Immediate Annuity Taxation is a critical aspect of retirement planning, as it directly impacts the amount of income you receive and the taxes you pay. Understanding the tax implications of immediate annuities is crucial for maximizing your retirement income and minimizing your tax burden.

Immediate annuities provide a guaranteed stream of income for life, but the tax treatment of these payments can vary depending on the type of annuity contract and the individual’s tax situation. This guide explores the key tax considerations for immediate annuities, including the taxability of payments, the tax implications of surrendering the contract, and the potential tax consequences for estate planning purposes.

Immediate needs annuities can be a valuable tool for covering unexpected expenses. This article on Immediate Needs Annuity Examples provides real-world scenarios to illustrate how they can work.

Contents List

Introduction to Immediate Annuities

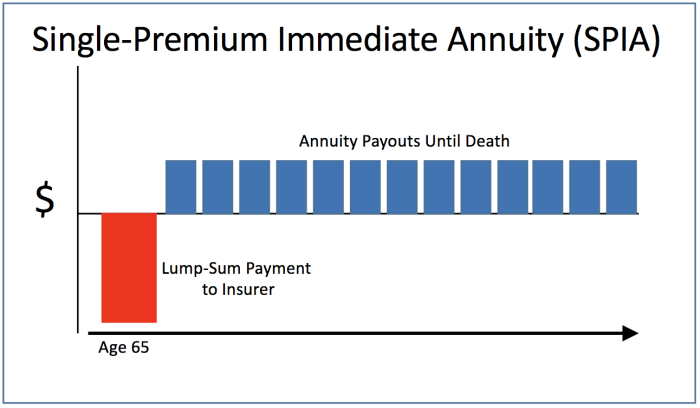

An immediate annuity is a type of insurance contract that provides a stream of regular payments to the annuitant, starting immediately upon purchase. These annuities are popular among individuals seeking a guaranteed income stream during retirement or for other financial planning purposes.

Thinking about annuities in the UK? This resource on Calculate Annuity Uk 2024 can help you understand the process and how to calculate your potential income in the UK.

Key Features and Characteristics

Immediate annuities are characterized by several key features that distinguish them from other types of annuities. These features include:

- Guaranteed Income Stream:The most defining feature of an immediate annuity is the guarantee of regular payments for the annuitant’s lifetime. This provides financial security and predictability in retirement.

- Immediate Payments:Payments begin immediately upon purchase of the annuity, making it an ideal option for those who need income right away.

- Fixed or Variable Payments:Immediate annuities can offer either fixed or variable payment options. Fixed annuities provide a guaranteed payment amount, while variable annuities offer payments that fluctuate based on the performance of underlying investments.

- Lump Sum Purchase:Immediate annuities typically require a lump sum payment at the time of purchase. This payment is used to fund the annuity contract.

- No Death Benefit:Unlike deferred annuities, immediate annuities typically do not offer a death benefit. If the annuitant dies before receiving all the payments, the remaining payments are usually forfeited.

Immediate Annuities vs. Deferred Annuities

Immediate annuities differ from deferred annuities in terms of when payments begin and the flexibility they offer.

- Immediate Annuities:Payments start immediately upon purchase. They provide guaranteed income right away, making them suitable for individuals who need income now.

- Deferred Annuities:Payments are deferred to a future date, allowing for potential growth of the invested funds. They offer greater flexibility and may be suitable for individuals who are further away from retirement.

Taxation of Immediate Annuities

The tax treatment of immediate annuity payments depends on the type of annuity contract and the specific provisions of the contract.

Tax Treatment of Annuity Payments

In general, the payments received from an immediate annuity are taxed as ordinary income. The portion of each payment that represents a return of the annuitant’s principal is tax-free, while the remaining portion is considered taxable interest income.

The potential returns of an immediate annuity can vary depending on several factors. This article on Immediate Annuity Returns can help you understand the potential benefits and risks.

Tax Implications Based on Annuity Contract Type

The tax implications of annuity payments can vary depending on the type of annuity contract. For example, payments from a fixed annuity are typically taxed as ordinary income, while payments from a variable annuity may have different tax consequences.

Planning to use a significant sum for an annuity? This article on Annuity $400 000 2024 might provide insights into the potential income you could receive from a $400,000 annuity.

- Fixed Annuities:Payments from fixed annuities are typically taxed as ordinary income. The portion of each payment that represents a return of the annuitant’s principal is tax-free, while the remaining portion is considered taxable interest income.

