Immediate Annuity Calculator UK is a powerful tool for anyone seeking to secure a steady income stream during retirement. These calculators allow individuals to estimate their potential annuity payments based on factors like age, desired income, and lump sum investment.

Understanding annuities can be a bit complex, especially when you’re considering a Annuity 2000 Basic Mortality Table 2024 or a L Share Variable Annuity Finra 2024. But don’t worry, we’ve got you covered with helpful articles and guides.

By inputting these details, users can gain valuable insights into the financial security they can achieve through an immediate annuity.

Immediate annuities offer a guaranteed income stream, providing peace of mind and financial stability throughout retirement. They can be particularly attractive for those seeking predictable cash flows, as the payments are typically fixed for life. Understanding the mechanics of immediate annuities and utilizing a calculator can empower individuals to make informed decisions about their retirement planning.

Contents List

- 1 Immediate Annuities in the UK

- 1.1 Introduction to Immediate Annuities in the UK

- 1.2 How Immediate Annuity Calculators Work

- 1.3 Factors Influencing Annuity Payments

- 1.4 Advantages and Disadvantages of Immediate Annuities, Immediate Annuity Calculator Uk

- 1.5 Choosing the Right Immediate Annuity

- 1.6 Examples of Immediate Annuity Calculators in the UK

- 1.7 Illustrative Example of an Immediate Annuity Calculation

- 2 Conclusive Thoughts: Immediate Annuity Calculator Uk

- 3 Questions Often Asked

Immediate Annuities in the UK

Immediate annuities are a popular retirement income option in the UK, offering a guaranteed stream of income for life. They are a simple and secure way to convert a lump sum of money into a regular income stream. This article provides a comprehensive overview of immediate annuities, covering their workings, benefits, drawbacks, and how to choose the right one for your individual needs.

Introduction to Immediate Annuities in the UK

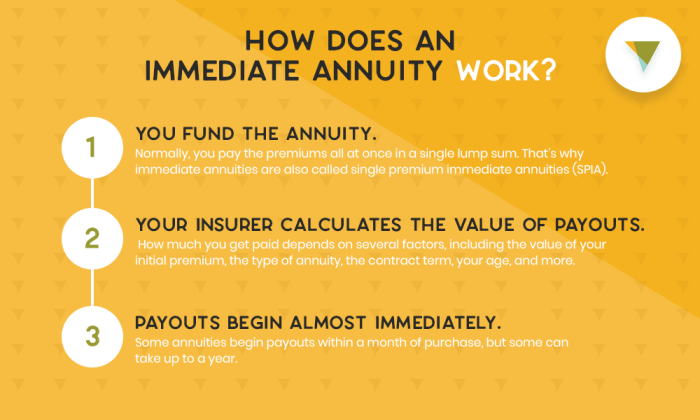

An immediate annuity is a financial product that provides a guaranteed stream of income for life, starting immediately after purchase. You pay a lump sum to an insurance company, and in return, they agree to make regular payments to you for the rest of your life.

Want to learn how to Calculate Growing Annuity Ba Ii Plus 2024 ? We’ve got the tools and techniques to make it easy. And if you’re looking for more general information, check out our articles on Variable Annuity Disclosure 2024 and Calculating Annuity Method 2024.

The amount of the payments depends on factors like your age, the size of the lump sum, and the current interest rates.

Are you looking for information about annuities in 2024? You’ve come to the right place. Whether you’re interested in a Annuity 1000 Per Month 2024 , a 7 Year Variable Annuity 2024 , or anything in between, we have the resources you need.

- Purpose:Immediate annuities are designed to provide a secure and reliable source of income during retirement. They are particularly beneficial for those who want to eliminate the risk of outliving their savings.

- Key Features:Immediate annuities offer several key features that make them attractive to retirees:

- Guaranteed Income:The payments are guaranteed for life, regardless of how long you live. This provides peace of mind knowing that you will receive a regular income stream.

