Travel insurance with COVID-19 quarantine coverage has become an essential part of travel planning in the current pandemic context. This type of insurance offers valuable protection and peace of mind, ensuring you’re covered in case of unexpected events related to the virus, such as testing positive, being required to quarantine, or incurring medical expenses.

Looking for the best rates on a 5-year immediate annuity? 5 Year Immediate Annuity Rates can help you compare different options and find the best deal for your needs.

Imagine yourself on a dream vacation, only to be struck by COVID-19, forcing you to cancel your trip or face unexpected quarantine costs. Travel insurance with COVID-19 quarantine coverage can act as your safety net, alleviating the financial burden and allowing you to focus on your health and well-being.

Variable annuities can offer potential for growth, but sometimes it makes sense to cash out. Variable Annuity Buyout Offers can help you determine if it’s the right time to exit your annuity.

This type of insurance goes beyond standard travel insurance by providing specific coverage for COVID-19-related situations. It can cover expenses such as medical costs, emergency evacuation, quarantine costs, and even trip cancellation or interruption due to COVID-19-related issues. This comprehensive coverage ensures that you’re protected throughout your journey, providing financial security and peace of mind in a world where unforeseen circumstances can arise at any moment.

Need to calculate the value of your annuity over a three-year period? 3 Year Annuity Calculator can help you estimate your future income stream.

Contents List

Introduction to Travel Insurance with COVID-19 Quarantine Coverage

In the current pandemic landscape, travel has become more complex and unpredictable. With the ongoing threat of COVID-19, it is essential to have adequate protection in place to safeguard your health, finances, and travel plans. Travel insurance with COVID-19 quarantine coverage offers a crucial safety net for travelers, providing financial assistance and peace of mind during these uncertain times.

Annuity and perpetuity are both financial instruments, but they have distinct differences. Annuity Vs Perpetuity can help you understand the key differences between the two and choose the right option for your needs.

This type of insurance policy goes beyond traditional travel insurance, offering specific coverage for COVID-19 related events, including quarantine requirements, medical expenses, and travel disruptions. By understanding the key features, benefits, and coverage details, you can make informed decisions about your travel insurance needs and ensure you have the right protection in place.

Chapter 9 of the Bankruptcy Code can affect your annuity payments. If you’re considering filing for bankruptcy, it’s important to understand how Chapter 9 annuities can impact your retirement plans.

Specific Coverage Offered by Travel Insurance with COVID-19 Quarantine Coverage

Travel insurance with COVID-19 quarantine coverage provides a range of benefits specifically designed to address the unique challenges posed by the pandemic. Here are some key aspects of this type of insurance:

- Quarantine Coverage:This coverage provides financial assistance for expenses incurred during mandatory quarantine periods, including accommodation, meals, and transportation. It can also cover lost wages if you are unable to work due to quarantine.

- Medical Expenses:Travel insurance with COVID-19 quarantine coverage typically includes medical expenses related to COVID-19, such as testing, treatment, and hospitalization. This coverage can help alleviate the financial burden of unexpected medical costs.

- Trip Cancellation and Interruption:If you need to cancel or interrupt your trip due to COVID-19 related reasons, such as testing positive or being subject to travel restrictions, this type of insurance can help cover non-refundable expenses like flights, accommodation, and tours.

- Emergency Evacuation:In case of a medical emergency, travel insurance with COVID-19 quarantine coverage can provide financial assistance for emergency evacuation and repatriation to your home country.

Scenarios Where COVID-19 Quarantine Coverage is Beneficial

Here are some scenarios where travel insurance with COVID-19 quarantine coverage can be particularly beneficial:

- Testing Positive for COVID-19:If you test positive for COVID-19 while traveling, you may need to quarantine in a designated facility or at your accommodation. Travel insurance can help cover the costs associated with quarantine, including accommodation, meals, and medical expenses.

- Quarantine Requirements:Many countries have quarantine requirements for travelers, even if they test negative for COVID-19. Travel insurance can provide financial assistance for the costs of quarantine, ensuring you have a comfortable and safe experience.

