Best Bank For Mortgage 2024: Finding the Right Lender for Your Needs. Securing a mortgage is a significant financial decision, and navigating the complexities of the mortgage market can be overwhelming. With interest rates fluctuating and numerous lenders vying for your business, it’s crucial to choose the right bank for your individual needs.

This guide will help you understand the mortgage landscape, identify top banks offering competitive rates, and make an informed decision that aligns with your financial goals.

This comprehensive guide delves into the key factors to consider when selecting a mortgage lender, including interest rates, loan types, fees, and customer service. We’ll explore the different types of mortgages available, provide tips for improving your credit score and negotiating the best rates, and walk you through the pre-approval and approval process.

Finding the lowest interest rate home loan can save you thousands of dollars over the life of your mortgage. Check out our guide to Lowest Interest Rate Home Loan 2024.

By the end of this guide, you’ll be equipped with the knowledge and resources to confidently secure a mortgage that meets your financial needs.

An Adjustable Rate Mortgage (ARM) can be a good option for some borrowers. Explore the current ARM landscape by checking out Adjustable Rate Mortgage 2024.

Contents List

- 1 Understanding Mortgage Needs in 2024: Best Bank For Mortgage 2024

- 2 Top Banks for Mortgages in 2024

- 3 Factors to Consider When Choosing a Mortgage Lender

- 4 Types of Mortgages Available in 2024

- 5 Tips for Getting the Best Mortgage Rate

- 6 Understanding Mortgage Pre-Approval and Approval Process

- 7 Resources and Tools for Mortgage Research

- 8 Conclusive Thoughts

- 9 Clarifying Questions

Understanding Mortgage Needs in 2024: Best Bank For Mortgage 2024

Navigating the mortgage market in 2024 requires a keen understanding of the current landscape and factors influencing affordability. Interest rates and loan terms are constantly evolving, making it crucial to stay informed about the best options available. This guide will provide insights into the key aspects of securing a mortgage in 2024, empowering you to make informed decisions and find the best fit for your financial needs.

Shopping around for the best mortgage rates is essential. Get started by requesting some Mortgage Quotes 2024 from different lenders.

