Travel insurance for seniors with COVID-19 protection is a vital consideration for older travelers seeking peace of mind. Seniors face heightened health risks during travel, and unexpected medical emergencies can lead to significant financial burdens. COVID-19 has added another layer of complexity, with unique vulnerabilities for older adults and ever-changing travel restrictions.

Jackson National Life is a well-known provider of variable annuities. Check out the performance of their variable annuity products on Jackson variable annuity performance 2024 to compare different options.

This guide explores the essential features of travel insurance specifically designed for seniors, addressing the unique challenges posed by the pandemic.

Want to learn how to calculate an annuity on your TI-84 calculator? Check out this helpful guide on calculating annuity on TI-84 2024. It provides step-by-step instructions and examples to help you master this financial calculation.

We’ll delve into the critical aspects of travel insurance for seniors, including medical expense coverage, trip cancellation protection, and emergency evacuation assistance. We’ll also discuss the importance of COVID-19 specific coverage, such as medical expenses related to the virus, quarantine costs, and potential travel disruptions due to pandemic-related restrictions.

Determining if an annuity is qualified for tax purposes is important for maximizing your retirement savings. Explore the criteria and implications of qualified annuities on annuity is qualified 2024 to make informed decisions.

By understanding these key features, seniors can make informed decisions about their travel insurance needs and enjoy their journeys with greater confidence.

Kotak Mahindra Bank offers an immediate annuity plan designed to provide regular income after retirement. Learn more about the features and benefits of this plan on immediate annuity plan Kotak.

Contents List

- 1 Importance of Travel Insurance for Seniors

- 2 COVID-19 Specific Considerations for Seniors

- 3 Key Features of Travel Insurance for Seniors with COVID-19 Protection

- 4 Choosing the Right Travel Insurance Policy

- 5 Tips for Seniors Traveling with COVID-19 Protection

- 6 Concluding Remarks: Travel Insurance For Seniors With COVID-19 Protection

- 7 FAQ Corner

Importance of Travel Insurance for Seniors

Traveling is a wonderful way to experience new cultures and create lasting memories. However, for seniors, it’s important to consider the increased health risks and potential financial burdens associated with travel. This is where travel insurance plays a crucial role in providing peace of mind and protecting your financial well-being.

Health Risks and Financial Burdens

As we age, our bodies become more susceptible to health issues. Unexpected medical emergencies while traveling can be particularly stressful and costly. Travel insurance can help mitigate these risks by providing coverage for medical expenses, emergency evacuation, and other essential services.

- Medical Emergencies:Seniors are more likely to experience health problems like heart attacks, strokes, or respiratory issues. Travel insurance can cover the costs of medical treatment, hospitalization, and medication.

- Emergency Evacuation:In case of a serious medical emergency, travel insurance can facilitate the transportation of the insured individual back home or to a suitable medical facility. This can be a significant expense, especially if air ambulance services are required.

- Lost or Stolen Luggage:Seniors may be more vulnerable to losing or having their luggage stolen while traveling. Travel insurance can provide compensation for lost or damaged belongings.

- Trip Cancellation or Interruption:Unexpected health issues can force seniors to cancel or interrupt their trips. Travel insurance can reimburse for non-refundable travel expenses, such as flights, accommodations, and tours.

Examples of Crucial Situations

- A senior falls and breaks a leg while on a cruise.Travel insurance covers the costs of medical treatment, hospitalization, and repatriation to their home country.

- A senior experiences a heart attack while visiting a foreign country.Travel insurance helps with the costs of emergency medical care and transportation to a suitable hospital.

- A senior’s flight is canceled due to a sudden illness.Travel insurance provides reimbursement for non-refundable travel expenses.

COVID-19 Specific Considerations for Seniors

The COVID-19 pandemic has added another layer of complexity to senior travel. Seniors are particularly vulnerable to severe complications from the virus, and travel restrictions and quarantine requirements can significantly impact their plans. Travel insurance with COVID-19 specific coverage is essential for seniors who are planning to travel.

An immediate annuity is a type of insurance product that provides guaranteed income for life. Learn more about the mechanics and benefits of this financial tool on immediate annuity meaning insurance.