- Travel Restrictions:Travel restrictions can change suddenly, leading to flight cancellations, border closures, and other disruptions. Travel insurance can help cover the costs of rebooking flights, accommodation, and other travel arrangements.

- Medical Emergencies:If you experience a medical emergency related to COVID-19 while traveling, travel insurance can cover the costs of medical treatment, hospitalization, and emergency evacuation.

Key Features and Benefits

Travel insurance policies with COVID-19 quarantine coverage offer several key features and benefits that provide travelers with financial protection, peace of mind, and essential support during their journey.

Want to calculate the present value of your annuity? Annuity Calculation Formula can help you understand the different formulas used to calculate annuities.

Essential Features

Here are some essential features commonly found in travel insurance policies with COVID-19 quarantine coverage:

- Comprehensive Coverage:These policies provide comprehensive coverage for a wide range of COVID-19 related events, including quarantine, medical expenses, trip cancellation, and travel disruptions.

- Flexible Coverage Options:Many insurance providers offer flexible coverage options to suit different travel needs and budgets. You can choose the level of coverage that best meets your requirements.

- 24/7 Assistance:Travel insurance providers typically offer 24/7 assistance services, providing support and guidance in case of emergencies or unexpected events.

- Global Coverage:Most travel insurance policies with COVID-19 quarantine coverage provide global coverage, ensuring you are protected regardless of your destination.

Benefits of Having COVID-19 Quarantine Coverage

Having travel insurance with COVID-19 quarantine coverage offers several benefits to travelers, including:

- Financial Protection:This type of insurance provides financial protection against unexpected expenses related to COVID-19, such as quarantine costs, medical bills, and travel disruptions.

- Peace of Mind:Knowing you have insurance coverage for COVID-19 related events can provide peace of mind and allow you to focus on enjoying your trip without worrying about potential financial risks.

- Medical Assistance:Travel insurance can provide access to medical assistance and support, ensuring you receive the necessary care in case of a medical emergency.

- Travel Flexibility:With travel insurance, you have more flexibility to adjust your travel plans in case of unexpected events or changes in travel restrictions.

Coverage Details

Travel insurance policies with COVID-19 quarantine coverage offer a range of specific coverage options to address different scenarios. Here is a table summarizing the different types of coverage, descriptions, examples, and benefits:

| Coverage Type | Description | Examples | Benefits |

|---|---|---|---|

| Quarantine Coverage | Covers expenses incurred during mandatory quarantine periods, including accommodation, meals, and transportation. | Testing positive for COVID-19 and being required to quarantine in a designated facility or at your accommodation. | Provides financial assistance for quarantine expenses, ensuring you have a comfortable and safe experience. |

| Medical Expenses | Covers medical expenses related to COVID-19, such as testing, treatment, and hospitalization. | Being diagnosed with COVID-19 and requiring medical treatment or hospitalization. | Alleviates the financial burden of unexpected medical costs associated with COVID-19. |

| Trip Cancellation and Interruption | Covers non-refundable expenses like flights, accommodation, and tours if you need to cancel or interrupt your trip due to COVID-19 related reasons. | Testing positive for COVID-19 and being unable to travel, or travel restrictions being imposed that prevent you from continuing your trip. | Provides financial compensation for lost travel expenses and allows you to recoup some of your investment. |

| Emergency Evacuation | Provides financial assistance for emergency evacuation and repatriation to your home country in case of a medical emergency. | Experiencing a medical emergency related to COVID-19 and requiring urgent medical attention or evacuation. | Ensures you receive the necessary medical care and support in case of a serious medical event while traveling. |

Choosing the Right Policy

Selecting the right travel insurance policy with COVID-19 quarantine coverage requires careful consideration of several factors. It is crucial to choose a policy that meets your specific needs and provides adequate protection for your travel plans.

If you’re participating in a 457(b) plan, you may have the option to invest in a variable annuity. 457 B Variable Annuity can help you understand the potential benefits and drawbacks of this investment strategy.

