The 5 Year Immediate Annuity Calculator sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. This calculator provides a powerful tool for understanding and managing your financial future.

Annuity issuers are the companies that provide these financial products. Annuity Issuer 2024 offers insights into the different types of annuity issuers and their respective offerings.

Imagine receiving a steady stream of income for five years, ensuring financial security and peace of mind. This guide delves into the world of 5-year immediate annuities, exploring their purpose, benefits, and potential risks. We’ll uncover the mechanics of how these calculators work, highlighting key factors like interest rates, principal amount, and age, all while demystifying the process with practical examples.

Understanding how annuity interest rates are calculated is crucial for making informed investment decisions. Calculating Annuity Interest Rate 2024 provides a breakdown of the factors that influence these rates.

Understanding the complexities of 5-year immediate annuities is crucial for making informed financial decisions. By navigating the intricacies of this financial instrument, you can gain valuable insights into its potential to meet your specific needs. Whether you’re seeking a reliable source of income for a specific period or simply want to explore your options for financial planning, this guide will equip you with the knowledge and tools to make sound choices.

To compare annuity yields from different providers, you can use an annuity yields calculator. Annuity Yields Calculator 2024 provides guidance on how to use these calculators effectively.

Contents List

- 1 Introduction to 5-Year Immediate Annuities

- 1.1 How 5-Year Immediate Annuity Calculators Work

- 1.2 Using a 5-Year Immediate Annuity Calculator, 5 Year Immediate Annuity Calculator

- 1.3 Key Considerations for Choosing a 5-Year Immediate Annuity

- 1.4 Examples of 5-Year Immediate Annuity Scenarios

- 1.5 Potential Risks and Limitations of 5-Year Immediate Annuities

- 2 Outcome Summary

- 3 Top FAQs: 5 Year Immediate Annuity Calculator

Introduction to 5-Year Immediate Annuities

A 5-year immediate annuity is a financial product that provides a guaranteed stream of income payments for a fixed period of five years. This type of annuity is typically purchased with a lump sum of money, and the payments begin immediately after the purchase.

Before you invest in a variable annuity, it’s important to understand the age requirements. Variable Annuity Age Requirements 2024 explains the eligibility criteria and how they may vary depending on the specific annuity you choose.

Immediate annuities are popular among individuals seeking a steady income stream for a specific period, often during retirement.

Annuity rates can fluctuate based on market conditions. Annuity 8 Percent 2024 explains how these rates can vary and the factors that influence them.

An annuity is a financial contract that provides a series of regular payments over a specified period. Key features of an annuity include:

- Guaranteed Payments:Annuities offer a guaranteed income stream, providing financial security and predictability.

- Fixed or Variable Payments:Annuities can offer fixed payments, where the amount remains constant, or variable payments, where the amount fluctuates based on investment performance.

- Lump Sum Investment:Annuities are typically purchased with a lump sum of money, which is then invested by the insurance company.

- Life Expectancy:Annuities can be structured to pay out for a specific period, or until the annuitant’s death.

5-year immediate annuities offer several benefits, including:

- Guaranteed Income:Provides a steady income stream for a defined period, reducing financial uncertainty.

- Inflation Protection:Some annuities offer inflation protection, ensuring that payments increase over time to maintain purchasing power.

- Tax Advantages:Annuity payments may be tax-deferred, allowing individuals to defer taxes until they receive the payments.

However, 5-year immediate annuities also have drawbacks, including:

- Limited Growth Potential:Annuities typically offer a fixed rate of return, which may not keep pace with inflation.

- Early Withdrawal Penalties:Withdrawing funds before the end of the annuity term may result in penalties.

- Lack of Flexibility:Once an annuity is purchased, it is difficult to change or modify the payment structure.