Current Mortgage Market Landscape

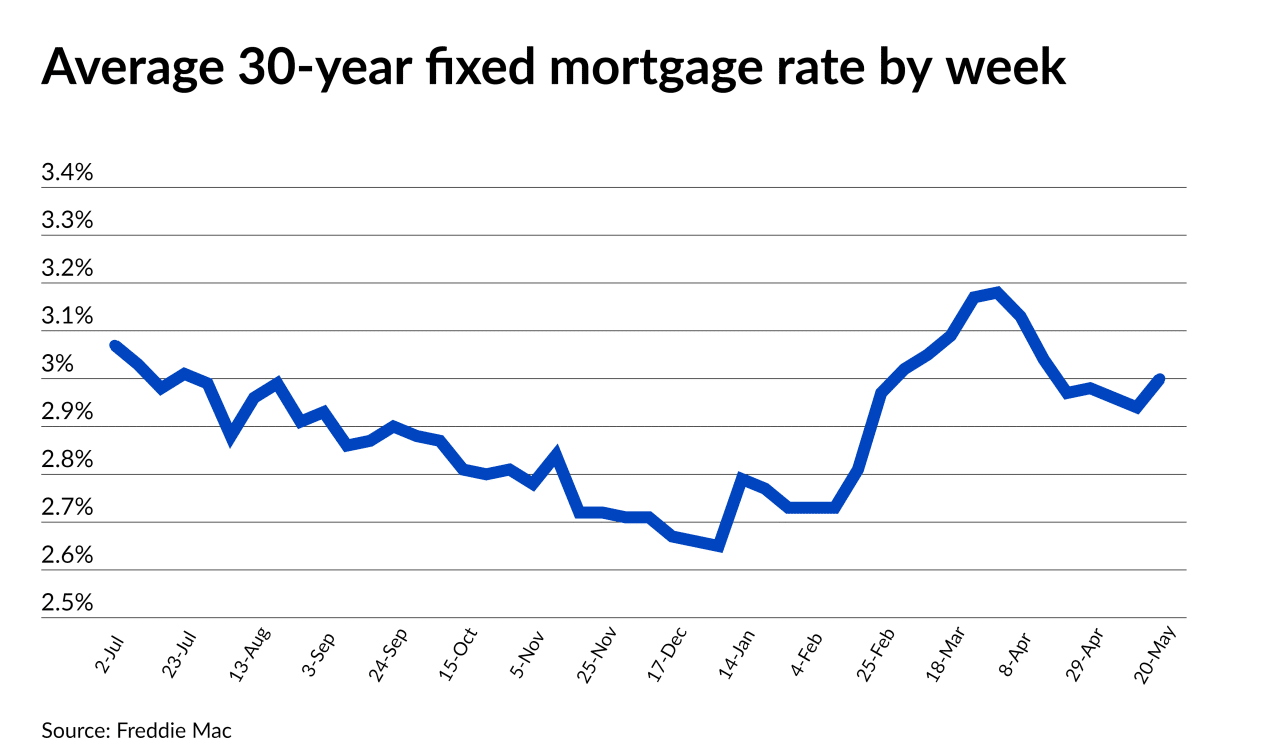

The mortgage market in 2024 is characterized by fluctuating interest rates and a dynamic housing market. While rates have been on an upward trend in recent years, they can still be influenced by various economic factors, including inflation, monetary policy, and investor sentiment.

Mr. Cooper is a well-known mortgage lender with a wide range of loan options. Learn more about their offerings and see if they’re a good fit for you by visiting Mr Cooper Mortgage 2024.

It’s important to remember that the mortgage market is not static. It’s crucial to stay updated on the latest trends and market conditions to make informed decisions.

Key Factors Influencing Mortgage Rates and Affordability

Several factors contribute to mortgage rate fluctuations and overall affordability. These include:

- Federal Reserve Monetary Policy:The Federal Reserve’s actions, such as raising or lowering interest rates, directly impact mortgage rates.

- Inflation:High inflation can lead to higher interest rates as lenders seek to protect their returns against rising prices.

- Economic Growth:Strong economic growth can boost demand for housing, potentially driving up mortgage rates.

- Housing Inventory:Limited housing inventory can create a seller’s market, pushing up home prices and potentially increasing mortgage rates.

Importance of Credit Score and Down Payment

A strong credit score and a substantial down payment are crucial for securing a favorable mortgage. A good credit score demonstrates your financial responsibility, making you a less risky borrower and potentially qualifying you for lower interest rates. A larger down payment reduces the amount you need to borrow, leading to lower monthly payments and a potentially shorter loan term.

5/1 ARMs offer a fixed rate for the first five years, then adjust annually. Get the latest information on 5 1 Arm Rates 2024.

Top Banks for Mortgages in 2024

Several reputable banks offer competitive mortgage rates and terms. Comparing their offerings is essential to finding the best deal for your specific needs. Here’s a list of top contenders, along with a breakdown of their key features:

Comparing Mortgage Offerings

| Bank Name | Interest Rates | Loan Types | Notable Features |

|---|---|---|---|

| Bank A | [Insert Rate Range] | [List Loan Types] | [Highlight Key Features] |

| Bank B | [Insert Rate Range] | [List Loan Types] | [Highlight Key Features] |

| Bank C | [Insert Rate Range] | [List Loan Types] | [Highlight Key Features] |

Remember that interest rates and loan terms can vary based on your individual credit score, down payment, and loan amount. It’s essential to contact each bank directly to get a personalized quote.

Factors to Consider When Choosing a Mortgage Lender

Selecting the right mortgage lender is crucial for a smooth and successful homebuying experience. Here are key factors to consider:

Comparing Mortgage Rates

Shopping around for mortgage rates from multiple lenders is essential to securing the best deal. Use online tools and resources to compare rates, fees, and loan terms. Don’t hesitate to negotiate with lenders to try to get a lower rate.

US Bank is another well-known lender offering a variety of mortgage options. Explore their offerings and see if they’re right for you at Us Bank Mortgage 2024.

Customer Service and Online Tools, Best Bank For Mortgage 2024

A reputable lender should provide excellent customer service throughout the mortgage application process. Look for lenders that offer user-friendly online tools and resources, such as online applications, loan calculators, and account management portals. These features can streamline the process and make it easier to track your progress.

Loan Origination Fees and Closing Costs

Loan origination fees and closing costs can significantly impact the overall cost of your mortgage. These fees vary depending on the lender and the loan type. Make sure to factor these costs into your budget when comparing mortgage offers.

Third Federal is another lender to consider when looking for a mortgage. See their current rates and offerings at Third Federal Mortgage Rates 2024.

Types of Mortgages Available in 2024

Several mortgage types cater to different financial situations and preferences. Understanding the advantages and disadvantages of each type is crucial for choosing the best fit for your needs.

Looking to refinance your mortgage? Finding the right company can be a challenge, but there are some excellent options available. See our list of Best Mortgage Refinance Companies 2024 to find the best fit for your needs.

