Chase Trip Delay Insurance Refund Policy in October 2024: Navigating the intricacies of travel insurance can be a challenge, especially when unexpected delays arise. This guide explores the specifics of Chase’s refund policy for trip delay insurance in October 2024, highlighting key considerations, eligibility requirements, and the claim process.

Annuity contracts can be complex, but understanding how they work is essential for making informed decisions. Exploring resources that provide a comprehensive Annuity How It Works 2024 can help you gain a deeper understanding of these financial products.

Understanding these details empowers travelers to navigate potential disruptions with greater confidence.

Is an annuity the right retirement strategy for you? It’s essential to carefully consider all options and weigh the pros and cons. Exploring the question, Is Annuity Retirement 2024 , can help you make an informed choice for your financial future.

The policy covers a range of delays, including those caused by mechanical issues, weather events, and air traffic control problems. However, there are specific exclusions and limitations, such as pre-existing medical conditions or travel choices that fall outside the policy’s scope.

Many individuals are seeking guaranteed income streams for retirement. A 4% withdrawal rate is often discussed, but it’s important to consider the factors that might affect this approach. Exploring Annuity 4 Percent 2024 can help you determine if this strategy aligns with your financial goals.

Understanding these nuances is crucial for travelers seeking to maximize their coverage and ensure a smooth claims process.

Calculating the future value of an annuity is crucial for understanding its potential growth over time. This involves considering factors such as interest rates and the duration of the annuity. Learn more about Calculating Annuity Future Values 2024 to make informed decisions.

Contents List

Chase Trip Delay Insurance Overview: Chase Trip Delay Insurance Refund Policy In October 2024

Chase Trip Delay Insurance is a valuable benefit offered to Chase credit cardholders, providing financial protection against unexpected travel disruptions. This insurance aims to alleviate the financial burden associated with delays during your trip, covering expenses incurred due to unforeseen circumstances.

The accumulation phase of a variable annuity is where your investment grows. It’s important to understand how this phase works and the factors that can influence its performance. Exploring the Variable Annuity Accumulation Phase 2024 can provide valuable insights.

This policy covers a wide range of trip delays, including those caused by weather conditions, mechanical issues, and unforeseen circumstances.

Variable annuities can be complex financial products. To make informed decisions, it’s helpful to have a clear understanding of how they work. Consider exploring resources that provide a comprehensive Variable Annuity Explained 2024.

Types of Trip Delays Covered, Chase Trip Delay Insurance Refund Policy in October 2024

- Weather-Related Delays:Delays caused by severe weather conditions, such as storms, snowstorms, or fog, are covered under the policy.

- Mechanical Issues:Delays resulting from mechanical problems with the transportation vehicle, such as aircraft or train, are also covered.

- Unforeseen Circumstances:The policy covers delays caused by unforeseen circumstances, such as natural disasters, political unrest, or security threats.

- Airline Strikes:Delays caused by airline strikes are generally covered under the policy.

Eligibility Criteria

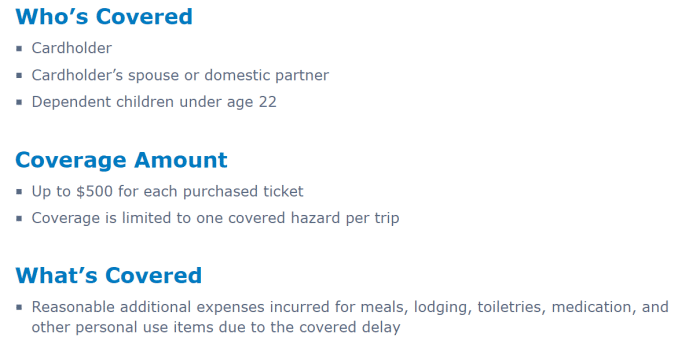

To be eligible for Chase Trip Delay Insurance, you must meet the following criteria:

- Use a Chase Credit Card:You must have purchased your travel tickets or packages using a qualifying Chase credit card.

- Trip Delay of a Certain Duration:The delay must exceed a specific duration, typically 6-12 hours, as defined by the policy.

- Covered Transportation:The delay must occur with a covered mode of transportation, such as a commercial airline, train, or cruise ship.

- Valid Travel Insurance:You must have valid travel insurance coverage for your trip.

Refund Policy in October 2024

Chase’s refund policy for trip delay insurance in October 2024 remains consistent with the general policy guidelines. However, it’s essential to stay updated on any specific changes or updates that may be announced during this period.

Annuity payments can provide income for an indefinite period. Understanding the concept of Annuity Is Indefinite Duration 2024 can be helpful when considering how to plan for your long-term financial security.

Key Factors Determining Refund Eligibility

- Delay Duration:The duration of the delay is a crucial factor. The policy typically specifies a minimum delay period, usually 6-12 hours, for a claim to be eligible.

- Cause of Delay:The cause of the delay must be covered under the policy. Commonly covered causes include weather conditions, mechanical issues, and unforeseen circumstances.

- Documentation Requirements:You will need to provide adequate documentation to support your claim. This includes flight information, receipts for expenses incurred due to the delay, and any other relevant supporting evidence.