- Flexibility:You can choose how often you want to receive payments, whether monthly, quarterly, or annually.

- Tax-efficient:Annuity payments are typically taxed as income, but the tax treatment can vary depending on the specific type of annuity.

Types of Immediate Annuities:

- Fixed Annuity:This type of annuity provides a fixed amount of income each period. The payment amount is determined at the time of purchase and remains constant for the life of the annuity.

- Variable Annuity:With a variable annuity, the payment amount can fluctuate based on the performance of a specific investment portfolio. This type of annuity offers the potential for higher returns but also comes with greater risk.

- Guaranteed Annuity:This type of annuity guarantees a minimum income level, even if the underlying investment portfolio performs poorly. This provides some protection against market volatility.

How Immediate Annuity Calculators Work

Immediate annuity calculators are online tools that help you estimate the potential income you could receive from an annuity. They take into account factors like your age, the size of your lump sum, and the current interest rates.

Are you considering a Variable Annuity With Death Benefit 2024 ? This type of annuity can provide peace of mind for your loved ones. And if you’re looking for a specific tool to help you make decisions, we have an Annuity Calculator Groww 2024 that you can use.

- Key Inputs:

- Age:Your age is a key factor in determining the annuity payout amount. The older you are, the higher the payout will be.

- Desired Income:You can specify the amount of income you want to receive each period.

- Lump Sum:This is the amount of money you plan to invest in the annuity.

Calculations:

Finally, if you’re wondering, “What are the characteristics of a A Variable Annuity Has Which Of The Following Characteristics 2024 ?” We have the information you need to make informed decisions about your financial future.

- The calculator uses actuarial tables to determine the life expectancy of someone your age.

- It then calculates the present value of the future annuity payments, taking into account the current interest rates and your life expectancy.

- The resulting amount is the lump sum you would need to invest to receive your desired income.

Factors Influencing Annuity Payments

Several factors can influence the amount of income you receive from an immediate annuity. Understanding these factors can help you make informed decisions about your annuity purchase.

If you’re looking for a guaranteed income stream, an Immediate Annuity Consists Of A might be a good option. We have information to help you understand the basics of this type of annuity. And if you’re interested in a career related to annuities, you might be interested in Annuity Health Careers 2024.

- Interest Rates:Interest rates play a significant role in annuity payouts. Higher interest rates generally lead to higher annuity payments, while lower interest rates result in lower payments.

- Health Status:Your health status can also impact your annuity payments. Individuals with good health and a longer life expectancy generally receive lower payments than those with poor health and a shorter life expectancy.

- Longevity:As mentioned earlier, your life expectancy is a key factor in determining annuity payments. The longer you are expected to live, the lower the annuity payments will be.

Advantages and Disadvantages of Immediate Annuities, Immediate Annuity Calculator Uk

Immediate annuities offer a number of advantages, but they also have some potential drawbacks. It’s essential to weigh these factors carefully before making a decision.

When making financial decisions, it’s important to weigh your options. For example, you might be interested in comparing an Annuity Vs 401k 2024. We have information to help you understand the pros and cons of each. You can also explore the history of Variable Annuity Sales 2016 2024 to see how the market has evolved.

- Advantages:

- Guaranteed Income:This is perhaps the most significant advantage of immediate annuities. You are guaranteed a regular income stream for life, regardless of how long you live.

- Simplicity:Immediate annuities are relatively simple to understand and purchase. They are a straightforward way to convert a lump sum into a guaranteed income stream.

- Peace of Mind:Knowing that you have a guaranteed income stream can provide peace of mind during retirement. You don’t have to worry about market fluctuations or running out of money.

- Disadvantages:

- Lower Returns:Immediate annuities generally offer lower returns than other investment options, such as stocks or bonds. This is because the insurance company guarantees the payments.

- Lack of Flexibility:Once you purchase an immediate annuity, you cannot typically withdraw the lump sum or change the payment amount. This can be a disadvantage if your circumstances change.

