Pushbullet 2024: What are the best Pushbullet alternatives for cross-platform communication? In today’s interconnected world, seamless communication across devices is essential. Pushbullet has long been a popular choice for this purpose, offering a range of features to sync notifications, files, and even browser tabs between computers, smartphones, and tablets.

Pushbullet has been a popular choice for sharing files between devices for years. But is it still a good option in 2024? Find out in the Pushbullet 2024: Is Pushbullet still a good option for sharing files between devices? article.

However, with the ever-evolving landscape of technology, it’s crucial to explore the best Pushbullet alternatives available in 2024.

What does the future hold for Android technology? Android Authority takes a look at the latest trends and innovations in the Android Authority 2024 future of Android technology article.

This article delves into the realm of cross-platform communication tools, providing a comprehensive overview of the top contenders. We’ll examine their functionalities, target audiences, and unique strengths, helping you make an informed decision based on your specific needs.

Looking for the best new Android phones of 2024? Check out the Android Authority 2024 best new phones article for a comprehensive list of top contenders.

Contents List

- 1 Pushbullet Alternatives in 2024: A Comprehensive Guide

- 1.1 Introduction to Pushbullet

- 1.2 Pushbullet Alternatives: A Comprehensive Overview

- 1.3 Deep Dive into Prominent Alternatives, Pushbullet 2024: What are the best Pushbullet alternatives for cross-platform communication?

- 1.4 Factors to Consider When Choosing an Alternative

- 1.5 Future of Cross-Platform Communication Tools

- 2 Ultimate Conclusion

- 3 Questions and Answers: Pushbullet 2024: What Are The Best Pushbullet Alternatives For Cross-platform Communication?

Pushbullet Alternatives in 2024: A Comprehensive Guide

In the realm of cross-platform communication, Pushbullet has emerged as a popular tool for seamlessly sharing files, links, and notifications across various devices. However, as technology evolves, users are constantly seeking new and improved alternatives to meet their growing demands.

Foldable phones are becoming increasingly popular, and Android Authority has you covered with its latest reviews. Check out the Android Authority 2024 foldable phone reviews to find the perfect device for you.

This article will delve into the best Pushbullet alternatives available in 2024, exploring their features, benefits, and drawbacks to help you find the perfect solution for your communication needs.

Pushbullet is a great tool for staying connected across your devices. Learn how to use it to send messages from your computer to your phone in the Pushbullet 2024: How to use Pushbullet to send messages from your computer to your phone article.

