Annuity Immediate Vs Annuity Due, two common types of annuities, offer distinct payment structures and timing. Understanding the nuances between these options is crucial for making informed financial decisions. Annuities are financial instruments that provide a stream of regular payments over a specific period, commonly used for retirement planning, investment strategies, and other financial goals.

While both types aim to provide a consistent income stream, the timing of payments differentiates them.

An annuity due is a type of annuity where payments are made at the beginning of each period. To understand how to calculate an annuity due, check out Calculating An Annuity Due 2024. This resource provides clear explanations and examples to help you master this financial calculation.

An annuity immediate, as the name suggests, makes payments at the end of each period, whereas an annuity due pays at the beginning of each period. This seemingly small difference in timing significantly impacts the present and future values of the annuity.

The choice between an annuity immediate and an annuity due depends on individual financial needs, risk tolerance, and time horizon.

An annuity loan formula can be used to calculate the payments for a loan that is paid off over a specific period. To learn more about this formula and its applications, visit Annuity Loan Formula 2024. This article explains the formula and provides examples to help you understand its use.

Contents List

Introduction to Annuities

An annuity is a financial product that provides a stream of regular payments over a set period of time. It’s essentially a contract where you make a lump sum payment (or a series of payments) to an insurance company or financial institution, and in return, you receive regular payments for a specified period.

Annuity products can be complex, and it’s important to understand their potential impact on your health insurance premiums. To learn more about the connection between annuities and health insurance, visit Annuity Health 2024. This article provides valuable insights into this often overlooked aspect of annuity planning.

Annuities are popular for retirement planning, as they provide a consistent income stream during your golden years.

HL offers a user-friendly annuity calculator to help you estimate your potential annuity payments. To learn more about this calculator and its features, visit Annuity Calculator Hl 2024. This article can help you gain a better understanding of your annuity options and potential outcomes.

There are two main types of annuities: annuities immediate and annuities due. The key difference lies in the timing of the first payment.

Before investing in a variable annuity, it’s essential to ask the right questions to ensure it aligns with your financial goals. To learn about key questions to ask about variable annuities, visit Variable Annuity Questions To Ask 2024. This article provides a comprehensive list of questions to guide your decision-making process.

Annuity Immediate vs. Annuity Due

In an annuity immediate, the first payment is made at the end of the first period. Think of it as a delayed payment. On the other hand, in an annuity due, the first payment is made at the beginning of the first period.

It’s like getting a payment upfront.

Variable annuities are a popular investment option for retirement planning, but understanding their tax implications is crucial. To learn more about the taxability of variable annuities in 2024, check out this article on Variable Annuity Taxable 2024. This resource can help you make informed decisions about your retirement savings.

Key Features and Benefits, Annuity Immediate Vs Annuity Due

- Annuity Immediate: This type of annuity is often preferred by individuals who want to delay their income stream, perhaps to allow their investments to grow further before receiving payments. It’s also suitable for situations where a lump sum payment is available, and the individual wants to convert it into a regular income stream.

- Annuity Due: This type of annuity is ideal for those who need a steady income stream right away. It’s often used in situations where a regular income is required, such as during retirement or for covering expenses during a specific period.

Payment Structure and Timing

The payment structure and timing are crucial aspects to understand when choosing between an annuity immediate and an annuity due.

Annuity Immediate Payment Structure

In an annuity immediate, payments are made at the end of each period. For example, if the payment period is monthly, the first payment will be made one month after the initial investment. The payment schedule continues for the specified term of the annuity.

Annuity Due Payment Structure

In an annuity due, payments are made at the beginning of each period. This means the first payment is made immediately after the initial investment. The subsequent payments follow the same pattern, with payments made at the start of each period.

Comparison of Payment Schedules

| Feature | Annuity Immediate | Annuity Due |

|---|---|---|

| First Payment | End of the first period | Beginning of the first period |

| Subsequent Payments | End of each period | Beginning of each period |

Present Value and Future Value Calculations

Understanding present value (PV) and future value (FV) is essential for evaluating the financial implications of annuities. PV represents the current value of a future stream of payments, while FV represents the future value of a stream of payments at a specific point in time.

