Tesla Q3 2024 gross margin is a crucial indicator of the company’s financial health and its ability to navigate the evolving electric vehicle market. This analysis delves into the factors driving Tesla’s gross margin performance, examining revenue sources, cost structures, and production efficiency.

The potential for stimulus checks in October 2024 is largely influenced by various economic factors. To understand the economic landscape and its impact on stimulus checks, it’s helpful to explore What are the economic factors influencing stimulus checks in October 2024?

.

By comparing Tesla’s performance to industry benchmarks, we gain insights into its competitive position and potential for future growth.

This exploration examines the interplay of pricing strategies, demand trends, and the regulatory landscape, all of which contribute to Tesla’s overall financial performance. The analysis concludes with a forward-looking perspective, considering potential factors that could influence Tesla’s gross margin in the coming quarters.

Taylor Swift, a global music icon, has accumulated an impressive net worth through her successful music career. To understand the breakdown of her net worth, you can explore Taylor Swift’s net worth breakdown.

Contents List

Tesla Q3 2024 Gross Margin Overview

Tesla’s gross margin is a crucial indicator of its financial health and profitability. It reflects the difference between the revenue generated from selling its vehicles and the cost of producing those vehicles. Understanding the factors that influence Tesla’s gross margin is essential for investors and industry analysts to assess the company’s performance and future prospects.

There’s been much discussion about the possibility of a fourth stimulus check. For the latest updates on the potential for a fourth stimulus check in October 2024, you can find information at Is there a 4th stimulus check update for October 2024?

.

Key Factors Influencing Tesla’s Gross Margin

Tesla’s gross margin is influenced by several key factors, including:

- Vehicle pricing:Tesla has a significant degree of control over its vehicle pricing, which directly impacts its gross margin. Higher prices generally lead to higher gross margins, but can also affect demand.

- Cost of goods sold (COGS):This includes the cost of raw materials, manufacturing, labor, and other expenses associated with producing vehicles. Efficiency in production and supply chain management plays a crucial role in controlling COGS.

- Production volume:Economies of scale are essential for Tesla to achieve competitive gross margins. Higher production volume can help spread fixed costs over a larger number of vehicles, leading to lower per-unit costs.

- Technological advancements:Tesla’s continuous innovation in battery technology, autonomous driving features, and other advancements can influence both revenue and costs. New features can command premium pricing, but also require significant R&D investments.

- Regulatory environment:Government incentives, subsidies, and tax policies can impact Tesla’s cost structure and overall profitability. Changes in regulations can create opportunities or challenges for the company.