Introduction to Pushbullet

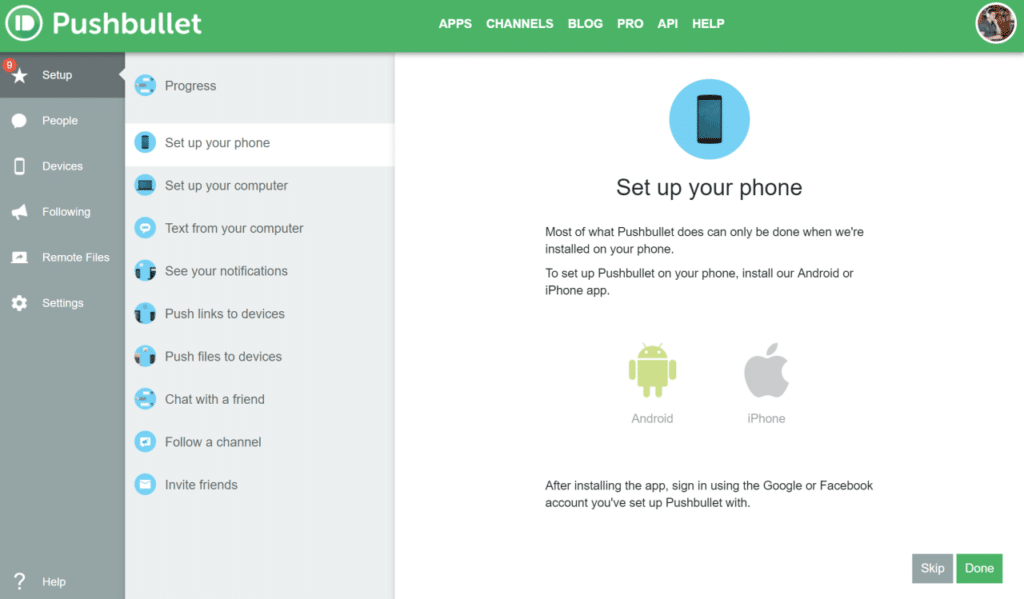

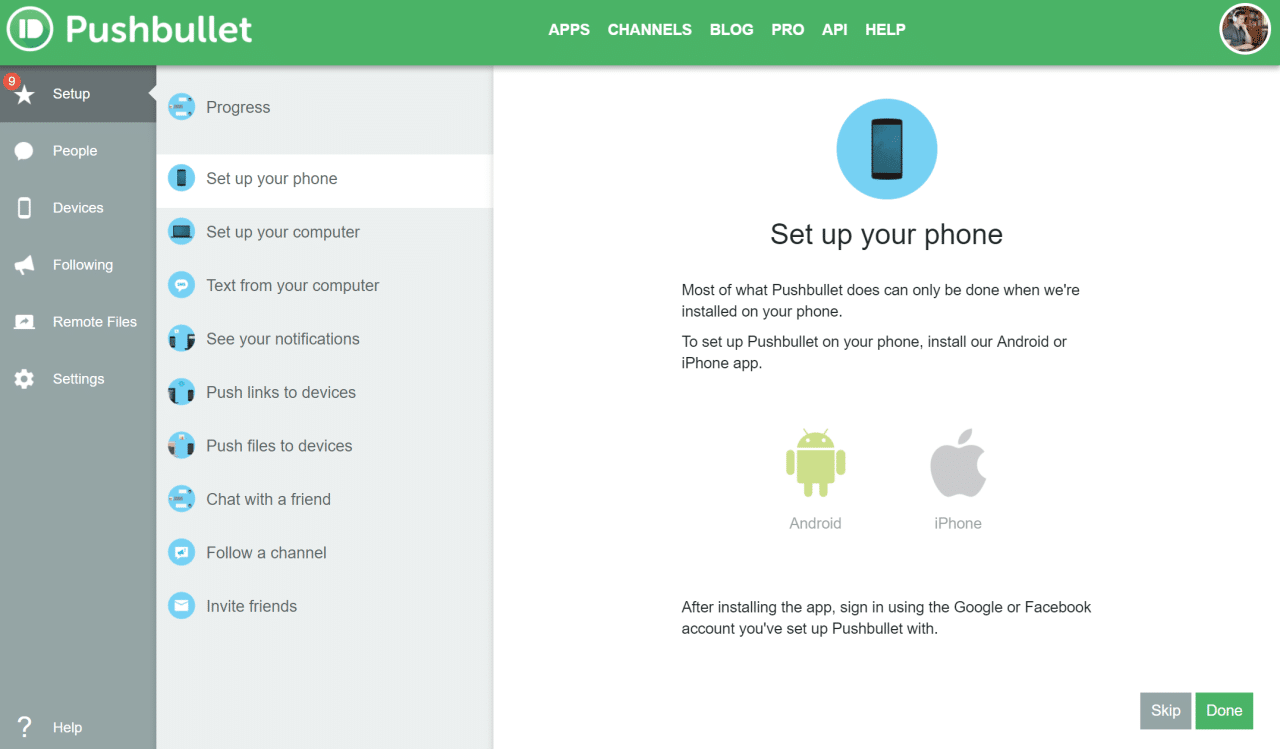

Pushbullet is a popular cross-platform communication tool that allows users to share files, links, and notifications between their devices. It supports various platforms, including Windows, macOS, Android, iOS, and Chromebooks, making it a versatile choice for individuals and teams. Pushbullet’s core functionality revolves around:

- File Sharing:Easily transfer files between your devices, regardless of their operating system.