- Inflation Risk:The fixed payments from an annuity may not keep pace with inflation, meaning your purchasing power could decline over time.

Choosing the Right Immediate Annuity

Choosing the right immediate annuity is an important decision that should not be taken lightly. There are several factors to consider:

- Your Financial Goals:What are your income needs in retirement? How much risk are you willing to take? Your financial goals will influence the type of annuity you choose.

- Your Age and Health:Your age and health status will impact your annuity payments. The older and healthier you are, the lower the payments will be.

- Interest Rates:Current interest rates will affect the annuity payouts. Higher interest rates generally lead to higher payments.

- Annuity Provider:It’s essential to choose a reputable annuity provider with a strong financial track record.

Step-by-Step Guide:

We understand that choosing the right annuity can be a big decision. For example, you might be wondering, “What is Kathy’s Annuity Is Currently Experiencing 2024 ?” We’ve got the answers you need.

- Assess your financial goals and needs:Determine how much income you need in retirement and how much risk you are willing to take.

- Research annuity providers:Compare different providers and their annuity products.

- Get professional financial advice:It’s highly recommended to consult with a financial advisor who can help you choose the right annuity for your specific situation.

- Compare annuity quotes:Get quotes from several providers to ensure you are getting the best possible deal.

- Make an informed decision:Carefully consider all the factors involved before purchasing an annuity.

Examples of Immediate Annuity Calculators in the UK

| Calculator Name | Provider | Features | Limitations |

|---|---|---|---|

| Aviva Annuity Calculator | Aviva | Provides estimates for both fixed and variable annuities, allows for customization of income options | Limited customization options for health status, does not account for potential tax implications |

| Legal & General Annuity Calculator | Legal & General | Offers detailed information on different annuity types, provides quotes based on your specific needs | Requires extensive personal information, does not include a comprehensive comparison tool |

| Standard Life Annuity Calculator | Standard Life | User-friendly interface, provides estimates for various annuity options, allows for comparison of different quotes | Limited customization options for income frequency, does not offer advice on specific annuity choices |

| Scottish Widows Annuity Calculator | Scottish Widows | Provides detailed information on annuity features, offers estimates based on your age, health, and lump sum | Does not include a comprehensive comparison tool, requires extensive personal information |

Illustrative Example of an Immediate Annuity Calculation

Let’s assume a 65-year-old individual has a lump sum of £100,000 to invest in an immediate annuity. They want to receive a monthly income of £500. Using the Aviva Annuity Calculator, we can estimate the potential annuity payout.

The calculator estimates that the individual would receive a monthly income of £480, based on their age, lump sum, and current interest rates. This is slightly lower than their desired income of £500. The individual could either reduce their desired income or increase their lump sum to achieve their desired income level.

This example illustrates how an immediate annuity calculator can help you estimate your potential income and make informed decisions about your annuity purchase.

Conclusive Thoughts: Immediate Annuity Calculator Uk

An immediate annuity calculator can be an invaluable tool for navigating the complexities of retirement planning. By providing a clear and concise estimate of potential income, these calculators enable individuals to assess the feasibility of their retirement goals and make informed decisions about their financial future.

Remember, consulting with a financial advisor is crucial to tailor your retirement plan to your specific needs and circumstances.

Questions Often Asked

What are the key benefits of using an immediate annuity calculator?

Immediate annuity calculators offer several benefits, including: providing an estimated income stream, comparing different annuity options, and understanding the impact of factors like age and investment amount on annuity payouts.

Are there any limitations to using an immediate annuity calculator?

While immediate annuity calculators provide valuable estimates, they cannot account for individual circumstances like health status or specific financial goals. It’s crucial to consult with a financial advisor for personalized advice.

What are the different types of immediate annuities available in the UK?

Immediate annuities come in various types, including fixed annuities, variable annuities, and guaranteed annuities. Each type offers different features and risks, and choosing the right one depends on your individual financial goals and risk tolerance.