Trends in Tesla’s Gross Margin

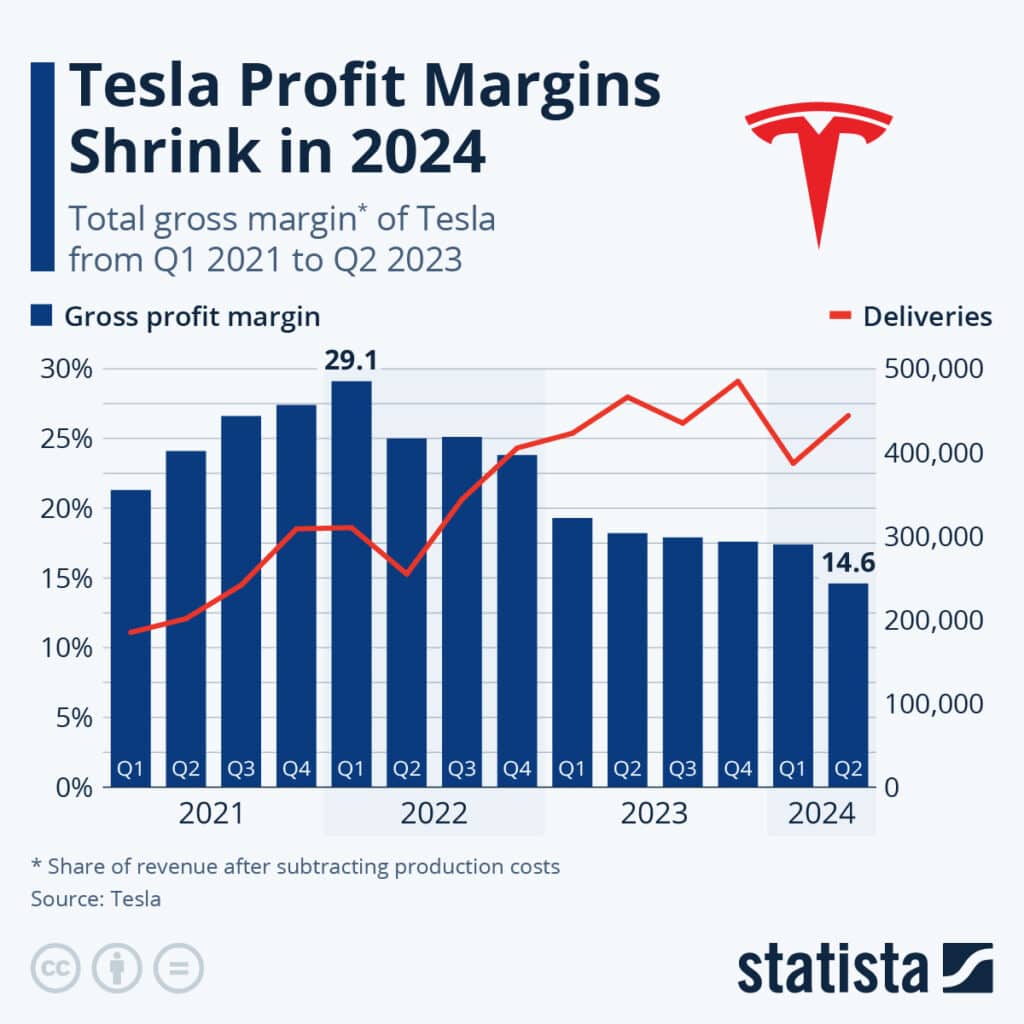

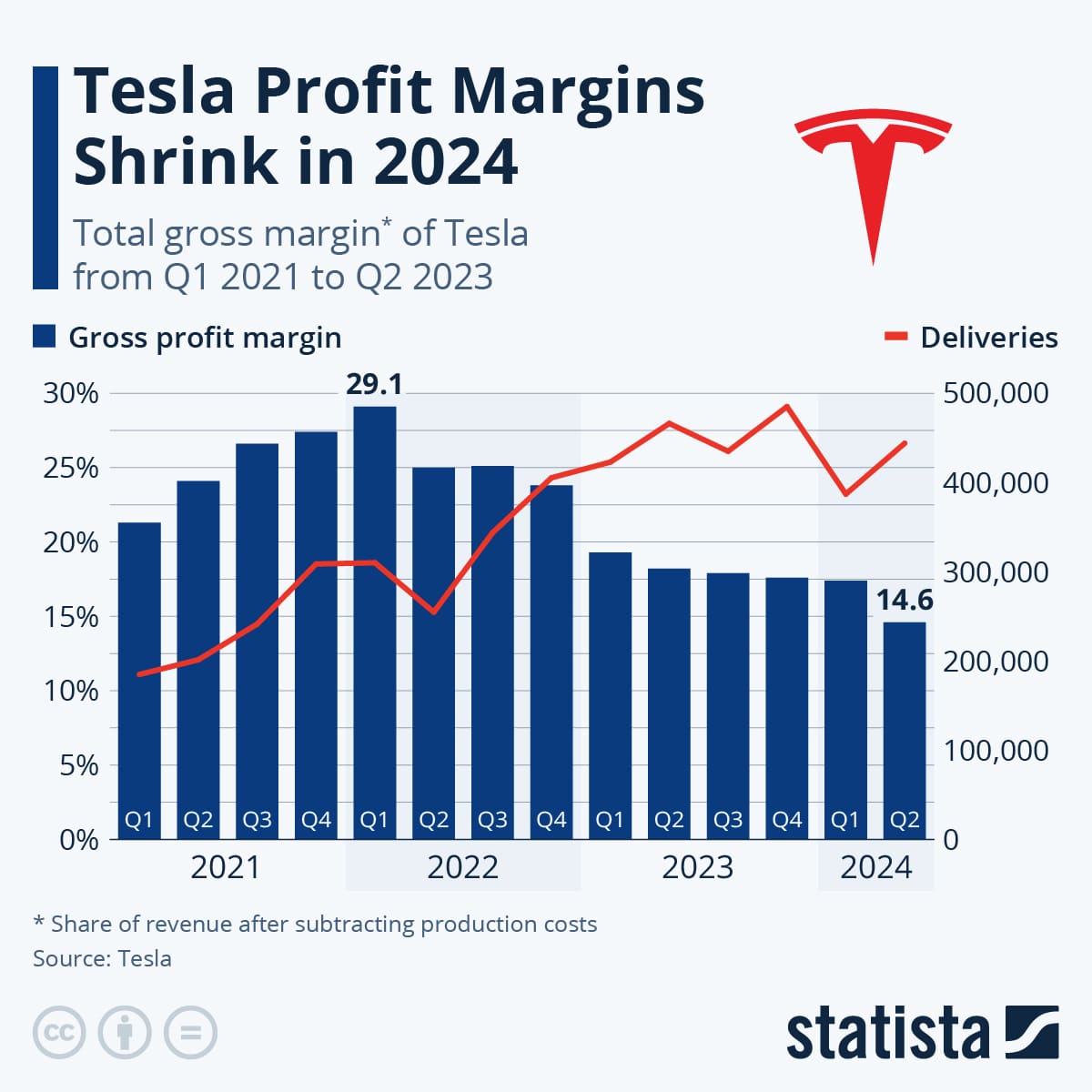

Tesla’s gross margin has fluctuated in recent quarters, influenced by factors such as production ramp-up, pricing strategies, and supply chain challenges.

October 2024 promises to be a pivotal month for businesses, with several key events likely to influence market dynamics. To stay informed about these events and their potential impact, consider reading Key Events in October 2024 Affecting Business.

- In Q2 2024, Tesla’s gross margin experienced a slight decline due to increased competition and price reductions on some models. However, the company managed to maintain a strong gross margin compared to its competitors.

- Analysts expect Tesla’s gross margin to improve in the coming quarters, driven by increased production volume, operational efficiency, and potential price increases. However, ongoing supply chain disruptions and rising material costs could pose challenges.

Comparison with Competitors

Tesla’s gross margin is generally higher than its competitors in the electric vehicle industry. This is partly attributed to its premium pricing strategy and vertically integrated manufacturing model.

- While Tesla faces increasing competition from established automakers like Volkswagen and Ford, it continues to maintain a significant lead in terms of gross margin. However, this advantage could be eroded if competitors achieve greater economies of scale and develop competitive technologies.

The Virginia tax rebate program aims to provide financial relief to residents. For information on the specific amount of the tax rebate, you can find details at Virginia tax rebate amount for October 2024.

Revenue and Cost of Goods Sold Analysis

Tesla’s revenue is primarily derived from the sale of its electric vehicles. However, the company also generates revenue from energy storage systems, solar panels, and software services.

Virginia residents eagerly await the news and updates regarding the state’s tax rebate program. For the latest information on the Virginia tax rebate, including eligibility and disbursement timelines, be sure to visit Virginia tax rebate news and updates for October 2024.