Variable annuity sales have been trending in recent years. To learn more about the sales figures for variable annuities from 2020 to 2024, visit Variable Annuity Sales 2020 2024. This article provides valuable data and insights into the popularity of variable annuities in the market.

Present Value of an Annuity Immediate

The present value of an annuity immediate is calculated by discounting each future payment to its present value and summing them up. The formula is:

PV = PMT

Excel is a powerful tool for financial calculations, including annuities. To learn how to calculate the present value of an annuity using Excel, visit Pv Annuity Excel 2024. This article provides a step-by-step guide and formulas to help you perform these calculations efficiently.

Annuity jackpots are a popular feature of some annuity products, offering the potential for significant payouts. To learn more about annuity jackpots and their mechanics, visit Annuity Jackpot 2024. This article explores the potential benefits and risks associated with annuity jackpots.

- [1

- (1 + i)^-n] / i

Where:

- PV = Present Value

- PMT = Payment amount

- i = Interest rate per period

- n = Number of periods

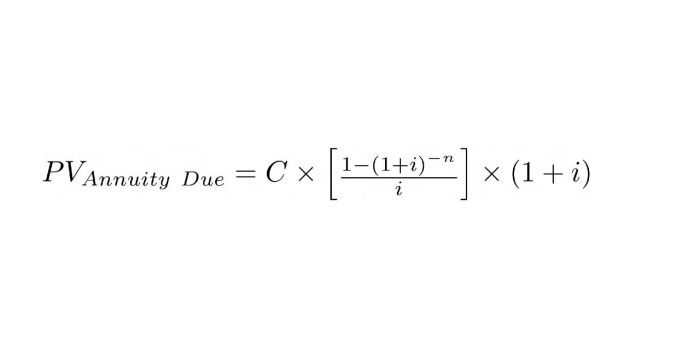

Present Value of an Annuity Due

The present value of an annuity due is calculated similarly to an annuity immediate, but with an additional factor to account for the upfront payment. The formula is:

PV = PMT

- [1

- (1 + i)^-n] / i

- (1 + i)

Future Value of an Annuity Immediate

The future value of an annuity immediate is calculated by compounding each payment to its future value and summing them up. The formula is:

FV = PMT

Financial calculators can be incredibly helpful when working with annuities. To learn how to calculate an annuity using a financial calculator, visit How To Calculate Annuity In Financial Calculator 2024. This article provides step-by-step instructions and examples to make your calculations easier.

- [(1 + i)^n

- 1] / i

Future Value of an Annuity Due

The future value of an annuity due is calculated similarly to an annuity immediate, but with an additional factor to account for the upfront payment. The formula is:

FV = PMT

- [(1 + i)^n

- 1] / i

- (1 + i)

Applications and Examples

Annuities have various applications in personal finance and investment strategies. Understanding their use cases can help you determine if an annuity is suitable for your financial goals.

Variable annuities offer a range of guarantees, but it’s important to understand exactly what they cover. To learn more about the guarantees provided by variable annuities, visit A Variable Annuity Guarantees Which Of The Following 2024. This article clarifies the different types of guarantees and their implications.

Annuity Immediate Examples

- Retirement Planning: Individuals who want to delay their income stream during retirement and allow their investments to grow further can opt for an annuity immediate. This allows them to receive a larger income stream later on.

- Inheritance Planning: An annuity immediate can be used to convert a lump sum inheritance into a regular income stream, providing a steady source of funds over time.

Annuity Due Examples

- Retirement Planning: Individuals who need an immediate income stream upon retirement can opt for an annuity due. This provides them with a regular source of income right from the start.

- Mortgage Payments: Annuities due can be used to structure mortgage payments, ensuring that the principal and interest are paid off over a specified period.

Uses in Financial Planning

Annuities are versatile financial tools that can be incorporated into various financial planning scenarios, including:

- Retirement Planning: Annuities provide a predictable income stream during retirement, helping individuals plan for their expenses and maintain a comfortable lifestyle.

