The Immediate Income Annuity Calculator is a powerful tool for individuals looking to secure a steady stream of income during retirement. It allows you to explore different annuity options and see how they can fit into your overall financial plan.

Understanding Variable Annuity Tax Qualification 2024 is essential for maximizing your tax benefits and minimizing your tax liability.

Understanding how immediate income annuities work and how they compare to other retirement savings strategies can help you make informed decisions about your future.

If you’re wondering “Annuity Kya Hai?” or “What is an annuity?” in Hindi, you can find information in Annuity Kya Hai 2024.

Immediate income annuities offer a guaranteed stream of payments for life, providing peace of mind and financial stability in retirement. These annuities are particularly attractive to individuals seeking to eliminate the risk of outliving their savings. However, it’s important to consider the trade-offs involved, such as the potential for lower returns compared to other investments.

Annuity Gator is a helpful resource for researching and comparing annuities. Check out Annuity Gator 2024 to find the right annuity for your needs.

The Immediate Income Annuity Calculator can help you weigh these factors and make an informed decision.

The Finra Variable Annuity 7 Day Rule 2024 is designed to protect investors by giving them a cooling-off period to review their annuity purchase.

Contents List

- 1 Immediate Income Annuities: An Overview: Immediate Income Annuity Calculator

- 2 How Immediate Income Annuities Work

- 3 Using an Immediate Income Annuity Calculator

- 4 Factors to Consider When Choosing an Immediate Income Annuity

- 5 Immediate Income Annuities vs. Other Retirement Income Options

- 6 Tax Implications of Immediate Income Annuities

- 7 Last Word

- 8 Commonly Asked Questions

Immediate Income Annuities: An Overview: Immediate Income Annuity Calculator

An immediate income annuity is a type of insurance contract that provides a guaranteed stream of income payments for life, starting immediately after you purchase the annuity. It is a popular choice for retirees seeking a reliable source of income to supplement their retirement savings.

Benefits of Immediate Income Annuities

Immediate income annuities offer several advantages, making them an attractive retirement planning option:

- Guaranteed Income for Life:Once you purchase an immediate income annuity, you are guaranteed a regular income stream for the rest of your life, regardless of how long you live. This provides peace of mind and financial security in retirement.

- Protection Against Longevity Risk:Immediate income annuities protect you from outliving your savings. They ensure that you have a consistent income stream even if you live longer than expected.

- Inflation Protection:Some immediate income annuities offer inflation protection, which means your payments increase over time to keep pace with rising prices. This helps maintain your purchasing power in retirement.

- Simplicity and Predictability:Immediate income annuities are relatively straightforward to understand and manage. You know exactly how much income you will receive each month, making it easier to budget and plan for your retirement expenses.

Potential Drawbacks of Immediate Income Annuities

While immediate income annuities offer significant benefits, it’s important to consider their potential drawbacks:

- Irreversible Commitment:Once you purchase an immediate income annuity, you cannot withdraw your principal or change the payment terms. This is a significant commitment, so it’s crucial to carefully consider your financial goals and risk tolerance before making a decision.

- Lower Returns:Immediate income annuities typically offer lower returns compared to other investment options, such as stocks or bonds. This is because the insurance company guarantees a fixed income stream, limiting potential growth.

- Limited Flexibility:Immediate income annuities offer limited flexibility in terms of accessing your funds. You cannot withdraw your principal or change the payment terms, which may not be suitable for everyone.

How Immediate Income Annuities Work

Understanding how immediate income annuities work is essential for making informed decisions about your retirement planning.

When you’re ready to start receiving income from your variable annuity, you can choose to Variable Annuity Annuitization 2024. This converts your investment into a guaranteed stream of payments.

Purchasing an Immediate Income Annuity

The process of purchasing an immediate income annuity is relatively straightforward:

- Choose an Annuity Provider:Select a reputable insurance company that offers immediate income annuities. Consider factors like financial stability, customer service, and product offerings.

- Determine Your Annuity Amount:Decide how much money you want to invest in the annuity. The amount you invest will determine the size of your monthly payments.

- Select a Payment Option:Choose the type of income payments you want to receive, such as a fixed monthly amount, a variable payment based on market performance, or a combination of both.

- Choose a Payment Period:Decide how long you want to receive payments, such as for life, for a specific period, or until a certain age.

- Finalize the Contract:Review the annuity contract carefully and make sure you understand the terms and conditions before signing.

Types of Immediate Income Annuities

Immediate income annuities come in various types, each with its own features and benefits:

- Single Premium Immediate Annuity (SPIA):A SPIA is purchased with a single lump-sum payment, and it provides a guaranteed income stream for life. This is the most common type of immediate income annuity.

