Virginia tax rebate October 2024 deadline to file takes center stage, reminding residents of the opportunity to claim their share of financial relief. This guide delves into the details of this tax rebate, explaining its purpose, eligibility criteria, and the steps involved in filing for it.

Amazon’s international revenue is a key indicator of its global reach. Check out this article to see how Amazon’s international revenue performed in Q3 2024.

Whether you’re a seasoned taxpayer or new to the process, understanding the intricacies of this rebate can help you maximize your potential savings.

Is there a fourth stimulus check coming in October 2024? Find out the latest updates on this topic and what it could mean for you.

The Virginia tax rebate, designed to provide financial assistance to eligible residents, has undergone changes over the years. Understanding the specifics of the October 2024 deadline is crucial for ensuring timely and accurate filing. This rebate aims to benefit individuals and families by offering a partial refund on their tax liability, potentially easing financial burdens and stimulating economic activity.

Google’s Q3 2024 earnings have been released, and analysts are weighing in. Check out this article for their reactions and predictions for Google’s future.

Contents List

Understanding Virginia Tax Rebates

The Virginia tax rebate program is a financial incentive offered by the state to eligible residents. This program aims to provide relief to taxpayers and stimulate the local economy. The program has evolved over the years, with changes in eligibility criteria, rebate amounts, and filing deadlines.

To qualify for the Virginia tax rebate in October 2024, you need to meet certain requirements. Find out more about the eligibility criteria to see if you qualify for this program.

Types of Tax Rebates

Virginia offers various tax rebates, with the October 2024 deadline being particularly relevant for certain types of rebates. Here are some key rebates to consider:

- Property Tax Relief Rebates:These rebates help offset property taxes for eligible homeowners. The October 2024 deadline might apply to specific property tax relief programs designed to assist seniors or low-income individuals.

- Income Tax Rebates:The state may offer income tax rebates to certain income brackets or for specific expenses, such as educational expenses. The October 2024 deadline could be related to claiming these rebates.

- Sales Tax Rebates:While less common, Virginia might offer sales tax rebates on specific goods or services during certain periods. These rebates could have an October 2024 deadline.

Eligibility for the October 2024 Tax Rebate

To be eligible for the Virginia tax rebate, you must meet specific requirements based on your income, residency, and other factors. The eligibility criteria may vary depending on the type of rebate you’re claiming.

Potential layoffs at PNC Bank could impact customer service. This article explores the potential consequences for customer service and how the bank might address them.

Eligibility Criteria

The October 2024 deadline might apply to rebates with specific eligibility requirements, such as:

- Income Limits:Some rebates may have income thresholds, meaning you must earn below a certain amount to qualify.

- Residency:You must be a Virginia resident for a specific period, typically a year or more, to be eligible.

- Age:Certain rebates might be specifically designed for seniors, requiring a minimum age to qualify.

- Property Ownership:Property tax relief rebates may require you to own your home and meet specific property value requirements.

Examples of Eligibility

- Eligible:A senior citizen living in Virginia, owning their home, and earning below a certain income threshold could qualify for a property tax relief rebate.

- Ineligible:A recent resident of Virginia who hasn’t met the residency requirements or someone earning above the income limit for a particular rebate would not be eligible.

Filing for the Tax Rebate

Filing for the Virginia tax rebate is typically done through the Virginia Department of Taxation. The process may involve completing specific forms and submitting them online, by mail, or in person.

Virginia is offering tax rebates to businesses in October 2024. Get the details on this program and how it could benefit businesses in the state.

Steps to File

- Gather Required Documentation:This may include your Social Security number, income tax return, proof of residency, and any other relevant documents.

- Download and Complete Forms:Access the necessary forms online or request them by mail from the Virginia Department of Taxation.

- Submit Application:File your application online, by mail, or in person, depending on the instructions provided by the department.

- Track Your Application:You can often track the status of your application online or by contacting the department.

Deadlines and Procedures

The October 2024 deadline is crucial. Ensure you file your application before this date to avoid penalties.

Virginia is offering tax rebates to low-income families in October 2024. Find out more about the eligibility requirements and details of this program.

- Filing Period:The exact filing period for the October 2024 deadline might be specific to the type of rebate you’re claiming.

- Late Filing Penalties:Filing after the deadline could result in penalties, such as late fees or a reduction in the rebate amount.

- Extensions:In some cases, you might be able to request an extension for filing your rebate application. However, extensions are typically granted only for valid reasons.