Vulnerability to COVID-19

Seniors are at a higher risk of contracting COVID-19 and experiencing severe illness due to weakened immune systems and pre-existing health conditions. They may also be more susceptible to long-term health complications, even after recovering from a mild infection.

If you’re an 80-year-old looking for a secure income stream, an immediate annuity can be a good option. Find out how immediate annuities can provide guaranteed income for life on immediate annuity for 80 year-old.

Travel Restrictions and Quarantine Requirements, Travel insurance for seniors with COVID-19 protection

Many countries have implemented travel restrictions and quarantine requirements for travelers, including seniors. These measures can change rapidly, so it’s crucial to stay informed about the latest regulations before booking a trip. Travel insurance can provide financial protection in case of unexpected travel disruptions due to COVID-19 related restrictions.

The UK offers a variety of annuity products, each with different rates and features. Compare the current annuity rates available in the UK on annuity rates UK 2024 to find the best option for your needs.

Importance of COVID-19 Medical Coverage

Travel insurance with COVID-19 medical coverage is essential for seniors. It can help cover the costs of medical treatment, hospitalization, and emergency evacuation if they contract the virus while traveling. Some policies may also provide coverage for COVID-19 related testing and quarantine expenses.

Understanding the trends in variable annuity sales can provide insights into market demand and consumer preferences. Check out the latest data on variable annuity sales 2019 2024 to stay informed.

Key Features of Travel Insurance for Seniors with COVID-19 Protection

When choosing travel insurance for seniors, it’s important to look for policies that offer comprehensive coverage, including COVID-19 specific features. The following table highlights some key features to consider:

| Feature | Description | Benefits for Seniors | COVID-19 Relevance |

|---|---|---|---|

| Medical Expenses | Covers the costs of medical treatment, hospitalization, and medication for unexpected illnesses or injuries while traveling. | Provides financial protection against high medical bills, especially in foreign countries where healthcare costs can be exorbitant. | Essential for covering COVID-19 related medical expenses, including testing, treatment, and hospitalization. |

| Trip Cancellation | Reimburses for non-refundable travel expenses if the trip is canceled due to unforeseen circumstances, such as illness, injury, or death. | Protects seniors from financial losses due to unexpected events that may force them to cancel their trip. | Covers trip cancellations due to COVID-19 related travel restrictions, quarantine requirements, or illness. |

| Emergency Evacuation | Provides transportation back home or to a suitable medical facility in case of a serious medical emergency. | Ensures that seniors receive timely and appropriate medical care, regardless of their location. | Essential for evacuating seniors who contract COVID-19 while traveling and require specialized medical care. |

| COVID-19 Specific Coverage | Provides additional protection for COVID-19 related expenses, such as testing, treatment, quarantine, and trip cancellation due to COVID-19 restrictions. | Offers peace of mind and financial security for seniors who are concerned about the risks of COVID-19 while traveling. | Essential for covering COVID-19 related expenses and protecting seniors from financial losses due to travel disruptions caused by the pandemic. |

Choosing the Right Travel Insurance Policy

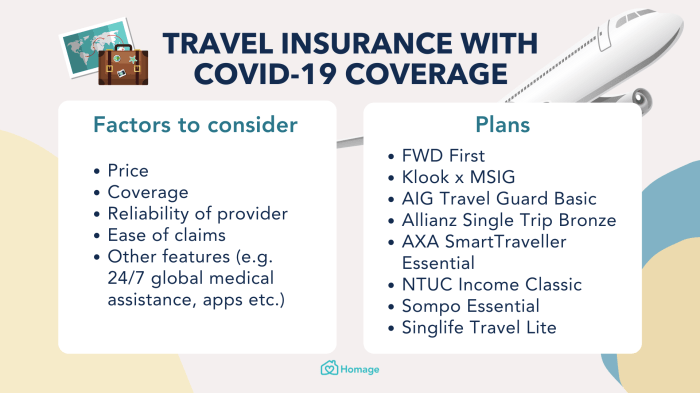

With numerous travel insurance providers offering various policies, choosing the right one can be overwhelming. Here are some factors to consider:

Compare and Contrast Providers

Research different travel insurance providers specializing in senior travel. Look for companies with a strong reputation, positive customer reviews, and a wide range of coverage options. Compare the benefits, premiums, and exclusions of different policies to find the best value for your needs.

