Immediate Annuity Vs CD: Choosing the right retirement income strategy can be daunting. Immediate annuities offer guaranteed income, while CDs provide principal protection. This exploration dives into the key differences, advantages, and disadvantages of each, guiding you toward the best option for your unique financial goals.

The immediate annuity formula is a mathematical calculation used to determine the amount of income payments you will receive from an immediate annuity. This formula takes into account factors such as your age, the amount of your initial investment, and the interest rate.

Immediate annuities provide a steady stream of income, but come with the risk of potential principal loss. CDs, on the other hand, guarantee principal but offer lower returns. Understanding the nuances of each investment is crucial for making an informed decision.

If you’re considering purchasing an immediate needs annuity , it’s a good idea to get quotes from multiple providers to compare rates and features. This will help you find the best annuity for your needs.

Contents List

- 1 Immediate Annuities vs. CDs: A Comprehensive Comparison: Immediate Annuity Vs Cd

- 1.1 Immediate Annuities: Introduction

- 1.2 How Immediate Annuities Work

- 1.3 Types of Immediate Annuities

- 1.4 Certificates of Deposit (CDs): Introduction

- 1.5 How CDs Work

- 1.6 Types of CDs

- 1.7 Immediate Annuity vs. CD: Key Differences

- 1.8 Risk Profile, Immediate Annuity Vs Cd

- 1.9 Liquidity and Accessibility

- 1.10 Tax Implications

- 1.11 Immediate Annuity vs. CD: Advantages and Disadvantages

- 1.12 Immediate Annuity vs. CD: Considerations for Investors

- 1.13 Immediate Annuity vs. CD: Real-World Examples

- 2 Outcome Summary

- 3 FAQ Explained

Immediate Annuities vs. CDs: A Comprehensive Comparison: Immediate Annuity Vs Cd

When it comes to retirement planning, individuals often seek investment strategies that offer both safety and income generation. Two popular options that are frequently compared are immediate annuities and certificates of deposit (CDs). Both provide a degree of security and predictable returns, but they differ significantly in their features, risks, and suitability for different investors.

This article aims to provide a comprehensive comparison of immediate annuities and CDs, exploring their key characteristics, advantages, disadvantages, and considerations for investors.

An immediate needs annuity can provide you with a quick and easy way to access a steady stream of income. These annuities typically offer guaranteed payments for a set period of time, making them a good option for those who need income right away.

Immediate Annuities: Introduction

Immediate annuities are financial products that provide a guaranteed stream of income payments for life. They are purchased with a lump sum of money, and in return, the annuitant receives regular payments, typically monthly, starting immediately.

An annuity is primarily used to provide a steady stream of income during retirement. It can be a valuable tool for individuals who want to ensure they have a reliable source of income to cover their living expenses.

How Immediate Annuities Work

Immediate annuities work by transferring a lump sum of money to an insurance company. In exchange, the insurance company agrees to make regular payments to the annuitant for the rest of their life. The amount of the payments is determined by several factors, including the size of the initial investment, the annuitant’s age, and the chosen payout option.

An annuity is essentially a stream of income payments that you receive over a set period of time, usually in exchange for a lump sum payment. This can be a valuable tool for retirement planning, as it can provide a steady income stream to cover your living expenses.

The income stream from an immediate annuity is guaranteed, meaning that the payments will continue regardless of market fluctuations or the annuitant’s longevity.

An annuity with a starting value of $300,000 can provide a significant amount of income, depending on factors such as your age, life expectancy, and the interest rate. It’s important to carefully consider your needs and goals before choosing an annuity.

Types of Immediate Annuities

- Fixed Annuities:These annuities provide a fixed rate of return, guaranteeing a specific amount of income for life. The payments are not affected by market performance, making them a suitable option for those seeking stability and predictability.

- Variable Annuities:These annuities offer the potential for higher returns but also carry greater risk. The income payments are linked to the performance of underlying investments, such as mutual funds or stocks. As a result, the payments can fluctuate over time.

- Indexed Annuities:These annuities offer a combination of fixed and variable features. They provide a minimum guaranteed return based on a fixed interest rate, but also allow for potential growth linked to the performance of a specific index, such as the S&P 500.

MetLife offers a range of variable annuities that can be tailored to meet your specific retirement needs. These annuities allow you to invest in a variety of sub-accounts, giving you more control over your investment portfolio.

Certificates of Deposit (CDs): Introduction

CDs are a type of time deposit offered by banks and credit unions. They allow individuals to lock in a fixed interest rate for a specified period, typically ranging from a few months to several years. CDs offer a safe and predictable way to earn interest on savings, but they come with limitations regarding access to funds.

