Immediate Annuity Vs Annuity Due: Choosing the right annuity can be a significant financial decision, and understanding the nuances between these two types is crucial. Immediate annuities provide income payments that begin immediately after purchase, while annuities due offer a delayed start date, allowing for potential growth before payments begin.

Microsoft Excel is a powerful tool for financial calculations, including annuity calculations. If you’re interested in learning how to calculate annuities using Excel, this article might be helpful: Calculate Annuity On Excel 2024. It provides a step-by-step guide to using Excel for annuity calculations.

This difference in timing can have a substantial impact on your financial strategy, depending on your individual circumstances and goals.

Vanguard, a well-known investment company, offers variable annuity products. If you’re interested in learning more about their offerings, you can visit this page: Variable Annuity Vanguard 2024. It will provide you with information on their variable annuity options and their features.

This article delves into the intricacies of both immediate and annuity due contracts, exploring their payment structures, benefits, drawbacks, and suitability in various scenarios. We’ll also discuss key considerations such as investment risks, tax implications, and the influence of inflation on your chosen annuity.

Groww, a financial technology platform, offers an annuity calculator. If you’re looking for a convenient tool to estimate annuity payments, you can use the Groww calculator: Annuity Calculator Groww 2024. It provides a simple and user-friendly interface for calculating annuity payments.

Contents List

Immediate Annuity vs. Annuity Due: Understanding the Differences: Immediate Annuity Vs Annuity Due

Annuities are financial products that provide a stream of regular payments, either for a fixed period or for the lifetime of the annuitant. Two common types of annuities are immediate annuities and annuities due. While both provide income, they differ in their payment structures and implications.

Understanding the different types of annuities can be challenging, especially when trying to determine the first payment schedule. This resource, An Annuity Immediate Has A First Payment , will clarify the distinction between different types of annuities and their payment structures.

This article will delve into the intricacies of immediate annuities and annuities due, comparing their features, benefits, drawbacks, and investment considerations.

Immediate Annuity

An immediate annuity is a type of annuity where payments begin immediately after the initial lump sum payment is made. In essence, you purchase an immediate annuity with a lump sum, and the insurance company starts making regular payments to you right away.

Immediate annuities are also available in Malaysia. If you’re interested in learning more about these products in the Malaysian market, you can visit this page: Immediate Annuity Malaysia. It provides information on immediate annuities and their availability in Malaysia.

Payment Structure

The payment structure of an immediate annuity is straightforward. You make a single, upfront payment to the insurance company, and in return, you receive regular payments, typically monthly, for a predetermined period or for the rest of your life. The amount of each payment is determined by the size of your initial investment, the chosen payment frequency, and the life expectancy of the annuitant.

Benefits

- Guaranteed Income: Immediate annuities provide a guaranteed stream of income, eliminating the risk of outliving your savings. This can be particularly beneficial for retirees who want a steady income source.

- Protection Against Market Volatility: Unlike investments in stocks or bonds, immediate annuities offer protection against market fluctuations. Your initial investment is locked in, and your payments are not subject to market volatility.

- Simplified Financial Planning: Immediate annuities simplify financial planning by providing a predictable income stream. You can budget for expenses with certainty, knowing the amount of your monthly payments.

Drawbacks

- Lower Returns: Immediate annuities typically offer lower returns compared to other investment options, such as stocks or mutual funds. This is because the insurance company guarantees the payments, limiting potential upside.

- Limited Flexibility: Once you purchase an immediate annuity, you typically cannot access the principal or change the payment structure. This lack of flexibility can be a disadvantage if your circumstances change.

- Inflation Risk: The value of your annuity payments can be eroded by inflation over time. The fixed payments may not keep pace with rising prices, reducing your purchasing power.

Hypothetical Scenario

Imagine a 65-year-old retiree who wants a guaranteed income stream to cover their living expenses. They have a substantial lump sum saved and are looking for a secure way to generate regular income. An immediate annuity could be a suitable option for them, providing a predictable income stream for the rest of their life, without the risk of outliving their savings.

Annuity Due, Immediate Annuity Vs Annuity Due

An annuity due is a type of annuity where payments are made at the beginning of each period, rather than at the end. This means you receive the first payment immediately upon purchasing the annuity, and subsequent payments are made at the beginning of each subsequent period.

Variable annuities offer tax-deferred growth, meaning that taxes are not paid until withdrawals are made. To learn more about the tax implications of variable annuities, you can refer to this resource: Variable Annuity Tax Deferred 2024. It will discuss the tax advantages and considerations associated with variable annuities.