If you prefer using a financial calculator, the BA II Plus is another popular choice. You can find a comprehensive guide on calculating annuity on BA II Plus 2024 , which covers all the necessary steps and formulas.

Coverage Limits, Deductibles, and Exclusions

Pay close attention to the coverage limits, deductibles, and exclusions of each policy. Coverage limits refer to the maximum amount the insurer will pay for a particular claim. Deductibles are the amount you pay out of pocket before the insurance kicks in.

Variable annuities with income riders can provide additional income guarantees in retirement. Explore the advantages and disadvantages of these products on variable annuity with income rider 2024 to make an informed decision.

Exclusions are specific events or situations that are not covered by the policy.

Working with annuity formulas can be challenging, but there are resources available to help. Find answers to common questions and explore different annuity formula applications on annuity formula questions 2024.

Essential Questions to Ask Providers

- What are the specific COVID-19 related coverage options included in the policy?

- What are the coverage limits for medical expenses, trip cancellation, and emergency evacuation?

- What are the deductibles for different types of claims?

- What are the policy’s exclusions?

- What are the claim procedures and how long does it take to process claims?

- What are the customer service options and how responsive is the provider?

Tips for Seniors Traveling with COVID-19 Protection

To minimize the risk of COVID-19 while traveling, seniors should follow these tips:

Minimize Risk

- Stay up-to-date on travel advisories and health protocols:Check the latest guidelines from the Centers for Disease Control and Prevention (CDC) and other relevant authorities before and during your trip.

- Get vaccinated and boosted:Vaccination is the most effective way to protect yourself from severe illness due to COVID-19.

- Practice good hygiene:Wash your hands frequently, wear a mask in crowded areas, and avoid close contact with people who are sick.

- Consider travel insurance with COVID-19 specific coverage:This can provide financial protection in case of unexpected events related to the pandemic.

- Check travel restrictions and quarantine requirements for your destination:These regulations can change rapidly, so it’s important to stay informed.

- Gather necessary documentation:Ensure you have all required travel documents, including vaccination certificates, negative COVID-19 test results, and any other relevant paperwork.

- Be prepared for potential delays or cancellations:Travel disruptions due to COVID-19 are still possible, so be flexible and have backup plans in place.

Concluding Remarks: Travel Insurance For Seniors With COVID-19 Protection

As travel continues to evolve in the wake of COVID-19, it’s crucial for seniors to have travel insurance that provides comprehensive protection. By carefully considering their individual needs, comparing different insurance providers, and staying informed about travel advisories, seniors can navigate the complexities of travel with confidence.

Understanding the tax implications of variable annuity death benefits is crucial for planning your estate. Visit variable annuity death benefit taxation 2024 to learn about the tax treatment of these benefits.

Remember, travel insurance is not just about financial protection; it’s about ensuring a safe and enjoyable experience for all travelers, especially those who are more vulnerable to health risks.

FAQ Corner

What are the most important things to consider when choosing travel insurance for seniors?

If you’re considering an immediate annuity, getting a quote is a crucial first step. You can easily obtain an immediate annuity quote by visiting immediate annuity quote and comparing different options.

When choosing travel insurance, consider the following: coverage limits for medical expenses, trip cancellation and interruption protection, emergency evacuation options, COVID-19 specific coverage, and the provider’s reputation for customer service and claims processing.

How can I find the right travel insurance provider for my needs?

In some situations, you may need to withdraw funds from your annuity before retirement. Learn more about the specific conditions and procedures for hardship withdrawals on annuity hardship withdrawal 2024 to ensure you understand the process.

Start by researching reputable travel insurance companies that specialize in senior travel. Compare coverage options, premiums, and customer reviews. Don’t hesitate to contact providers directly with questions about their policies and to clarify any uncertainties.

What are some tips for staying safe while traveling during COVID-19?

Understanding the difference between fixed and variable annuities is crucial for making informed financial decisions. Explore the key features and benefits of each type on fixed variable annuity 2024 to make an informed choice.

Stay up-to-date on travel advisories and health protocols. Wear a mask in public spaces, practice good hand hygiene, and maintain social distancing. Consider getting vaccinated and boosted against COVID-19. Be prepared for potential travel disruptions and quarantine requirements.