An annuity is not a bond, but it can be used in conjunction with bonds as part of a diversified investment portfolio. It’s important to understand the differences between annuities and bonds before making any investment decisions.

How CDs Work

When you purchase a CD, you deposit a lump sum of money with a financial institution. The institution agrees to pay you a fixed interest rate on your deposit for the duration of the CD’s term. The interest rate is typically higher than a traditional savings account, but you are not allowed to withdraw your funds before the maturity date without incurring a penalty.

If Kathy’s annuity is experiencing a decline in value, it’s important to understand the factors that may be contributing to this. It could be due to market volatility, changes in interest rates, or other factors. Consulting with a financial advisor can help you assess the situation and determine the best course of action.

Types of CDs

- Traditional CDs:These are the most common type of CDs, offering a fixed interest rate for a set period.

- Bump-Up CDs:These CDs allow you to increase the interest rate once during the term, typically after a certain period. This option can be beneficial if interest rates rise after you purchase the CD.

- Callable CDs:These CDs allow the issuing institution to call back the deposit before maturity. This option is typically offered when interest rates fall, as the institution can refinance the deposit at a lower rate.

Immediate Annuity vs. CD: Key Differences

Immediate annuities and CDs are distinct financial products with different risk profiles, liquidity features, and tax implications. Understanding these differences is crucial for investors to make informed decisions.

Risk Profile, Immediate Annuity Vs Cd

- Immediate Annuities:Annuities offer guaranteed income for life, but they also carry the risk of losing principal. If the annuitant dies before receiving back the full amount of their initial investment, the insurance company keeps the remaining balance. However, the guaranteed income stream provides peace of mind and longevity protection.

When calculating an annuity , it’s important to consider factors such as your age, life expectancy, the amount of your initial investment, and the interest rate. There are online calculators and financial advisors who can help you determine the best annuity for your situation.

- CDs:CDs offer guaranteed principal and fixed interest rates, making them a relatively low-risk investment. The principal is protected, and the interest earned is predictable. However, CDs do not provide guaranteed income for life, and the fixed interest rate may not keep pace with inflation.

Liquidity and Accessibility

- Immediate Annuities:Once you purchase an immediate annuity, the funds are generally not accessible. The insurance company makes regular payments to you, but you cannot withdraw the principal or access the funds directly.

- CDs:While you cannot withdraw funds before maturity without a penalty, CDs offer greater liquidity than annuities. You can access your funds at maturity without penalty, and some CDs may allow early withdrawal with a penalty.

Tax Implications

- Immediate Annuities:Annuities are generally taxed as ordinary income. The payments you receive are considered taxable income, but you may be able to defer taxes on the growth of the annuity until you begin receiving payments. Some annuities also offer tax-advantaged options, such as tax-deferred growth or tax-free withdrawals.

Variable annuities can offer a variety of benefits , including tax-deferred growth, potential for higher returns, and guaranteed income payments. However, it’s important to note that variable annuities also carry some risks, such as the potential for investment losses.

- CDs:Interest earned on CDs is generally taxed as ordinary income. The interest is typically reported to you on a Form 1099-INT, and you will need to include it on your tax return.

Immediate Annuity vs. CD: Advantages and Disadvantages

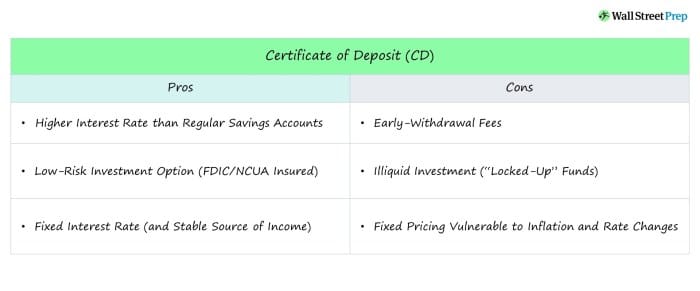

Both immediate annuities and CDs have their own advantages and disadvantages, which investors should carefully consider before making a decision.

The Putnam Capital Manager 5 Variable Annuity is a product offered by Putnam Investments. This annuity provides a variety of investment options and features, including a guaranteed income rider.

Advantages of Immediate Annuities

- Guaranteed Income:Annuities provide a guaranteed stream of income for life, regardless of market fluctuations or the annuitant’s longevity.

- Longevity Protection:Annuities can provide peace of mind knowing that you will receive income for as long as you live, even if you live longer than expected.

- Potential Tax Benefits:Some annuities offer tax-advantaged features, such as tax-deferred growth or tax-free withdrawals.