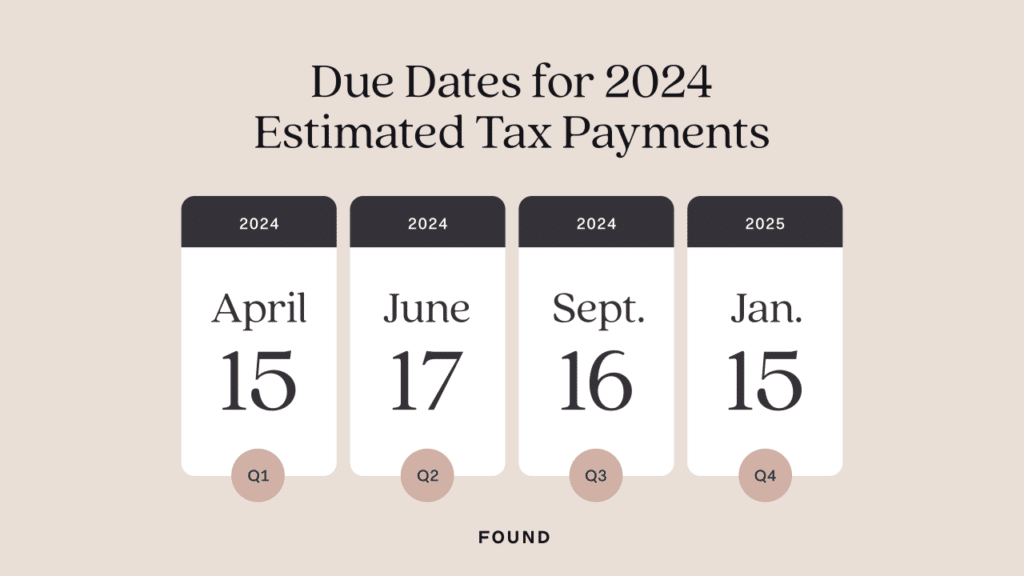

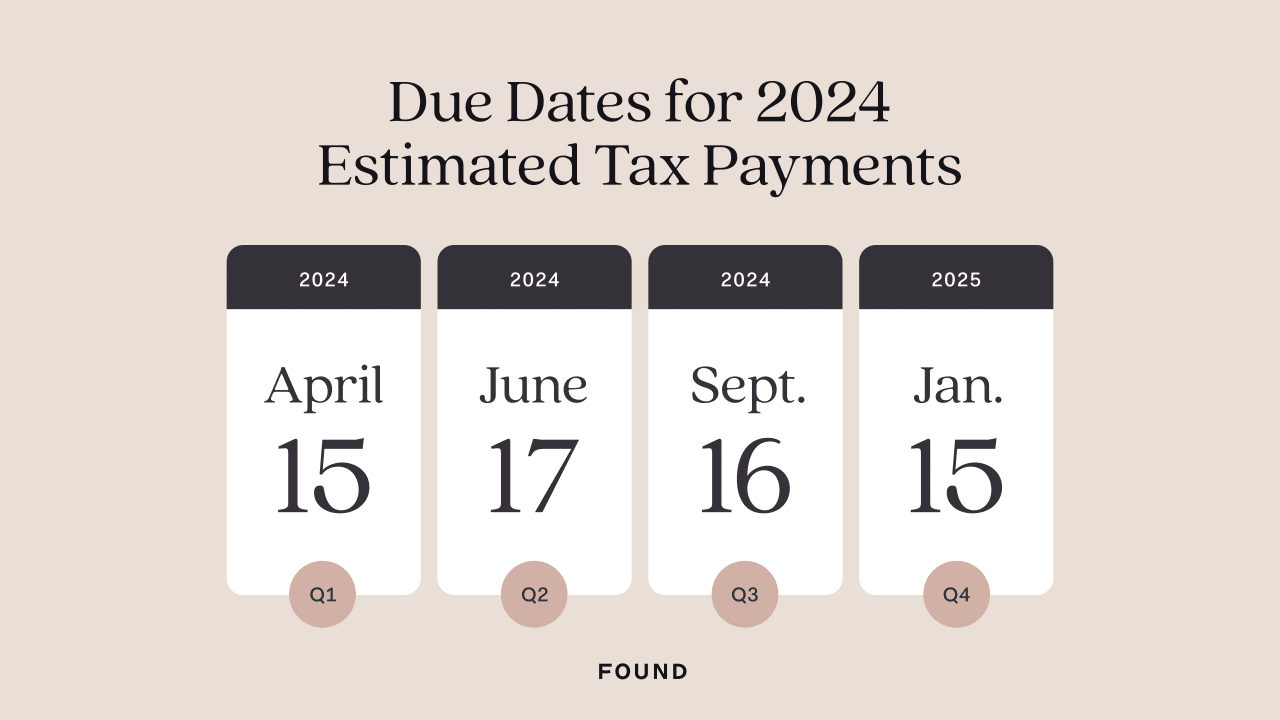

Key Dates and Deadlines

The October 2024 deadline is just one of several important dates related to the Virginia tax rebate program. Understanding these deadlines is essential for ensuring timely filing and avoiding penalties.