Breakdown of Tesla’s Q3 2024 Revenue Sources

- Vehicle sales:This is the largest source of revenue for Tesla, accounting for over 80% of total revenue. Strong demand for Tesla’s vehicles, particularly the Model 3 and Model Y, has been a key driver of revenue growth.

- Energy generation and storage:Tesla’s solar panels and energy storage systems contribute a smaller but growing portion of revenue. The company is expanding its presence in the renewable energy market, aiming to capitalize on the increasing demand for clean energy solutions.

- Software and services:Tesla’s software and services, including Autopilot and Full Self-Driving, generate a significant amount of recurring revenue. These features are highly profitable and have the potential to drive future growth.

Analysis of Tesla’s Cost of Goods Sold

Tesla’s cost of goods sold (COGS) primarily includes the cost of raw materials, manufacturing, labor, and other expenses associated with producing its vehicles.

Travis Kelce, a renowned tight end for the Kansas City Chiefs, has garnered significant success both on and off the field. His impressive performance has contributed to his substantial net worth, which is estimated to be quite impressive. If you’re curious about the exact figure, you can find out more by checking out this article: What is Travis Kelce’s net worth as of October 2024.

- Raw materials:The cost of raw materials, such as lithium, nickel, and cobalt, has been volatile in recent years due to supply chain disruptions and geopolitical factors. Tesla has been actively exploring alternative battery chemistries and sourcing strategies to mitigate these risks.

- Manufacturing:Tesla’s manufacturing costs include labor, utilities, and other expenses related to its production facilities. The company has invested heavily in automation and robotics to improve efficiency and reduce labor costs.

- Research and development:Tesla’s significant investments in research and development (R&D) are reflected in its COGS. These investments are essential for maintaining Tesla’s technological edge and developing new features.