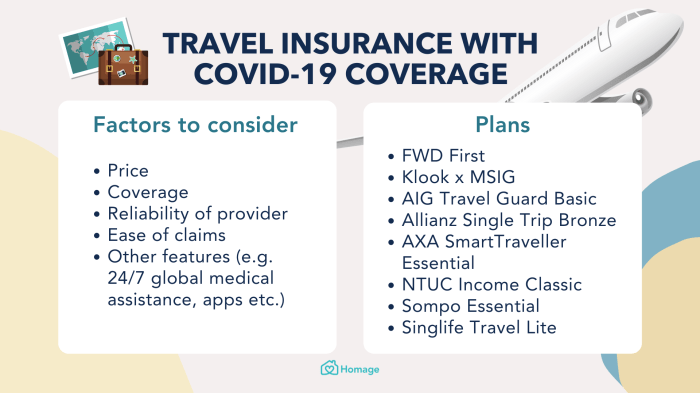

Factors to Consider

Here are some key factors to consider when choosing a travel insurance policy:

- Coverage Levels:Compare the coverage levels offered by different policies, including the maximum amount of coverage for quarantine expenses, medical expenses, trip cancellation, and other benefits.

- Exclusions:Review the policy’s exclusions carefully, as they may limit your coverage for certain events or circumstances. Pay attention to any exclusions related to COVID-19.

- Price:Consider the price of the policy and compare it to the coverage levels offered by other providers. Ensure the price is reasonable and reflects the value of the coverage.

- Reputation of the Insurance Provider:Choose a reputable insurance provider with a track record of reliable customer service and prompt claim processing.

- Specific Travel Needs:Consider your specific travel needs, such as your destination, duration of travel, and any pre-existing medical conditions. Choose a policy that meets your individual requirements.

Comparing Policies

When comparing different policies, consider the following:

- Coverage:Compare the coverage levels for quarantine expenses, medical expenses, trip cancellation, and other benefits.

- Price:Compare the premiums for similar coverage levels and choose a policy that offers good value for money.

- Reputation:Research the reputation of the insurance provider and look for reviews and ratings from other customers.

Tips for Ensuring the Policy Meets Your Needs

Here are some tips to ensure the policy meets your specific needs:

- Read the Policy Carefully:Read the policy terms and conditions thoroughly before purchasing to understand the coverage details, exclusions, and limitations.

- Ask Questions:If you have any questions or concerns about the policy, contact the insurance provider directly for clarification.

- Consider Additional Coverage:Explore additional coverage options, such as travel delay, baggage loss, and personal liability, to ensure you have comprehensive protection.

Claims Process

Filing a claim under travel insurance with COVID-19 quarantine coverage typically involves the following steps:

Steps Involved in Filing a Claim

- Contact the Insurance Provider:Contact your insurance provider as soon as possible after an incident occurs, such as testing positive for COVID-19 or experiencing a travel disruption.

- Provide Documentation:Provide the necessary documentation to support your claim, such as medical records, flight confirmations, and receipts for expenses incurred.

- Submit the Claim:Submit your claim form and supporting documentation to the insurance provider according to their instructions.

- Claim Processing:The insurance provider will review your claim and process it according to their procedures.

- Claim Payment:If your claim is approved, the insurance provider will pay the covered expenses according to the policy terms.

Documentation Required

The documentation required for a claim may vary depending on the specific circumstances. However, common documents include:

- Medical Records:If you are claiming for medical expenses, you will need to provide medical records from a licensed healthcare provider.

- Flight Confirmations:If you are claiming for trip cancellation or interruption, you will need to provide flight confirmations or other travel documents.

- Receipts:Provide receipts for any expenses incurred, such as accommodation, meals, transportation, and medical bills.

- Policy Documents:Provide a copy of your insurance policy and any relevant policy documents.

Common Claim Scenarios, Travel insurance with COVID-19 quarantine coverage

Here are some examples of common claim scenarios and how the process works:

- Quarantine Expenses:If you test positive for COVID-19 and are required to quarantine, you can submit a claim for expenses such as accommodation, meals, and transportation.

- Medical Expenses:If you incur medical expenses related to COVID-19, such as testing, treatment, or hospitalization, you can submit a claim for reimbursement.

