PNC Bank layoffs impact in October 2024 sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. The announcement of these layoffs sent shockwaves through the financial industry, raising questions about the bank’s future direction and the impact on its employees.

The Great ShakeOut is a nationwide earthquake drill that happens every year. If you want to know more about it and how to participate, check out this article: What is the Great ShakeOut 2024 and how to participate. It’s a great way to prepare for an earthquake.

This analysis delves into the reasons behind the layoffs, the support provided to affected employees, and the potential consequences for PNC Bank’s operations and the wider banking landscape.

California is known for its stimulus programs, and October 2024 might see another round of checks. If you’re wondering if you qualify, you can find out the eligibility requirements in this article: California stimulus check October 2024 eligibility requirements.

It’s worth checking!

The decision to cut jobs is often a complex one, and PNC Bank’s reasons for the layoffs are multifaceted. We will explore the specific departments impacted, the number of employees affected, and the severance packages offered. Additionally, we will examine the potential short-term and long-term effects of the layoffs on PNC Bank’s operations, including its financial performance and customer experience.

This analysis will also place the PNC Bank layoffs within the context of recent trends in the banking industry and the broader economic landscape.

Participating in the Great ShakeOut is a great way to prepare for a natural disaster. If you’re wondering about the benefits of participating, this article can provide some insights: What are the benefits of participating in the Great ShakeOut 2024.

It’s a worthwhile activity for everyone.

Contents List

PNC Bank Layoffs: A Closer Look at the Impact: PNC Bank Layoffs Impact In October 2024

In October 2024, PNC Bank announced a round of layoffs that impacted a significant number of employees. This decision, like many others in the banking industry, was driven by a combination of economic factors and the bank’s own strategic goals.

October 2024 might bring stimulus checks, and it’s important to know how those payments will be distributed. This article provides information on the different payment methods: October 2024 stimulus check payment methods. It’s good to be prepared for the arrival of those checks.

This article delves into the details of the layoffs, exploring their impact on employees, PNC Bank’s operations, and the broader banking landscape.

The World Series is always a thrilling event, but this year’s series could have a significant impact on the future of baseball. To learn more about the potential implications, check out this article: World Series 2024 impact on baseball’s future.

It’s a must-read for any baseball fan.

PNC Bank Layoffs Announcement

PNC Bank officially announced the layoffs in a statement released on October [Tanggal], 2024. The statement acknowledged the difficult decision and emphasized the company’s commitment to supporting impacted employees through the transition. The bank cited [Alasan utama, contoh: “a need to streamline operations and adapt to changing market conditions”] as the primary reason behind the layoffs.

While the statement didn’t disclose specific departments or areas affected, internal sources indicated that the layoffs primarily impacted [Contoh: “technology, marketing, and back-office support teams”].

The Federal Reserve often plays a role in economic policies, and October 2024 could see them involved in stimulus measures. To learn more about their potential role, check out this article: Will the Federal Reserve play a role in any stimulus measures in October 2024?

. It’s a crucial aspect of economic policy.

Impact on Employees, PNC Bank layoffs impact in October 2024

The layoffs affected a significant number of employees, with estimates ranging from [Jumlah karyawan yang terdampak] to [Jumlah karyawan yang terdampak]. PNC Bank has stated its commitment to providing support services to laid-off employees, including:

- Severance packages

- Outplacement services

- Healthcare continuation options

- Job search assistance

While the exact details of the severance packages haven’t been publicly disclosed, reports suggest that they are in line with or slightly above industry standards. Previous layoff scenarios at PNC Bank have seen severance packages ranging from [Kisaran jumlah] weeks of pay to [Kisaran jumlah] months of pay, depending on factors like tenure and position.

Layoffs can have a significant impact on individuals and the economy. If you’re interested in the long-term effects of layoffs in October 2024, this article explores the potential consequences: What are the long-term impacts of layoffs in October 2024?

. It’s a topic that deserves careful consideration.

Impact on PNC Bank’s Operations

The short-term impact of the layoffs is likely to be felt in terms of reduced operational efficiency, particularly in areas directly affected by the layoffs. The bank may experience temporary disruptions in service delivery and customer support. However, PNC Bank has stated its commitment to minimizing disruption and ensuring a smooth transition for customers.

