Allianz Travel Insurance October 2024 Price Comparison provides a comprehensive overview of the cost of travel insurance from Allianz, comparing it to other leading providers. Navigating the world of travel insurance can be overwhelming, especially when trying to find the best value for your money.

This guide will equip you with the knowledge and tools needed to make informed decisions about your travel insurance needs. We will delve into the factors that influence pricing, analyze the coverage options offered by Allianz and its competitors, and provide practical tips for securing the most competitive rates.

This analysis considers key factors such as destination, duration of trip, age of the traveler, and level of coverage desired. We will examine the different types of policies available, including single trip, multi-trip, and annual policies, highlighting the benefits and drawbacks of each.

When calculating the amount of money you need to deposit into an annuity, you can use Calculate Annuity Deposit 2024. This article explains how to calculate the amount of money you need to deposit, as well as the factors that affect this amount.

By comparing Allianz Travel Insurance with its competitors, you can gain a clear understanding of the price differences and determine which provider best suits your specific travel needs.

Contents List

- 1 Understanding Allianz Travel Insurance

- 2 Factors Influencing Allianz Travel Insurance Prices

- 3 Comparing Allianz Travel Insurance Prices in October 2024

- 4 Tips for Finding the Best Allianz Travel Insurance Price

- 5 Evaluating Allianz Travel Insurance Value

- 6 End of Discussion: Allianz Travel Insurance October 2024 Price Comparison

- 7 Commonly Asked Questions

Understanding Allianz Travel Insurance

Allianz Travel Insurance is a comprehensive insurance plan designed to protect travelers from unexpected events and financial burdens that may arise during their trips. It offers peace of mind by providing financial assistance for medical emergencies, travel disruptions, lost luggage, and other unforeseen circumstances.

Key Benefits and Features

Allianz Travel Insurance provides a wide range of benefits and features to cater to different travel needs. These include:

- Medical Expenses Coverage:Covers medical expenses incurred due to illness or injury during your trip, including hospitalization, surgery, and emergency medical evacuation.

- Trip Cancellation and Interruption Coverage:Provides reimbursement for non-refundable trip expenses if you have to cancel or interrupt your trip due to unforeseen circumstances like illness, injury, or family emergencies.

- Lost or Delayed Luggage Coverage:Offers compensation for lost or delayed luggage, including personal belongings and essential items.

- Emergency Evacuation and Repatriation Coverage:Covers the cost of emergency medical evacuation or repatriation to your home country if necessary.

- Personal Liability Coverage:Protects you against financial claims arising from accidental injury or damage to property caused by you during your trip.

Types of Coverage Options

Allianz Travel Insurance offers various coverage options to suit different travel needs and budgets. The most common types include:

- Single Trip Insurance:Provides coverage for a specific trip with a defined duration.

- Multi-Trip Insurance:Offers coverage for multiple trips within a specific period, typically a year.

- Annual Travel Insurance:Provides comprehensive coverage for all your trips throughout the year, regardless of the number of trips or destinations.

Factors Influencing Allianz Travel Insurance Prices

The price of Allianz Travel Insurance is determined by various factors, including:

Key Factors

- Destination:Travel insurance premiums are higher for destinations with higher medical costs and greater risks of travel disruptions.

- Duration of Trip:Longer trips generally require higher premiums as the risk of unforeseen events increases with the length of travel.

- Age and Health:Older travelers and those with pre-existing medical conditions may face higher premiums due to increased risk of medical emergencies.

- Coverage Level:The extent of coverage you choose, including the amount of medical expenses covered, trip cancellation benefits, and other features, impacts the price of your policy.

- Travel Activities:Engaging in high-risk activities like extreme sports or adventure travel can lead to higher premiums.

Impact on Policy Cost

For example, a trip to a developed country with a short duration and no pre-existing medical conditions will generally have a lower premium compared to a trip to a remote destination with a longer duration and pre-existing health concerns.

Understanding how to calculate an annuity can be helpful when planning your retirement. Calculate Annuity Example 2024 provides a step-by-step guide to calculating annuities, as well as examples to illustrate the process.