- Trip Cancellation:If you need to cancel your trip due to COVID-19 related reasons, you can submit a claim for non-refundable expenses like flights and accommodation.

- Travel Interruption:If you need to interrupt your trip due to COVID-19 related reasons, you can submit a claim for expenses incurred during the interruption, such as accommodation and transportation.

Additional Considerations

It is crucial to read the policy terms and conditions carefully to understand the coverage details, exclusions, and limitations. This will help you make informed decisions about your travel insurance needs and maximize the benefits of your policy.

Are you unsure about the best annuity option for you? Annuity Uncertain can help you navigate the complexities of annuities and make informed decisions about your retirement savings.

Importance of Reading Policy Terms and Conditions

Reading the policy terms and conditions thoroughly is essential for understanding the scope of your coverage and any limitations or exclusions. This will help you avoid surprises or disappointments later on.

Variable annuity sales have been growing in recent years. Variable Annuity Sales can provide insights into the trends and popularity of these financial products.

Limitations and Exclusions

Travel insurance policies typically have limitations and exclusions, which are specific circumstances or events that are not covered by the policy. It is important to understand these limitations and exclusions to avoid any unexpected costs or denials of coverage.

There are many different types of annuities available, and variable annuity options can offer the potential for higher returns. However, it’s important to understand the risks and potential downsides before investing.

Tips for Maximizing Benefits

Here are some tips for maximizing the benefits of your travel insurance with COVID-19 quarantine coverage:

- Purchase Insurance Early:Purchase your travel insurance as early as possible to ensure you have coverage for any unexpected events that may occur before your trip.

- Choose the Right Coverage:Select a policy that provides adequate coverage for your specific travel needs and budget.

- Keep Records:Keep detailed records of all your travel expenses, including receipts, flight confirmations, and medical bills, in case you need to file a claim.

- Contact the Insurance Provider:Contact your insurance provider immediately if any unexpected events occur during your trip to discuss your coverage options and claim procedures.

Final Thoughts

In conclusion, travel insurance with COVID-19 quarantine coverage offers a crucial layer of protection for travelers in today’s uncertain world. It provides financial security, peace of mind, and valuable assistance in the event of unforeseen circumstances related to the virus.

By understanding the key features, benefits, and coverage details, you can choose a policy that meets your specific needs and ensure a safe and enjoyable travel experience. Remember to read the policy terms and conditions carefully and familiarize yourself with the claims process to maximize the benefits of your insurance.

FAQ Overview: Travel Insurance With COVID-19 Quarantine Coverage

What are the common exclusions in travel insurance with COVID-19 quarantine coverage?

Looking for a way to protect your retirement income from inflation? An immediate annuity with inflation protection can provide a guaranteed stream of income that increases over time, helping you maintain your purchasing power in retirement.

Common exclusions may include pre-existing medical conditions, travel against government advice, and activities considered high-risk. It’s crucial to read the policy carefully to understand the specific limitations.

How do I file a claim under travel insurance with COVID-19 quarantine coverage?

The claims process typically involves contacting your insurance provider, providing necessary documentation, and following their instructions. The specific requirements may vary depending on the insurer and the nature of your claim.

If you’re planning for retirement in the future, a deferred annuity might be a good option for you. Calculating a deferred annuity can help you determine how much you need to save and how much income you can expect to receive in retirement.

Is it mandatory to have travel insurance with COVID-19 quarantine coverage?

Want to know how much income you can expect from a $2,000 per month annuity? Annuity 2000 per month can provide you with a reliable stream of income for your retirement years.

While not always mandatory, it’s highly recommended to have this type of insurance, especially during the pandemic. It offers valuable protection and peace of mind, ensuring you’re prepared for any unexpected events.

Living in the UK and looking to calculate your annuity? Calculate Annuity Uk can help you understand the UK annuity market and find the right option for your retirement needs.

Traveling with your family and want to ensure peace of mind? Best travel insurance for families with COVID-19 coverage can help you find the right policy for your needs, especially in the current climate.