Significant Changes in Cost Structure

- Tesla has been focusing on cost optimization initiatives to improve its gross margin. This includes streamlining its supply chain, improving manufacturing efficiency, and negotiating better prices with suppliers.

- The company has also been exploring ways to reduce its reliance on expensive raw materials, such as lithium, by developing alternative battery chemistries.

Production and Delivery Performance

Tesla’s production volume is a key factor influencing its gross margin. Higher production volume can help spread fixed costs over a larger number of vehicles, leading to lower per-unit costs.

Layoffs in October 2024 could have a significant impact on the stock market. To understand how layoffs might affect the stock market, you can find insights at How do layoffs in October 2024 affect the stock market?.

Impact of Production Volume on Gross Margin

- Tesla has been aggressively expanding its production capacity to meet growing demand. The company has opened new factories in Texas and Germany, and is planning to build additional facilities in other regions.

- Increased production volume has helped Tesla achieve economies of scale, which has contributed to improved gross margins. However, maintaining high production levels while ensuring quality can be challenging.

Efficiency of Tesla’s Manufacturing Operations

Tesla’s manufacturing operations are characterized by a high degree of automation and vertical integration.

- The company’s Gigafactories are designed to produce vehicles and batteries at scale, with minimal reliance on external suppliers. This approach allows Tesla to control costs and improve efficiency.

- Tesla has also invested heavily in robotics and automation to streamline its production processes. However, achieving optimal efficiency can be a complex and ongoing challenge.

Vehicle Delivery Figures

Tesla’s vehicle delivery figures provide insights into its production capacity, demand, and market share.

The Great ShakeOut is a significant event for promoting earthquake preparedness. To ensure you’re ready and know how to participate, check out the Great ShakeOut 2024 registration and participation guide.

- In Q3 2024, Tesla delivered a record number of vehicles, exceeding analysts’ expectations. This strong performance reflects the continued demand for Tesla’s vehicles, despite rising competition.

- Tesla’s delivery figures are closely watched by investors and industry analysts as a key indicator of the company’s growth trajectory.

Pricing Strategies and Demand

Tesla’s pricing strategies play a significant role in its gross margin. The company has a reputation for charging premium prices for its vehicles, but it has also made price adjustments in recent years to address competitive pressures and changing market conditions.

Impact of Pricing Strategies on Gross Margin

- Tesla’s pricing strategies have been designed to maximize profitability while maintaining a strong brand image. The company has often priced its vehicles at a premium to competitors, but has also introduced more affordable models, such as the Model 3 and Model Y.

The economic outlook for October 2024 is a topic of interest, particularly regarding the potential for a recession. To learn more about the signs that might indicate a recession, you can explore What are the signs of a recession in October 2024?

.

- Tesla’s pricing strategies have been subject to scrutiny in recent years, with some critics arguing that the company’s prices are too high. However, Tesla has maintained that its pricing reflects the value of its vehicles and the high cost of developing and manufacturing its technology.

Demand for Tesla Vehicles

Tesla’s vehicles continue to enjoy strong demand globally.

Amazon’s earnings report for October 2024 is expected to shed light on the company’s advertising revenue performance. To get the latest insights on Amazon’s advertising revenue, you can find details at Amazon advertising revenue in October 2024 earnings.

- The Model 3 and Model Y are among the best-selling electric vehicles worldwide, driven by their performance, technology, and range. However, Tesla faces increasing competition from established automakers, which are launching their own electric vehicle models.

- Tesla’s demand is influenced by factors such as government incentives, consumer preferences, and economic conditions. The company’s ability to maintain strong demand in a competitive market will be crucial for its future success.

Potential Changes in Customer Demand

- Tesla’s customer base is diverse, ranging from early adopters of electric vehicles to mainstream consumers. As the electric vehicle market matures, Tesla will need to adapt its pricing and product offerings to cater to a wider range of customers.

- The rise of other electric vehicle manufacturers could also impact Tesla’s customer demand. Tesla will need to continue innovating and differentiating its products to stay ahead of the competition.

Impact of Regulatory Environment

The regulatory environment plays a significant role in Tesla’s operations and profitability. Government policies and regulations can impact Tesla’s cost structure, demand, and overall business strategy.

Taylor Swift’s net worth is often compared to other prominent musicians. To see how her net worth stacks up against other music industry giants, you can check out Taylor Swift’s net worth compared to other musicians.