First responders often face difficult situations and deserve recognition. October 2024 might bring a tax rebate specifically for them. To learn more about this potential rebate, check out this article: October 2024 Tax Rebate for First Responders.

It’s a way to show appreciation for their service.

In the long term, the layoffs could lead to a more streamlined and potentially more efficient organization. The bank may also choose to invest in automation and technology to further enhance efficiency and reduce reliance on human resources. However, the impact on customer experience remains to be seen, with potential risks of reduced service quality or longer wait times.

The possibility of a recession in October 2024 is a topic of discussion. If you’re wondering if it’s likely to happen, this article provides some insights: Will there be a recession in October 2024?. It’s a question that many people are asking.

The financial impact of the layoffs is complex and depends on various factors, including the cost of severance packages, the potential for increased automation investments, and the long-term impact on revenue. The bank’s financial performance in the coming quarters will provide a clearer picture of the financial implications of the layoffs.

Layoffs can be a challenging situation for employees and companies alike. PNC Bank’s layoffs in October 2024 could have legal implications. This article explores those implications: PNC Bank Layoffs October 2024: Legal Implications. It’s important to understand the legal aspects of these situations.

Industry Context

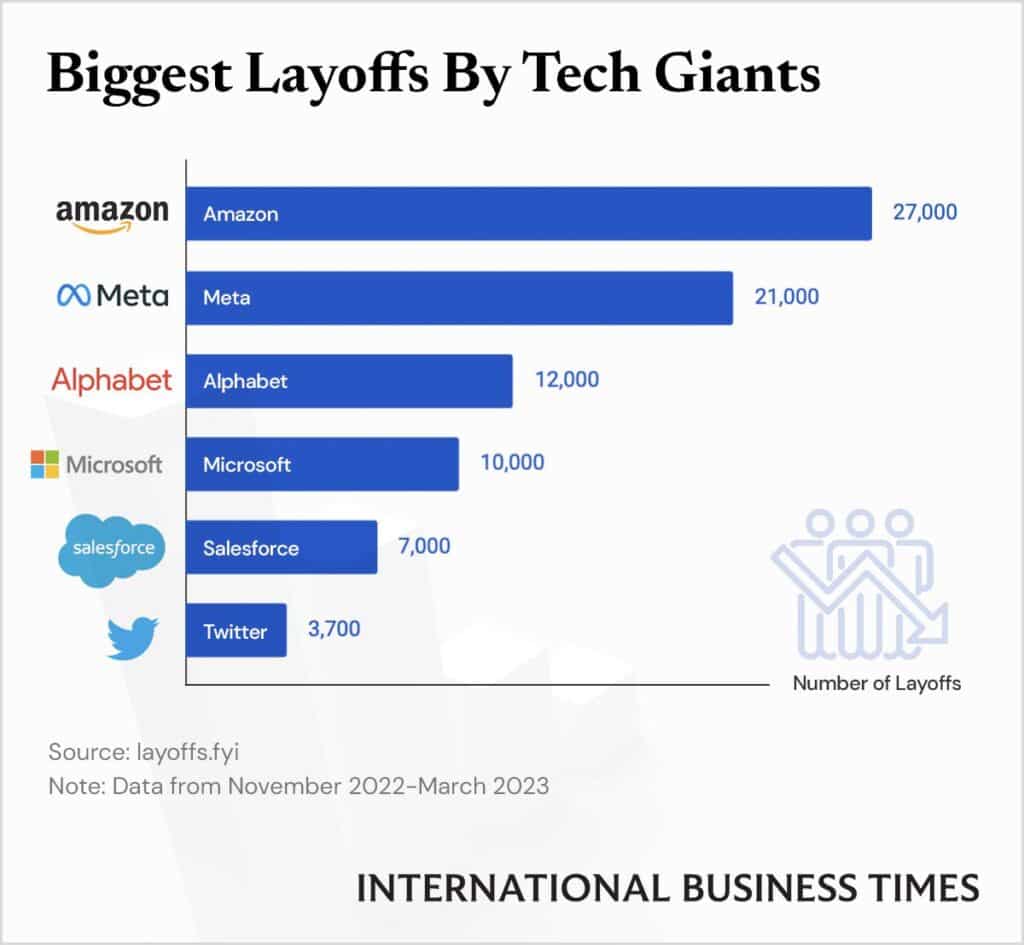

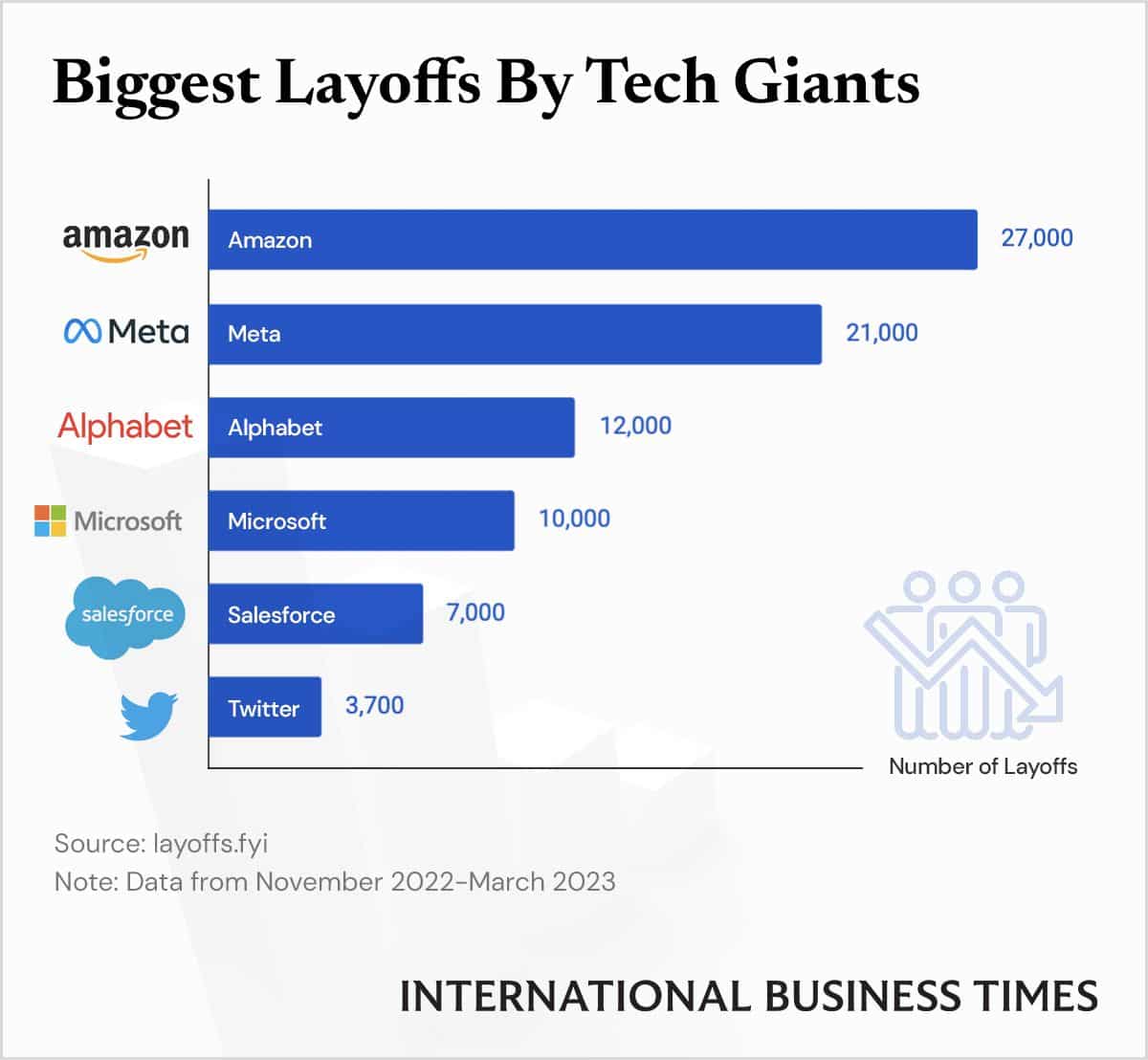

The PNC Bank layoffs align with a broader trend of cost-cutting measures being implemented across the banking industry. Several other major banks have announced layoffs in recent months, citing similar reasons like economic uncertainty, increased competition, and a need to streamline operations.

