Non Owner Car Insurance 2024 is a crucial insurance option for individuals who don’t own a car but need coverage while driving. This type of insurance provides financial protection against potential liabilities and damages caused by accidents while operating a vehicle.

Understanding your health insurance policy is essential. Health Insurance Policy 2024 offers a detailed guide to help you navigate the complexities of your policy, ensuring you know your rights and benefits.

It’s essential for anyone who occasionally borrows a car, drives a rental vehicle, or even uses a carpool.

When it comes to protecting your home, State Farm Home Insurance 2024 is a trusted name in the industry. They offer a variety of coverage options to meet your specific needs and provide peace of mind.

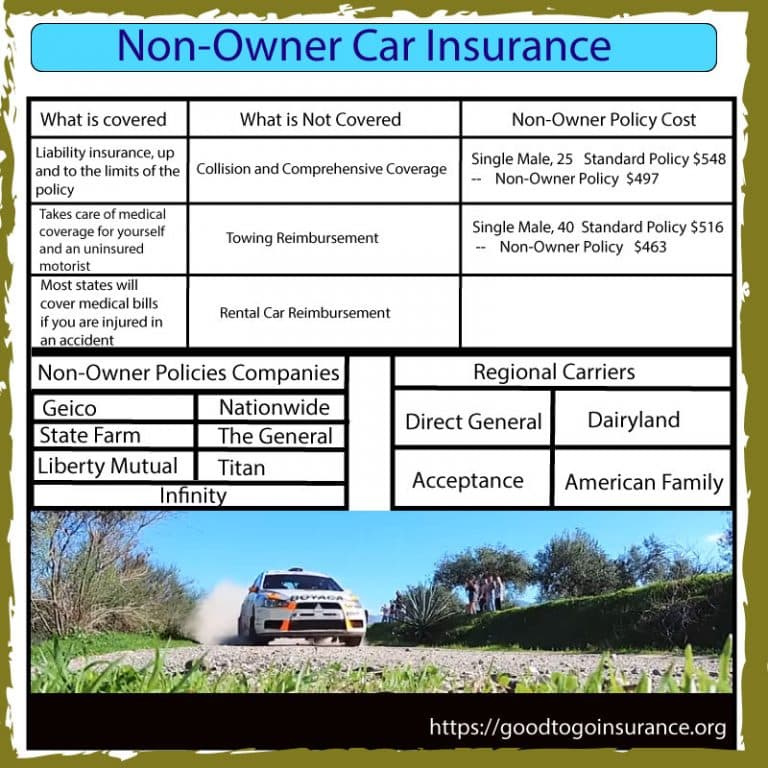

Non-owner car insurance policies typically offer various coverage options, including liability, medical payments, and uninsured motorist coverage. The specific coverage options and limits vary depending on the insurer and the individual’s needs. This guide will delve into the intricacies of non-owner car insurance, explaining its purpose, coverage options, eligibility criteria, and how to obtain the right policy.

If you need coverage for a short trip or a specific event, you might want to look into Day Car Insurance 2024. This type of insurance provides temporary coverage for your vehicle, which can be a cost-effective option for short-term needs.

Contents List

What is Non-Owner Car Insurance?

Non-owner car insurance is a type of insurance policy that provides coverage for individuals who drive vehicles they don’t own. This type of insurance is designed to protect drivers from financial liability in case of an accident while driving a borrowed or rented car.

If you’re renting, you need to protect yourself from potential losses. Best Renters Insurance 2024 provides a list of top-rated renters insurance providers, helping you find the right coverage for your belongings and peace of mind.

It’s also important to note that this type of insurance does not cover damage to the vehicle itself.

If you’re looking for affordable life insurance coverage for a specific period, Term Insurance 2024 might be a good option. This type of insurance provides coverage for a set period, making it a cost-effective choice for many individuals.

Difference Between Non-Owner Car Insurance and Regular Car Insurance

Non-owner car insurance differs significantly from regular car insurance. Regular car insurance covers the vehicle itself, including damage or theft, as well as liability for accidents. Non-owner car insurance, on the other hand, solely focuses on providing liability coverage for the driver, protecting them from financial responsibility in case of an accident.

A major health insurance provider, United Healthcare Insurance 2024 offers a range of plans, from individual coverage to family plans, ensuring you can find the right option for your healthcare needs.

