a guaranteed minimum income payment for life, even if the underlying investments perform poorly. It offers protection against longevity risk and ensures a minimum income stream.

Features and Benefits of Each Type of Immediate Annuity

- Fixed Annuity:Offers guaranteed income payments, providing stability and predictability. However, the fixed payment amount may not keep pace with inflation.

- Variable Annuity:Offers potential for growth but doesn’t guarantee income payments. The value of your annuity is subject to market fluctuations, which can be risky.

- Indexed Annuity:Combines potential for growth with some protection against market losses. The payments are linked to an index, providing a balance between stability and growth potential.

- GLWB:Provides a guaranteed minimum income payment for life, offering longevity protection and ensuring a steady income stream. However, the minimum payment may be lower than the potential income based on investment performance.

Suitability of Different Types of Immediate Annuities

The suitability of each type of immediate annuity depends on individual circumstances, risk tolerance, and financial goals.

- Fixed Annuities:Best suited for individuals seeking guaranteed income and stability, with a low risk tolerance. They are suitable for those who prioritize predictable income over potential growth.

- Variable Annuities:May be suitable for individuals with a higher risk tolerance who are seeking potential for growth. However, they are not appropriate for those who need guaranteed income or who are risk-averse.

- Indexed Annuities:Offer a balance between potential growth and protection against market losses. They may be suitable for individuals with a moderate risk tolerance who are looking for a combination of stability and growth potential.

- GLWB:Suitable for individuals who want to protect against longevity risk and ensure a minimum income stream for life. They are appropriate for those who prioritize longevity protection and need guaranteed income payments.

Choosing the Right Immediate Annuity Single Premium

Selecting the right immediate annuity is crucial for maximizing your income and achieving your financial goals.

If you’re seeking quotes for an immediate annuity from Vanguard, you can find them here. These quotes can help you compare different annuity options and make informed decisions.

Step-by-Step Guide for Selecting an Appropriate Immediate Annuity

- Determine Your Financial Goals and Needs:Identify your specific income requirements, desired payment frequency, and longevity protection needs.

- Consider Your Risk Tolerance and Investment Horizon:Assess your comfort level with market volatility and your time horizon for receiving income payments.

- Research and Compare Different Annuity Options:Explore various annuity types, payment structures, and features offered by different insurance companies.

- Evaluate the Financial Stability of the Insurance Company:Ensure the insurer is financially sound and has a strong track record of paying claims.

- Consult with a Financial Advisor:Seek professional advice from a qualified financial advisor to help you choose the annuity that best aligns with your individual circumstances and financial goals.

Factors to Consider When Evaluating Different Immediate Annuity Options

- Payment Amount:Compare the income payments offered by different annuities based on your premium amount, age, and chosen payment period.

- Payment Frequency:Determine the frequency of payments that best suits your needs, such as monthly, quarterly, or annually.

- Payment Period:Choose a payment period that aligns with your desired income stream, such as for life, for a specific number of years, or until a certain age.

- Fees and Expenses:Compare the fees and expenses associated with different annuities, including administrative fees, surrender charges, and mortality charges.

- Guarantees:Assess the guarantees offered by each annuity, such as guaranteed income payments, minimum payments, or death benefits.

Checklist of Essential Questions to Ask Before Purchasing an Immediate Annuity

- What is the guaranteed income payment amount?

- What is the payment frequency?

- What is the payment period?

- What are the fees and expenses associated with the annuity?

- What guarantees are offered, such as guaranteed income payments, minimum payments, or death benefits?

- What is the financial stability of the insurance company issuing the annuity?

- What are the tax implications of the annuity?

Immediate Annuity Single Premium in Retirement Planning

Immediate annuities can play a vital role in retirement planning, providing a steady and predictable income stream.

While an IRA and an annuity share similarities, they are distinct financial instruments. To clarify the differences between an annuity and an IRA in 2024, you can find helpful information here.

Role of Immediate Annuities in Retirement Planning

Immediate annuities can supplement other retirement income sources, such as Social Security, pensions, and savings. They can provide a guaranteed income stream, reducing reliance on volatile investments and offering financial security in retirement.

