GameGuardian 2024 for Roblox sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. GameGuardian 2024 is a powerful tool that can be used to modify game values in Roblox, giving players an edge in their gameplay.

It allows players to adjust their health, currency, and even unlock items that would otherwise be difficult to obtain. However, it’s important to use this tool responsibly and understand the potential risks associated with it.

This guide delves into the world of GameGuardian 2024, exploring its features, benefits, and drawbacks. We’ll cover everything from installation and configuration to ethical considerations and legal implications. Whether you’re a seasoned Roblox player or a curious newcomer, this comprehensive exploration will equip you with the knowledge to make informed decisions about using GameGuardian 2024.

Looking for a convenient way to order food and groceries? The Glovo app might be your solution. Learn more in Glovo App 2024: A Comprehensive Guide.

Contents List

GameGuardian 2024: An Overview

GameGuardian 2024 is a powerful tool designed to modify and enhance gameplay in various mobile games, including Roblox. It allows users to manipulate game values, automate actions, and gain an advantage over other players. This comprehensive guide will delve into the functionalities, advantages, disadvantages, and ethical considerations associated with using GameGuardian 2024 for Roblox.

While newer chipsets are always being released, the Snapdragon 865 is still a solid performer. Is it still relevant in 2024? Find out in Snapdragon 865 2024: Still Relevant?.