How 5-Year Immediate Annuity Calculators Work

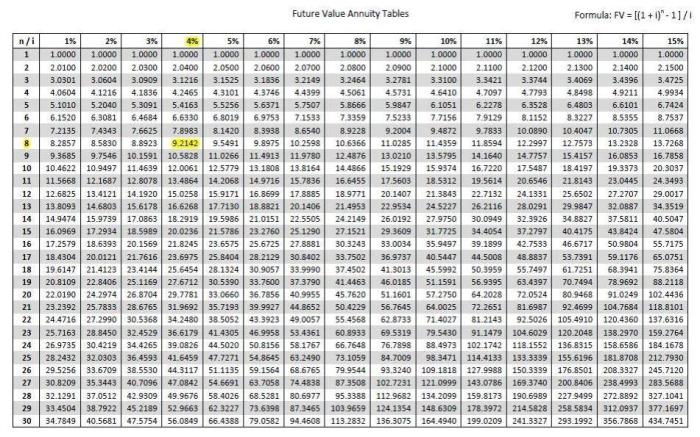

5-year immediate annuity calculators use a set of mathematical formulas to determine the estimated annual payout based on the principal amount, interest rate, and other relevant factors. The calculator takes into account the time value of money, which means that money received today is worth more than the same amount received in the future due to potential investment earnings.

The tax implications of annuities can vary depending on your location. Is Annuity Taxable In India 2024 provides information on how annuities are taxed in India.

The key factors that influence annuity payouts include:

- Principal Amount:The larger the principal amount, the higher the annual payout.

- Interest Rate:A higher interest rate generally results in a larger annual payout.

- Age:The age of the annuitant can impact the payout, as younger individuals are expected to live longer.

- Payment Frequency:The frequency of payments (e.g., monthly, quarterly, annually) can affect the total payout.

Here’s a simplified example of how a 5-year immediate annuity calculator works:

Suppose you invest $100,000 in a 5-year immediate annuity with an interest rate of 3%. The calculator would use the principal amount, interest rate, and the annuity term to determine the estimated annual payout. In this case, the annual payout might be around $21,000, based on the specific formula used by the calculator.

Premium immediate annuities offer a higher initial payout compared to standard immediate annuities. Premium Immediate Annuity provides a deeper understanding of these annuities and their advantages.

Using a 5-Year Immediate Annuity Calculator, 5 Year Immediate Annuity Calculator

Using a 5-year immediate annuity calculator is relatively straightforward. Most calculators have a user-friendly interface and require you to input the following information:

- Principal Amount:The amount of money you plan to invest in the annuity.

- Interest Rate:The annual interest rate offered by the annuity provider.

- Annuity Term:The duration of the annuity, typically 5 years.

- Payment Frequency:How often you would like to receive payments (e.g., monthly, quarterly, annually).

It is crucial to enter accurate information into the calculator, as any errors in the input data will affect the results. To ensure accuracy, double-check your entries and consult with a financial advisor if you have any questions.

Variable annuities are a popular investment option for those looking to grow their retirement savings. Variable Annuity Investment Options 2024 offers a variety of sub-accounts to choose from, allowing you to tailor your portfolio to your individual risk tolerance and financial goals.

When searching for a 5-year immediate annuity calculator, look for reliable and reputable sources, such as financial institutions, insurance companies, or well-known financial websites. Be wary of calculators that seem too good to be true or lack transparency in their calculations.

The HP10bii calculator is a popular tool for financial professionals and individuals alike. Calculate Annuity Hp10bii 2024 explains how to use this calculator to determine the present and future value of annuities.

Key Considerations for Choosing a 5-Year Immediate Annuity

Choosing the right 5-year immediate annuity requires careful consideration of several factors, including:

- Interest Rates:Compare interest rates offered by different annuity providers to maximize your return.

- Fees:Be aware of any fees associated with the annuity, such as administrative fees, surrender charges, or mortality and expense charges.

- Payment Options:Choose a payment frequency that suits your needs and financial goals.

- Inflation Protection:Consider annuities that offer inflation protection to ensure that your payments keep pace with rising prices.

- Guarantee Period:Understand the length of the guarantee period and how it affects your payments.

There are different types of annuities available, each with its own features and benefits. Some common types include:

- Fixed Annuities:Offer a guaranteed interest rate and fixed payments for the duration of the annuity.

- Variable Annuities:Allow your investment to grow based on the performance of underlying investments, but payments may fluctuate.

- Indexed Annuities:Link your payments to the performance of a specific index, such as the S&P 500.

It is highly recommended to consult with a qualified financial advisor before purchasing a 5-year immediate annuity. An advisor can help you understand your financial goals, assess your risk tolerance, and recommend the most suitable annuity product for your specific needs.