Variable annuities, often classified as Class A, B, or C, can offer different fee structures and investment options. If you’re looking for information on Class B variable annuities in 2024, you can find it here.

How Immediate Annuities Can Supplement Other Retirement Income Sources

Imagine a retiree receiving $2,000 per month from Social Security and $1,000 per month from a pension. To supplement their income, they could purchase an immediate annuity with a portion of their savings, providing an additional $1,500 per month in guaranteed income.

This would increase their total monthly income to $4,500, enhancing their financial security and allowing for a more comfortable retirement.

When considering an immediate needs annuity, it’s essential to evaluate the costs involved. To help you understand the costs associated with an immediate needs annuity in the UK, you can use a calculator here. This tool can provide valuable insights into the financial aspects of your decision.

Examples of How Immediate Annuities Can Be Used to Achieve Specific Retirement Goals

- Covering Essential Expenses:Immediate annuities can provide a reliable income stream to cover essential expenses, such as housing, healthcare, and utilities, in retirement.

- Generating Income for Travel and Leisure:Retirees can use immediate annuities to generate income for travel, hobbies, and other leisure activities, enhancing their quality of life in retirement.

- Providing a Legacy for Loved Ones:Some immediate annuities offer death benefits, allowing retirees to leave a financial legacy for their loved ones.

Tax Implications of Immediate Annuity Single Premiums

The tax implications of immediate annuities can vary depending on the type of annuity and your individual circumstances.

Variable annuities can be classified as qualified or non-qualified, depending on the source of funding. To learn more about the differences between qualified and non-qualified variable annuities in 2024, you can find helpful information here.

Tax Implications of Immediate Annuities

- Tax Treatment of Premium Payments:The premium payment you make to purchase an immediate annuity is generally not tax-deductible. However, the income payments you receive from the annuity may be subject to taxation.

- Taxation of Income Payments:The income payments from an immediate annuity are typically taxed as ordinary income. The specific tax treatment depends on the type of annuity and whether the payments are considered to be interest, dividends, or capital gains.

- Tax-Deferred Annuities:Some types of annuities, such as deferred annuities, allow for tax-deferred growth. This means that the earnings on your investment are not taxed until you begin receiving income payments. However, the income payments are typically taxed as ordinary income.

- Tax-Free Annuities:Some annuities, such as qualified retirement annuities, may offer tax-free income payments. However, these annuities are subject to specific eligibility requirements.

Tax Considerations for Retirees Receiving Income from Immediate Annuities

- Tax Brackets:The tax bracket you fall into will determine the tax rate applied to your annuity income payments.

- Withholding:The insurance company issuing your annuity may withhold taxes from your income payments. You can adjust your withholding amount to reflect your individual tax situation.

- Tax Reporting:You will need to report your annuity income on your tax return. The specific form and instructions will depend on the type of annuity you have.

Last Word

Immediate Annuity Single Premium presents a compelling option for individuals seeking a secure and predictable income stream during retirement. While it’s essential to carefully consider the potential risks and factors that can impact returns, the benefits of guaranteed income and financial security make it a worthwhile investment for many retirees.

By understanding the features, benefits, and potential drawbacks, individuals can make informed decisions and determine if an Immediate Annuity Single Premium aligns with their unique retirement goals.

Top FAQs

What are the tax implications of an Immediate Annuity Single Premium?

The tax implications of an Immediate Annuity Single Premium can vary depending on the specific type of annuity and the individual’s tax situation. In general, the payments received from an immediate annuity are taxed as ordinary income, with the portion representing the return of principal being tax-free.

How do I choose the right Immediate Annuity Single Premium?

Choosing the right Immediate Annuity Single Premium involves considering factors such as your age, health, risk tolerance, and financial goals. It’s essential to compare different annuity options from reputable providers and consult with a financial advisor to ensure you select a product that aligns with your individual needs.

Can I withdraw my principal investment from an Immediate Annuity Single Premium?

Immediate Annuity Single Premiums are typically non-refundable, meaning you cannot withdraw your principal investment once you purchase the annuity. However, some types of immediate annuities may offer limited withdrawal options or death benefits for beneficiaries.