It does not cover the vehicle they are driving.

Protecting your loved ones financially is a crucial aspect of planning for the future. Life Insurance Companies 2024 provides a comprehensive overview of the different types of life insurance available, helping you choose the right option for your needs.

Situations Where Non-Owner Car Insurance is Necessary

- Borrowing a car from a family member or friend:If you frequently borrow a car from someone else, non-owner car insurance can protect you in case of an accident.

- Renting a car:Although rental companies often include insurance in their rental agreements, it’s often limited and may not cover all situations. Non-owner car insurance can provide additional protection.

- Driving a company car:If you drive a company car for work, you may not be fully covered by the company’s insurance policy. Non-owner car insurance can provide additional protection.

- Driving a car without a permanent license:Individuals who do not have a permanent driver’s license but need to drive occasionally might benefit from non-owner car insurance.

Coverage Options for Non-Owner Car Insurance

Non-owner car insurance policies typically offer various coverage options, similar to regular car insurance. These coverage options can be tailored to meet individual needs and financial situations.

Professionals in various fields need to protect themselves from potential liability. Professional Indemnity Insurance 2024 offers insights into this type of insurance, helping you understand its importance and how it can safeguard your career.

Types of Coverage

- Liability Coverage:This coverage protects you from financial responsibility if you cause an accident, covering damages to other vehicles and injuries to other people.

- Uninsured/Underinsured Motorist Coverage:This coverage protects you if you are involved in an accident with a driver who is uninsured or underinsured. It covers your medical expenses and property damage.

- Medical Payments Coverage:This coverage pays for your medical expenses, regardless of who is at fault, if you are injured in an accident.

Limits and Deductibles

The limits and deductibles associated with non-owner car insurance coverage options can vary depending on the insurance company and the policy you choose. Limits refer to the maximum amount the insurance company will pay for a covered claim, while deductibles are the amount you pay out of pocket before the insurance coverage kicks in.

If you’re looking for a life insurance policy with a cash value component, Iul Policy 2024 provides valuable information on this type of policy, helping you understand its features and benefits.

Factors Affecting Cost

Several factors can affect the cost of non-owner car insurance, including:

- Driving history:Your driving record, including accidents and traffic violations, can significantly impact your premium.

- Age and experience:Younger and less experienced drivers typically pay higher premiums due to a higher risk of accidents.

- Location:The cost of non-owner car insurance can vary depending on the state or region you live in.

- Coverage options:The type and amount of coverage you choose will directly affect your premium.

Who Needs Non-Owner Car Insurance?

While not everyone needs non-owner car insurance, it can be beneficial for certain individuals. Understanding who might benefit from this type of coverage is crucial for making informed decisions.

Known for its strong financial standing and excellent customer service, Usaa Insurance 2024 is a popular choice for military families and veterans. They offer a variety of insurance products, including auto, home, and life insurance.

Individuals Who May Benefit

- Occasional Drivers:Individuals who only drive occasionally, such as those who rely on public transportation or ride-sharing services but occasionally borrow a car, might benefit from non-owner car insurance.

- Young Drivers:Young drivers who don’t own a car but frequently borrow or rent vehicles might need non-owner car insurance to ensure adequate coverage.

- Individuals with Suspended Licenses:If your driver’s license is suspended but you need to drive occasionally, non-owner car insurance can provide coverage.

- Individuals with Limited Driving Needs:Individuals with limited driving needs, such as those who only drive for specific errands or appointments, might find non-owner car insurance a cost-effective option.

Why Someone Who Doesn’t Own a Car Might Need Insurance Coverage

Even if you don’t own a car, driving without insurance can have severe consequences. Accidents can happen unexpectedly, and without insurance, you could be held financially responsible for damages and injuries, potentially leading to significant financial hardship.

When it comes to health insurance, Aetna Health Insurance 2024 is a well-known provider. They offer a variety of plans to meet different needs, so it’s worth checking out what they have to offer.

Potential Consequences of Driving Without Insurance

- High Fines and Penalties:Driving without insurance is illegal in most jurisdictions and can result in hefty fines and penalties.

- License Suspension:Your driver’s license can be suspended or revoked if you are caught driving without insurance.

- Financial Ruin:In case of an accident, you could be held liable for all damages and injuries, potentially leading to significant financial ruin.