- Link Sharing:Quickly share web pages, articles, and other content with your devices or contacts.

- Notification Mirroring:Receive notifications from your Android phone on your computer, keeping you informed even when your phone is not in your hand.

- Universal Clipboard:Copy text or images on one device and paste it on another, streamlining your workflow.

- Remote Control:Control your Android phone from your computer, including sending text messages, making calls, and managing apps.

Pushbullet offers several benefits for cross-platform communication:

- Seamless Integration:Pushbullet integrates seamlessly with popular platforms and apps, ensuring a smooth user experience.

- Cross-Platform Compatibility:Supports a wide range of devices, making it suitable for diverse users.

- Enhanced Productivity:Streamlines communication and workflow by enabling quick file sharing and notification mirroring.

- Accessibility:Provides a user-friendly interface, making it easy to use for both beginners and experienced users.

However, Pushbullet also has some limitations:

- Limited Free Plan:The free plan has limitations on features and storage space.

- Privacy Concerns:Some users may have concerns about data privacy, as Pushbullet collects user data.

- Occasional Glitches:Pushbullet may experience occasional glitches or performance issues, impacting user experience.

Pushbullet Alternatives: A Comprehensive Overview

In 2024, several excellent alternatives to Pushbullet have emerged, offering similar features and functionalities with unique strengths. These alternatives cater to different user needs and preferences, providing a wide range of options to choose from.

Want to download the latest version of GameGuardian? You can find it in the GameGuardian 2024 latest version download article.

| Alternative | Platform Compatibility | Pricing | Unique Functionalities |

|---|---|---|---|

| AirDroid | Windows, macOS, Android, iOS, Web | Free, Paid | Remote control, file management, SMS/call management |

| Join | Windows, macOS, Android, iOS, Web | Free, Paid | Group messaging, file sharing, task management |

| MightyText | Windows, macOS, Android, Web | Free, Paid | SMS/MMS messaging, notification mirroring, file sharing |

| Pushy | Windows, macOS, Android, iOS, Linux | Free, Paid | Open-source, customizable, cross-device notifications |

| Send Anywhere | Windows, macOS, Android, iOS, Web | Free, Paid | Large file sharing, encrypted transfers, offline sharing |

| Franz | Windows, macOS, Linux | Free, Paid | Unified messaging platform, integrates with various messaging apps |

Deep Dive into Prominent Alternatives, Pushbullet 2024: What are the best Pushbullet alternatives for cross-platform communication?

Let’s explore three prominent Pushbullet alternatives in detail, highlighting their strengths and weaknesses, and identifying their ideal use cases.

GameGuardian is a popular tool for Call of Duty Mobile players. Learn more about its features and how to use it in the GameGuardian 2024 for Call of Duty Mobile article.

AirDroid

AirDroid is a comprehensive cross-platform communication tool that offers a wide range of features, including file sharing, remote control, SMS/call management, and notification mirroring. It excels in providing a seamless experience for managing your Android device from your computer. AirDroid’s strengths lie in its user-friendly interface, robust remote control capabilities, and comprehensive file management features.

GameGuardian is a popular tool for PUBG Mobile players. Learn more about its features and how to use it in the GameGuardian 2024 for PUBG Mobile article.

However, its free plan has limitations, and some users may find its interface slightly cluttered.

Android phones are known for their flexibility and customization, but they can also be vulnerable to security threats. Check out the Android Authority 2024 Android phone security concerns article to learn about the latest threats and how to protect your device.

Join

Join is a unique alternative that focuses on collaborative communication and task management. It allows users to create groups for sharing files, messages, and tasks, making it ideal for teams and families. Join’s strengths lie in its collaborative features, secure file sharing, and intuitive task management system.

