Acoustic Music Bands 2024: The year 2024 marks a significant resurgence in acoustic music, a genre that has always held a special place in the hearts of music lovers. This renewed interest is a testament to the enduring power of raw, unadulterated sound, a stark contrast to the often overproduced and heavily processed music that dominates the mainstream.

This shift towards authenticity is fueled by a growing yearning for simpler sounds, a desire to connect with music on a more intimate and emotional level.

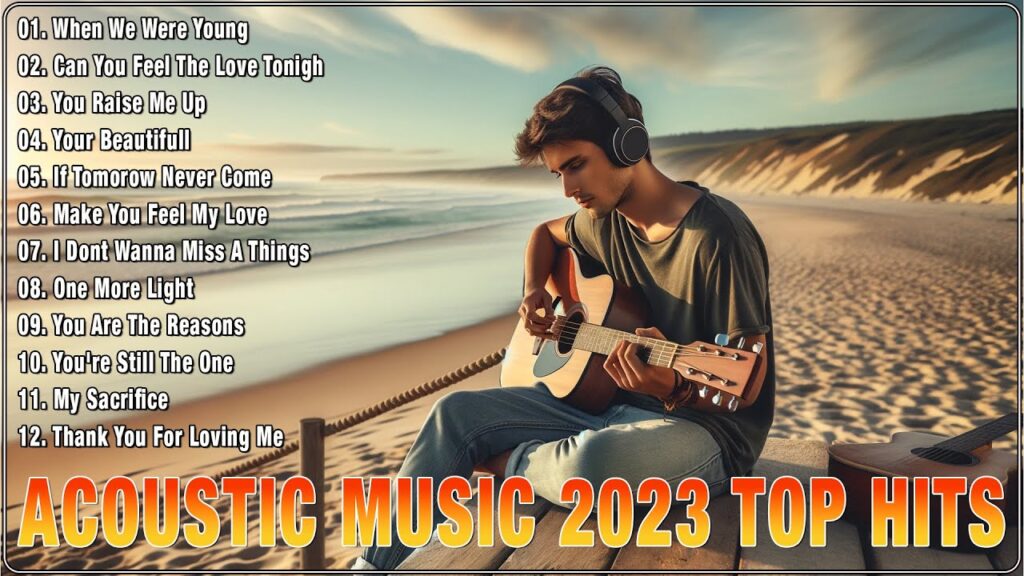

Discover a world of acoustic music on Acoustic Music Youtube 2024. From folk and blues to contemporary artists, you’ll find countless videos to enjoy, learn from, and get inspired by.

The acoustic music scene in 2024 is a vibrant tapestry of diverse sounds, from the soulful melodies of singer-songwriters to the energetic rhythms of folk and Americana bands. These artists are not just musicians; they are storytellers, poets, and social commentators, using their music to explore themes of love, loss, hope, and resilience.

Improve the acoustics of your space with 1 Acoustic Panels 2024. These panels are designed to absorb sound, reducing unwanted echoes and improving the overall clarity of your audio.

The acoustic revival is not just a musical trend; it’s a cultural phenomenon, reflecting a broader societal shift towards authenticity, introspection, and a deeper appreciation for the power of music to connect us.

The The Locata Challenge Acoustic Source Localization And Tracking 2024 is a fascinating competition that challenges participants to develop algorithms for accurately identifying and tracking sound sources. It’s a great way to push the boundaries of acoustic technology.

Contents List

The Resurgence of Acoustic Music

In 2024, acoustic music has experienced a remarkable resurgence, captivating audiences with its raw and intimate sound. This renewed interest in acoustic music can be attributed to a number of factors, including a growing appreciation for authenticity and a desire for simpler, more relatable music.

Factors Contributing to the Resurgence

The current acoustic music scene reflects a shift in cultural values, with many listeners seeking a return to the essence of music. The rise of digital technology has led to an oversaturation of synthesized sounds, making the organic and unfiltered nature of acoustic music all the more appealing.