How to Get Non-Owner Car Insurance: Non Owner Car Insurance 2024

Obtaining non-owner car insurance is generally a straightforward process. However, understanding the steps involved and the necessary documentation can make the process smoother.

Finding the right insurance company can be a challenge, but luckily there are resources available to help. Best Insurance Companies 2024 lists some of the top-rated providers in the industry, giving you a good starting point for your search.

Process of Obtaining Non-Owner Car Insurance

- Contact Insurance Companies:Reach out to several insurance companies to get quotes and compare their policies.

- Provide Information:Be prepared to provide information such as your driving history, personal details, and the type of coverage you need.

- Choose a Policy:Select the policy that best suits your needs and budget.

- Pay Premium:Make the initial premium payment to activate your policy.

Required Documentation, Non Owner Car Insurance 2024

When applying for non-owner car insurance, you will typically need to provide the following documentation:

- Driver’s license:A valid driver’s license is essential to prove your legal right to drive.

- Proof of residency:This could include a utility bill, bank statement, or lease agreement.

- Social Security number:This is required for identification and verification purposes.

- Driving history:You may need to provide your driving record, which can be obtained from your state’s department of motor vehicles.

Tips for Finding the Best Non-Owner Car Insurance Policy

- Compare quotes:Obtain quotes from multiple insurance companies to compare prices and coverage options.

- Consider your needs:Determine the level of coverage you need based on your driving habits and potential risks.

- Read the policy carefully:Ensure you understand the terms, conditions, and exclusions of the policy before signing up.

- Ask questions:Don’t hesitate to ask the insurance company any questions you have about the policy or coverage options.

Non-Owner Car Insurance in 2024

The non-owner car insurance market is constantly evolving, with new laws, regulations, and trends influencing the landscape. Understanding these changes is crucial for drivers seeking non-owner car insurance in 2024.

Need short-term car insurance for a specific period? Temporary Car Insurance 2024 can help you find the right coverage for your temporary needs, whether it’s for a few days or a few weeks.

Recent Changes and Updates

Recent years have seen increased focus on improving driver safety and ensuring adequate insurance coverage. Some states have implemented new laws or regulations regarding non-owner car insurance, such as stricter requirements for proof of insurance or changes in coverage options.

Market Trends and Factors Affecting Cost

The cost of non-owner car insurance can fluctuate due to various factors, including:

- Inflation:Rising inflation can lead to higher costs for repairs and medical expenses, potentially affecting insurance premiums.

- Technology:Advancements in technology, such as telematics devices, can influence pricing based on driving behavior and risk assessment.

- Competition:Competition among insurance companies can lead to changes in pricing strategies and the availability of coverage options.

Insights into the Future

The future of non-owner car insurance is likely to be shaped by the growing popularity of ride-sharing services, the increasing adoption of autonomous vehicles, and the ongoing focus on driver safety. These trends could lead to new insurance models and coverage options tailored to evolving transportation needs.

End of Discussion

Understanding the complexities of non-owner car insurance is essential for anyone who drives a vehicle without owning it. By carefully evaluating your needs and exploring the available options, you can ensure that you have adequate protection in the event of an accident.

Remember, even if you don’t own a car, driving without insurance can have serious consequences, including fines, license suspension, and even legal repercussions.

Common Queries

What are the benefits of having non-owner car insurance?

Non-owner car insurance offers various benefits, including financial protection in case of an accident, coverage for medical expenses, and peace of mind knowing you’re insured while driving.

How much does non-owner car insurance cost?

The cost of non-owner car insurance varies depending on factors such as your driving history, age, location, and the coverage options you choose.

Can I get non-owner car insurance if I have a bad driving record?

While a bad driving record may affect your insurance premiums, you can still obtain non-owner car insurance. However, you might face higher rates compared to individuals with clean driving records.

Is non-owner car insurance mandatory in all states?

Non-owner car insurance requirements vary by state. Some states mandate insurance for all drivers, regardless of car ownership, while others have specific requirements for non-owners.

Looking for reliable home insurance coverage? Allianz Home Insurance 2024 is a well-known provider offering a range of plans to protect your home from various risks.

Comparing house insurance quotes can save you money. Compare House Insurance 2024 provides a platform to compare quotes from different providers, helping you find the best deal for your needs.