Immediate Annuity Usage is a powerful financial tool that offers guaranteed income for life, providing peace of mind for individuals seeking a reliable stream of income during retirement. Immediate annuities are particularly attractive to those who desire a predictable income stream, eliminating the uncertainty associated with market fluctuations.

While annuities can provide a stream of income in retirement, it’s important to understand the tax implications. The rules regarding annuity income taxation can vary depending on your location. For example, if you live in the UK, you may need to pay taxes on your annuity income.

It’s important to consult with a financial advisor to understand how the tax laws in your country will affect your annuity payments. You can find more information on the tax implications of annuities in the UK.

By converting a lump sum of money into a series of regular payments, immediate annuities provide a stable and consistent source of income, allowing retirees to focus on enjoying their golden years without worrying about outliving their savings.

If you’re considering a TSP annuity, you’ll need to understand how to calculate your potential payments. You can find more information on the TSP website or by consulting with a financial advisor.

Contents List

- 1 What is an Immediate Annuity?: Immediate Annuity Usage

- 2 How Immediate Annuities Work

- 3 Uses of Immediate Annuities

- 4 Immediate Annuity Considerations

- 5 Immediate Annuity vs. Other Investment Options

- 6 Tax Implications of Immediate Annuities

- 7 Case Studies of Immediate Annuity Usage

- 8 Future Trends in Immediate Annuity Usage

- 9 Final Conclusion

- 10 Popular Questions

What is an Immediate Annuity?: Immediate Annuity Usage

An immediate annuity is a financial product that provides a guaranteed stream of income payments for life, starting immediately after the purchase. These annuities are designed to provide a steady source of income for retirees or individuals seeking financial security.

Core Features of an Immediate Annuity

Immediate annuities are characterized by the following core features:

- Guaranteed Income Payments:Annuity payments are guaranteed for life, regardless of how long the annuitant lives.

- Immediate Payment Commencement:Income payments begin immediately after the purchase, providing instant financial security.

- Lump Sum Investment:A single lump sum payment is required to purchase an immediate annuity.

- Fixed or Variable Payments:Payments can be fixed or variable, depending on the type of annuity chosen.

Differences Between Immediate and Deferred Annuities, Immediate Annuity Usage

The key difference between immediate and deferred annuities lies in the timing of income payments. While immediate annuities start paying out immediately, deferred annuities have a delayed payment commencement, typically starting at a future date.

Annuities can be a valuable tool for retirement planning, but it’s important to understand how they work and how they might fit into your overall retirement plan. You can find more information on the use of annuities in retirement planning.

| Feature | Immediate Annuity | Deferred Annuity |

|---|---|---|

| Payment Commencement | Immediately after purchase | At a future date |

| Investment Type | Lump sum | Regular contributions or a lump sum |

| Flexibility | Less flexible, as payments begin immediately | More flexible, as payments can be delayed |

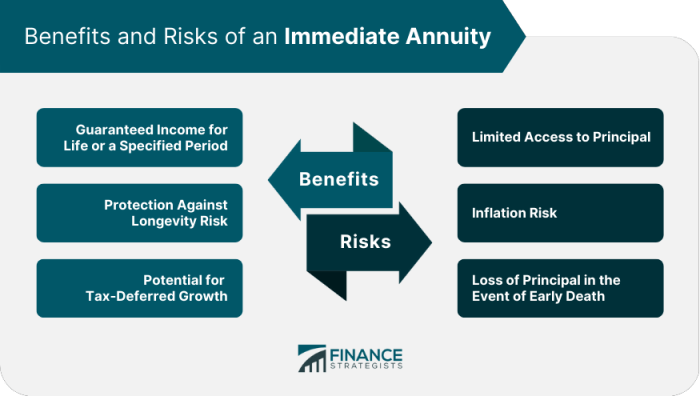

Advantages and Disadvantages of Immediate Annuities

Immediate annuities offer several advantages, but they also have potential drawbacks. It’s essential to weigh these factors carefully before making a decision.