If you’re considering participating in the Tony’s Acoustic Challenge Refund 2024 , make sure to check the refund policy beforehand. It’s always good to be prepared and understand the terms and conditions.

Moreover, the complexities of modern life have created a yearning for simpler sounds that evoke a sense of nostalgia and comfort. The raw emotion and vulnerability conveyed through acoustic instruments resonate deeply with audiences, providing a much-needed respite from the noise and distractions of everyday life.

Level up your audio engineering skills with the L’acoustics Training 2024 program. This comprehensive course will teach you everything you need to know about sound design, system setup, and more, using L’acoustics equipment.

Notable Acoustic Music Bands of 2024

A number of acoustic music bands have emerged as frontrunners in the current scene, captivating audiences with their unique blend of talent and originality. These bands have garnered critical acclaim and a devoted following, showcasing the diversity and depth of the contemporary acoustic music landscape.

| Band Name | Genre | Notable Tracks | Social Media Presence |

|---|---|---|---|

| The Lumineers | Folk Rock | “Ho Hey,” “Cleopatra,” “Stubborn Love” | Strong presence on platforms like Instagram, Twitter, and Facebook, with a large and engaged fan base. |

| Mumford & Sons | Folk Rock | “Little Lion Man,” “I Will Wait,” “The Cave” | Active on social media, with a dedicated following that interacts with their posts and shares their music. |

| Fleet Foxes | Indie Folk | “Helplessness Blues,” “Mykonos,” “Tiger Mountain Peasant Song” | Maintain a strong online presence, sharing updates on upcoming tours and releases, and engaging with fans through social media platforms. |

| Bon Iver | Indie Folk | “Skinny Love,” “Holocene,” “For Emma, Forever Ago” | Utilize social media to connect with fans, promote new music, and share behind-the-scenes content. |

The Evolution of Acoustic Music, Acoustic Music Bands 2024

Acoustic music has a rich history, evolving over centuries and encompassing a wide range of styles and influences. From the traditional folk music of the past to the contemporary indie folk and singer-songwriter genres, acoustic music has continuously adapted and innovated, reflecting the changing cultural landscape.

Looking for a unique and captivating acoustic experience? Check out the Acoustic # 3 2024 event. This showcase features talented artists performing acoustic music with a fresh and innovative twist.

- Early Folk Music:The origins of acoustic music can be traced back to ancient times, with traditional folk songs and ballads passed down through generations. These songs often told stories of everyday life, love, loss, and social issues, providing a powerful means of cultural expression.

Looking for a reliable acoustic guitar that won’t break the bank? Check out the F Acoustic Guitar 2024. It’s known for its quality construction and affordable price, making it a great choice for both beginners and experienced players.

- The Folk Revival:In the mid-20th century, a resurgence of interest in folk music led to a wave of influential artists, including Bob Dylan, Joan Baez, and Simon & Garfunkel. These artists revitalized the genre, blending traditional elements with contemporary themes and influences, and inspiring a new generation of musicians.

- The Rise of Singer-Songwriters:The 1970s and 1980s saw the emergence of a distinct singer-songwriter movement, characterized by introspective lyrics, personal narratives, and a focus on intimate performances. Artists like James Taylor, Joni Mitchell, and Cat Stevens defined this era, exploring themes of love, loss, and societal change through their music.

- Contemporary Acoustic Music:In recent years, acoustic music has continued to evolve, incorporating elements of indie rock, alternative, and electronic music. Artists like The Lumineers, Mumford & Sons, and Bon Iver have brought a fresh perspective to the genre, blending traditional acoustic sounds with modern production techniques.

Looking for a high-quality speaker system? Check out the L’acoustics Contour Xo 2024 for exceptional sound reproduction and a sleek design. It’s perfect for both home theater and professional audio applications.