- Investment Strategies: Annuities can be used as part of a diversified investment portfolio, providing a stream of income while potentially growing the principal over time.

- Estate Planning: Annuities can be used to provide for beneficiaries after an individual’s passing, ensuring a steady income stream for their loved ones.

Factors Affecting Annuity Values

Several factors influence the present value and future value of an annuity, impacting its overall attractiveness to investors.

Need to calculate the future value of an annuity? Calculator.net offers a comprehensive tool to help you with your calculations. Learn more about this useful resource and its features by visiting Calculator.Net Annuity 2024. This article can help you understand the potential growth of your annuity over time.

Interest Rates

Interest rates play a significant role in determining the value of an annuity. Higher interest rates generally lead to higher future values and lower present values. This is because higher interest rates mean that future payments are worth more today.

Time Period

The length of the annuity period also affects its value. A longer annuity period generally results in a higher future value and a lower present value. This is because the longer the period, the more time there is for interest to accumulate.

Payment Amount

The payment amount directly impacts the value of an annuity. Larger payment amounts result in higher present values and future values. This is because the investor receives more money over the annuity period.

Equivest offers a variable annuity series, Series 100, that provides investment flexibility and potential growth. To learn more about this series and its features, visit Equivest Variable Annuity Series 100 2024. This article can help you understand the benefits and potential risks of this variable annuity series.

Changes in Factors

Changes in any of these factors can significantly affect the value of an annuity. For example, if interest rates rise after an annuity is purchased, the present value of the annuity will decrease. Conversely, if interest rates fall, the present value will increase.

Variable annuities are complex financial products, and understanding their structure is essential. To learn whether a variable annuity is considered a unit investment trust (UIT), visit Is A Variable Annuity A Uti 2024. This article explains the key differences between variable annuities and UITs.

Comparison and Selection Criteria: Annuity Immediate Vs Annuity Due

Choosing between an annuity immediate and an annuity due depends on your individual financial goals, risk tolerance, and time horizon.

When you purchase an immediate annuity, you have several options for receiving your payments. These options can impact your income stream and tax implications. To learn more about immediate annuity settlement options, check out Immediate Annuity Settlement Options.

This resource provides valuable information to help you choose the best option for your needs.

Advantages and Disadvantages

| Feature | Annuity Immediate | Annuity Due |

|---|---|---|

| Advantages | Higher potential for growth due to delayed payments | Provides immediate income stream |

| Disadvantages | Delayed income stream | Lower potential for growth due to upfront payments |

Selection Criteria

- Financial Goals: If you need immediate income, an annuity due is more suitable. If you want to maximize growth potential, an annuity immediate might be a better choice.

- Risk Tolerance: Annuities generally involve a lower level of risk compared to other investments. However, if you have a higher risk tolerance, you might consider other investment options.

- Time Horizon: The length of time you plan to receive payments from the annuity will affect its value. If you have a longer time horizon, an annuity immediate might be more advantageous.

Final Summary

Understanding the intricacies of annuity immediate vs. annuity due is essential for navigating the complex world of financial planning. By carefully considering the payment structure, timing, and factors influencing their values, individuals can make informed decisions that align with their financial goals.

Whether seeking a secure income stream during retirement or maximizing investment returns, choosing the right type of annuity is crucial for achieving financial success.

Q&A

What is the main difference between an annuity immediate and an annuity due?

The key difference lies in the timing of payments. An annuity immediate pays at the end of each period, while an annuity due pays at the beginning of each period.

Which type of annuity is typically more valuable?

An annuity due is generally more valuable than an annuity immediate because payments are received earlier, allowing for potential interest earnings.

Are there any specific situations where one type of annuity is preferred over the other?

Yes, the choice depends on individual needs. An annuity due might be preferable for individuals who need immediate income, while an annuity immediate could be suitable for those who want to maximize potential interest earnings.

How do interest rates affect the value of an annuity?

Higher interest rates generally result in higher present and future values for both annuity immediate and annuity due.