Many annuities have surrender charges that can apply if you withdraw funds before a certain period. Annuity 10 Penalty 2024 provides insights into these penalties and how they can impact your overall returns.

Examples of 5-Year Immediate Annuity Scenarios

| Scenario | Principal Amount | Interest Rate | Annual Payout |

|---|---|---|---|

| Scenario 1: Conservative Investment | $50,000 | 2.5% | $10,625 |

| Scenario 2: Moderate Investment | $100,000 | 3.0% | $21,000 |

| Scenario 3: Aggressive Investment | $200,000 | 3.5% | $42,000 |

| Scenario 4: High-Yield Investment | $500,000 | 4.0% | $105,000 |

These scenarios illustrate how the principal amount and interest rate can significantly impact the annual payout. Scenario 1 represents a conservative investment with a lower principal amount and interest rate, resulting in a smaller annual payout. Scenario 4, on the other hand, represents a high-yield investment with a larger principal amount and a higher interest rate, leading to a substantial annual payout.

For those seeking a steady stream of income during retirement, an annuity can be a valuable tool. Annuity 1000 Per Month 2024 provides information on how to calculate the amount of monthly income you can expect to receive based on your investment.

Potential Risks and Limitations of 5-Year Immediate Annuities

While 5-year immediate annuities offer a guaranteed income stream, it is important to be aware of potential risks and limitations associated with these products.

Immediate annuities offer a guaranteed stream of income starting right away. Immediate Annuity Minimum Age explains the minimum age requirements for purchasing this type of annuity.

- Interest Rate Changes:If interest rates rise after you purchase an annuity, you may miss out on potential higher returns. Conversely, if interest rates fall, your annuity may provide a lower return than you expected.

- Early Withdrawal Penalties:Withdrawing funds from an annuity before the end of the term may result in significant penalties, reducing your overall return.

- Fixed Payment Structure:Annuities offer fixed payments, which may not keep pace with inflation. As inflation erodes the purchasing power of your payments, you may need to adjust your spending habits to maintain your lifestyle.

- Lack of Growth Potential:Annuities typically have limited growth potential, as they offer a fixed interest rate. This can be a disadvantage if you are seeking to grow your wealth over time.

For example, if you purchase a 5-year immediate annuity with a fixed interest rate of 3% and inflation rises to 4% during that period, your payments will not keep pace with inflation, and your purchasing power will decline. Additionally, if you need to withdraw funds from the annuity before the end of the term, you may face early withdrawal penalties, reducing your overall return.

Outcome Summary

In conclusion, the 5 Year Immediate Annuity Calculator is a valuable tool for individuals seeking a structured income stream for a defined period. It offers a way to turn a lump sum into a predictable flow of payments, providing financial stability and peace of mind.

While it’s essential to consider the potential risks and limitations associated with annuities, understanding their mechanics and carefully evaluating your options can empower you to make informed decisions that align with your financial goals. Remember, seeking guidance from a financial advisor can help you navigate the intricacies of annuities and ensure that your chosen strategy is suitable for your individual circumstances.

Top FAQs: 5 Year Immediate Annuity Calculator

What are the common uses for a 5-year immediate annuity?

5-year immediate annuities are often used for bridging retirement income gaps, funding short-term expenses, or providing a steady income stream for a specific period. They can also be used to supplement existing income sources or as part of a broader financial plan.

How do I find a reputable 5-year immediate annuity calculator?

Look for calculators offered by reputable financial institutions, insurance companies, or trusted financial websites. Ensure the calculator is user-friendly, provides clear explanations, and offers transparent information about its calculations.

What are the potential tax implications of a 5-year immediate annuity?

The tax implications of an annuity depend on the specific type of annuity and your individual tax situation. Consult with a tax advisor for personalized guidance.

Microsoft Excel is a powerful tool for financial analysis. Calculating Annuity Cash Flows Excel 2024 explains how to use Excel to calculate the cash flows associated with annuities.

Immediate needs annuities provide a quick source of income for urgent needs. Immediate Needs Annuity Just offers insights into these annuities and their suitability for different financial situations.

For those looking to secure a substantial monthly income stream, an annuity with a payout of $300,000 might be a good option. Annuity 300 000 2024 provides guidance on how to calculate the monthly payments you can expect from such an annuity.