If you’re receiving payments from an annuity, you may be wondering how your payments will be taxed. It’s important to understand how the tax laws apply to your specific situation. The IRS provides guidance on how to calculate the taxable portion of your annuity payments, and you can also find information on the IRS website.

Advantages:

- Guaranteed Income:Provides a predictable and reliable source of income for life.

- Longevity Protection:Protects against outliving your savings, ensuring a steady income stream even in your later years.

- Simplicity:Relatively easy to understand and purchase compared to other investment options.

Disadvantages:

- Limited Flexibility:Once purchased, the annuity contract is generally non-refundable, limiting your ability to access your funds.

- Potential for Lower Returns:Returns on immediate annuities may be lower compared to other investment options, such as stocks or bonds.

- Inflation Risk:Fixed annuity payments may not keep pace with inflation, eroding the purchasing power of your income over time.

How Immediate Annuities Work

Purchasing an immediate annuity involves a straightforward process, starting with choosing the right annuity product and provider.

Annuity payments can be a valuable source of income in retirement, but it’s important to understand how to calculate the present value of these payments. This will help you to determine how much money you’ll need to invest today to receive a certain amount of income in the future.

You can find more information on the calculation of annuity present values.

Purchasing an Immediate Annuity

- Choose an Annuity Provider:Compare different annuity providers and their offerings to find the best fit for your needs and risk tolerance.

- Determine Annuity Type:Select the type of immediate annuity that aligns with your financial goals, such as fixed, variable, or indexed.

- Specify Payment Options:Decide on the frequency and duration of your annuity payments, considering your income needs and lifestyle preferences.

- Provide Funding:Make a lump sum payment to the annuity provider to secure your guaranteed income stream.

Annuity Payment Calculation and Structure

Annuity payments are calculated based on factors such as the purchase price, the annuitant’s age, gender, and chosen payment options. The payment structure can vary depending on the annuity type, with options like:

- Life Annuity:Payments continue for the lifetime of the annuitant.

- Period Certain Annuity:Payments are guaranteed for a specific period, even if the annuitant dies before the period ends.

- Joint Life Annuity:Payments continue as long as at least one of two annuitants is alive.

Types of Immediate Annuities

Immediate annuities are available in various types, each with its own characteristics and potential benefits:

- Fixed Annuities:Offer a fixed, guaranteed rate of return, providing predictable income payments.

- Variable Annuities:Payments fluctuate based on the performance of underlying investments, potentially offering higher returns but also carrying greater risk.

- Indexed Annuities:Payments are linked to the performance of a specific index, such as the S&P 500, offering potential growth with downside protection.

Uses of Immediate Annuities

Immediate annuities can serve a variety of financial purposes, providing individuals with a reliable and predictable source of income for various needs.

If you’re looking for a way to calculate the present value of an annuity, there are a number of calculators available online. You can also use a financial calculator like the TI-84 to perform these calculations. You can find more information on the TI-84 calculator website.

Retirement Income

Immediate annuities are a popular choice for retirees seeking a guaranteed stream of income to cover their living expenses. They can provide a consistent income stream that complements other retirement savings and investments.

Income for Life

For individuals who desire a lifelong source of income, immediate annuities offer a guaranteed stream of payments that continues until their death. This can provide peace of mind and financial security for the long term.

Legacy Planning

Immediate annuities can be used to create a legacy for loved ones. By purchasing a joint life annuity, individuals can ensure that their beneficiaries will receive income payments even after their death.

Addressing Specific Financial Needs

Immediate annuities can be tailored to address specific financial needs, such as:

- Covering Essential Expenses:Provide a reliable income stream to cover essential expenses, such as housing, utilities, and healthcare.

- Supplementing Existing Income:Boost existing income sources, providing additional financial support during retirement or other life stages.

- Funding Long-Term Care:Help cover the costs of long-term care services, providing financial protection against unexpected healthcare expenses.

Immediate Annuity Considerations

Before purchasing an immediate annuity, it’s crucial to carefully consider various factors to ensure it aligns with your financial goals and risk tolerance.

Variable annuities are complex financial products, and it’s important to choose a reputable company to work with. You can find more information on the variable annuity offerings of different life insurance companies.