If you’re a gamer looking for the best Android phone to power your gaming sessions, check out the Android Authority 2024 gaming phone guide. It’s a comprehensive guide that covers everything from performance and battery life to display and design.

However, its focus on group communication may not be suitable for individuals seeking individual communication tools.

If you’re a Genshin Impact player, you might be interested in using GameGuardian to enhance your gameplay. Learn more about its features and how to use it in the GameGuardian 2024 for Genshin Impact article.

MightyText

MightyText is a popular alternative known for its focus on SMS/MMS messaging and notification mirroring. It allows users to send and receive text messages from their computer, making it a convenient option for those who frequently use their phone for communication.

GameGuardian can be a fun tool for Among Us players. Learn more about its features and how to use it in the GameGuardian 2024 for Among Us article.

MightyText’s strengths lie in its seamless integration with Android devices, robust SMS/MMS capabilities, and intuitive notification mirroring features. However, it lacks advanced features like file sharing and remote control.

GameGuardian can be a fun tool for Roblox players. Learn more about its features and how to use it in the GameGuardian 2024 for Roblox article.

Factors to Consider When Choosing an Alternative

Choosing the right Pushbullet alternative depends on your specific needs and preferences. Here are key factors to consider:

- Platform Compatibility:Ensure the alternative supports all your devices and operating systems.

- Pricing:Determine if the free plan meets your requirements or if you need to invest in a paid plan.

- Security:Choose an alternative with robust security measures to protect your data and privacy.

- Features:Identify the specific features you need, such as file sharing, notification mirroring, remote control, or task management.

- User Interface:Opt for an alternative with a user-friendly interface that is easy to navigate and use.

Future of Cross-Platform Communication Tools

The future of cross-platform communication tools looks promising, with advancements in artificial intelligence (AI), cloud computing, and mobile technology driving innovation. We can expect to see:

- AI-Powered Communication:AI-powered chatbots and virtual assistants will enhance communication efficiency and personalization.

- Enhanced Security:More sophisticated security measures will ensure data privacy and protection.

- Seamless Integration:Cross-platform communication tools will integrate seamlessly with other applications and services.

- Emerging Features:New features like real-time translation, augmented reality (AR) integration, and personalized recommendations will enhance user experience.

As technology continues to evolve, Pushbullet and its alternatives will adapt and evolve to meet the changing needs of users. We can anticipate a future where cross-platform communication tools become even more powerful and intuitive, further blurring the lines between devices and enhancing our digital lives.

Ultimate Conclusion

As the world becomes increasingly reliant on seamless communication across devices, the demand for robust cross-platform tools will only grow. While Pushbullet remains a viable option, the alternatives explored in this article offer compelling features and functionalities. By carefully considering factors like platform compatibility, pricing, and security, you can choose the perfect tool to enhance your communication experience and stay connected across all your devices.

Questions and Answers: Pushbullet 2024: What Are The Best Pushbullet Alternatives For Cross-platform Communication?

Is Pushbullet still a good option in 2024?

Pushbullet remains a solid choice, especially for its ease of use and extensive platform compatibility. However, some users might find its free plan limiting, and newer alternatives offer more advanced features.

What are the key features to consider when choosing a Pushbullet alternative?

Platform compatibility, pricing, security, file transfer size limits, and unique functionalities like universal clipboard or browser tab syncing are all important factors to consider.

Are there any free Pushbullet alternatives?

Yes, there are several free alternatives available, often with limitations on features or file transfer sizes. Some offer free plans with limited features, while others offer a fully functional free version with advertising.

Android 14 is packed with new features and updates. Learn more about them in the Android Authority 2024 Android 14 features and updates article.

Battery life is a crucial factor when choosing a new phone. Check out the Android Authority 2024 phone battery life comparison to see how different models stack up.