Suzanne Somers is a well-known actress and entrepreneur. This article provides a breakdown of her net worth for 2024, offering insights into her various sources of income.

Key Dates and Deadlines

| Date | Description |

|---|---|

| October 2024 | Deadline to file for certain Virginia tax rebates |

| [Insert Date] | Start of the filing period for [Specific Rebate Type] |

| [Insert Date] | Deadline for requesting an extension for [Specific Rebate Type] |

| [Insert Date] | Estimated date for rebate payments to be processed |

Resources and Support: Virginia Tax Rebate October 2024 Deadline To File

The Virginia Department of Taxation provides a wealth of information and resources for taxpayers. They offer assistance to help you understand the rebate program, file your application correctly, and resolve any issues.

Want to get a deeper understanding of Amazon’s performance in Q3 2024? Read the transcript of their earnings call for insights into their strategies and future plans.

Resources, Virginia tax rebate October 2024 deadline to file

- Virginia Department of Taxation Website:[Insert Website URL] – This website offers comprehensive information about the Virginia tax rebate program, including eligibility criteria, filing instructions, forms, and contact information.

- Taxpayer Assistance Hotline:[Insert Phone Number] – The department provides a helpline where you can speak with a representative to get answers to your questions.

- Tax Preparation Services:If you need help preparing your tax return or understanding the rebate program, consider seeking assistance from a qualified tax professional.

Tax Rebate Impact

The Virginia tax rebate program aims to provide financial relief to taxpayers, stimulate the local economy, and improve the overall well-being of residents. However, the impact of the program can vary depending on factors such as the rebate amount, eligibility criteria, and the economic conditions.

Rumors are circulating about potential layoffs at PNC Bank in October 2024. Read more about these rumors and their potential impact on the bank.

Potential Impact

- Economic Stimulus:Rebates can inject money into the economy, boosting consumer spending and potentially creating jobs.

- Financial Relief:For eligible taxpayers, the rebates can provide much-needed financial assistance, especially during challenging economic times.

- Targeted Benefits:Rebates focused on specific groups, such as seniors or low-income individuals, can address particular needs and inequalities.

Potential Drawbacks

- Limited Impact:The impact of the rebate program may be limited if the rebate amount is small or the eligibility criteria are too restrictive.

- Potential for Abuse:There’s a risk of the program being misused or exploited by individuals who are not genuinely eligible.

- Government Budget:Rebates can strain government budgets, especially during periods of economic hardship.

Comparison to Other Programs

The Virginia tax rebate program can be compared to similar programs in other states and jurisdictions. Some states offer more generous rebates, while others have stricter eligibility requirements. The specific design and impact of each program vary depending on the local economic context and policy priorities.

Travis Kelce is not only a talented football player, but also a savvy investor. Learn about his investments and assets as of October 2024.

Conclusion

Navigating the Virginia tax rebate system can be straightforward with the right information. By understanding the eligibility requirements, filing procedures, and deadlines, residents can confidently claim their rightful share of financial relief. Remember to utilize the resources available to you, including official websites and support services, to ensure a smooth and successful filing process.

The Virginia tax rebate presents an opportunity to optimize your financial well-being, and by staying informed and prepared, you can make the most of this valuable program.

Wondering how a potential recession in October 2024 could affect the housing market? This article explores the potential impact, considering factors like interest rates, affordability, and consumer confidence.

Query Resolution

What is the exact amount of the Virginia tax rebate for 2024?

The exact amount of the Virginia tax rebate for 2024 is not yet publicly available. You can check the Virginia Department of Taxation website or contact them directly for the latest information.

Taylor Swift is a global superstar, and her net worth reflects her success. This article compares her net worth to other celebrities, giving you a glimpse into the world of celebrity finances.

What happens if I miss the October 2024 deadline to file for the Virginia tax rebate?

Missing the October 2024 deadline may result in penalties. It’s crucial to file your tax rebate application by the designated deadline to avoid any potential financial repercussions.

Are there any income limitations to qualify for the Virginia tax rebate?

Yes, there are usually income limitations for tax rebates. You can find the specific income thresholds for the 2024 Virginia tax rebate on the official website or by contacting the Virginia Department of Taxation.

The potential for a stimulus check in October 2024 has sparked political debate. Read about the political discussions surrounding this issue and the arguments for and against a stimulus package.

Potential layoffs at PNC Bank could have a direct impact on customers. This article explores how these layoffs might affect customer service, access to banking services, and overall customer experience.