Key Features and Improvements

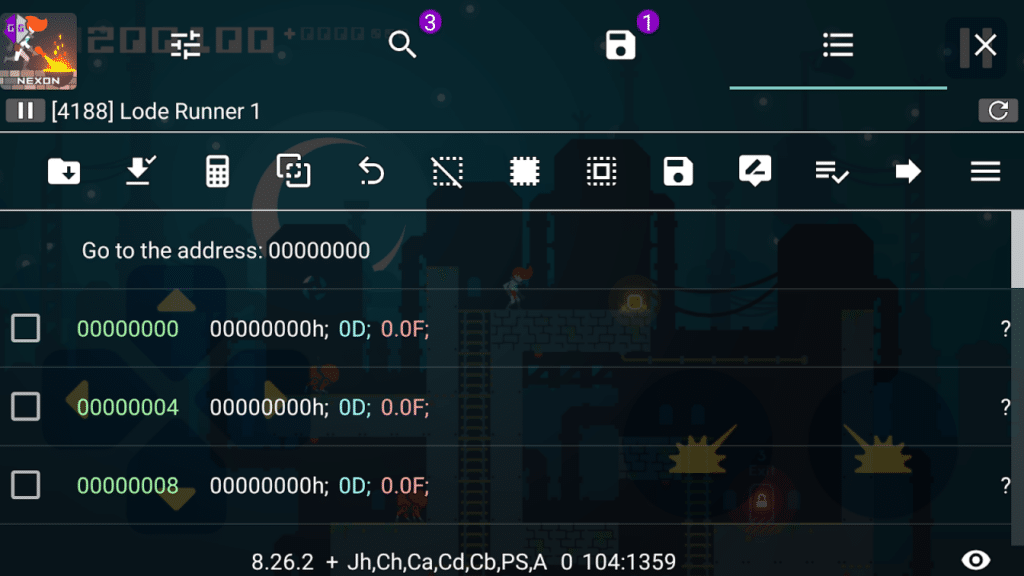

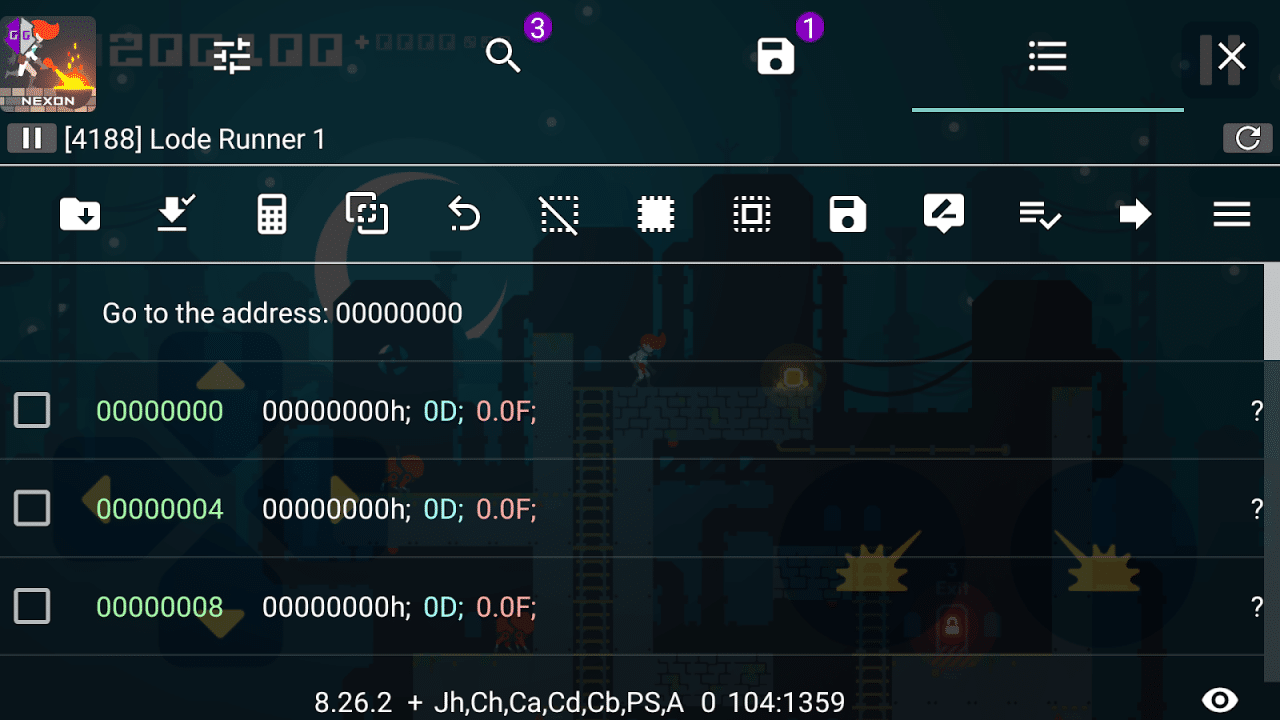

GameGuardian 2024 boasts several key features and improvements over previous versions, making it a popular choice among Roblox players.

- Enhanced Compatibility:GameGuardian 2024 is designed to be compatible with a wider range of Android devices and game versions, including the latest updates to Roblox. This ensures that users can access its functionalities without encountering compatibility issues.

- Advanced Scripting:The tool offers a robust scripting engine that allows users to create complex scripts for automating actions in Roblox. These scripts can be used to perform repetitive tasks, execute actions automatically, and even create custom game features.

- Improved User Interface:GameGuardian 2024 features a user-friendly interface that is easy to navigate and understand, even for beginners. This makes it easier for users to find the features they need and start modifying their gameplay.

- Enhanced Security:The developers have implemented security measures to protect users from detection and account bans. This includes advanced anti-detection techniques and a secure connection to the game server.

Using GameGuardian 2024 for Roblox

GameGuardian 2024 can be used to modify various aspects of Roblox gameplay, providing players with a significant advantage.

Want to get organized in 2024? Check out Google Tasks 2024: A Comprehensive Guide for tips and tricks on maximizing this powerful tool.

- Modifying Game Values:Users can easily modify game values such as health, currency, and item quantities. This allows them to overcome challenges, unlock items, and progress through the game faster.

- Automating Actions:GameGuardian 2024’s scripting capabilities enable users to automate repetitive actions, such as farming, building, and even combat. This can save time and effort, allowing players to focus on other aspects of the game.

- Creating Custom Features:With its advanced scripting features, GameGuardian 2024 allows users to create custom game features, such as new items, abilities, or even entire game modes. This opens up endless possibilities for creativity and customization.

Advantages and Disadvantages of Using GameGuardian 2024

GameGuardian 2024 offers a range of advantages and disadvantages that players should consider before using it.

Android Authority is a go-to source for all things Android. Get a comprehensive look at the platform in Android Authority 2024: A Deep Dive.