Payment Structure

The payment structure of an annuity due involves receiving the first payment upfront, followed by regular payments at the beginning of each period. This structure can be advantageous for individuals who need immediate income or want to maximize their investment growth.

Understanding how annuity payments are calculated is crucial for making informed financial decisions. This article, How Do You Calculate Annuity Payments 2024 , will provide you with a clear explanation of the factors that influence annuity payments and the calculations involved.

Benefits

- Early Income: Annuity due provides immediate income, allowing you to start receiving payments right away. This can be helpful for covering immediate expenses or starting a new project.

- Potential for Higher Returns: The upfront payment in an annuity due allows the investment to start earning interest immediately, potentially leading to higher returns compared to immediate annuities.

- Flexibility: Some annuity due contracts offer flexibility in terms of payment frequency, withdrawal options, or even the ability to adjust the payment amount in certain circumstances.

Drawbacks

- Higher Initial Investment: Due to the upfront payment, an annuity due typically requires a higher initial investment than an immediate annuity, which might not be suitable for everyone.

- Potential for Higher Fees: Some annuity due contracts may have higher fees compared to immediate annuities, which can impact the overall return on your investment.

- Limited Availability: Annuity due contracts may not be as widely available as immediate annuities, making it important to compare options carefully.

Hypothetical Scenario

Consider a young professional who wants to save for retirement and wants to start receiving income early on. They have a moderate lump sum to invest and are looking for an option that provides both growth potential and early income.

An annuity due could be a suitable choice for them, allowing them to start earning returns immediately and benefit from potential growth over time.

If you’re looking to estimate the income you could receive from an immediate lifetime annuity, you can use an online calculator. This resource, Immediate Lifetime Annuity Calculator , provides a user-friendly tool for calculating potential annuity payments based on your specific circumstances.

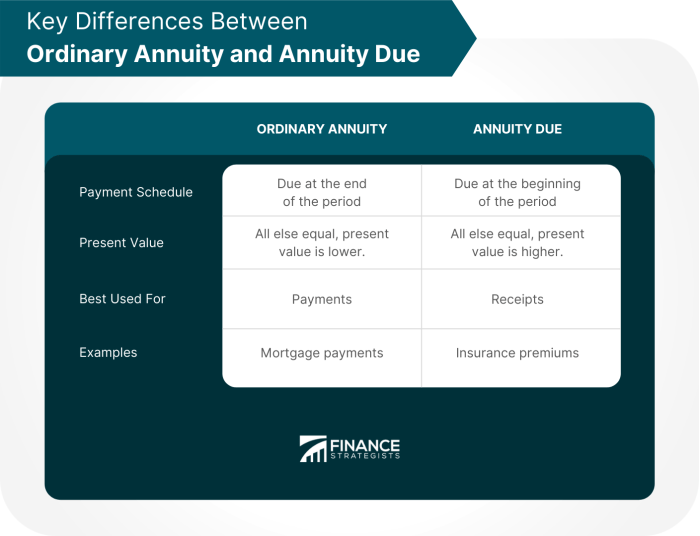

Comparison

The key difference between immediate annuities and annuities due lies in the timing of payments. Immediate annuities start payments immediately after the initial investment, while annuities due start payments at the beginning of each period. This difference in timing can have significant implications for the overall return and suitability of each type of annuity.

Immediate annuities provide a guaranteed stream of income for life. If you’re considering an immediate annuity, you might find this article helpful: Immediate Annuity Loan. It discusses the benefits and drawbacks of immediate annuities and their potential uses.

Key Features

| Feature | Immediate Annuity | Annuity Due |

|---|---|---|

| Payment Timing | Payments start immediately | Payments start at the beginning of each period |

| Initial Investment | Single upfront payment | Single upfront payment |

| Income Stream | Guaranteed and predictable | Guaranteed and predictable |

| Flexibility | Limited flexibility | More flexibility in some cases |

| Potential Returns | Lower returns | Potential for higher returns |

Advantages and Disadvantages

| Type of Annuity | Advantages | Disadvantages |

|---|---|---|

| Immediate Annuity | Guaranteed income, protection against market volatility, simplified financial planning | Lower returns, limited flexibility, inflation risk |

| Annuity Due | Early income, potential for higher returns, flexibility in some cases | Higher initial investment, potential for higher fees, limited availability |

Factors to Consider

- Time Horizon: Immediate annuities are suitable for individuals who need immediate income, while annuities due can be better for those with a longer time horizon.

- Risk Tolerance: Immediate annuities are less risky than annuities due, as they provide guaranteed payments. However, they also offer lower returns. Annuities due have the potential for higher returns but come with greater risk.

