Immediate Annuity Withdrawal offers a way to access your retirement savings sooner than expected. This strategy allows you to tap into the funds you’ve accumulated within an annuity contract, providing you with a lump sum or a series of payments.

Annuity is a financial concept that’s often discussed in financial planning. If you’re new to the term, Annuity Meaning In English 2024 provides a simple and understandable explanation of what an annuity is and how it works. You can also delve into the mathematical aspects of annuities by checking out Annuity Equation 2024.

While it can be a useful option for addressing immediate financial needs, understanding the implications and potential drawbacks is crucial before making a decision.

Immediate annuity withdrawals are influenced by various factors, including interest rates, contract terms, and tax implications. The amount you can withdraw and the tax consequences will depend on the specific details of your annuity contract. It’s important to carefully consider the pros and cons before proceeding with any withdrawal.

Contents List

What is an Immediate Annuity Withdrawal?

An immediate annuity withdrawal allows you to access funds from your annuity contract right away. This can be a valuable option if you need cash quickly for unexpected expenses or to fund a specific goal.

If you’re considering a variable annuity, you’ll need to be aware of the Variable Annuity Age Requirements 2024. These requirements can vary depending on the specific annuity provider, so it’s essential to do your research. Once you understand the basics, you can explore 8 Annuity Income Secret 2024 for tips on maximizing your income potential.

Defining Immediate Annuity Withdrawal

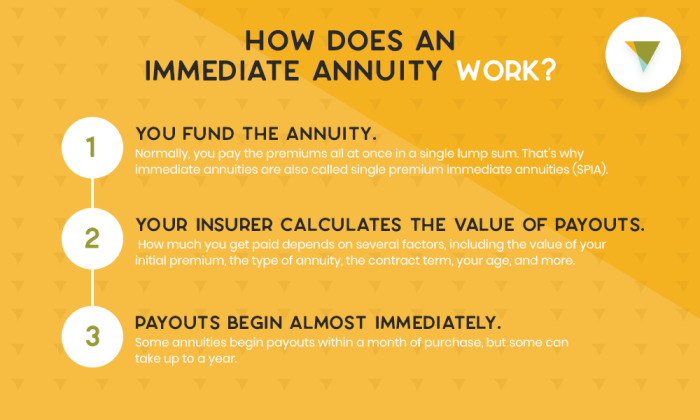

An immediate annuity withdrawal is the process of taking out a portion or all of the money you have accumulated in an annuity contract. This is distinct from a traditional annuity payout, where you receive regular payments over a set period of time.

For a deeper dive into the mathematical side of annuities, you can refer to Formula Of Immediate Annuity. This article explores the formula used to calculate immediate annuity payments, providing a more detailed understanding of the financial concepts involved.

Process of Withdrawing Funds

The process for withdrawing funds from an immediate annuity typically involves contacting your annuity provider and submitting a withdrawal request. You’ll need to provide information about the amount you want to withdraw and the method of payment you prefer. The provider will then process your request and transfer the funds to your designated account.

Scenarios for Beneficial Immediate Annuity Withdrawal

- Unexpected Expenses:If you face a sudden medical bill, home repair, or other unforeseen cost, an immediate annuity withdrawal can provide quick access to the funds you need.

- Funding a Major Purchase:If you’re planning a significant purchase, such as a new car or a down payment on a house, an immediate annuity withdrawal can help you meet the financial requirements.

- Early Retirement:If you decide to retire earlier than planned, an immediate annuity withdrawal can provide a lump sum to supplement your retirement income.

Factors Affecting Immediate Annuity Withdrawal

Several factors influence the amount you can withdraw from your immediate annuity and the potential tax implications.

To understand the different types of annuities, it’s helpful to explore Fixed Variable Annuity Definition 2024. This article explains the key differences between fixed and variable annuities, allowing you to choose the option that best aligns with your risk tolerance and financial goals.

Impact of Interest Rates

Interest rates play a significant role in determining the value of your annuity contract. When interest rates rise, the value of your annuity may increase, allowing you to withdraw a larger amount. Conversely, falling interest rates can reduce the value of your annuity, potentially limiting your withdrawal options.

Ready to take the next step? Buy A Immediate Annuity offers insights into the process of purchasing an immediate annuity. This can help you navigate the steps involved and make informed decisions about your retirement income.

Annuity Contract Terms

The terms of your annuity contract dictate the specific rules and limitations surrounding withdrawals. Some contracts may impose penalties or restrictions on early withdrawals, while others may offer flexible withdrawal options.

The world of annuities can seem complex, but it doesn’t have to be. 7 Annuities 2024 offers a concise overview of the different types of annuities available, making it easier to choose the one that suits your needs.

Tax Implications

The tax implications of an immediate annuity withdrawal depend on the type of annuity you have and the withdrawal method you choose. Some withdrawals may be taxed as ordinary income, while others may be subject to capital gains tax.

Benefits and Drawbacks of Immediate Annuity Withdrawal

Accessing funds through an immediate annuity withdrawal offers both advantages and disadvantages.