Assessing Financial Goals and Risk Tolerance

It’s essential to evaluate your individual financial needs and risk tolerance before investing in an immediate annuity. Consider factors such as:

- Income Needs:Determine the amount of income you require to cover your living expenses.

- Time Horizon:Consider your expected lifespan and the duration of your income needs.

- Risk Tolerance:Assess your comfort level with different levels of investment risk.

Comparing Annuity Providers and Offerings

Different annuity providers offer a wide range of products and features. It’s essential to compare and contrast their offerings to find the best fit for your needs, considering factors such as:

- Interest Rates and Returns:Compare the interest rates and potential returns offered by different providers.

- Fees and Expenses:Evaluate the fees and expenses associated with each annuity product.

- Payment Options:Consider the flexibility and customization of payment options offered.

- Financial Strength and Stability:Research the financial strength and stability of the annuity provider to ensure their long-term viability.

Immediate Annuity vs. Other Investment Options

Immediate annuities should be compared with other retirement income options to determine the most suitable approach for your financial situation.

Annuities can be a valuable tool for retirement planning. They can provide a guaranteed stream of income for life, which can help to ensure that you have enough money to live on in your later years. If you’re considering an annuity, it’s important to understand how they work and how they might fit into your overall retirement plan.

You can find more information on the use of annuities in retirement planning.

Comparison with Stocks, Bonds, and Real Estate

Immediate annuities can be compared with other common investment options, such as stocks, bonds, and real estate, considering their potential benefits and drawbacks:

| Investment Option | Potential Benefits | Potential Drawbacks |

|---|---|---|

| Stocks | Higher potential returns, potential for growth | Volatility, risk of losing principal |

| Bonds | Lower risk than stocks, steady income | Lower returns than stocks, potential for interest rate risk |

| Real Estate | Potential for appreciation, rental income | Illiquidity, high maintenance costs |

| Immediate Annuities | Guaranteed income for life, longevity protection | Lower potential returns than other investments, limited flexibility |

Scenarios for Immediate Annuity Suitability

Immediate annuities may be a suitable choice in specific scenarios, such as:

- Risk-Averse Investors:Individuals seeking a guaranteed income stream with minimal investment risk.

- Long-Term Income Needs:Retirees or individuals with a long-term need for predictable income.

- Longevity Concerns:Individuals concerned about outliving their savings and ensuring a steady income stream in their later years.

Tax Implications of Immediate Annuities

The tax treatment of immediate annuity payments depends on the type of annuity and the specific tax rules in place.

While variable annuities offer the potential for growth, they also come with some risks. It’s important to understand what a variable annuity guarantees. For example, they may offer a minimum death benefit or a guaranteed income stream in retirement.

However, it’s crucial to read the fine print and understand the terms and conditions of the annuity before making a decision.

Tax Treatment of Annuity Payments

Annuity payments are generally taxed as ordinary income. The portion of each payment that represents a return of your original investment is tax-free, while the remaining portion is taxed as income. The tax treatment can vary depending on the type of annuity.

Tax Strategies Related to Immediate Annuities

Tax strategies related to immediate annuities can help minimize your tax burden. Some strategies include:

- Tax-Deferred Annuities:Consider purchasing a tax-deferred annuity, where payments are taxed only when withdrawn in retirement.

- Structured Settlements:Explore structured settlements, which can provide tax advantages for certain types of annuity payments.

- Consult with a Tax Advisor:Consult with a qualified tax advisor to understand the tax implications of your specific annuity product and develop a tax plan that minimizes your liability.

Case Studies of Immediate Annuity Usage

Real-world examples illustrate how immediate annuities have been used effectively to address various financial needs.

Case Study 1: Retirement Income Security

A retired teacher, concerned about outliving their savings, purchased a fixed immediate annuity to provide a guaranteed income stream for life. This annuity provided peace of mind and ensured they had a reliable source of income to cover their living expenses.

Annuities can be a complex financial product, but they can also be a valuable tool for retirement planning. If you’re considering an annuity, it’s important to understand how they work and how they might fit into your overall retirement plan.