- Protection from Market Risk:Fixed annuities provide a fixed rate of return, shielding investors from market volatility.

Disadvantages of Immediate Annuities

- Limited Flexibility:Once you purchase an annuity, the funds are generally not accessible. You cannot withdraw the principal or change the payout options without penalties.

- Potential Loss of Principal:If you die before receiving back the full amount of your initial investment, the insurance company keeps the remaining balance.

- Potential for Low Returns:Fixed annuities may offer lower returns than other investments, especially in a rising market.

- High Fees:Annuities often come with higher fees than other investment options.

Advantages of CDs

- Guaranteed Principal:CDs offer guaranteed principal protection, meaning that you will receive back your original investment at maturity.

- Fixed Interest Rates:CDs provide a fixed interest rate, offering predictable returns for the term of the CD.

- Low Risk:CDs are considered a relatively low-risk investment, as the principal is protected and the interest rate is fixed.

- FDIC Insurance:CDs offered by banks are insured by the FDIC up to $250,000 per depositor, providing additional security.

Disadvantages of CDs

- Limited Liquidity:You cannot withdraw funds before maturity without a penalty, which can be a disadvantage if you need access to your money.

- Potential for Low Returns:CDs may offer lower returns than other investments, especially in a rising market.

- Inflation Risk:The fixed interest rate on a CD may not keep pace with inflation, eroding the value of your principal over time.

- Early Withdrawal Penalties:If you withdraw funds before maturity, you will typically incur a penalty.

Immediate Annuity vs. CD: Considerations for Investors

The decision of whether to invest in an immediate annuity or a CD depends on various factors, including your financial goals, risk tolerance, and time horizon. It’s important to consider the following factors when making your decision:

- Income Needs:If you need a guaranteed stream of income for life, an immediate annuity may be a suitable option. Annuities provide predictable payments that are not affected by market fluctuations.

- Risk Tolerance:If you are risk-averse and prioritize principal protection, CDs may be a better choice. CDs offer guaranteed principal and fixed interest rates, minimizing the risk of losing your investment.

- Time Horizon:If you need access to your funds in the short term, CDs may be a more appropriate option. Annuities generally do not allow early withdrawal without penalties.

- Tax Implications:Consider the tax implications of each investment option. Annuities may offer tax-advantaged features, while CDs are typically taxed as ordinary income.

- Investment Goals:Determine your investment goals. If your primary goal is to generate income, an immediate annuity may be suitable. If you are looking to preserve capital and earn a fixed return, a CD may be a better choice.

Immediate Annuity vs. CD: Real-World Examples

Imagine a retired individual named John, who is 65 years old and has $200,000 in savings. He is looking for a way to generate income to cover his living expenses. He is risk-averse and wants a guaranteed stream of income for the rest of his life.

There are several different types of annuities , each with its own unique features and benefits. It’s important to carefully consider your individual needs and goals before choosing an annuity that’s right for you.

In this scenario, an immediate annuity might be a suitable option for John. An annuity could provide him with a predictable stream of income for life, regardless of market fluctuations or his longevity. He could purchase an annuity with his $200,000 savings and receive regular payments for the rest of his life.

A variable annuity offered by Jackson National Life Insurance Company is a type of annuity that allows your investment to grow based on the performance of the underlying sub-accounts. These sub-accounts typically invest in a variety of assets, such as stocks, bonds, and mutual funds.

However, if John has a shorter time horizon and needs access to his funds in the next few years, a CD might be a better choice. He could invest his $200,000 in a CD with a fixed interest rate and receive a guaranteed return for the term of the CD.

At maturity, he could access his funds and reinvest them in another CD or use them for other purposes.

A Variable Annuity Income Rider is a feature you can add to a variable annuity contract that allows you to receive guaranteed income payments, often for life, starting at a specific age. These riders can provide peace of mind for retirees by ensuring a steady stream of income, even if market performance is volatile.

Outcome Summary

Ultimately, the choice between immediate annuities and CDs hinges on your individual circumstances, risk tolerance, and financial goals. Whether you prioritize guaranteed income or principal protection, a thorough analysis of both options will help you make the best decision for your retirement future.

FAQ Explained

How do immediate annuities differ from traditional annuities?

Immediate annuities start paying out income immediately, while traditional annuities have a delay period before income begins.

What are the potential tax implications of immediate annuities?

Immediate annuity payments are typically taxed as ordinary income. However, there may be tax advantages depending on the specific type of annuity.

Are there any penalties for withdrawing funds early from a CD?

Yes, early withdrawal penalties typically apply to CDs. These penalties can vary depending on the CD’s terms and the financial institution.