Compare travel insurance prices for October 2024 sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. Planning a trip in October 2024? It’s exciting to think about all the adventures that await, but it’s also important to consider the unexpected.

Annuity income is often a topic of discussion when it comes to taxes. To understand whether annuity income is considered capital gains in 2024, you can find relevant information here.

Travel insurance can provide peace of mind, knowing you’re covered in case of emergencies or unforeseen circumstances. This guide will help you understand the different types of coverage, key factors that influence prices, and tips for finding the best deal for your needs.

Excel is a powerful tool for financial calculations, and it can be used to calculate annuity payments. You can find resources on how to calculate annuities using Excel in 2024 here.

From medical emergencies to flight cancellations, travel insurance can protect you financially and emotionally. We’ll explore the various coverage options available, including medical, cancellation, baggage, and more. You’ll learn how factors like destination, trip duration, age, pre-existing conditions, and coverage level impact the cost of your policy.

Understanding the term “annuity” is crucial for anyone considering long-term financial planning. You can learn more about the definition and application of annuities in 2024 by visiting this link.

We’ll also provide a comprehensive comparison of prices from reputable providers, helping you make an informed decision.

Annuity income can be a valuable source of financial support. To learn more about how annuity income works in 2024, you can visit this link.

Contents List

Understanding Travel Insurance

Travel insurance is a vital component of any travel plan, providing financial protection against unforeseen events that could disrupt your trip or lead to unexpected expenses. It acts as a safety net, safeguarding you from potential financial losses and allowing you to focus on enjoying your journey.

The world of finance is always evolving, and variable annuity jobs are becoming increasingly sought after in 2024. These positions require a unique blend of financial knowledge and analytical skills.

Types of Travel Insurance Coverage, Compare travel insurance prices for October 2024

Travel insurance policies typically offer a range of coverage options, tailored to meet diverse travel needs. Common types of coverage include:

- Medical Coverage:This covers medical expenses incurred while traveling, including emergency medical treatment, hospitalization, and medical evacuation.

- Trip Cancellation and Interruption:This protects you against financial losses if you need to cancel or interrupt your trip due to covered reasons, such as illness, injury, or natural disasters.

- Baggage Coverage:This provides compensation for lost, stolen, or damaged baggage during your travels.

- Travel Delay:This covers expenses incurred due to unexpected travel delays, such as flight cancellations or weather disruptions.

- Emergency Assistance:This offers 24/7 support and assistance in case of emergencies, such as lost passports or medical emergencies.

Examples of Travel Insurance Scenarios

Travel insurance can provide peace of mind in various scenarios, such as:

- Medical Emergency:If you fall ill or experience a medical emergency while traveling, medical coverage can help cover the costs of treatment and evacuation.

- Trip Cancellation:If you need to cancel your trip due to a family emergency or a natural disaster, trip cancellation coverage can reimburse you for non-refundable expenses.

- Lost Baggage:If your luggage is lost or stolen during your travels, baggage coverage can help replace your belongings.

- Travel Delay:If your flight is delayed or canceled, travel delay coverage can cover expenses for accommodation, meals, and other necessities.

Factors Influencing Travel Insurance Prices

The cost of travel insurance can vary significantly depending on several factors. Understanding these factors can help you compare prices and choose a policy that suits your needs and budget.

If you’re looking for a tool to help you calculate annuity payments in Hong Kong, you can find an annuity calculator specifically for HK in 2024 here.

Key Factors Affecting Travel Insurance Costs

The following factors play a crucial role in determining travel insurance prices:

| Factor | Impact on Price |

|---|---|

| Destination | Travel insurance costs are often higher for destinations with higher medical expenses or a greater risk of natural disasters. |

| Trip Duration | Longer trips generally require higher insurance premiums due to a longer exposure to potential risks. |

| Age of Travelers | Older travelers may face higher premiums due to an increased risk of medical issues. |

| Pre-existing Medical Conditions | Travelers with pre-existing medical conditions may need to pay higher premiums or face limitations on coverage. |

| Coverage Level | The level of coverage you choose, such as the amount of medical expenses covered or the types of activities included, will impact the price. |

| Travel Activities | Engaging in high-risk activities, such as extreme sports or adventure travel, can increase insurance premiums. |