- Financial Goals: Consider your specific financial goals and how each type of annuity can help you achieve them. Immediate annuities are suitable for retirees seeking guaranteed income, while annuities due can be better for those seeking early income and growth potential.

The tax treatment of annuity income can be complex. To understand whether annuity income is considered capital gains, you can refer to this article: Is Annuity Income Capital Gains 2024. It will discuss the tax implications of annuity income and how it is treated for tax purposes.

Investment Considerations

When considering immediate annuities and annuities due, it’s crucial to understand the potential risks and different types available in the market.

Variable annuities can be a complex financial product, especially when considering the different types available in the US. To learn more about these products, you can check out this resource: Variable Annuity Usa 2024. This article will provide you with a deeper understanding of variable annuities and their potential benefits.

Potential Risks

- Interest Rate Risk: Interest rate fluctuations can impact the value of annuities, especially for those with fixed payment structures. If interest rates rise, the value of your annuity may decrease.

- Inflation Risk: As mentioned earlier, inflation can erode the purchasing power of your annuity payments, especially if they are fixed. This is a key consideration for long-term annuities.

- Credit Risk: The financial stability of the insurance company issuing the annuity is crucial. If the company defaults, your annuity payments may be at risk.

Types of Annuities

- Fixed Annuities: These annuities offer guaranteed payments based on a fixed interest rate. They provide stability but may not keep pace with inflation.

- Variable Annuities: These annuities offer the potential for higher returns but also carry greater risk. The payments are linked to the performance of underlying investments, such as mutual funds.

- Indexed Annuities: These annuities offer a minimum guaranteed return linked to the performance of a specific index, such as the S&P 500. They provide some protection against inflation and market volatility.

Impact of Inflation

Inflation can significantly impact the value of annuities, especially those with fixed payments. As prices rise, the purchasing power of your annuity payments decreases. To mitigate inflation risk, consider annuities with features like inflation protection or variable payment structures linked to inflation indices.

Living benefit riders are often included with variable annuities to provide additional protection and income guarantees. To understand how these riders work and their potential impact, check out this resource: Variable Annuity With Living Benefit Rider 2024. It will provide valuable insights into this important aspect of variable annuities.

Tax Implications

Understanding the tax implications of receiving payments from immediate annuities and annuities due is essential for maximizing your after-tax income.

If you’re looking to understand how to calculate annuity payments using the BA II Plus calculator, there’s a great resource available: Calculate Annuity Payments Ba Ii Plus 2024. This guide will walk you through the steps and provide helpful tips for using this financial calculator effectively.

Tax Treatment of Annuity Payments

Annuity payments are typically taxed as ordinary income. However, the tax treatment can vary depending on the type of annuity and your income level.

Tax Advantages and Disadvantages

- Tax-Deferred Growth: Some annuities offer tax-deferred growth, meaning that earnings are not taxed until they are withdrawn. This can be advantageous for long-term investments.

- Tax-Free Withdrawals: Certain annuities may allow for tax-free withdrawals of a portion of the principal, depending on the contract terms.

- Taxable Payments: Most annuity payments are taxable as ordinary income, which can be a disadvantage if you are in a high tax bracket.

Last Word

Ultimately, the decision between an immediate annuity and an annuity due boils down to your individual financial needs and risk tolerance. Immediate annuities offer the immediate benefit of income payments, making them suitable for those seeking immediate financial security.

Variable annuities offer a unique combination of investment growth potential and income security. To learn more about how variable annuities work and their potential benefits, you can refer to this article: A Variable Annuity Is Both An Annuity And A 2024.

It will delve into the details of this financial product and its implications.

Annuity due contracts, on the other hand, provide potential for growth before payments begin, appealing to those with a longer time horizon. By carefully weighing the pros and cons of each option, you can make an informed decision that aligns with your financial goals and aspirations.

FAQ Summary

What is the main difference between an immediate annuity and an annuity due?

The key difference lies in the timing of payments. Immediate annuities begin paying out immediately after purchase, while annuity due payments start at a later date, often after a set period.

Are there any tax implications for receiving annuity payments?

Yes, annuity payments are typically taxed as ordinary income. However, the specific tax treatment can vary depending on the type of annuity, your income level, and other factors. Consulting with a tax professional is advisable.

Can I withdraw funds from an annuity before payments begin?

This depends on the specific annuity contract. Some annuities allow for withdrawals, but may incur penalties or fees. It’s essential to review the terms of your contract carefully.

How does inflation affect the value of my annuity payments?

Inflation can erode the purchasing power of your annuity payments over time. Some annuities offer inflation protection, but this typically comes with higher costs. It’s important to consider the potential impact of inflation when choosing an annuity.