Immediate Annuity 10 Penalty sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. Immediate annuities, financial products designed to provide a steady stream of income during retirement, often come with a significant drawback: a 10% penalty for early withdrawals.

This penalty, levied on traditional IRAs and 401(k)s, can significantly impact your financial planning if you need to access your funds before reaching a certain age.

Understanding the intricacies of this penalty is crucial for anyone considering immediate annuities as a retirement income strategy. This guide will explore the nuances of the 10% penalty, providing insights into its application to immediate annuities, potential consequences of early withdrawals, and strategies for minimizing or avoiding this financial hurdle.

Contents List

Understanding Immediate Annuities

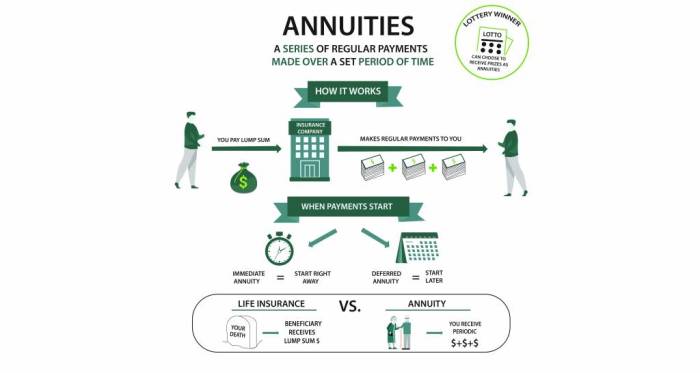

Immediate annuities are a type of insurance product that provides a guaranteed stream of income for life. They are often used by retirees to supplement their retirement income or to provide a steady source of income in the event of an unexpected financial need.

Annuity planning can be a crucial part of retirement preparation. If you’re looking to learn more about annuities in 2024, you’re in the right place. There are many resources available, including 9 Annuity 2024 , which provides a comprehensive overview of the topic.

You can also explore specific aspects like Calculating Retirement Annuity 2024 or delve into examples for better understanding with Annuity Examples 2024.

How Immediate Annuities Work

When you purchase an immediate annuity, you make a lump-sum payment to an insurance company in exchange for a guaranteed stream of payments for life. The amount of the payments is determined by the amount of the lump-sum payment, the annuitant’s age, and the interest rate at the time of purchase.

Annuity funds can be a part of retirement planning, and it’s helpful to understand their characteristics. You can learn about Annuity Fund Is Unrestricted Fund 2024 to get a better understanding of their nature. For those in New Zealand, you can use Annuity Calculator Nz 2024 to estimate your potential annuity payouts.

Types of Immediate Annuities, Immediate Annuity 10 Penalty

- Fixed immediate annuitiesprovide a fixed amount of income each month for life. The amount of the payments is guaranteed and will not fluctuate, even if interest rates change.

- Variable immediate annuitiesoffer the potential for higher income payments, but the amount of the payments can fluctuate based on the performance of the underlying investment portfolio.

Examples of Situations Where an Immediate Annuity Might Be Suitable

- Retirement income:Immediate annuities can provide a reliable source of income for retirees who are looking to supplement their savings or Social Security benefits.

- Long-term care:Immediate annuities can be used to help pay for long-term care expenses, such as assisted living or nursing home care.

- Estate planning:Immediate annuities can be used to provide a stream of income to beneficiaries after the annuitant’s death.

The 10% Penalty on Early Withdrawals

The 10% penalty on early withdrawals applies to distributions from traditional IRAs and 401(k)s that are taken before age 59 1/2. This penalty is in addition to the ordinary income tax that is due on the distribution.

Variable annuities can be a complex investment, and it’s important to understand the different aspects. For instance, you can explore Variable Annuity Companies 2024 to see which providers are available. You can also learn about the characteristics of these annuities with A Variable Annuity Has Which Of The Following Characteristics 2024.

Circumstances Where the Penalty May Be Waived or Reduced

- First-time homebuyer:The penalty may be waived for withdrawals used to purchase a first home.

- Medical expenses:The penalty may be waived for withdrawals used to pay for medical expenses that exceed a certain percentage of adjusted gross income.

- Disability:The penalty may be waived for withdrawals made due to disability.

- Death:The penalty is not applied to distributions made due to the death of the account holder.

Impact of the 10% Penalty on Financial Planning

The 10% penalty can significantly impact an individual’s financial planning, especially if they need to access retirement funds before age 59 1/2. It can reduce the amount of money available for retirement, and it can also increase the overall tax burden.

There are different types of annuities, and it’s helpful to understand the distinctions. For instance, An Immediate Annuity Has Been Purchased describes a specific type of annuity. If you’re looking into annuities that start later, you can learn about Deferred Variable Annuities 2024.

Immediate Annuities and the 10% Penalty

Immediate annuities are not subject to the 10% penalty on early withdrawals. This is because immediate annuities are considered to be insurance products, not retirement accounts.