- Flexible Premium Immediate Annuity (FPIA):An FPIA allows you to make multiple payments over time, giving you more flexibility in funding your annuity. However, your income payments may vary depending on the amount you contribute.

- Joint and Survivor Annuity:This type of annuity provides income payments for two people, typically a couple. The payments continue even after one spouse passes away, ensuring the surviving spouse continues to receive income.

- Deferred Income Annuity:A deferred income annuity provides payments at a later date, typically after a specific period or when you reach a certain age. This option allows you to defer your income payments and potentially earn higher returns on your investment.

Annuity Payment Calculations

Annuity payments are calculated based on several factors, including:

- Annuity Amount:The amount you invest in the annuity.

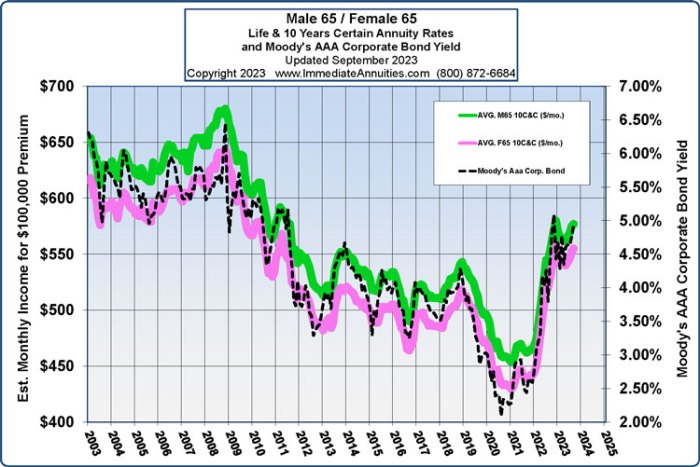

- Your Age and Gender:Your age and gender affect your life expectancy, which influences the amount of income you will receive.

- Interest Rates:Current interest rates play a role in determining the annuity payment amount.

- Payment Option:The type of income payments you choose will affect the amount you receive.

Using an Immediate Income Annuity Calculator

An immediate income annuity calculator is a valuable tool that can help you estimate your potential income payments and compare different annuity options.

Variable annuity contracts often have different classes, such as Class B. Learn about Variable Annuity Class B 2024 and how it compares to other classes.

Step-by-Step Guide, Immediate Income Annuity Calculator

- Enter Your Annuity Amount:Input the amount of money you plan to invest in the annuity.

- Enter Your Age and Gender:Provide your age and gender, as these factors influence life expectancy and annuity payments.

- Select a Payment Option:Choose the type of income payments you want to receive, such as a fixed monthly amount, a variable payment, or a combination of both.

- Select a Payment Period:Specify how long you want to receive payments, such as for life, for a specific period, or until a certain age.

- View the Results:The calculator will display your estimated monthly income payments, the total amount you will receive over the payment period, and other relevant information.

Key Inputs

The key inputs required for an immediate income annuity calculator are:

- Annuity Amount:The amount of money you invest in the annuity.

- Your Age and Gender:Your age and gender are important factors that affect life expectancy and annuity payments.

- Payment Option:The type of income payments you choose will determine the amount you receive.

- Payment Period:The length of time you want to receive payments, such as for life or for a specific period.

Outputs

An immediate income annuity calculator typically provides the following outputs:

- Estimated Monthly Income Payments:The amount of income you can expect to receive each month.

- Total Income Received:The total amount of income you will receive over the payment period.

- Guaranteed Income Period:The length of time for which your income payments are guaranteed.

- Present Value of Annuity:The current value of the future income stream.

Factors to Consider When Choosing an Immediate Income Annuity

Choosing the right immediate income annuity is a crucial decision that can significantly impact your retirement income. Several factors should be carefully considered:

Financial Goals

Your financial goals should be the primary consideration when choosing an immediate income annuity. Determine your income needs in retirement, your risk tolerance, and your overall financial situation. Consider how an immediate income annuity fits into your broader retirement planning strategy.

If you’re looking for an immediate annuity, Guardian Immediate Annuity is a reputable option to consider. They offer a variety of plans to fit your individual needs and goals.

Age and Health

Your age and health are significant factors that influence your life expectancy and annuity payments. Younger individuals with good health typically receive lower income payments than older individuals with health concerns. It’s essential to be realistic about your life expectancy and choose an annuity that aligns with your health status.

An immediate annuity is also commonly known as a “single premium immediate annuity” or a “SPIA.” You can learn more about Immediate Annuity Is Also Known As to understand its different names.