- Variable Annuities:Payments from variable annuities can be more complex. The portion of each payment that represents a return of the annuitant’s principal is tax-free, while the remaining portion is taxed as capital gains or losses, depending on the performance of the underlying investments.

Did you know that the first variable annuity was introduced in 1952? Learn more about the history of this financial product by reading this article on First Variable Annuity In 1952 2024.

Taxability of Principal and Interest Components

The taxability of annuity payments depends on the portion of the payment that represents a return of the annuitant’s principal and the portion that represents interest income.

The annuity rate is a crucial factor in determining your potential income. This article on Annuity Rate Is 2024 explains how the rate is determined and its impact on your payouts.

- Principal:The portion of each payment that represents a return of the annuitant’s principal is generally tax-free.

- Interest:The portion of each payment that represents interest income is taxed as ordinary income.

Taxable Events and Considerations: Immediate Annuity Taxation

Certain events related to immediate annuities can trigger tax consequences for the annuitant.

yang mengintegrasikan link ke dalam teks untuk setiap topik yang Anda berikan:

When choosing between a variable annuity and a fixed annuity, understanding the potential risks and rewards is crucial. A Variable Annuity Versus Fixed Annuity 2024 article can help you weigh the options based on your individual financial goals and risk tolerance.

Surrendering an Annuity Contract

If an annuitant surrenders an immediate annuity contract before receiving all the payments, the proceeds from the surrender are generally taxed as ordinary income. The portion of the proceeds that represents a return of the annuitant’s principal is tax-free, while the remaining portion is considered taxable interest income.

Curious about the accumulation period of an immediate annuity? This article on Immediate Annuity Accumulation Period will explain how your funds grow before payments begin.

Death Benefits from an Immediate Annuity

Immediate annuities typically do not offer a death benefit. However, if the annuity contract does provide a death benefit, the proceeds from the death benefit are generally taxed as ordinary income to the beneficiary.

Navigating the world of variable annuities can be confusing, but understanding the terminology is crucial. Check out this article on Variable Annuity Terminology 2024 to demystify the jargon and make informed decisions.

Estate Planning Implications

Immediate annuities can be used for estate planning purposes. However, it is important to consider the potential tax consequences. For example, if an immediate annuity is included in an estate, the value of the annuity may be subject to estate taxes.

Understanding the fees associated with an immediate annuity is important before making a decision. Read this article on Immediate Annuity Fees to learn about potential costs and how they can impact your returns.

Tax Planning Strategies

There are several strategies that annuitants can use to minimize the tax impact of immediate annuity income.

Looking for a specific annuity payout rate? This article on 5 Percent Annuity 2024 might be helpful in understanding how a 5% annuity rate could work for you.

Minimizing Tax Impact

Annuitants can use the following strategies to minimize the tax impact of their immediate annuity income:

- Consider the Annuity Contract Type:Different types of annuity contracts have different tax implications. For example, fixed annuities typically have simpler tax treatment than variable annuities.

- Choose Payment Options Carefully:Annuitants can choose different payment options that may affect the tax treatment of their annuity income. For example, choosing a payment option that provides a higher initial payment may result in higher taxable income in the early years.

- Maximize Tax-Free Principal:Annuitants should try to maximize the portion of their annuity payments that represents a return of their principal, as this portion is tax-free.

- Consider Tax-Efficient Withdrawal Strategies:Annuitants can consider tax-efficient withdrawal strategies to minimize the tax impact of their annuity income. For example, they may want to withdraw a smaller amount of income in years when they are in a lower tax bracket.

Tax-Efficient Ways to Purchase and Manage Immediate Annuities

There are several tax-efficient ways to purchase and manage immediate annuities:

- Purchase with Tax-Advantaged Funds:Annuitants can consider purchasing immediate annuities with tax-advantaged funds, such as a traditional IRA or a 401(k). This can help reduce the tax impact of annuity payments.

- Use a Roth IRA:Annuitants can consider purchasing immediate annuities with funds from a Roth IRA. This can allow for tax-free withdrawals of annuity payments in retirement.

- Consult with a Financial Advisor:Annuitants should consult with a financial advisor to discuss tax-efficient strategies for purchasing and managing immediate annuities.