Claim Process and Requirements

Filing a claim for Chase Trip Delay Insurance is a straightforward process. You can submit your claim online or through their customer service channels.

When considering an annuity, you might be interested in the rates offered for different terms. Exploring Annuity 3 Year Rates 2024 can help you compare options and find the best fit for your needs.

Steps to File a Claim

- Gather Necessary Documentation:Collect all relevant documents, including flight information, receipts for expenses incurred due to the delay, and any supporting evidence.

- Contact Chase:Reach out to Chase’s customer service team through their website, phone number, or email address.

- Submit Claim:Provide the required information and documentation to Chase, either online or through their customer service representatives.

- Review and Processing:Chase will review your claim and process it according to their policy guidelines.

Required Documentation

- Flight Itinerary:A copy of your flight itinerary, including flight numbers, dates, and times.

- Boarding Pass:Your boarding pass for the delayed flight.

- Receipts:Receipts for any expenses incurred due to the delay, such as hotel accommodations, meals, and transportation.

- Supporting Evidence:Any other relevant documentation that supports your claim, such as weather reports, airline notifications, or official statements.

Exclusions and Limitations

While Chase Trip Delay Insurance provides comprehensive coverage, there are certain exclusions and limitations to be aware of. These exclusions and limitations are Artikeld in the policy document.

Understanding how Required Minimum Distributions (RMDs) work with variable annuities is crucial for retirement planning. If you’re approaching retirement age and have a variable annuity, make sure to familiarize yourself with the rules and regulations surrounding RMD Variable Annuity 2024.

Common Exclusions

- Pre-Existing Conditions:Delays caused by pre-existing medical conditions are generally not covered.

- Travel Choices:Delays caused by travel choices, such as booking a non-refundable flight, are typically not covered.

- Specific Events:Delays caused by certain events, such as acts of war, terrorism, or political unrest, may be excluded.

Limitations

- Maximum Reimbursement:There is a maximum amount of reimbursement for expenses incurred due to a delay.

- Coverage Duration:The coverage period for trip delay insurance is limited to a specific timeframe, typically 24-48 hours.

Customer Support and Contact Information

Chase provides dedicated customer support channels for Chase Trip Delay Insurance. You can reach out to them through their website, phone, or email.

Immediate annuities are designed to provide income immediately. While they offer a guaranteed income stream, it’s important to understand the terms and conditions. Exploring the question, Does An Immediate Annuity Have A Surrender Period , can provide clarity on the potential for early withdrawals.

Contact Information

| Region | Phone Number | Email Address | Website |

|---|---|---|---|

| United States | 1-800-432-3117 | [email protected] | www.chase.com/tripdelay |

| Canada | 1-800-572-4733 | [email protected] | www.chase.ca/tripdelay |

| United Kingdom | +44-20-7946-2000 | [email protected] | www.chase.co.uk/tripdelay |

Final Wrap-Up

Navigating travel delays can be stressful, but having the right information can make a world of difference. Chase Trip Delay Insurance offers a safety net for unexpected disruptions, providing financial assistance for eligible delays. By familiarizing yourself with the refund policy, claim process, and key exclusions, you can confidently approach any travel challenges that may arise.

For individuals with immediate financial needs, an immediate needs annuity can provide a steady stream of income. These annuities can be a valuable tool for bridging gaps in income or covering essential expenses. Learn more about Immediate Needs Annuity to determine if it’s right for you.

Remember, preparation and understanding are your best allies in navigating the world of travel insurance.

Annuity loans can be a valuable tool for accessing funds from your annuity contract. However, it’s crucial to understand the terms and conditions associated with these loans. Familiarizing yourself with the Formula Annuity Loan 2024 can help you make informed decisions.

Question & Answer Hub

What are the common causes of trip delays covered by Chase Trip Delay Insurance?

When thinking about the future value of an annuity, it’s important to understand how interest rates and time play a role. The concept of Annuity Is Future Value 2024 can help you estimate the potential growth of your investment over time.

Common causes include mechanical issues, weather events, air traffic control problems, and security delays. The policy details the specific events covered, so it’s essential to review the policy for complete clarity.

Annuity options offer flexibility for your retirement income. Understanding the differences between immediate and deferred annuities can be crucial for your planning. Learn more about Immediate Deferred Annuity to find the best fit for your needs.

How long does a delay need to be to qualify for a refund?

The policy specifies a minimum delay duration for eligibility. This duration may vary depending on the cause of the delay and other factors. Review the policy for the specific requirements.

What documentation is required to file a claim?

When considering a variable annuity, you might wonder about average returns. While past performance doesn’t guarantee future results, exploring Average Variable Annuity Returns 2024 can provide valuable insights for your decision-making process.

Typically, you’ll need flight information, receipts for expenses incurred due to the delay, and any supporting documentation that confirms the cause of the delay. The policy Artikels the specific documentation required.

What are the typical limitations on reimbursement?

The policy Artikels the maximum amount of reimbursement available for eligible expenses. There may also be limitations on the types of expenses covered and the duration of coverage. Review the policy for these details.