Annuity Providers and Offerings

Compare different annuity providers and their offerings before making a decision. Consider factors such as financial stability, customer service, product features, and fees. Look for reputable companies with a strong track record and a clear understanding of their products.

Transamerica offers a range of variable annuities, including the Transamerica Variable Annuity Series X-Share 2024. This series provides investment options and potential growth opportunities.

Immediate Income Annuities vs. Other Retirement Income Options

Immediate income annuities are just one of many retirement income options available. Comparing them to other alternatives can help you determine the best choice for your situation.

Getting a Variable Annuity Quote 2024 is a good first step in comparing different annuity options and finding the best fit for your situation.

Traditional Retirement Savings Accounts

Traditional retirement savings accounts, such as 401(k)s and IRAs, offer tax advantages and allow you to grow your savings over time. However, they do not provide guaranteed income for life, and you are responsible for managing your investments and withdrawals.

Variable annuities offer the potential for growth, but they also come with risks. Understanding Variable Annuity Blocks 2024 is crucial for making informed investment decisions.

- Pros of Traditional Retirement Savings Accounts:Tax-advantaged growth, flexibility in investment choices, potential for higher returns.

- Cons of Traditional Retirement Savings Accounts:No guaranteed income, risk of market volatility, responsibility for investment management.

Immediate Income Annuities vs. Traditional Retirement Savings Accounts

Immediate income annuities offer guaranteed income for life, while traditional retirement savings accounts provide flexibility and potential for higher returns. The best choice depends on your individual circumstances, risk tolerance, and financial goals.

- Scenario 1:If you are risk-averse and prioritize guaranteed income, an immediate income annuity might be a suitable choice. It provides a steady stream of income for life, regardless of market fluctuations.

- Scenario 2:If you have a higher risk tolerance and are comfortable with market volatility, a traditional retirement savings account might be a better option. It allows for potential higher returns but does not guarantee income.

Tax Implications of Immediate Income Annuities

Understanding the tax implications of immediate income annuities is crucial for planning your retirement income.

The Immediate Annuity Name can vary depending on the provider and type of plan, but it’s typically clear and easy to understand.

Taxation of Annuity Payments

Annuity payments are generally taxed as ordinary income. The portion of each payment that represents a return of your principal investment is tax-free, while the remaining portion is considered taxable income.

An Immediate Annuity Plan provides a guaranteed stream of income for life, starting immediately after you purchase it. This can be a great option for retirees who want to ensure a steady income stream.

Potential Tax Advantages

Immediate income annuities can offer potential tax advantages:

- Tax-Deferred Growth:While your annuity is accumulating, the earnings are not taxed until you start receiving payments. This allows your investment to grow tax-deferred.

- Tax-Free Principal Return:The portion of your annuity payments that represents a return of your principal investment is tax-free.

Tax Scenarios

Here are some examples of tax scenarios related to immediate income annuities:

- Scenario 1:If you invest $100,000 in an immediate income annuity and receive $10,000 in annual payments, the first $10,000 in payments will be tax-free. Any amount exceeding $10,000 will be considered taxable income.

- Scenario 2:If you purchase an annuity with a death benefit, the death benefit proceeds will be included in your estate and subject to estate taxes.

Last Word

Ultimately, the decision of whether or not an immediate income annuity is right for you depends on your individual circumstances and financial goals. The Immediate Income Annuity Calculator provides a valuable tool for exploring this option and comparing it to other retirement income strategies.

By carefully considering the factors involved and seeking professional financial advice, you can make informed decisions about your retirement income plan and ensure a secure and comfortable future.

Calculating the future value of an annuity can be helpful in financial planning. You can use an Fv Calculator Annuity 2024 to estimate the potential growth of your investment.

Commonly Asked Questions

What is the difference between an immediate income annuity and a deferred income annuity?

An immediate income annuity starts paying out immediately after purchase, while a deferred income annuity has a delay before payments begin. Deferred annuities are typically purchased by individuals who are still working and want to build up a larger nest egg before starting to receive income.

Annuities are versatile financial tools, and they’re becoming increasingly popular in 2024. Learn more about how Annuity Is Used In 2024 and how they can benefit you.

How do I choose the right annuity provider?

It’s important to research and compare different annuity providers before making a decision. Consider factors such as the provider’s financial strength, reputation, and the terms of the annuity contract.

What are the tax implications of immediate income annuities?

Annuity payments are generally taxed as ordinary income. However, there may be tax advantages depending on the type of annuity and your individual circumstances. It’s important to consult with a tax advisor to understand the tax implications of your specific situation.