Considering Individual Needs and Travel Plans, Allianz Travel Insurance October 2024 Price Comparison

It is essential to carefully consider your individual needs and travel plans when choosing Allianz Travel Insurance coverage. Evaluate your potential risks, medical history, and desired level of protection to determine the appropriate policy for your trip.

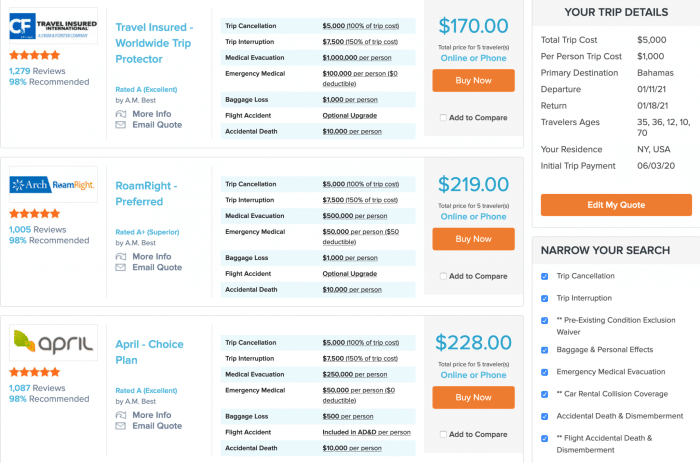

Comparing Allianz Travel Insurance Prices in October 2024

Allianz Travel Insurance faces competition from various insurance providers offering similar travel insurance plans. To understand the pricing landscape, it is crucial to compare Allianz’s offerings with those of its competitors.

If you’re in India and looking to calculate the amount of income you can receive from an immediate annuity, you can use Immediate Annuity Calculator India. This calculator takes into account factors such as your age, gender, and the amount of money you invest.

Key Competitors

Some of the key competitors of Allianz Travel Insurance include:

- World Nomads

- SafetyWing

- AXA

- Travel Guard

Pricing Structures and Coverage Options

These competitors offer a range of pricing structures and coverage options, which can vary depending on the factors discussed earlier. To make an informed decision, it is essential to compare the premiums, benefits, and exclusions offered by each provider.

Comparison Table

| Provider | Single Trip (7 Days) | Multi-Trip (Annual) | Coverage Highlights |

|---|---|---|---|

| Allianz Travel Insurance | $100

Variable annuities are a popular choice for retirement planning. To learn more about this type of annuity, check out Variable Annuity Life Insurance Co 2024. This article discusses the benefits and drawbacks of variable annuities, as well as how they work.

|

$300

An annuity calculator can be a helpful tool for planning your retirement. Annuity Calculator Hk 2024 provides a comprehensive overview of how to use annuity calculators, as well as the different types of calculators available.

|

Medical expenses, trip cancellation, lost luggage, emergency evacuation |

| World Nomads | $80

|

$250

An immediate annuity plan can be a good way to provide yourself with a guaranteed stream of income in retirement. Immediate Annuity Plan explains the different types of immediate annuity plans available, as well as how they work.

|

Medical expenses, trip cancellation, lost luggage, adventure activities coverage |

| SafetyWing | $40

When traveling, it’s essential to have travel insurance. Essential travel insurance tips for October 2024 provides helpful tips on how to choose the right travel insurance plan for your needs.

|

$150

|

Medical expenses, trip cancellation, lost luggage, remote work coverage |

| AXA | $90

|

$280

|

Medical expenses, trip cancellation, lost luggage, 24/7 assistance |

| Travel Guard | $110

Variable annuities allow you to invest your money in different subaccounts, which can provide the potential for growth. Variable Annuity Subaccounts 2024 explains how variable annuity subaccounts work, as well as the different types of subaccounts available.

|

$320

If you’re looking for a way to generate immediate income, an immediate income annuity may be a good option. Immediate Income Annuity Calculator provides a helpful tool for calculating the amount of income you can receive from an immediate income annuity.

|

Medical expenses, trip cancellation, lost luggage, comprehensive coverage options |

Note:The prices mentioned above are indicative and can vary based on factors like destination, age, coverage level, and specific travel plans. It is essential to obtain personalized quotes from each provider to compare prices accurately.