The Impact of Acoustic Music on Culture

Acoustic music has had a profound impact on culture, influencing literature, film, and other art forms. Its ability to connect with audiences on an emotional level has made it a powerful tool for storytelling, social commentary, and cultural expression.

Want to participate in the Tony’s Acoustic Challenge Price 2024 ? Make sure to check the entry fee and prize structure before signing up. It’s a great way to challenge yourself and potentially win some awesome prizes.

- Literary Influences:Acoustic music has inspired countless writers, providing a rich source of themes, imagery, and narrative structures. From the folk ballads of traditional literature to the contemporary novels that feature acoustic music as a central element, the genre has left an enduring mark on the literary landscape.

Looking for a platform to share your acoustic music with the world? Acoustic Music Works 2024 provides a space for musicians to connect, collaborate, and showcase their talent. It’s a great resource for aspiring and established artists alike.

- Film and Television:Acoustic music has become a staple of film and television soundtracks, creating evocative atmospheres and enhancing the emotional impact of scenes. Its ability to evoke nostalgia, create tension, or convey a sense of hope makes it a versatile tool for filmmakers and television producers.

For guitarists who demand versatility, a 2 Channel Acoustic Guitar Amp 2024 is a must-have. With separate channels for clean and overdrive tones, you can easily switch between different sounds and styles.

- Social Movements and Political Activism:Acoustic music has played a vital role in social movements and political activism, providing a platform for expressing dissent, promoting social change, and raising awareness of important issues. From the folk music of the Civil Rights Movement to the contemporary artists who use their music to advocate for environmental protection or social justice, acoustic music has served as a powerful voice for those seeking to make a difference.

The J Acoustical Society Of America 2024 conference is a great opportunity to learn about the latest advancements in acoustics. From research papers to workshops, you’ll find a wealth of information on topics ranging from sound design to noise control.

Ending Remarks

The future of acoustic music is bright, with new generations of artists pushing the boundaries of the genre and exploring fresh sounds and styles. Acoustic music continues to evolve, blending traditional elements with contemporary influences, creating a unique and dynamic soundscape.

Ready to test your acoustic skills? Sign up for the Tony’s Acoustic Challenge Sign Up 2024 and see how you measure up against other musicians. It’s a great way to improve your technique and learn from the best.

As technology continues to advance, acoustic music will undoubtedly find new ways to reach audiences and inspire generations to come. Whether it’s through intimate performances in small venues or the global reach of online platforms, acoustic music is poised to remain a vital and influential force in the world of music.

Helpful Answers: Acoustic Music Bands 2024

What are some of the most popular acoustic music bands of 2024?

Support a good cause and enjoy some amazing acoustic music at the Acoustic 4 A Cure 2024 event. Proceeds from this concert will benefit a worthy charity, so you can feel good about your contribution while enjoying a night of live music.

The acoustic music scene is brimming with talent, and some of the most popular bands include [Band 1], [Band 2], and [Band 3]. Each band brings a unique flavor to the genre, captivating audiences with their raw talent and emotional depth.

How has technology influenced the creation and consumption of acoustic music?

Want to expand your musical horizons? Consider getting a Acoustic 7 String 2024 guitar. With its unique tuning and wider range, it offers a fresh perspective on acoustic music and allows you to explore new sounds.

Technology has played a pivotal role in shaping the acoustic music landscape. From the use of recording software to the rise of online platforms for music distribution and sharing, technology has democratized music creation and consumption. This has allowed independent artists to reach wider audiences and has fostered a vibrant community of acoustic musicians.

What are some examples of how acoustic music has been used to tell stories and connect with audiences on a deeper level?

Acoustic music has a long and rich history of storytelling. From traditional folk ballads to contemporary singer-songwriter anthems, acoustic music has the power to transport listeners to different times and places, evoking a range of emotions. Songs like [Song 1] and [Song 2] are powerful examples of how acoustic music can capture the human experience in all its complexity and beauty.