Tax-Advantaged Accounts, Immediate Annuity Taxation

Using tax-advantaged accounts for immediate annuity investments can offer tax benefits.

- Traditional IRA:Contributions to a traditional IRA may be tax-deductible, and withdrawals are taxed as ordinary income in retirement. This can be a tax-efficient way to purchase an immediate annuity.

- Roth IRA:Contributions to a Roth IRA are not tax-deductible, but withdrawals are tax-free in retirement. This can be a tax-efficient way to purchase an immediate annuity if the annuitant expects to be in a higher tax bracket in retirement.

- 401(k):Contributions to a 401(k) may be tax-deductible, and withdrawals are taxed as ordinary income in retirement. This can be a tax-efficient way to purchase an immediate annuity if the annuitant is still employed.

Illustrative Examples

The following examples illustrate the tax treatment of immediate annuities in different scenarios.

Tax implications are a crucial factor to consider when dealing with variable annuities. Check out this article on Variable Annuity Tax 2024 to understand how taxes might affect your income and investment growth.

Table of Annuity Scenarios and Tax Implications

| Scenario | Annuity Type | Tax Implications |

|---|---|---|

| Annuitant purchases a fixed immediate annuity with a lump sum payment of $100,000. The annuity contract provides for annual payments of $6,000 for life. | Fixed Annuity | The portion of each payment that represents a return of the annuitant’s principal is tax-free, while the remaining portion is considered taxable interest income. |

| Annuitant purchases a variable immediate annuity with a lump sum payment of $100,000. The annuity contract provides for annual payments that fluctuate based on the performance of underlying investments. | Variable Annuity | The portion of each payment that represents a return of the annuitant’s principal is tax-free, while the remaining portion is taxed as capital gains or losses, depending on the performance of the underlying investments. |

| Annuitant surrenders an immediate annuity contract before receiving all the payments. The proceeds from the surrender are $80,000. | Surrendered Annuity | The proceeds from the surrender are generally taxed as ordinary income. The portion of the proceeds that represents a return of the annuitant’s principal is tax-free, while the remaining portion is considered taxable interest income. |

Example: Immediate Annuity Purchased with a Roth IRA

Annuitant purchases an immediate annuity with a lump sum payment of $100,000 from a Roth IRA. The annuity contract provides for annual payments of $6,000 for life. The payments from the annuity are tax-free because the annuity was purchased with funds from a Roth IRA.

Planning for retirement and want to calculate your potential annuity payouts? A Annuity Calculator Xls 2024 can help you estimate your income based on different factors like age, savings, and interest rates.

Example: Immediate Annuity Inherited by a Beneficiary

Annuitant dies before receiving all the payments from an immediate annuity. The beneficiary inherits the remaining payments from the annuity. The beneficiary will be taxed on the portion of each payment that represents interest income.

Closure

Navigating the complexities of immediate annuity taxation requires careful planning and consideration. By understanding the tax implications of immediate annuities, individuals can make informed decisions about their retirement income strategies and minimize their tax liabilities. Whether you are considering purchasing an immediate annuity or already own one, it is essential to consult with a qualified financial advisor to ensure you are making the most tax-efficient choices for your retirement planning.

FAQ Compilation

What is the difference between a traditional IRA and a Roth IRA for immediate annuities?

Want to understand the basics of immediate annuities? An Immediate Annuity Definition will clarify the key aspects of this financial tool and how it can potentially provide guaranteed income.

A traditional IRA allows for pre-tax contributions, meaning you pay taxes on the distributions in retirement. A Roth IRA allows for after-tax contributions, meaning you pay no taxes on the distributions in retirement. When purchasing an immediate annuity with a traditional IRA, the payments will be taxed as ordinary income.

When purchasing an immediate annuity with a Roth IRA, the payments will be tax-free.

Can I deduct the cost of an immediate annuity on my taxes?

Dreaming of a consistent monthly income stream? An annuity can provide that. Check out this article on Annuity 1000 Per Month 2024 to learn how you can potentially secure a $1,000 monthly payment for life.

You cannot deduct the cost of an immediate annuity on your taxes. However, the payments you receive from the annuity will be taxed as ordinary income.

What happens to the remaining value of an immediate annuity after death?

The remaining value of an immediate annuity after death will be included in the deceased’s estate and may be subject to estate taxes. However, if the beneficiary is a spouse, they may be able to roll over the remaining value into their own annuity without incurring any tax liability.