You can find more information on the calculation of annuity payments.

Case Study 2: Funding Long-Term Care

An elderly couple, worried about the potential costs of long-term care, purchased a joint life immediate annuity to provide a stream of income for their future care needs. This annuity helped them protect their assets and ensure they had financial resources for long-term care expenses.

Case Study 3: Legacy Planning

A successful entrepreneur, wanting to leave a legacy for their children, purchased a joint life immediate annuity with their spouse. This annuity provided a guaranteed income stream for their children even after their death, ensuring their financial security and preserving their legacy.

Immediate annuities are a popular choice for retirees because they provide a guaranteed stream of income for life. However, it’s important to understand the tax implications of these annuities. The IRS website provides information on the tax treatment of immediate annuities.

Future Trends in Immediate Annuity Usage

The immediate annuity market is expected to evolve as retirement planning trends and financial needs shift.

Changes in the Immediate Annuity Market

Potential changes in the immediate annuity market include:

- Increased Demand:As individuals live longer and seek financial security in retirement, the demand for immediate annuities is likely to increase.

- Product Innovation:Annuity providers are likely to introduce new products and features to meet evolving customer needs.

- Technological Advancements:Technology is expected to play a greater role in annuity distribution and management, making it easier for individuals to access and manage their annuities.

Emerging Trends in Retirement Planning

Emerging trends in retirement planning, such as the increasing popularity of retirement income planning and the growing need for longevity protection, are likely to drive the demand for immediate annuities.

Potential Innovations in Immediate Annuity Products and Services

Potential innovations in immediate annuity products and services include:

- Hybrid Annuities:Combining features of fixed and variable annuities to offer greater flexibility and potential returns.

- Personalized Annuities:Tailoring annuity products to individual needs and preferences, offering customized payment options and features.

- Digital Annuity Platforms:Providing online platforms for purchasing, managing, and accessing annuity information.

Final Conclusion

Immediate annuities can be a valuable addition to a well-rounded retirement plan, offering a unique combination of guaranteed income and longevity protection. Whether you’re looking to supplement your existing retirement income, cover essential expenses, or leave a legacy for future generations, understanding the intricacies of immediate annuity usage can empower you to make informed financial decisions.

Popular Questions

What are the risks associated with immediate annuities?

An immediate annuity ladder is a strategy that involves purchasing a series of annuities with staggered starting dates. This can help to ensure that you have a steady stream of income for life, even if interest rates rise. It’s a complex strategy, so it’s important to consult with a financial advisor to understand if it’s right for you.

The primary risk with immediate annuities is the potential for lower returns compared to other investments, especially during periods of strong market growth. Additionally, once you purchase an annuity, you typically cannot access the principal amount, making it important to carefully consider your financial needs and goals before making a decision.

Variable annuities offer the potential for growth, but they don’t guarantee a specific rate of return. It’s important to understand what a variable annuity guarantees. For example, they may offer a minimum death benefit or a guaranteed income stream in retirement.

However, it’s crucial to read the fine print and understand the terms and conditions of the annuity before making a decision.

Can I withdraw my principal from an immediate annuity?

If you’re looking for a way to supplement your retirement income, a Variable Annuity 457 might be a good option. These annuities offer the potential for growth, but they also come with some risks. It’s important to do your research and understand the pros and cons before making a decision.

Generally, immediate annuities do not allow for withdrawals of the principal amount. The payments you receive represent both the principal and interest earned on the investment. However, some annuities may offer limited withdrawal options, subject to specific terms and conditions.

It’s crucial to review the annuity contract carefully to understand the withdrawal provisions.

A Immediate Annuity can provide you with a guaranteed stream of income for life, which can be helpful if you’re concerned about running out of money in retirement. However, it’s important to understand how these annuities work and how they might impact your eligibility for Medicaid.

How do immediate annuities affect my estate?

Immediate annuities can impact your estate planning in various ways. The payments you receive during your lifetime are generally considered taxable income. However, upon your death, the remaining value of the annuity may be included in your estate for tax purposes.

Consulting with a financial advisor and estate planning attorney is recommended to understand the specific implications for your situation.