- Advantages:

- Enhanced Gameplay:GameGuardian 2024 can significantly enhance gameplay by providing players with advantages, such as increased resources and automated actions.

- Customization:The tool allows players to customize their gameplay experience by modifying game values and creating custom features.

- Time-Saving:GameGuardian 2024 can automate repetitive tasks, saving players time and effort.

- Disadvantages:

- Account Bans:Using GameGuardian 2024 can result in account bans from Roblox, as it violates their Terms of Service.

- Security Risks:Downloading and using third-party tools like GameGuardian 2024 can expose users to security risks, such as malware and data breaches.

- Unfair Advantage:Using GameGuardian 2024 to gain an unfair advantage over other players can create an imbalance in the game and detract from the enjoyment of legitimate players.

Ethical Considerations and Legal Implications, GameGuardian 2024 for Roblox

Using GameGuardian 2024 for Roblox raises significant ethical and legal concerns.

- Ethical Implications:

- Fairness:Using GameGuardian 2024 to gain an unfair advantage over other players can undermine the principles of fairness and sportsmanship in online gaming.

- Impact on Other Players:The use of GameGuardian 2024 can create a negative gaming experience for other players, as it can lead to an imbalance in gameplay and frustration.

- Legal Ramifications:

- Roblox Terms of Service:Using GameGuardian 2024 violates Roblox’s Terms of Service, which prohibits the use of unauthorized third-party tools and modifications.

- Potential Consequences:Using GameGuardian 2024 can lead to account bans, legal action, and even financial penalties in some cases.

Alternatives to GameGuardian 2024

There are several alternatives to GameGuardian 2024 for modifying Roblox gameplay.

- Script Injection:This method involves injecting scripts into Roblox games to modify their functionality. It requires some technical knowledge and can be more difficult to use than GameGuardian 2024.

- Roblox Studio:Roblox Studio is a powerful tool that allows users to create and modify Roblox games. While it is not designed for cheating, it can be used to create custom game features and experiences.

- Exploits:Exploits are vulnerabilities in Roblox games that can be used to gain an advantage. However, exploits are often patched quickly, and using them can result in account bans.

Best Practices for Using GameGuardian 2024

If you choose to use GameGuardian 2024, it is crucial to do so responsibly and safely.

- Understand the Risks:Be aware of the risks associated with using GameGuardian 2024, including account bans and security threats.

- Use a Separate Account:Consider using a separate Roblox account for testing GameGuardian 2024 to minimize the risk of banning your main account.

- Avoid Overuse:Avoid using GameGuardian 2024 excessively, as this can increase the risk of detection and account bans.

- Stay Updated:Keep GameGuardian 2024 updated to the latest version to ensure compatibility and security.

- Be Discreet:Avoid bragging about using GameGuardian 2024 to other players, as this can attract unwanted attention.

Ending Remarks

In conclusion, GameGuardian 2024 for Roblox offers a compelling blend of possibilities and challenges. While it can enhance gameplay and provide an advantage, it’s crucial to approach its use with caution. Understanding the ethical and legal implications is paramount, as is adhering to best practices to mitigate risks.

The future of GameGuardian 2024 and Roblox is uncertain, but one thing remains clear: the landscape of online gaming is constantly evolving, demanding responsible and informed participation from all players.

Dollify has taken the internet by storm, letting you create AI-powered avatars that reflect your personality. Discover the impact of this trend in Dollify 2024: AI-Powered Avatars Reshaping Digital Identity.

FAQ Insights: GameGuardian 2024 For Roblox

Is GameGuardian 2024 legal to use?

Using GameGuardian 2024 to modify game values in Roblox is generally against the platform’s Terms of Service and can lead to account bans. It’s important to consult Roblox’s official rules and guidelines before using any third-party tools.

What are the risks of using GameGuardian 2024?

Using GameGuardian 2024 carries risks such as account bans, security breaches, and potential malware exposure. It’s essential to use reputable sources and follow safety precautions to minimize these risks.

Are there any alternatives to GameGuardian 2024?

Yes, there are other tools and methods for modifying Roblox gameplay. Some popular alternatives include scripts, exploits, and cheat engines. Each option has its own advantages and disadvantages, so it’s crucial to research and compare them before choosing one.