Comparing Travel Insurance Prices for October 2024

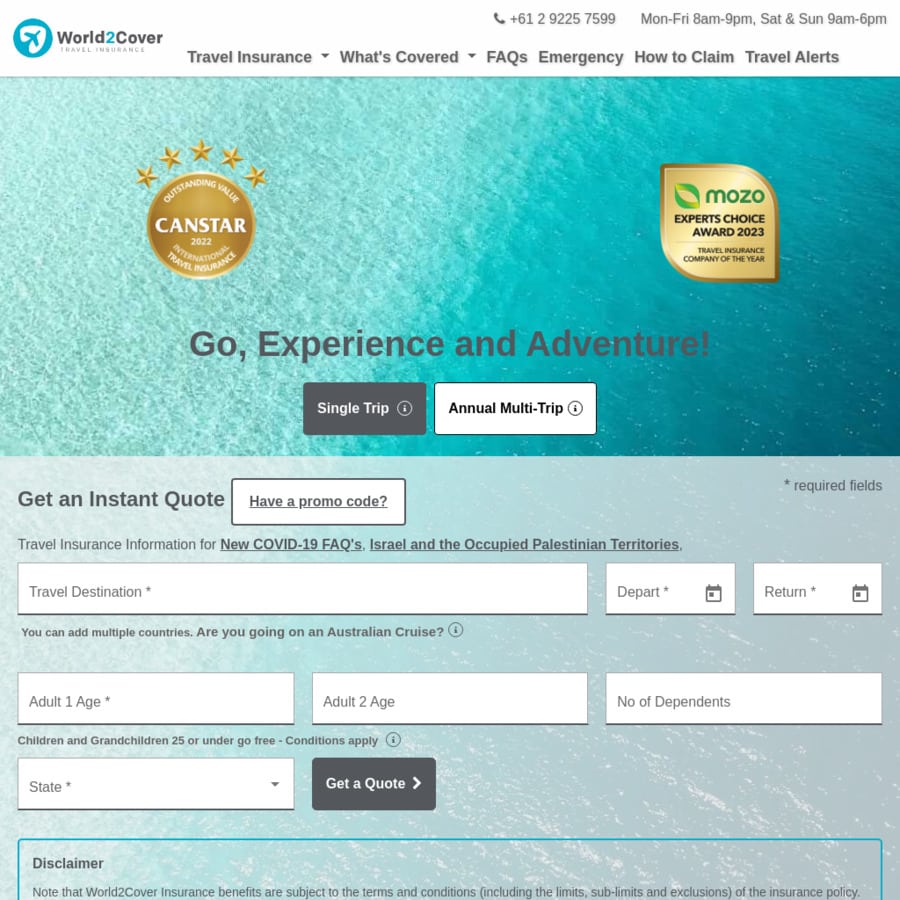

With numerous travel insurance providers available, comparing prices and coverage options is essential to find the best deal. Online comparison tools can simplify this process by allowing you to enter your travel details and receive quotes from multiple providers.

Annuity 5 is a type of annuity that provides a fixed income stream for a specific period. You can find more details about this type of annuity, including information for 2024, here.

Reputable Travel Insurance Providers

Here are some reputable travel insurance providers you can consider:

- World Nomads

- SafetyWing

- InsureMyTrip

- Travel Guard

- Allianz Travel Insurance

Price Comparisons for Specific Scenarios

To illustrate price variations, let’s compare prices for a 7-day trip to Europe for a family of 4 (two adults and two children) in October 2024.

Variable annuities offer a unique combination of features. To understand the key characteristics of variable annuities in 2024, you can explore this resource here.

| Provider | Plan Name | Price |

|---|---|---|

| World Nomads | Standard | $500 |

| SafetyWing | Nomad | $450 |

| InsureMyTrip | Family Traveler | $480 |

| Travel Guard | Explorer | $520 |

| Allianz Travel Insurance | Global Travel | $550 |

Remember that these are just illustrative prices and actual costs may vary depending on the specific plan features, coverage levels, and other factors.

An immediate annuity contract can be a valuable tool for securing a steady income stream. To understand the details of this contract type, you can check out this resource.

Summary

Navigating the world of travel insurance can seem daunting, but it doesn’t have to be. By understanding the different types of coverage, factors that influence prices, and tips for finding the best deal, you can confidently secure the protection you need for your upcoming October 2024 trip.

Securing a substantial income stream through an annuity can be a significant financial goal. If you’re interested in learning more about annuities that generate $2 million in income in 2024, you can find information here.

Remember to read the policy carefully and compare prices from multiple providers to ensure you’re getting the best value for your money. With a little research and planning, you can travel with peace of mind, knowing you’re prepared for the unexpected.

Calculating the annuity factor is a key step in understanding the potential returns of an annuity. You can find helpful resources on this topic, including calculations for 2024, here.

FAQ Resource: Compare Travel Insurance Prices For October 2024

What are some common travel insurance exclusions?

Retirement planning is a crucial aspect of financial well-being. If you’re looking for information on how variable annuities can contribute to your retirement goals in 2024, you can find it here.

Common exclusions can include pre-existing medical conditions, adventure sports, risky activities, and certain types of travel like cruises. It’s essential to carefully review the policy’s exclusions to understand what is not covered.

How long does it take to process a travel insurance claim?

The processing time for claims varies depending on the insurer and the complexity of the claim. However, most insurers aim to process claims within a reasonable timeframe, often within a few weeks.

Can I purchase travel insurance after I’ve already booked my trip?

Yes, you can generally purchase travel insurance after booking your trip. However, it’s advisable to purchase it as soon as possible after booking to ensure maximum coverage.

If you’re curious about the Hindi meaning of “annuity” in 2024, you can find it here. It’s a term that’s gaining more attention as people explore different financial options for their future.

Traveling during these times requires extra precautions. If you’re planning a cruise vacation, you can find information about COVID-19 travel insurance specifically designed for cruises here.

Immediate annuities offer a guaranteed income stream starting immediately. You can find information on current immediate annuity rates here , which can help you make informed decisions about your financial future.