Impact of Government Policies and Regulations, Tesla Q3 2024 gross margin

- Government incentives, such as tax credits and subsidies, have been crucial for driving demand for electric vehicles, including Tesla’s models. However, these incentives are often subject to change, which can create uncertainty for Tesla.

- Regulations related to emissions, safety, and autonomous driving technology can also impact Tesla’s operations and costs. The company must comply with these regulations while maintaining its technological edge.

Potential Impact of Upcoming Changes in Regulations

- The automotive industry is undergoing a period of rapid change, driven by technological advancements and evolving regulations. Tesla must be prepared to adapt to these changes, which could include stricter emissions standards, new safety requirements, and regulations governing autonomous driving technology.

Opportunities and Challenges Related to Regulatory Landscape

- The regulatory landscape can create both opportunities and challenges for Tesla. The company can benefit from government incentives and policies that promote electric vehicles. However, it must also navigate the complexities of evolving regulations and ensure compliance with all applicable laws.

The Great ShakeOut is a yearly event that encourages individuals and communities to practice earthquake preparedness. This year’s event, Great ShakeOut 2024 earthquake preparedness for vulnerable populations , is focusing on ensuring that vulnerable populations, like those with disabilities or limited mobility, have the resources and information needed to stay safe during an earthquake.

Future Outlook and Projections

Tesla’s future prospects are closely tied to the growth of the electric vehicle market, its ability to maintain strong demand, and its ability to manage costs effectively.

Factors Impacting Tesla’s Gross Margin in Future Quarters

- Production volume:Tesla’s continued expansion of production capacity will be crucial for achieving economies of scale and improving gross margins. However, the company must also ensure that it can maintain high production levels while ensuring quality.

- Pricing strategies:Tesla’s pricing strategies will need to be carefully calibrated to balance profitability with demand. The company may need to adjust prices to address competitive pressures or changing consumer preferences.

- Cost of goods sold:Tesla’s cost of goods sold will be influenced by factors such as raw material prices, labor costs, and supply chain disruptions. The company must continue to explore ways to optimize its cost structure and reduce its reliance on expensive materials.

- Technological advancements:Tesla’s continued innovation in battery technology, autonomous driving features, and other advancements will be crucial for maintaining its competitive edge and driving demand.

- Regulatory environment:The regulatory landscape will continue to evolve, creating both opportunities and challenges for Tesla. The company must be prepared to adapt to changing regulations and leverage any opportunities that arise.

Long-Term Trends in the Electric Vehicle Market

- The electric vehicle market is expected to grow significantly in the coming years, driven by factors such as government incentives, increasing consumer demand, and technological advancements. Tesla is well-positioned to benefit from this growth, but it faces increasing competition from established automakers.

The Virginia tax rebate deadline for October 2024 is approaching, and residents need to be aware of the critical dates. For accurate information on the deadline and other relevant details, refer to Virginia tax rebate deadline for October 2024.

Potential for Tesla to Maintain or Improve Gross Margin

- Tesla has a strong track record of profitability and has the potential to maintain or improve its gross margin in the future. The company’s continued focus on production volume, cost optimization, and technological innovation will be key to achieving this goal.

However, the competitive landscape is evolving rapidly, and Tesla must be prepared to adapt to changing market conditions.

Final Review

Understanding Tesla’s Q3 2024 gross margin provides valuable insights into the company’s financial health and its ability to compete in a rapidly evolving market. The analysis reveals the complex interplay of factors influencing Tesla’s performance, highlighting the importance of efficient operations, strategic pricing, and navigating the regulatory landscape.

While there have been discussions about additional stimulus checks, the possibility of receiving a stimulus check in October 2024 is uncertain. For the most up-to-date information on potential stimulus checks, you can find details at Are there any plans for stimulus checks in October 2024?

.

As Tesla continues to grow, its ability to maintain or improve its gross margin will be a key factor in its long-term success.

Essential Questionnaire: Tesla Q3 2024 Gross Margin

What are the main drivers of Tesla’s gross margin?

Tesla’s gross margin is influenced by factors such as production volume, manufacturing efficiency, pricing strategies, and the cost of raw materials.

How does Tesla’s gross margin compare to its competitors?

Tesla’s gross margin generally outperforms its competitors in the electric vehicle industry, though this can fluctuate based on factors like model mix and production costs.

What are the key takeaways from Tesla’s Q3 2024 gross margin performance?

Key takeaways include insights into Tesla’s revenue sources, cost structure, production efficiency, and the impact of regulatory changes on its financial performance.