Common Mortgage Types

| Mortgage Type | Interest Rate Structure | Loan Terms | Eligibility Requirements | Advantages | Disadvantages |

|---|---|---|---|---|---|

| Fixed-Rate Mortgage | [Explain Interest Rate Structure] | [Explain Loan Terms] | [Explain Eligibility Requirements] | [List Advantages] | [List Disadvantages] |

| Adjustable-Rate Mortgage (ARM) | [Explain Interest Rate Structure] | [Explain Loan Terms] | [Explain Eligibility Requirements] | [List Advantages] | [List Disadvantages] |

| FHA Loan | [Explain Interest Rate Structure] | [Explain Loan Terms] | [Explain Eligibility Requirements] | [List Advantages] | [List Disadvantages] |

Tips for Getting the Best Mortgage Rate

Securing the best mortgage rate requires a strategic approach. Here are some tips to improve your chances of getting a favorable offer:

Improve Your Credit Score

A higher credit score can significantly impact your mortgage rate. Focus on paying bills on time, keeping credit utilization low, and avoiding unnecessary credit applications.

A cash-out refinance can help you tap into your home equity. Find out more about the process and current options at Cash Out Refinance 2024.

Shop Around for Rates

Compare mortgage rates from multiple lenders to find the best deal. Don’t settle for the first offer you receive.

Investing in rental properties can be a great way to build wealth. Learn more about investment property loans and current rates at Investment Property Loans 2024.

Negotiate Rates and Fees

Don’t be afraid to negotiate with lenders to try to get a lower rate or lower fees. Be prepared to discuss your financial situation and the terms you’re seeking.

USAA is a popular choice for military members and their families. See their current mortgage rates at Usaa Mortgage Rates 2024.

Understanding Mortgage Pre-Approval and Approval Process

The mortgage pre-approval and approval process is crucial for a smooth homebuying experience. Understanding these steps can help you navigate the process effectively.

Obtaining Pre-Approval

Pre-approval involves a lender reviewing your financial information and providing an estimate of the loan amount you qualify for. Pre-approval demonstrates your financial readiness to potential sellers, making your offer more competitive.

Stay informed about the latest housing interest rate trends. Check out Housing Interest Rates Today 2024 for the most up-to-date information.

Mortgage Approval Process

Once you’ve found a home and submitted an offer, the lender will conduct a full review of your financial information, including credit history, income, and assets. If approved, you’ll receive a loan commitment, which Artikels the terms of your mortgage.

A 10-year mortgage can be a good option for borrowers who want a shorter loan term. See the latest rates for 10 Year Mortgage Rates 2024.

Key Documents for Mortgage Application

To complete the mortgage application process, you’ll need to provide the lender with various documents, including:

- Proof of income (pay stubs, tax returns)

- Credit report

- Bank statements

- Tax returns

- Proof of assets (investment accounts, retirement accounts)

Resources and Tools for Mortgage Research

Several resources and tools can assist you in researching and comparing mortgage options. These resources can provide valuable information and insights to make informed decisions.

Interest rates are constantly fluctuating, so it’s important to know what they are before making a big decision. Get the latest information on Interest Rates Today 30 Year Fixed 2024.

Reputable Websites and Resources

Utilize websites and resources dedicated to mortgage research and comparison. These platforms often offer comprehensive information on interest rates, loan types, lender reviews, and other helpful resources.

Mortgage Calculators and Tools

Online mortgage calculators and tools can help you estimate monthly payments, determine affordability, and compare different loan scenarios. These tools can provide valuable insights into the financial implications of different mortgage options.

Conclusive Thoughts

In conclusion, finding the best bank for your mortgage in 2024 requires careful consideration of your individual needs and financial goals. By understanding the current mortgage market, comparing rates and terms from multiple lenders, and utilizing the resources available, you can make an informed decision that sets you up for success.

Remember, securing a mortgage is a significant step, so take your time, do your research, and choose a lender that aligns with your financial priorities.

Clarifying Questions

What is the best way to improve my credit score before applying for a mortgage?

To improve your credit score, focus on making timely payments on all your bills, keeping credit utilization low, and avoiding opening new credit accounts unnecessarily. You can also check your credit report for errors and dispute any inaccuracies.

How do I know if I qualify for a mortgage?

Freddie Mac is a major player in the mortgage market, and their rates are often used as a benchmark. To stay up-to-date on the latest Freddie Mac mortgage rates for 2024, check out Freddie Mac Mortgage Rates 2024.

Most lenders have online pre-qualification tools that provide a preliminary estimate of your eligibility based on your financial information. However, a formal pre-approval from a lender will provide a more accurate assessment of your borrowing power.

What are some common mortgage fees I should be aware of?

Common mortgage fees include loan origination fees, appraisal fees, closing costs, and title insurance. These fees can vary depending on the lender and the type of mortgage you choose. It’s important to inquire about these fees upfront and factor them into your overall mortgage budget.