Variable annuities are a popular retirement savings option. You can learn more about Variable Annuity Funds 2024 to understand how they work. If you’re considering incorporating variable annuities into your 401k, you can find information on 401k Variable Annuity 2024.

Consequences of Withdrawing Funds from an Immediate Annuity Before a Certain Age

While there is no 10% penalty associated with early withdrawals from immediate annuities, there may be other consequences. For example, withdrawing funds from an immediate annuity before a certain age may result in a reduction in the amount of future payments.

Deciding between an annuity and a 401k can be a complex decision. Fortunately, you can find resources to help you compare these options, such as Annuity Vs 401k 2024. If you’re interested in using Excel for annuity calculations, you can find guides on Calculate Interest Rate Annuity Excel 2024.

It’s important to review the terms and conditions of the annuity contract before making any withdrawals.

Importance of Understanding the Terms and Conditions of an Immediate Annuity Contract

It’s essential to carefully review the terms and conditions of an immediate annuity contract before making a purchase. This includes understanding the rules regarding withdrawals, surrender charges, and other fees.

Strategies for Avoiding the 10% Penalty

While immediate annuities are not subject to the 10% penalty, there are strategies that can help individuals minimize or avoid the penalty when using traditional IRAs and 401(k)s.

Strategies for Minimizing or Avoiding the 10% Penalty

- Rollover to a Roth IRA:Rolling over funds from a traditional IRA to a Roth IRA can eliminate the 10% penalty on future withdrawals. However, this strategy requires paying taxes on the amount rolled over.

- Withdrawals for Qualified Expenses:As discussed earlier, the 10% penalty may be waived for withdrawals used for certain qualified expenses, such as first-time home purchases, medical expenses, and disability.

- Delayed Withdrawals:Delaying withdrawals until after age 59 1/2 is the most straightforward way to avoid the 10% penalty.

Considerations for Using Immediate Annuities: Immediate Annuity 10 Penalty

Immediate annuities can be a valuable tool for retirement planning, but they also come with certain risks and considerations.

Potential Benefits and Risks of Immediate Annuities

- Benefits:

- Guaranteed income for life

- Protection against inflation (with some types of annuities)

- No 10% penalty on early withdrawals

- Risks:

- Loss of principal if the annuity is surrendered early

- Potential for lower returns compared to other investments

- Limited flexibility in accessing funds

Factors to Consider Before Purchasing an Immediate Annuity

- Age:Younger individuals may not benefit as much from immediate annuities, as they have more time to grow their savings.

- Health:Individuals with health concerns may want to consider purchasing an immediate annuity, as it can provide a guaranteed stream of income even if they are unable to work.

- Financial goals:Immediate annuities can be a good option for individuals who are looking for a guaranteed stream of income to meet their retirement needs.

Comparing Immediate Annuities to Other Retirement Income Options

Immediate annuities are just one of many retirement income options available. Individuals should compare the benefits and risks of different options before making a decision.

Illustrative Scenarios

| Scenario | Age | Annuity Amount | Potential 10% Penalty | Impact on Income and Financial Planning |

|---|---|---|---|---|

| Early Withdrawal from Traditional IRA | 55 | $100,000 | $10,000 | The 10% penalty reduces the amount of money available for retirement and increases the overall tax burden. |

| Immediate Annuity Purchase | 65 | $100,000 | None | Provides a guaranteed stream of income for life, without the 10% penalty. |

| Withdrawal from Immediate Annuity | 70 | $100,000 | None | May result in a reduction in future payments, depending on the terms of the annuity contract. |

Last Word

Navigating the complexities of immediate annuities and the 10% penalty requires careful consideration of your financial goals, risk tolerance, and long-term planning. By understanding the potential consequences of early withdrawals, exploring strategies to mitigate the penalty, and comparing immediate annuities to other retirement income options, you can make informed decisions that align with your individual circumstances.

Frequently Asked Questions

Can I avoid the 10% penalty on an immediate annuity if I withdraw funds for a specific reason, like medical expenses?

It’s important to understand the various aspects of variable annuities, such as the investment options available. You can explore Variable Annuity Investment Options 2024 for insights into this area. Additionally, it’s crucial to be aware of how variable annuities are taxed.

You can find information on this at Variable Annuity Taxation 2024.

Yes, there are certain exceptions that may allow you to withdraw funds from an immediate annuity without incurring the 10% penalty. These exceptions typically include medical expenses, disability, or other qualifying events. It’s important to consult with a financial advisor or tax professional to determine if your situation qualifies for an exception.

What are the specific age requirements for avoiding the 10% penalty on an immediate annuity?

The age requirement for avoiding the 10% penalty on immediate annuities generally aligns with the rules for traditional IRAs and 401(k)s. You typically need to be 59 1/2 years old to avoid the penalty, although certain exceptions may apply.

Are there any strategies for minimizing the 10% penalty if I must withdraw funds from an immediate annuity before age 59 1/2?

While you cannot completely avoid the 10% penalty, you can potentially minimize its impact. Strategies include withdrawing the minimum required distribution (if applicable) or strategically withdrawing funds to minimize the penalty on the total amount withdrawn.