Advantages of Immediate Annuity Withdrawal

- Quick Access to Funds:Immediate annuity withdrawals provide a rapid way to access your accumulated funds.

- Flexibility:You have the flexibility to withdraw a portion or all of your annuity balance, depending on your needs.

- Potential Tax Benefits:Depending on your specific circumstances, you may be able to withdraw funds tax-free or at a lower tax rate.

Drawbacks of Immediate Annuity Withdrawal

- Potential Penalties:Some annuity contracts may impose penalties for early withdrawals, which can reduce the amount you receive.

- Tax Implications:Withdrawals may be subject to taxes, potentially reducing your overall return.

- Reduced Future Income:Withdrawing funds from your annuity can decrease the amount of future income you receive from the contract.

Comparing Immediate Withdrawal with Other Options

| Feature | Immediate Withdrawal | Other Annuity Options |

|---|---|---|

| Access to Funds | Immediate | Delayed (e.g., monthly payments) |

| Flexibility | High | Limited (e.g., fixed payment schedule) |

| Tax Implications | Potentially higher taxes | Potentially lower taxes (e.g., qualified withdrawals) |

| Future Income | Reduced | Guaranteed stream of income |

Strategies for Immediate Annuity Withdrawal

Developing a strategic approach to immediate annuity withdrawals can help you maximize your benefits while minimizing tax liability.

Maximizing Withdrawal Amounts

To maximize your withdrawal amount, consider factors such as the current value of your annuity, interest rates, and potential penalties for early withdrawal.

Minimizing Tax Liability

To minimize tax liability, explore tax-advantaged withdrawal options offered by your annuity provider, such as qualified withdrawals or tax-deferred rollovers.

If you’re looking for information on a specific type of annuity, you might want to check out Annuity 72t 2024. This article provides details on the 72t rule, which allows for tax-advantaged withdrawals from qualified retirement plans before age 59 1/2.

Choosing the Right Withdrawal Method

The most suitable withdrawal method depends on your individual circumstances, including your tax bracket, financial goals, and risk tolerance.

Before diving into the world of annuities, it’s crucial to understand the different types available. A popular option is the Kotak Immediate Annuity Plan Calculator. This calculator can help you estimate the income you might receive from an immediate annuity, giving you a clearer picture of your financial future.

Partial or Full Withdrawal Scenarios

Partial withdrawals may be preferable for smaller expenses, while full withdrawals can provide a lump sum for larger financial needs.

To understand the mechanics of annuities, you might want to familiarize yourself with Formula For Calculating The Annuity 2024. This article provides a clear explanation of the formula used to calculate annuity payments, which can be helpful for understanding the underlying principles.

Considerations for Immediate Annuity Withdrawal

Before making a decision to withdraw from your annuity, it’s essential to consider all the factors involved and seek professional financial advice.

Seeking Professional Advice

A financial advisor can help you understand the implications of an immediate annuity withdrawal, evaluate your options, and create a personalized strategy that aligns with your financial goals.

Factors to Consider

- Your Financial Goals:What are you hoping to achieve with the withdrawal?

- Tax Implications:How will the withdrawal affect your tax liability?

- Future Income Needs:Will the withdrawal impact your future income stream?

- Annuity Contract Terms:What are the specific rules and restrictions surrounding withdrawals?

Checklist for Immediate Annuity Withdrawal

- Review your annuity contract terms.

- Consult with a financial advisor.

- Consider your financial goals and future income needs.

- Understand the tax implications of the withdrawal.

- Choose the most appropriate withdrawal method.

- Contact your annuity provider to initiate the withdrawal.

Concluding Remarks

Ultimately, deciding whether to withdraw from an immediate annuity is a personal financial decision. It’s essential to weigh the benefits of accessing your funds against the potential risks and tax implications. Seeking professional financial advice can help you make an informed choice that aligns with your individual circumstances and long-term financial goals.

With the right tools, you can easily analyze annuity options. For instance, Calculating An Annuity In Excel 2024 provides a comprehensive guide to using Excel for annuity calculations. This can help you make informed decisions about your retirement planning.

FAQ Section

What are the potential tax implications of withdrawing from an immediate annuity?

But is an annuity the right choice for you? Is Annuity Right For Me 2024 delves into the factors you should consider before making a decision. It’s important to understand the potential benefits and drawbacks to ensure it aligns with your individual needs and goals.

The tax implications of withdrawing from an immediate annuity depend on the type of annuity and the withdrawal method. Some withdrawals may be subject to ordinary income tax, while others may be taxed as capital gains. It’s essential to consult with a tax advisor to understand the specific tax implications of your situation.

Looking for a reliable and flexible way to plan for retirement? Consider a Variable Annuity Nationwide 2024. This type of annuity offers the potential for growth while providing guaranteed income payments in retirement. You can learn more about the process of converting your annuity to income payments by exploring Variable Annuity Annuitization 2024.

Can I withdraw from my annuity before reaching retirement age?

Whether you can withdraw from your annuity before retirement age depends on the terms of your contract. Some annuities allow for early withdrawals, while others may have penalties or restrictions. Review your contract carefully or consult with your financial advisor to determine your options.