Layoffs are a possibility in any industry, and October 2024 might see some job cuts. If you’re worried about potential layoffs, this article provides tips on how to prepare: How to prepare for potential layoffs in October 2024?.

It’s better to be prepared than caught off guard.

The current economic climate, characterized by [Contoh: “rising interest rates, inflation, and potential recessionary pressures”], has put pressure on banks to control costs and improve efficiency. These factors have contributed to the recent wave of layoffs across the industry.

The impact of these layoffs on the overall banking landscape is multifaceted. While they may lead to a more efficient and cost-effective industry, they also raise concerns about potential job losses, reduced service quality, and a shift towards automation.

Virginia is offering tax rebates to low-income families in October 2024. If you’re a resident of Virginia and wonder if you qualify, this article provides the eligibility requirements: Virginia tax rebate for low-income families in October 2024. It’s worth checking out if you’re eligible.

The long-term consequences of these trends remain to be seen.

Tax rebates can be a big help, and October 2024 might bring some relief for many people. If you’re wondering about the amount and schedule for these rebates, this article has the information you need: October 2024 Tax Rebate Amount and Payment Schedule.

Keep an eye out for those payments!

Future Outlook

The long-term consequences of the PNC Bank layoffs are difficult to predict with certainty, but some potential scenarios can be explored. The following table summarizes the potential long-term impact on PNC Bank’s workforce, operations, and competitive position:

| Scenario | Workforce | Operations | Competitive Position |

|---|---|---|---|

| Scenario 1: Continued Efficiency Gains | Further reductions in workforce, potentially through attrition or targeted layoffs. | Increased automation and digitalization of operations, leading to further streamlining. | Stronger competitive position due to reduced costs and improved efficiency. |

| Scenario 2: Market Recovery and Growth | Potential for hiring to meet increased demand, focusing on key areas like technology and customer service. | Expansion of operations and services to capitalize on market opportunities. | Enhanced competitive position due to growth and innovation. |

| Scenario 3: Continued Economic Uncertainty | Stagnant workforce with potential for further reductions in response to economic headwinds. | Focus on cost optimization and maintaining operational efficiency. | Potential for competitive pressure as other banks adapt to the changing market. |

In the short term, PNC Bank is likely to focus on integrating the changes resulting from the layoffs and ensuring a smooth transition for its remaining workforce. Over the longer term, the bank’s strategic direction will be influenced by economic conditions and competitive pressures.

The future outlook for PNC Bank’s workforce will depend on the bank’s ability to adapt to these changing dynamics and maintain its competitive position in the evolving banking landscape.

Outcome Summary

The PNC Bank layoffs in October 2024 serve as a stark reminder of the ever-changing landscape of the financial industry. While the immediate impact on employees is undeniable, the long-term consequences for PNC Bank and the banking sector as a whole remain to be seen.

The bank’s response to these challenges will be crucial in shaping its future and determining its ability to navigate the complexities of the evolving economic environment. As we move forward, it will be important to monitor PNC Bank’s actions and assess the broader implications of these layoffs for the banking industry.

While recessions are often seen as negative, there can be some unexpected benefits. If you’re curious about the potential upside of a recession in October 2024, check out this article: What are the potential benefits of a recession in October 2024?

. It might surprise you!

Commonly Asked Questions

What are the reasons cited by PNC Bank for the layoffs?

Travis Kelce is one of the highest-paid players in the NFL, but how does his net worth stack up against other stars? You can find out by checking out this article: Travis Kelce’s net worth compared to other NFL players in October 2024.

It’s fascinating to see how much these athletes earn and how their wealth compares.

PNC Bank has cited various reasons for the layoffs, including a need to streamline operations, improve efficiency, and adapt to changing market conditions. The specific reasons may vary depending on the department affected.

Will PNC Bank offer any support to laid-off employees?

PNC Bank typically provides support services to laid-off employees, including severance packages, outplacement services, and career counseling. The specific support offered may vary depending on the employee’s position and length of service.

How do these layoffs compare to previous layoff scenarios at PNC Bank?

The size and scope of these layoffs, as well as the severance packages offered, will need to be compared to previous layoff scenarios to determine any significant differences in the bank’s approach to workforce reduction.