Tips for Finding the Best Allianz Travel Insurance Price

Finding the best Allianz Travel Insurance price involves a combination of research, comparison, and negotiation. Here are some tips to help you find the most competitive price:

Comparing Quotes

- Use Online Comparison Websites:Several websites allow you to compare quotes from different insurance providers, including Allianz, side-by-side.

- Contact Insurance Brokers:Insurance brokers can provide you with personalized quotes and guidance on choosing the right policy.

- Get Quotes from Allianz Directly:Contact Allianz directly to get a quote and discuss your specific travel needs.

Negotiating Prices

- Inquire about Discounts:Ask about discounts for group travel, multiple policies, or membership affiliations.

- Consider a Higher Deductible:Choosing a higher deductible can often lower your premium.

- Negotiate with Allianz:If you find a lower price from a competitor, you can use it as leverage to negotiate a better price with Allianz.

Reading Policy Documents

Before purchasing a policy, carefully read the policy document to understand the terms and conditions, coverage details, and exclusions. This will ensure you have a clear understanding of what is covered and what is not.

If you’re interested in a career in the financial industry, you may want to consider a job in variable annuities. Variable Annuity Jobs 2024 provides information on the different types of variable annuity jobs available, as well as the skills and qualifications required.

Evaluating Allianz Travel Insurance Value

The value of Allianz Travel Insurance depends on a balance between price and coverage. It is essential to assess whether the benefits offered by Allianz justify the cost compared to its competitors.

Price and Coverage Balance

Allianz Travel Insurance generally offers comprehensive coverage with a wide range of benefits. However, its premiums may be higher than some of its competitors, especially for specific coverage options. Therefore, it is essential to compare the price and coverage offered by Allianz with other providers to determine the best value for your needs.

Cost-Effectiveness

Consider the overall value proposition of Allianz Travel Insurance. While it may not always be the cheapest option, its comprehensive coverage and reputation for customer service can provide peace of mind for travelers. Evaluate whether the additional cost is justified by the extra benefits and protection offered.

An immediate annuity is a type of annuity that provides you with payments immediately after you purchase it. What Is The Meaning Of Immediate Annuity explains the basics of immediate annuities, including how they work and the benefits they offer.

End of Discussion: Allianz Travel Insurance October 2024 Price Comparison

Ultimately, the best travel insurance policy is the one that provides the right coverage at a price you can afford. This guide provides the tools and insights to help you navigate the world of travel insurance and make a decision that fits your individual circumstances.

If you’re considering purchasing a variable annuity, you may be wondering about the issue age. You can find information on this topic in Variable Annuity Issue Age 90 2024. This article explains how issue age affects the cost and benefits of variable annuities.

Remember to carefully read the policy documents and understand the terms and conditions before purchasing any insurance. By doing so, you can travel with peace of mind knowing that you are protected in case of unforeseen events.

A Roth variable annuity can be a great way to save for retirement tax-free. You can learn more about this type of annuity by reading Roth Variable Annuity 2024. This article explains the rules and regulations surrounding Roth variable annuities, as well as how they can benefit your retirement planning.

Commonly Asked Questions

What are the main benefits of Allianz Travel Insurance?

Allianz Travel Insurance offers a wide range of benefits, including medical expenses coverage, trip cancellation and interruption protection, lost luggage reimbursement, and emergency evacuation assistance.

How can I get a quote for Allianz Travel Insurance?

You can obtain a quote for Allianz Travel Insurance online through their website or by contacting an authorized insurance agent.

Is Allianz Travel Insurance worth the cost?

Understanding how annuities work can be tricky. If you have questions, you can find answers and explanations in Annuity Calculation Questions And Answers 2024. This article provides helpful information on calculating annuities, including how to determine the right amount for your needs.

The value of Allianz Travel Insurance depends on your individual travel needs and risk tolerance. It is generally advisable to have travel insurance, especially for international trips or trips with significant expenses.

What are some tips for negotiating travel insurance prices?

Consider purchasing insurance as early as possible, explore different coverage options, and compare quotes from multiple providers. You can also inquire about discounts for group travel or multiple policies.

Looking to learn more about annuities? There are many resources available to help you understand how they work, such as Annuity 4 Percent 2024. This article explains the basics of annuities, including how they can provide a steady stream of income in retirement.